Irs Name Change Notification

Irs Name Change Notification - The answer to this and other irs name change questions is no. In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc name change. The specific action required may vary depending on the type of business. If the ein was recently. Notifying the irs is an essential step when you change your business name. You can download our irs llc name. Corporations and llcs can check the name change box while filing their annual tax return with the internal revenue service (irs). Do i need to notify the irs of a name change? The irs matches your registered. Do you have to notify the irs if you change your business name?

You can download our irs llc name. Do you have to notify the irs if you change your business name? Do i need to notify the irs of a name change? Notifying the irs is an essential step when you change your business name. Business owners and other authorized individuals can submit a name change for their business. The specific action required may vary depending on the type of business. The answer to this and other irs name change questions is no. The irs matches your registered. In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc name change. Corporations and llcs can check the name change box while filing their annual tax return with the internal revenue service (irs).

You must notify the social security administration, as the irs will check. The specific action required may vary depending on the type of business. Do you have to notify the irs if you change your business name? Corporations and llcs can check the name change box while filing their annual tax return with the internal revenue service (irs). The answer to this and other irs name change questions is no. Do i need to notify the irs of a name change? Business owners and other authorized individuals can submit a name change for their business. The irs matches your registered. If the ein was recently. Notifying the irs is an essential step when you change your business name.

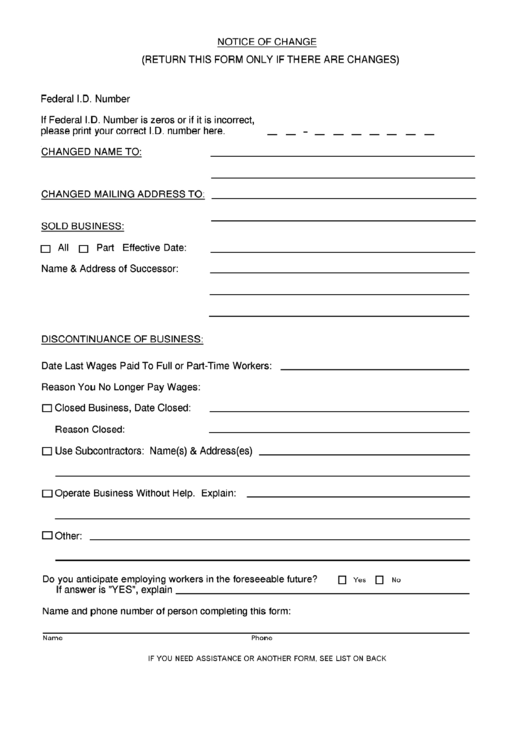

Irs Business Name Change Letter Template

You must notify the social security administration, as the irs will check. Corporations and llcs can check the name change box while filing their annual tax return with the internal revenue service (irs). The irs matches your registered. Do i need to notify the irs of a name change? In order to change your llc name with the irs, you’ll.

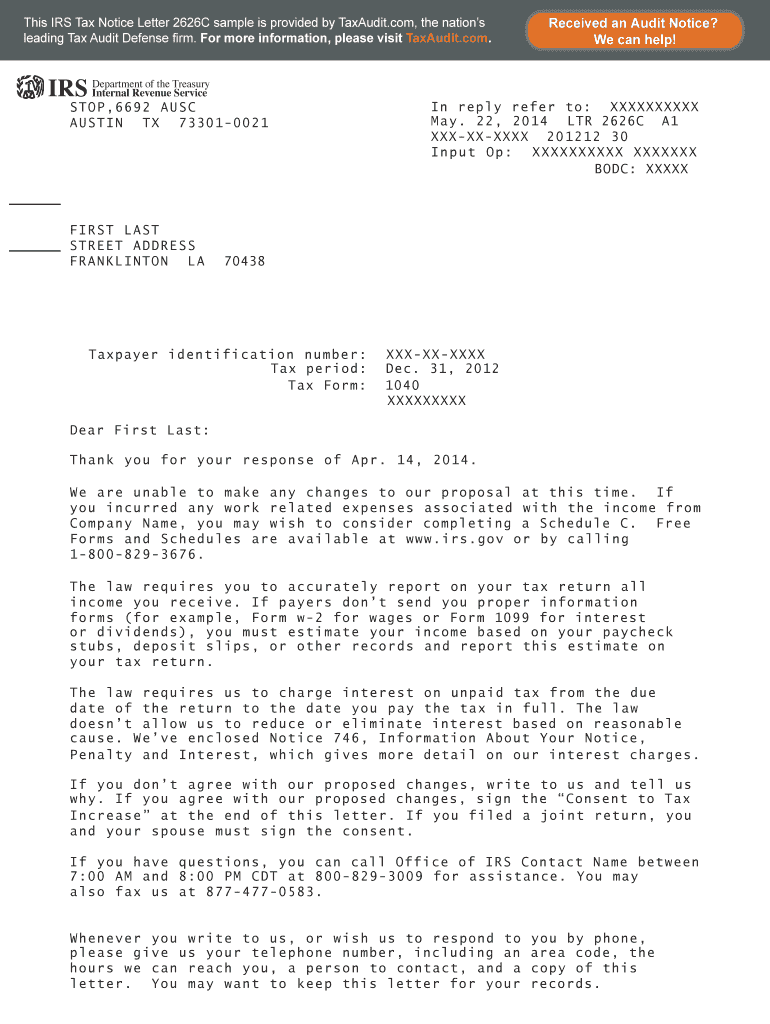

Irs Name Change Letter Sample / 12 INFO IRS TAX NOTICE LETTER 12C PRINT

In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc name change. If the ein was recently. The specific action required may vary depending on the type of business. The irs matches your registered. Do i need to notify the irs of a name.

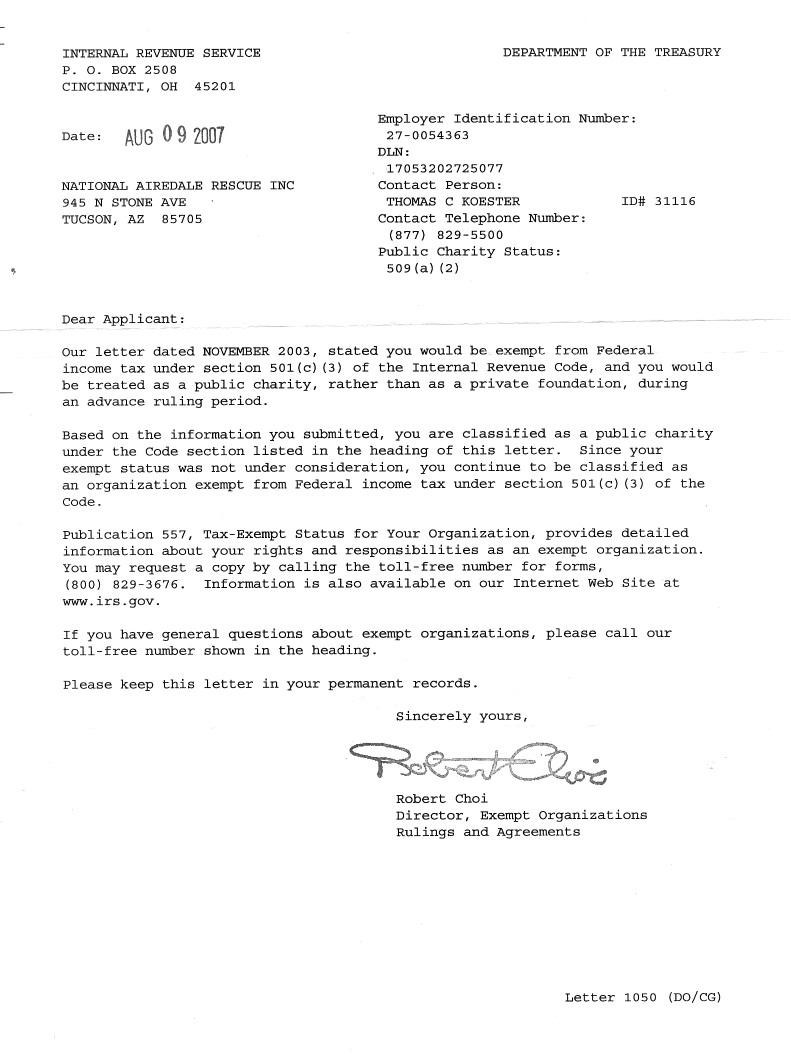

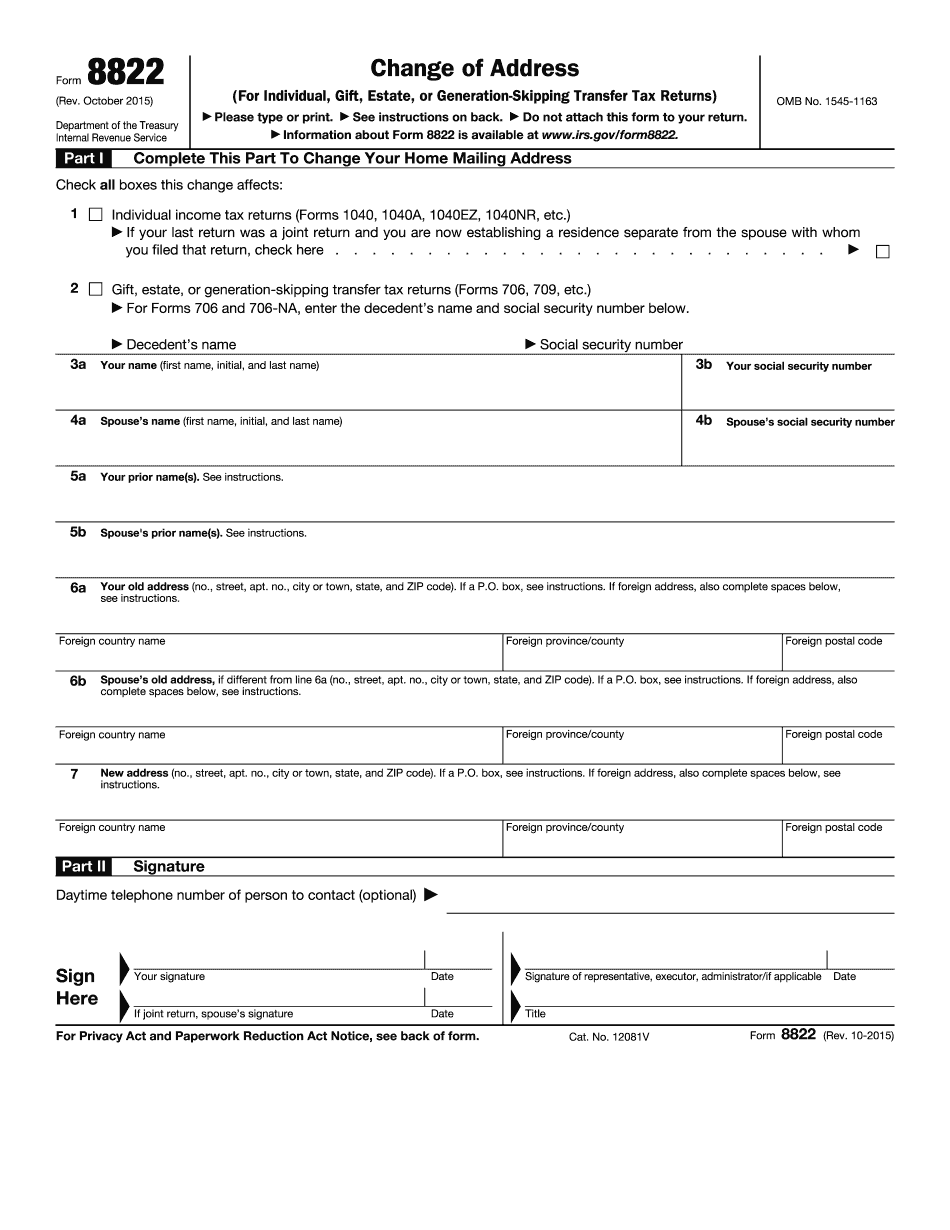

Irs Name Change Letter Sample An irs corporate name change form 8822

You must notify the social security administration, as the irs will check. The specific action required may vary depending on the type of business. You can download our irs llc name. Do i need to notify the irs of a name change? In order to change your llc name with the irs, you’ll need to mail them a letter and.

Business Name Change Irs Sample Letter Company name change letter sample.

Corporations and llcs can check the name change box while filing their annual tax return with the internal revenue service (irs). Do i need to notify the irs of a name change? The specific action required may vary depending on the type of business. Do you have to notify the irs if you change your business name? You can download.

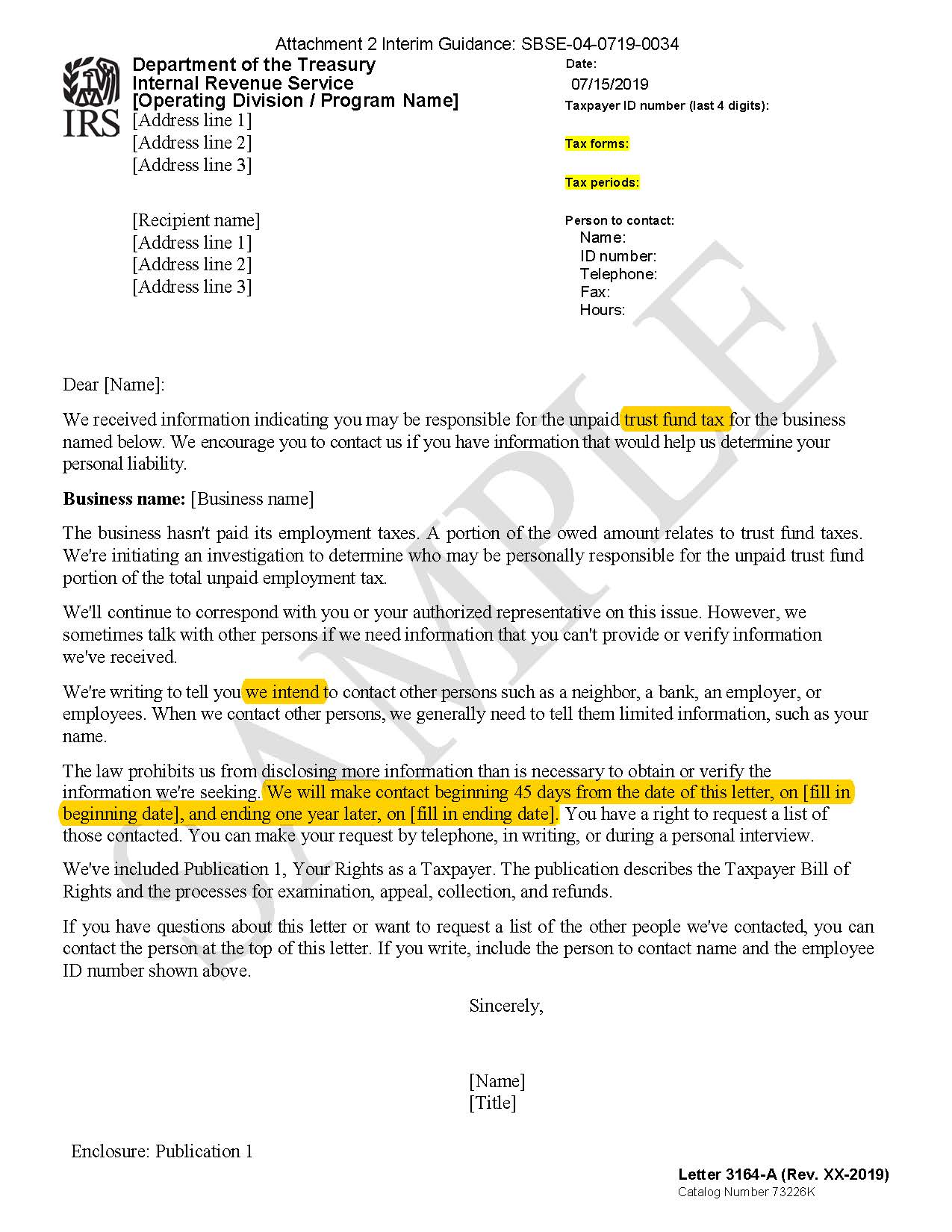

Irs Name Change Letter Sample Internal revenue service deception

The irs matches your registered. If the ein was recently. Notifying the irs is an essential step when you change your business name. Do i need to notify the irs of a name change? You must notify the social security administration, as the irs will check.

Name Change Notification Letter Sample PDF Template

Do you have to notify the irs if you change your business name? Corporations and llcs can check the name change box while filing their annual tax return with the internal revenue service (irs). If the ein was recently. Notifying the irs is an essential step when you change your business name. Do i need to notify the irs of.

Top Irs Name Change Form Templates free to download in PDF format

The answer to this and other irs name change questions is no. Business owners and other authorized individuals can submit a name change for their business. Do i need to notify the irs of a name change? Notifying the irs is an essential step when you change your business name. Corporations and llcs can check the name change box while.

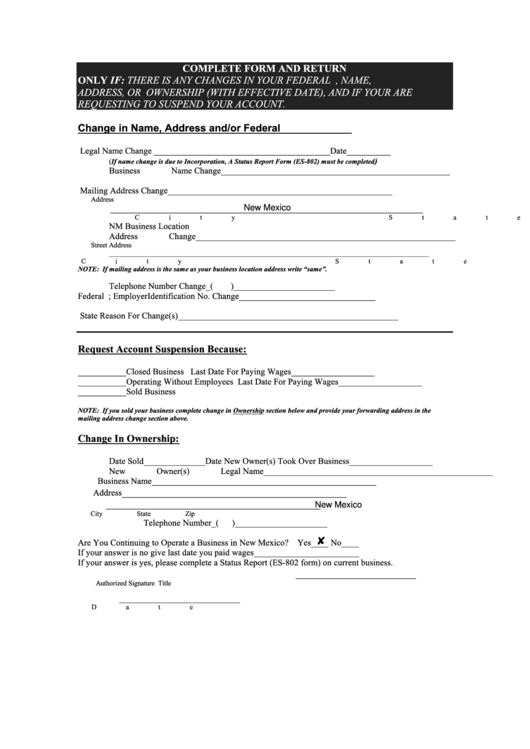

irs name change form Fill Online, Printable, Fillable Blank form

Do you have to notify the irs if you change your business name? Notifying the irs is an essential step when you change your business name. Business owners and other authorized individuals can submit a name change for their business. If the ein was recently. You can download our irs llc name.

Top Irs Name Change Form Templates free to download in PDF format

You can download our irs llc name. If the ein was recently. Do i need to notify the irs of a name change? Do you have to notify the irs if you change your business name? Business owners and other authorized individuals can submit a name change for their business.

Irs Business Name Change Letter Template

You can download our irs llc name. Do you have to notify the irs if you change your business name? The irs matches your registered. The specific action required may vary depending on the type of business. In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state.

Do I Need To Notify The Irs Of A Name Change?

In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc name change. Notifying the irs is an essential step when you change your business name. The answer to this and other irs name change questions is no. If the ein was recently.

Do You Have To Notify The Irs If You Change Your Business Name?

The specific action required may vary depending on the type of business. You must notify the social security administration, as the irs will check. Business owners and other authorized individuals can submit a name change for their business. Corporations and llcs can check the name change box while filing their annual tax return with the internal revenue service (irs).

The Irs Matches Your Registered.

You can download our irs llc name.