Kentucky Local Government Premium Tax

Kentucky Local Government Premium Tax - Deadline to file local government premium tax is march 23. Kentucky policyholders often have questions about the taxes that show up on their premium notices. This bulletin contains information regarding changes to procedures for adjudicating local government premium tax (“lgpt”); Insurance companies and surplus lines brokers are responsible for paying kentucky local government premium tax (lgpt) to taxing. The insurance premium surcharge is charged and collected by every foreign, domestic, or alien insurer, other than life insurers, on premiums,. Local government premium tax krs 91a.080 authorizes local governments to impose and collect license fees or taxes upon insurance. The kentucky department of insurance (doi).

Insurance companies and surplus lines brokers are responsible for paying kentucky local government premium tax (lgpt) to taxing. This bulletin contains information regarding changes to procedures for adjudicating local government premium tax (“lgpt”); The insurance premium surcharge is charged and collected by every foreign, domestic, or alien insurer, other than life insurers, on premiums,. The kentucky department of insurance (doi). Kentucky policyholders often have questions about the taxes that show up on their premium notices. Local government premium tax krs 91a.080 authorizes local governments to impose and collect license fees or taxes upon insurance. Deadline to file local government premium tax is march 23.

Deadline to file local government premium tax is march 23. The kentucky department of insurance (doi). Local government premium tax krs 91a.080 authorizes local governments to impose and collect license fees or taxes upon insurance. Insurance companies and surplus lines brokers are responsible for paying kentucky local government premium tax (lgpt) to taxing. The insurance premium surcharge is charged and collected by every foreign, domestic, or alien insurer, other than life insurers, on premiums,. Kentucky policyholders often have questions about the taxes that show up on their premium notices. This bulletin contains information regarding changes to procedures for adjudicating local government premium tax (“lgpt”);

Kentucky pension crisis Local governments face ballooning pension

This bulletin contains information regarding changes to procedures for adjudicating local government premium tax (“lgpt”); Deadline to file local government premium tax is march 23. Local government premium tax krs 91a.080 authorizes local governments to impose and collect license fees or taxes upon insurance. The kentucky department of insurance (doi). Kentucky policyholders often have questions about the taxes that show.

Kentucky Bond Corporation Issues Bonds for Kentucky’s First Local

This bulletin contains information regarding changes to procedures for adjudicating local government premium tax (“lgpt”); Local government premium tax krs 91a.080 authorizes local governments to impose and collect license fees or taxes upon insurance. Kentucky policyholders often have questions about the taxes that show up on their premium notices. Deadline to file local government premium tax is march 23. The.

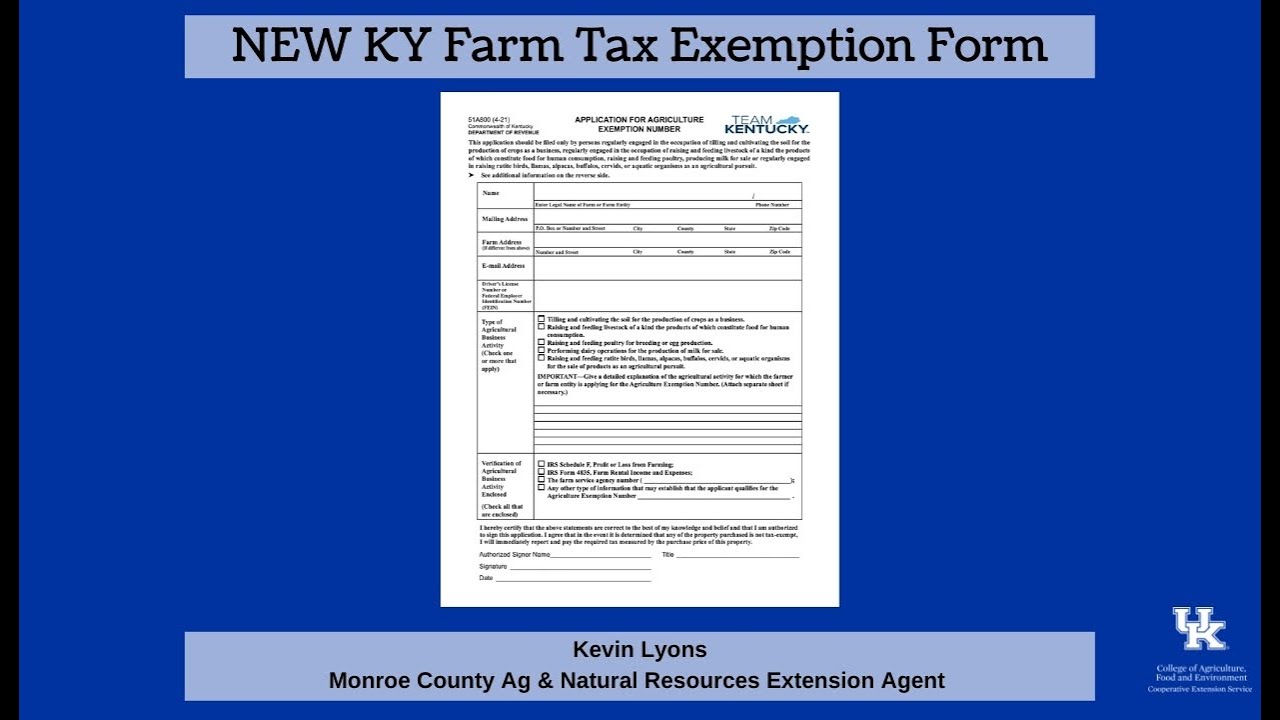

Kentucky Farm Tax Exempt Form 2023 Printable Forms Free Online

The kentucky department of insurance (doi). Insurance companies and surplus lines brokers are responsible for paying kentucky local government premium tax (lgpt) to taxing. Deadline to file local government premium tax is march 23. Local government premium tax krs 91a.080 authorizes local governments to impose and collect license fees or taxes upon insurance. The insurance premium surcharge is charged and.

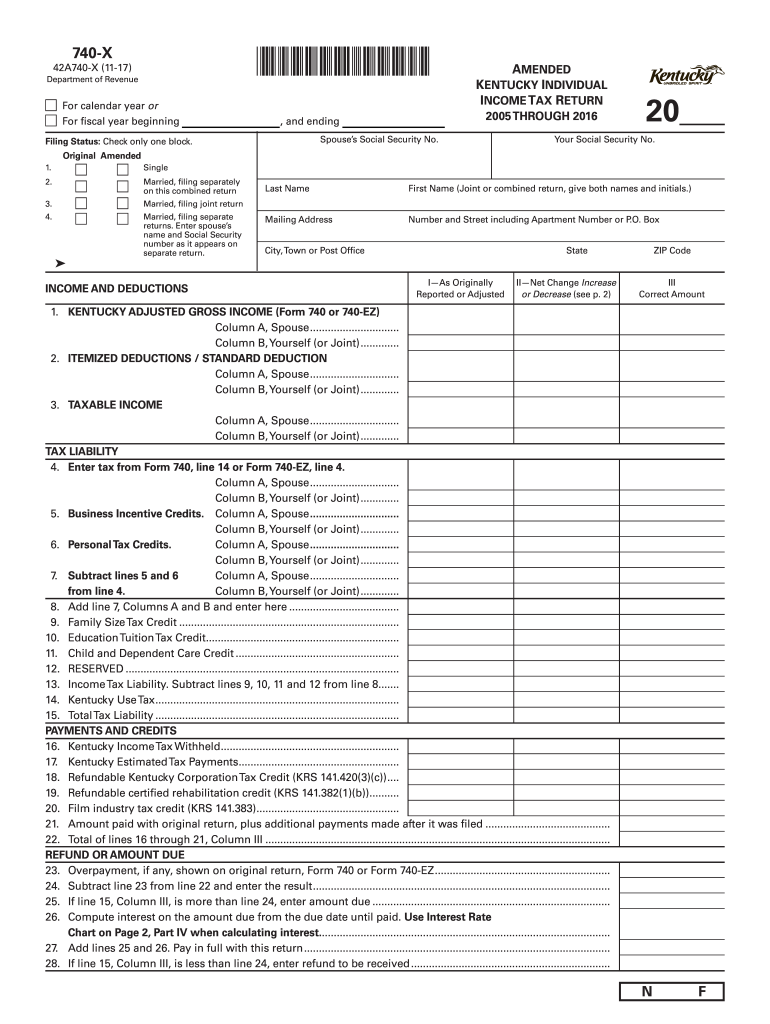

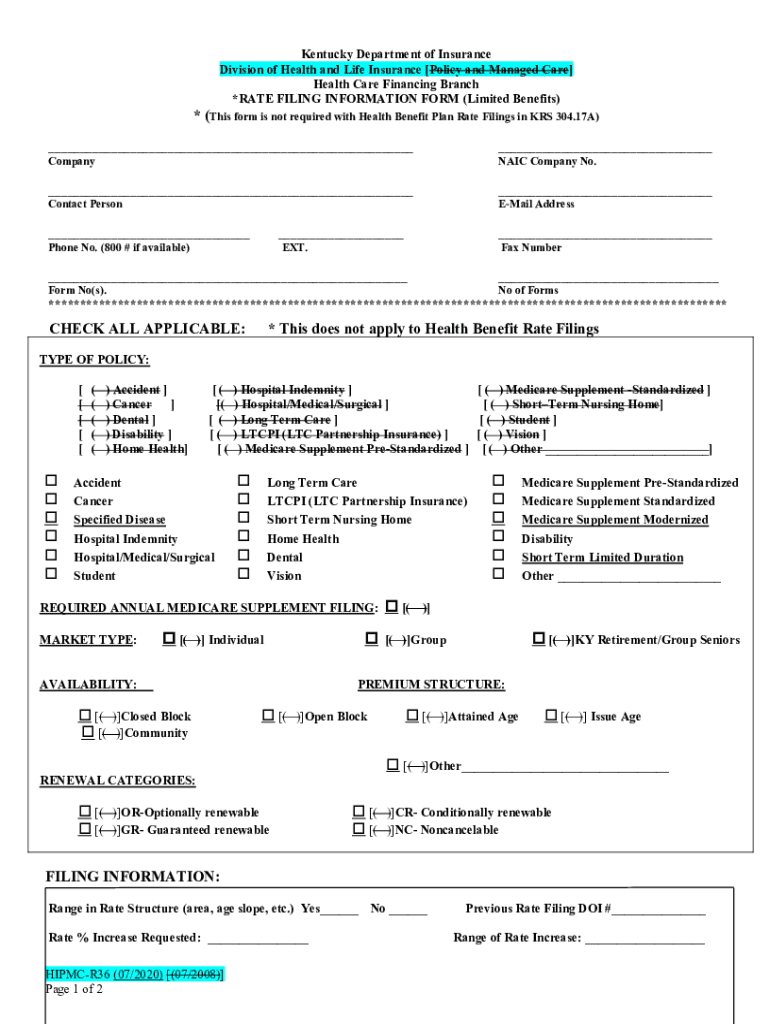

Kentucky tax type 005 Fill out & sign online DocHub

The kentucky department of insurance (doi). Local government premium tax krs 91a.080 authorizes local governments to impose and collect license fees or taxes upon insurance. This bulletin contains information regarding changes to procedures for adjudicating local government premium tax (“lgpt”); Kentucky policyholders often have questions about the taxes that show up on their premium notices. The insurance premium surcharge is.

Kentucky Tax Withholding Form 2024 Rani Valeda

The kentucky department of insurance (doi). This bulletin contains information regarding changes to procedures for adjudicating local government premium tax (“lgpt”); The insurance premium surcharge is charged and collected by every foreign, domestic, or alien insurer, other than life insurers, on premiums,. Insurance companies and surplus lines brokers are responsible for paying kentucky local government premium tax (lgpt) to taxing..

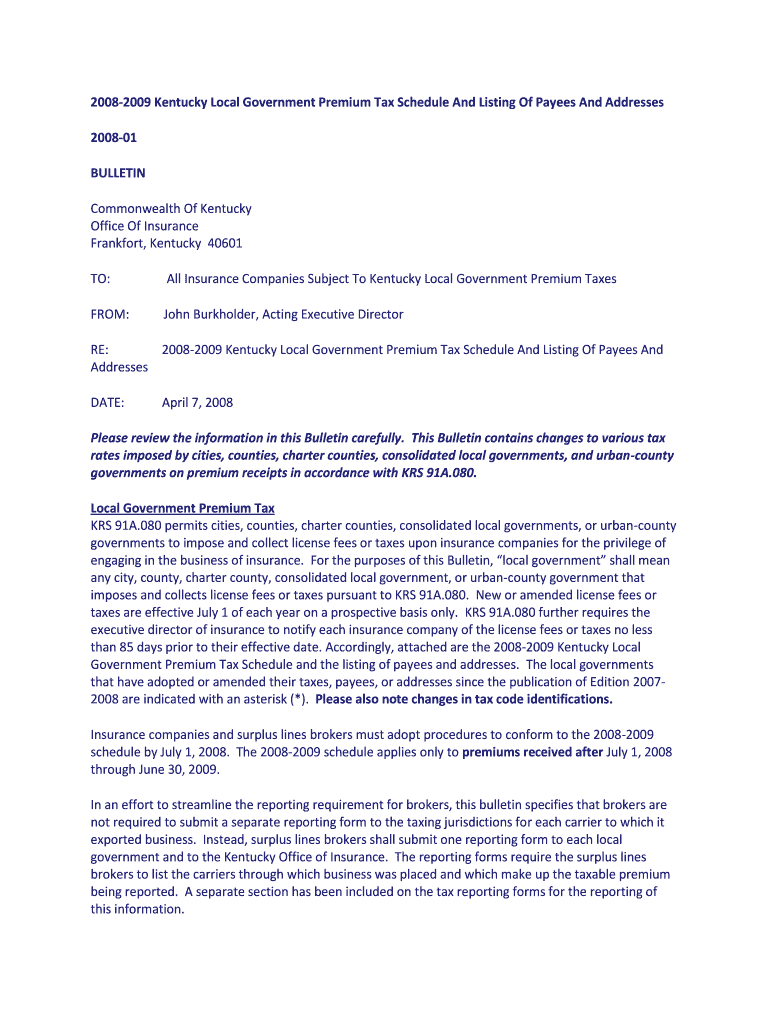

Fillable Online 20082009 Kentucky Local Government Premium Tax

The kentucky department of insurance (doi). Kentucky policyholders often have questions about the taxes that show up on their premium notices. Local government premium tax krs 91a.080 authorizes local governments to impose and collect license fees or taxes upon insurance. This bulletin contains information regarding changes to procedures for adjudicating local government premium tax (“lgpt”); The insurance premium surcharge is.

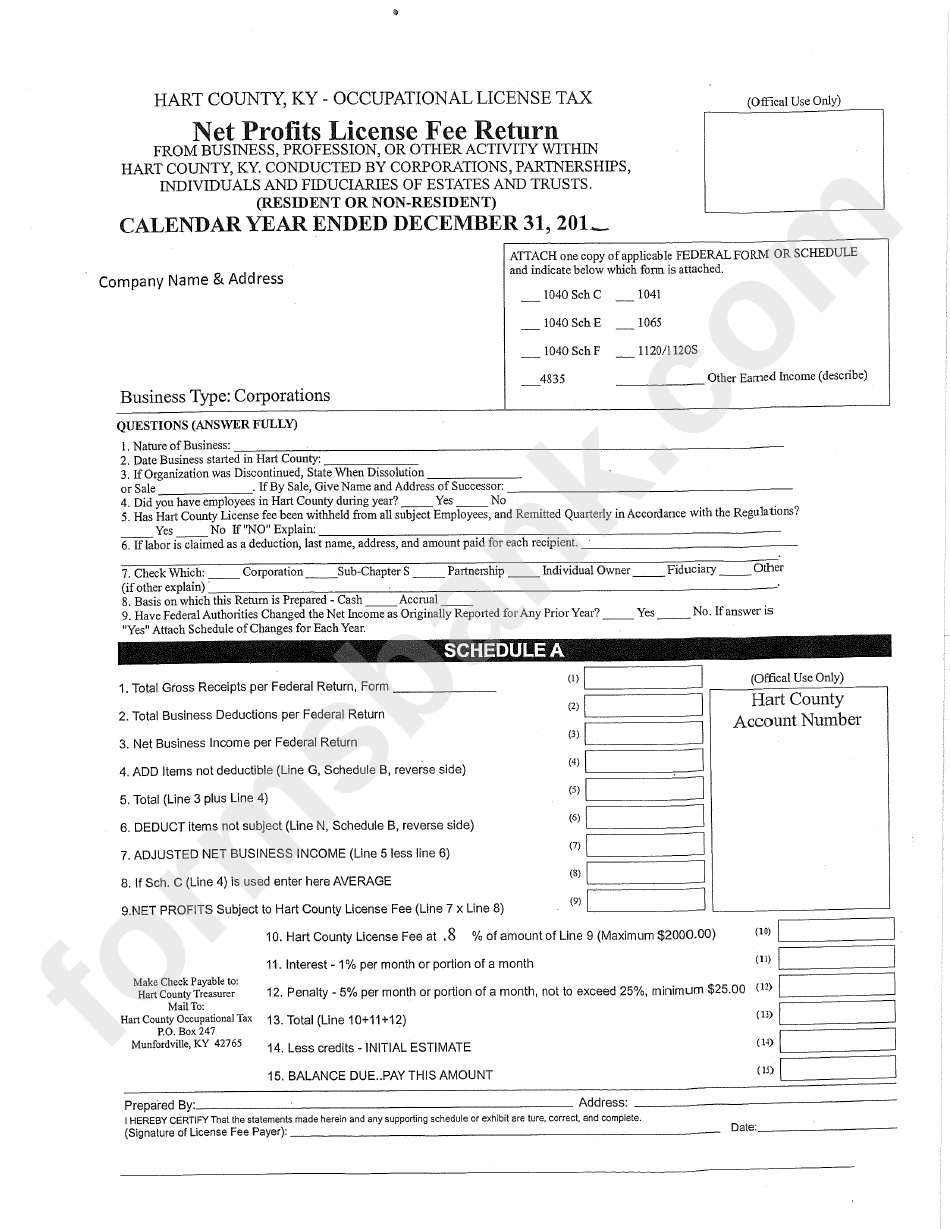

Net Profit License Fee Return Hart County, Kentucky Occupational Tax

The insurance premium surcharge is charged and collected by every foreign, domestic, or alien insurer, other than life insurers, on premiums,. This bulletin contains information regarding changes to procedures for adjudicating local government premium tax (“lgpt”); Insurance companies and surplus lines brokers are responsible for paying kentucky local government premium tax (lgpt) to taxing. The kentucky department of insurance (doi)..

Fillable Online Local Government Premium Tax Fax Email Print pdfFiller

Insurance companies and surplus lines brokers are responsible for paying kentucky local government premium tax (lgpt) to taxing. The kentucky department of insurance (doi). Local government premium tax krs 91a.080 authorizes local governments to impose and collect license fees or taxes upon insurance. This bulletin contains information regarding changes to procedures for adjudicating local government premium tax (“lgpt”); The insurance.

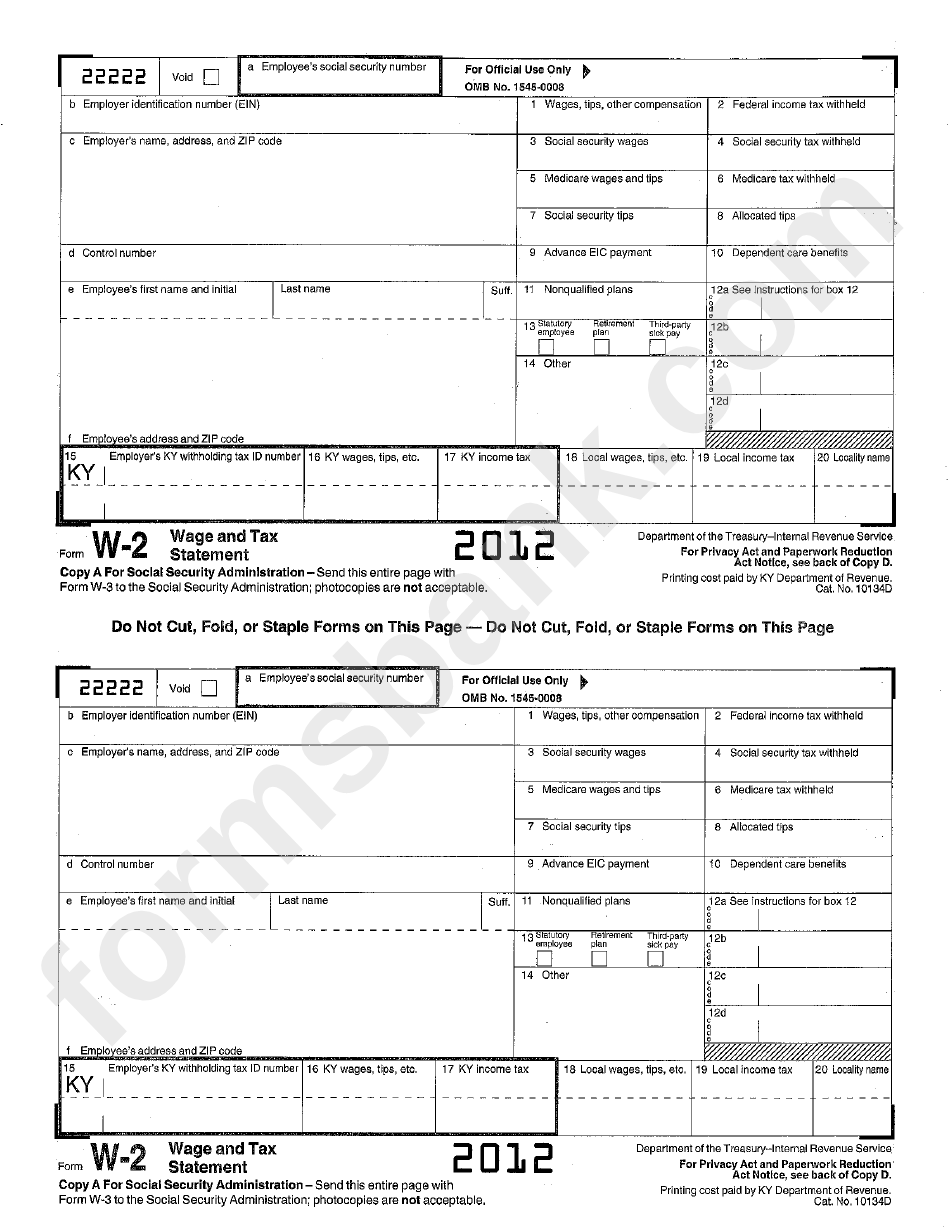

Form W2 Wage And Tax Statement Kentucky Department Of Revenue

Local government premium tax krs 91a.080 authorizes local governments to impose and collect license fees or taxes upon insurance. Insurance companies and surplus lines brokers are responsible for paying kentucky local government premium tax (lgpt) to taxing. The kentucky department of insurance (doi). The insurance premium surcharge is charged and collected by every foreign, domestic, or alien insurer, other than.

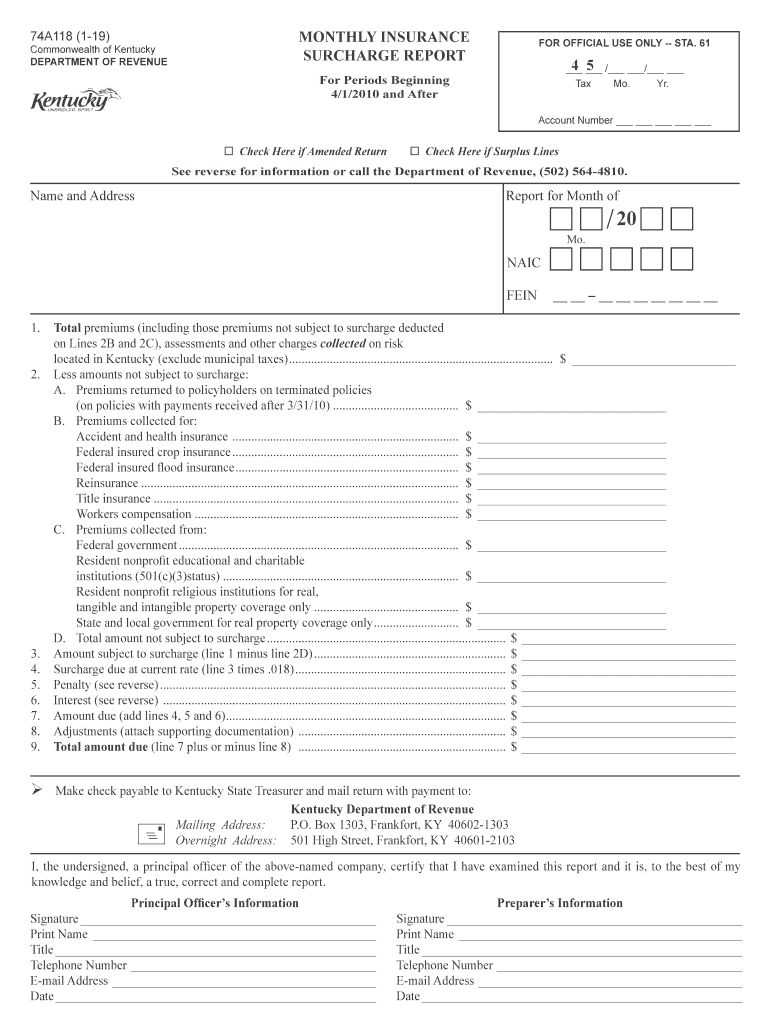

2019 Form KY 74A118 Fill Online, Printable, Fillable, Blank pdfFiller

The kentucky department of insurance (doi). Kentucky policyholders often have questions about the taxes that show up on their premium notices. Insurance companies and surplus lines brokers are responsible for paying kentucky local government premium tax (lgpt) to taxing. This bulletin contains information regarding changes to procedures for adjudicating local government premium tax (“lgpt”); Local government premium tax krs 91a.080.

The Kentucky Department Of Insurance (Doi).

Local government premium tax krs 91a.080 authorizes local governments to impose and collect license fees or taxes upon insurance. Kentucky policyholders often have questions about the taxes that show up on their premium notices. This bulletin contains information regarding changes to procedures for adjudicating local government premium tax (“lgpt”); Deadline to file local government premium tax is march 23.

The Insurance Premium Surcharge Is Charged And Collected By Every Foreign, Domestic, Or Alien Insurer, Other Than Life Insurers, On Premiums,.

Insurance companies and surplus lines brokers are responsible for paying kentucky local government premium tax (lgpt) to taxing.