Is Airbnb Taxable Income

Is Airbnb Taxable Income - As an airbnb host, all the money you make from your rental property is considered taxable income. This includes both cash and. Today, many people earn extra money by temporarily renting out their entire home (or a room in their house or apartment).

This includes both cash and. Today, many people earn extra money by temporarily renting out their entire home (or a room in their house or apartment). As an airbnb host, all the money you make from your rental property is considered taxable income.

This includes both cash and. Today, many people earn extra money by temporarily renting out their entire home (or a room in their house or apartment). As an airbnb host, all the money you make from your rental property is considered taxable income.

[Ask the Tax Whiz] Is Airbnb taxable in the Philippines?

As an airbnb host, all the money you make from your rental property is considered taxable income. This includes both cash and. Today, many people earn extra money by temporarily renting out their entire home (or a room in their house or apartment).

Airbnb Revenue Estimate How to Calculate Mashvisor

This includes both cash and. Today, many people earn extra money by temporarily renting out their entire home (or a room in their house or apartment). As an airbnb host, all the money you make from your rental property is considered taxable income.

Tax on Airbnb NZ is my Airbnb taxable?

As an airbnb host, all the money you make from your rental property is considered taxable income. Today, many people earn extra money by temporarily renting out their entire home (or a room in their house or apartment). This includes both cash and.

Is your Airbnb taxable? » Stem Rural

This includes both cash and. Today, many people earn extra money by temporarily renting out their entire home (or a room in their house or apartment). As an airbnb host, all the money you make from your rental property is considered taxable income.

Is your Airbnb rental taxable?

As an airbnb host, all the money you make from your rental property is considered taxable income. Today, many people earn extra money by temporarily renting out their entire home (or a room in their house or apartment). This includes both cash and.

Is my Airbnb rental taxable?

As an airbnb host, all the money you make from your rental property is considered taxable income. This includes both cash and. Today, many people earn extra money by temporarily renting out their entire home (or a room in their house or apartment).

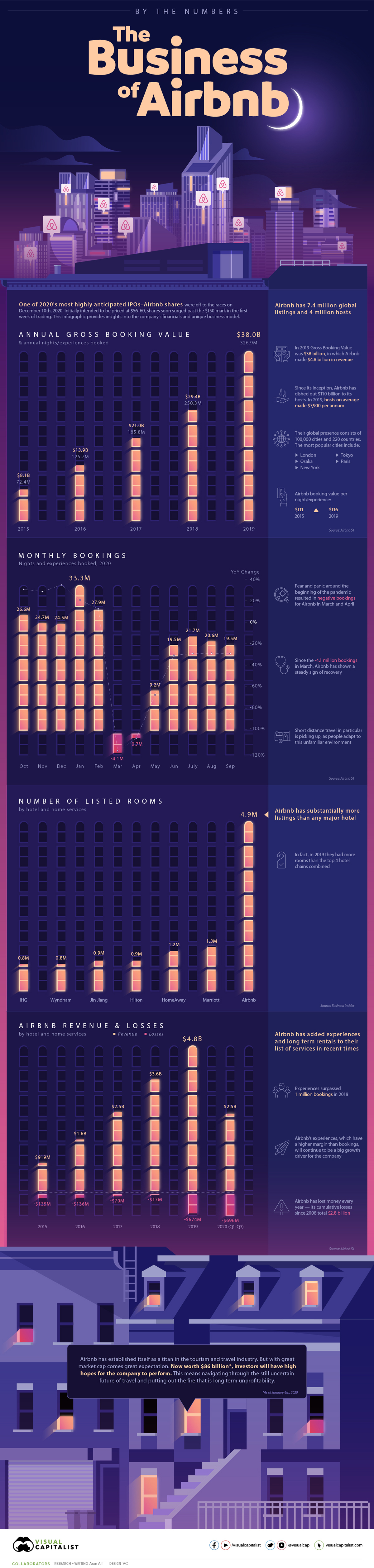

The Business of Airbnb, by the Numbers Investment Watch Blog

This includes both cash and. Today, many people earn extra money by temporarily renting out their entire home (or a room in their house or apartment). As an airbnb host, all the money you make from your rental property is considered taxable income.

Airbnb Startup Cost—Business Plan

This includes both cash and. Today, many people earn extra money by temporarily renting out their entire home (or a room in their house or apartment). As an airbnb host, all the money you make from your rental property is considered taxable income.

App Economy Insights on Twitter "ABNB Airbnb's Statement."

As an airbnb host, all the money you make from your rental property is considered taxable income. Today, many people earn extra money by temporarily renting out their entire home (or a room in their house or apartment). This includes both cash and.

Airbnb EGift Card (1002000) Thank You Reward for Our Client

As an airbnb host, all the money you make from your rental property is considered taxable income. This includes both cash and. Today, many people earn extra money by temporarily renting out their entire home (or a room in their house or apartment).

As An Airbnb Host, All The Money You Make From Your Rental Property Is Considered Taxable Income.

Today, many people earn extra money by temporarily renting out their entire home (or a room in their house or apartment). This includes both cash and.

![[Ask the Tax Whiz] Is Airbnb taxable in the Philippines?](https://www.rappler.com/tachyon/2021/06/airbnb-shutterstock-sq.jpg)