Is Coursera Tax Deductible

Is Coursera Tax Deductible - In this article, we’ll explore the. Whether a coursera subscription is tax deductible depends on the context of your education, employment, and tax jurisdiction. Under the tax cuts and jobs act (tcja), the. When it comes to tax season, you might wonder if you can deduct these expenses on your taxes. Coursera courses are not eligible for tax deduction in the same way that traditional educational institutions are.

In this article, we’ll explore the. When it comes to tax season, you might wonder if you can deduct these expenses on your taxes. Whether a coursera subscription is tax deductible depends on the context of your education, employment, and tax jurisdiction. Under the tax cuts and jobs act (tcja), the. Coursera courses are not eligible for tax deduction in the same way that traditional educational institutions are.

When it comes to tax season, you might wonder if you can deduct these expenses on your taxes. Under the tax cuts and jobs act (tcja), the. Whether a coursera subscription is tax deductible depends on the context of your education, employment, and tax jurisdiction. Coursera courses are not eligible for tax deduction in the same way that traditional educational institutions are. In this article, we’ll explore the.

Is Coursera Down? Exploring The Impact Of Technical Glitches And Server

Coursera courses are not eligible for tax deduction in the same way that traditional educational institutions are. In this article, we’ll explore the. When it comes to tax season, you might wonder if you can deduct these expenses on your taxes. Under the tax cuts and jobs act (tcja), the. Whether a coursera subscription is tax deductible depends on the.

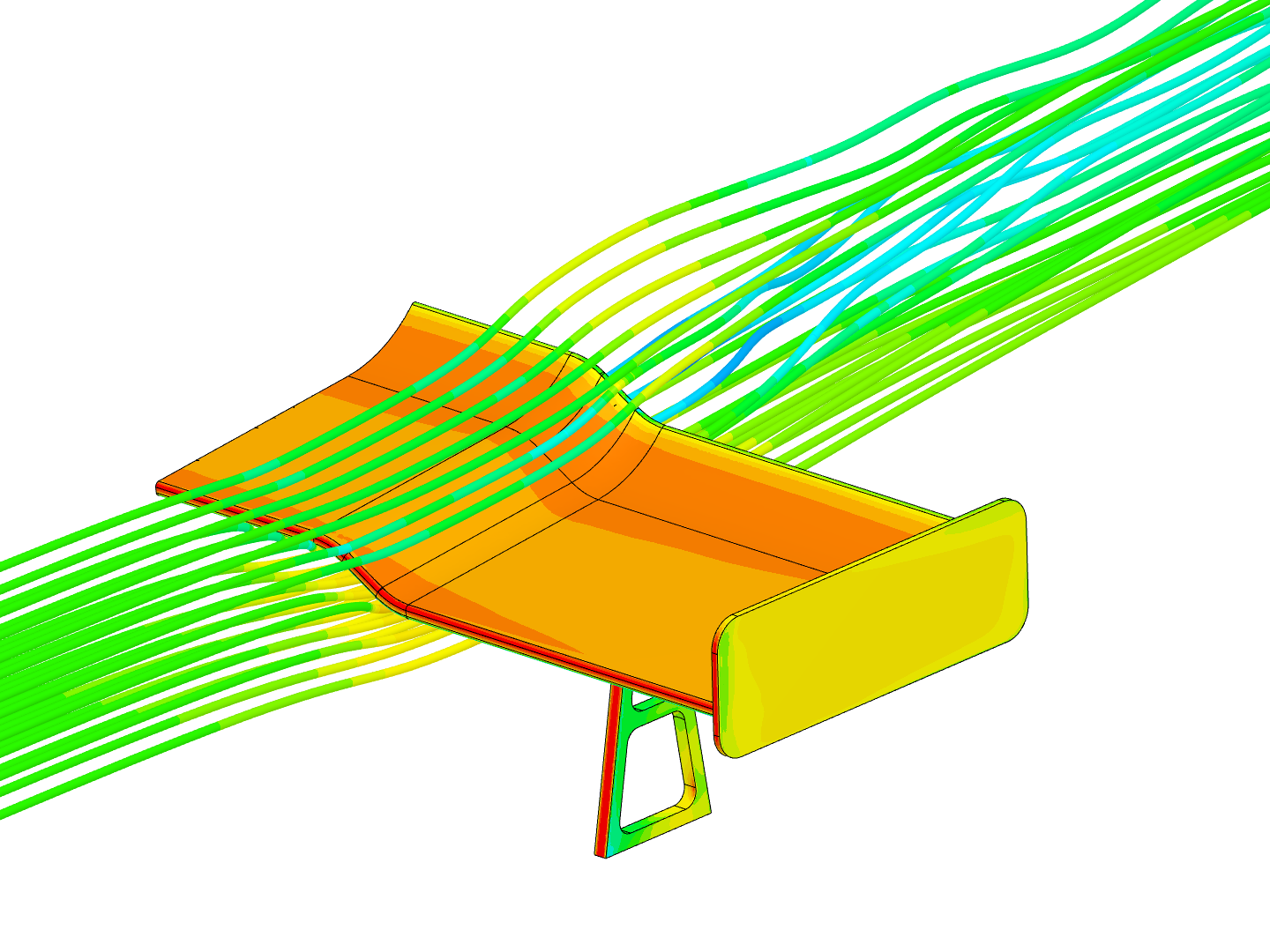

Coursera Spoiler by drexrdc SimScale

Whether a coursera subscription is tax deductible depends on the context of your education, employment, and tax jurisdiction. Under the tax cuts and jobs act (tcja), the. Coursera courses are not eligible for tax deduction in the same way that traditional educational institutions are. When it comes to tax season, you might wonder if you can deduct these expenses on.

Explore 3 Top DataCamp Alternatives for 2024 Aircada Pro

In this article, we’ll explore the. Coursera courses are not eligible for tax deduction in the same way that traditional educational institutions are. When it comes to tax season, you might wonder if you can deduct these expenses on your taxes. Whether a coursera subscription is tax deductible depends on the context of your education, employment, and tax jurisdiction. Under.

Coursera Vs DataCamp Navigating The Landscape Of Online Learning

Under the tax cuts and jobs act (tcja), the. When it comes to tax season, you might wonder if you can deduct these expenses on your taxes. Coursera courses are not eligible for tax deduction in the same way that traditional educational institutions are. Whether a coursera subscription is tax deductible depends on the context of your education, employment, and.

Guide To Coursera Student Discounts Unlocking Knowledge With Savings

Whether a coursera subscription is tax deductible depends on the context of your education, employment, and tax jurisdiction. In this article, we’ll explore the. Under the tax cuts and jobs act (tcja), the. When it comes to tax season, you might wonder if you can deduct these expenses on your taxes. Coursera courses are not eligible for tax deduction in.

Maximizing Learning With Coursera Plus Your Gateway To Unlimited Knowledge

When it comes to tax season, you might wonder if you can deduct these expenses on your taxes. In this article, we’ll explore the. Coursera courses are not eligible for tax deduction in the same way that traditional educational institutions are. Whether a coursera subscription is tax deductible depends on the context of your education, employment, and tax jurisdiction. Under.

How To Get Paid Coursera Course Certificates For FREE in 2020?!🔥 Step

Whether a coursera subscription is tax deductible depends on the context of your education, employment, and tax jurisdiction. In this article, we’ll explore the. Under the tax cuts and jobs act (tcja), the. Coursera courses are not eligible for tax deduction in the same way that traditional educational institutions are. When it comes to tax season, you might wonder if.

Figma Community

Whether a coursera subscription is tax deductible depends on the context of your education, employment, and tax jurisdiction. In this article, we’ll explore the. When it comes to tax season, you might wonder if you can deduct these expenses on your taxes. Under the tax cuts and jobs act (tcja), the. Coursera courses are not eligible for tax deduction in.

Coursera Developer Tools Explore 10,000+ AI Tools & Explore Best

Under the tax cuts and jobs act (tcja), the. When it comes to tax season, you might wonder if you can deduct these expenses on your taxes. Coursera courses are not eligible for tax deduction in the same way that traditional educational institutions are. Whether a coursera subscription is tax deductible depends on the context of your education, employment, and.

Best Tax Courses Online with Certificates [2024] Coursera

Coursera courses are not eligible for tax deduction in the same way that traditional educational institutions are. When it comes to tax season, you might wonder if you can deduct these expenses on your taxes. Whether a coursera subscription is tax deductible depends on the context of your education, employment, and tax jurisdiction. In this article, we’ll explore the. Under.

Coursera Courses Are Not Eligible For Tax Deduction In The Same Way That Traditional Educational Institutions Are.

When it comes to tax season, you might wonder if you can deduct these expenses on your taxes. Whether a coursera subscription is tax deductible depends on the context of your education, employment, and tax jurisdiction. In this article, we’ll explore the. Under the tax cuts and jobs act (tcja), the.

![Best Tax Courses Online with Certificates [2024] Coursera](https://s3.amazonaws.com/coursera/media/Grid_Coursera_Partners_updated.png)