Is Tenant Improvement Be A Category For Quickbooks Online

Is Tenant Improvement Be A Category For Quickbooks Online - You must capitalize any expense you pay to improve your rental property. An expense is for an improvement if it. Recording building improvements in quickbooks involves several key steps to ensure proper documentation and classification of these. All property improvements will be entered in the assets/depreciation section of the program under the rental & royalty income.

You must capitalize any expense you pay to improve your rental property. All property improvements will be entered in the assets/depreciation section of the program under the rental & royalty income. Recording building improvements in quickbooks involves several key steps to ensure proper documentation and classification of these. An expense is for an improvement if it.

An expense is for an improvement if it. Recording building improvements in quickbooks involves several key steps to ensure proper documentation and classification of these. All property improvements will be entered in the assets/depreciation section of the program under the rental & royalty income. You must capitalize any expense you pay to improve your rental property.

Fillable Online Construction of Tenant Improvement Plans Fax Email

Recording building improvements in quickbooks involves several key steps to ensure proper documentation and classification of these. All property improvements will be entered in the assets/depreciation section of the program under the rental & royalty income. You must capitalize any expense you pay to improve your rental property. An expense is for an improvement if it.

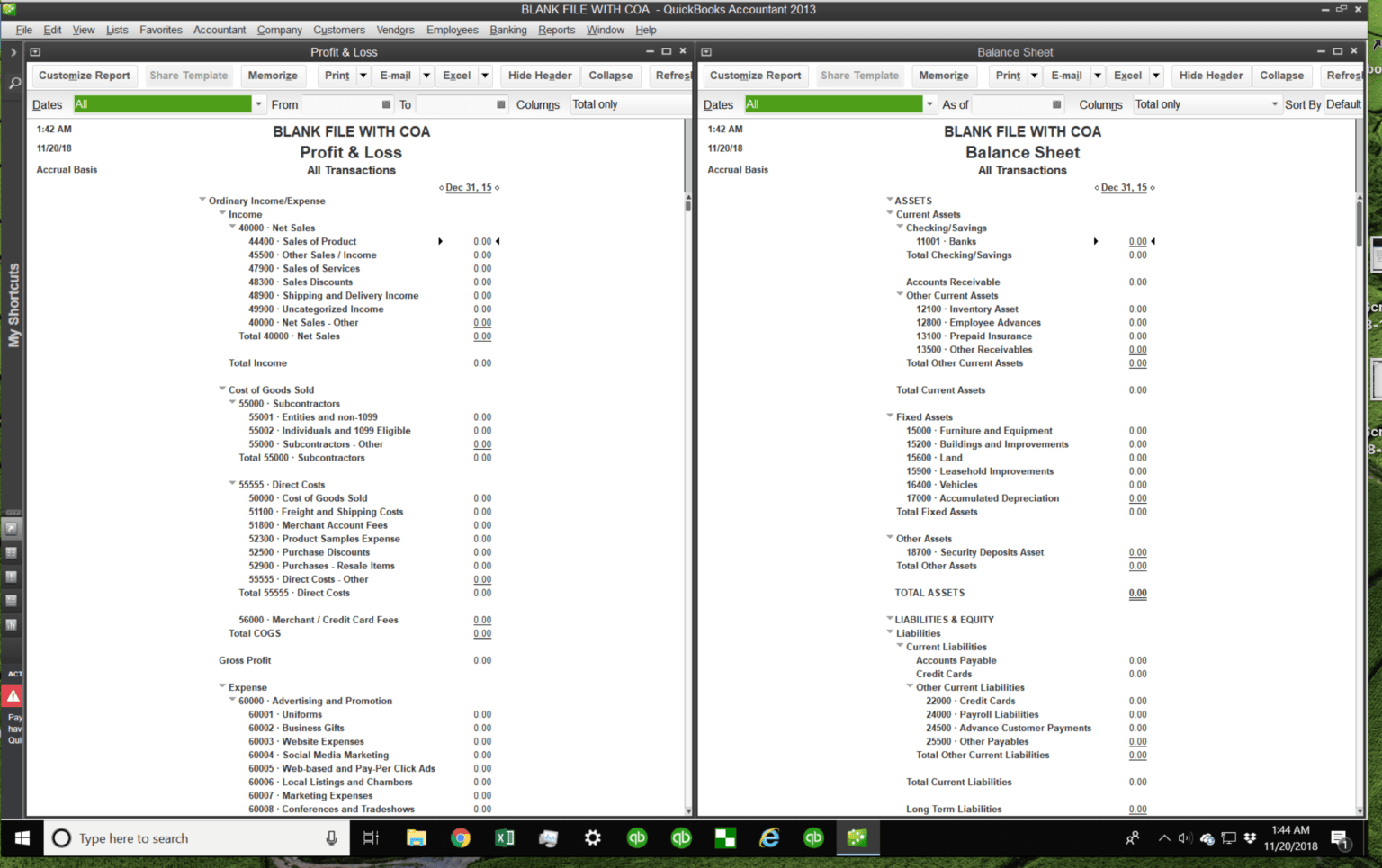

Real Estate Agent Chart Of Accounts

All property improvements will be entered in the assets/depreciation section of the program under the rental & royalty income. You must capitalize any expense you pay to improve your rental property. An expense is for an improvement if it. Recording building improvements in quickbooks involves several key steps to ensure proper documentation and classification of these.

Lease Accounting Tenant Improvement Allowance Occupier

You must capitalize any expense you pay to improve your rental property. An expense is for an improvement if it. All property improvements will be entered in the assets/depreciation section of the program under the rental & royalty income. Recording building improvements in quickbooks involves several key steps to ensure proper documentation and classification of these.

Tips for Maximizing Your Tenant Improvement Budget Cook Builders

You must capitalize any expense you pay to improve your rental property. Recording building improvements in quickbooks involves several key steps to ensure proper documentation and classification of these. All property improvements will be entered in the assets/depreciation section of the program under the rental & royalty income. An expense is for an improvement if it.

McCarthy Building Companies Tenant Improvement CDs by SCA Design

An expense is for an improvement if it. All property improvements will be entered in the assets/depreciation section of the program under the rental & royalty income. You must capitalize any expense you pay to improve your rental property. Recording building improvements in quickbooks involves several key steps to ensure proper documentation and classification of these.

Calculating Tenant Improvement Allowance

An expense is for an improvement if it. Recording building improvements in quickbooks involves several key steps to ensure proper documentation and classification of these. All property improvements will be entered in the assets/depreciation section of the program under the rental & royalty income. You must capitalize any expense you pay to improve your rental property.

Tips for Maximizing Your Tenant Improvement Budget Cook Builders

All property improvements will be entered in the assets/depreciation section of the program under the rental & royalty income. An expense is for an improvement if it. You must capitalize any expense you pay to improve your rental property. Recording building improvements in quickbooks involves several key steps to ensure proper documentation and classification of these.

Project Gallery TSG Constructors

All property improvements will be entered in the assets/depreciation section of the program under the rental & royalty income. You must capitalize any expense you pay to improve your rental property. Recording building improvements in quickbooks involves several key steps to ensure proper documentation and classification of these. An expense is for an improvement if it.

Tenant Improvement Critique List

All property improvements will be entered in the assets/depreciation section of the program under the rental & royalty income. You must capitalize any expense you pay to improve your rental property. An expense is for an improvement if it. Recording building improvements in quickbooks involves several key steps to ensure proper documentation and classification of these.

TENANT IMPROVEMENT PROJECT OFFICE Behance

All property improvements will be entered in the assets/depreciation section of the program under the rental & royalty income. You must capitalize any expense you pay to improve your rental property. Recording building improvements in quickbooks involves several key steps to ensure proper documentation and classification of these. An expense is for an improvement if it.

Recording Building Improvements In Quickbooks Involves Several Key Steps To Ensure Proper Documentation And Classification Of These.

An expense is for an improvement if it. You must capitalize any expense you pay to improve your rental property. All property improvements will be entered in the assets/depreciation section of the program under the rental & royalty income.