Irs Tax Lien Lookup Free

Irs Tax Lien Lookup Free - If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. See sources to check your. Notice of federal tax lien filed (in public records) document filed with the local recording office that identifies tax liabilities owed by the. Visit irs.gov/payments to find information about making payments and the options available, including those below, for taxpayers who can't. Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below.

Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. Visit irs.gov/payments to find information about making payments and the options available, including those below, for taxpayers who can't. Notice of federal tax lien filed (in public records) document filed with the local recording office that identifies tax liabilities owed by the. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. See sources to check your. Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below.

See sources to check your. Notice of federal tax lien filed (in public records) document filed with the local recording office that identifies tax liabilities owed by the. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. Visit irs.gov/payments to find information about making payments and the options available, including those below, for taxpayers who can't.

IRS Federal and State Tax Lien Help — Genesis Tax Consultants

Notice of federal tax lien filed (in public records) document filed with the local recording office that identifies tax liabilities owed by the. See sources to check your. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. Search logic mandated by the ucc statute and locates.

A Complete breakdown of IRS tax lien Conto Business

Notice of federal tax lien filed (in public records) document filed with the local recording office that identifies tax liabilities owed by the. Visit irs.gov/payments to find information about making payments and the options available, including those below, for taxpayers who can't. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien.

IRS Tax Lien RJS LAW Tax Attorney San Diego California

Notice of federal tax lien filed (in public records) document filed with the local recording office that identifies tax liabilities owed by the. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. If a property owner fails to pay federal taxes, the irs files a notice.

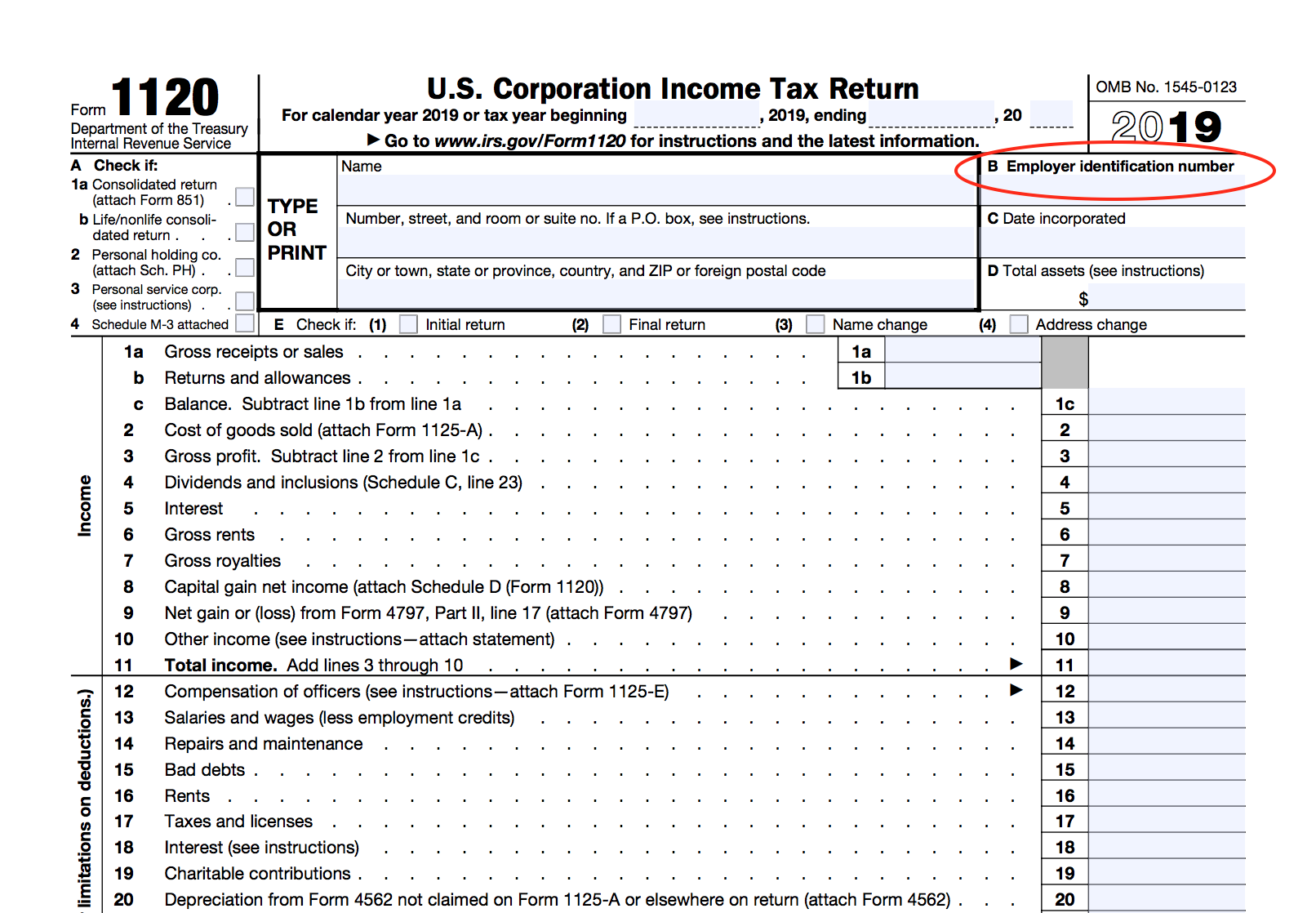

Tax IDentification Number Lookup IRS TIN Number

Notice of federal tax lien filed (in public records) document filed with the local recording office that identifies tax liabilities owed by the. See sources to check your. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Visit irs.gov/payments to find information about making.

IRS Tax Lien Removal Enterprise consultants group

See sources to check your. Visit irs.gov/payments to find information about making payments and the options available, including those below, for taxpayers who can't. Notice of federal tax lien filed (in public records) document filed with the local recording office that identifies tax liabilities owed by the. If a property owner fails to pay federal taxes, the irs files a.

IRS Federal Tax Lien Semper Tax Relief Tax Settlement Expert

Visit irs.gov/payments to find information about making payments and the options available, including those below, for taxpayers who can't. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided.

When Does The Irs File A Tax Lien?

If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Visit irs.gov/payments to find information about making payments and the options available, including those below, for taxpayers who can't. Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations.

IRS Tax Lien Help Tampa Tax Attorney Darrin t. Mish

Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. Visit irs.gov/payments to find information about making payments and the options available, including those below, for taxpayers who.

Can The IRS Refile A Tax Lien?

Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. Notice of federal tax lien filed (in public records) document filed with the local recording office that identifies tax liabilities owed by the. Visit irs.gov/payments to find information about making payments and the options available, including those below, for taxpayers who.

How to Tackle IRS Tax Lien or Levy Notice? Internal Revenue Code

If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. See sources to check your. Notice of federal tax lien filed (in.

Learn What A Federal Tax Lien Is, How It Affects Your Credit And Assets, And How To Find Out If You Have One.

If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Notice of federal tax lien filed (in public records) document filed with the local recording office that identifies tax liabilities owed by the. Visit irs.gov/payments to find information about making payments and the options available, including those below, for taxpayers who can't. Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below.