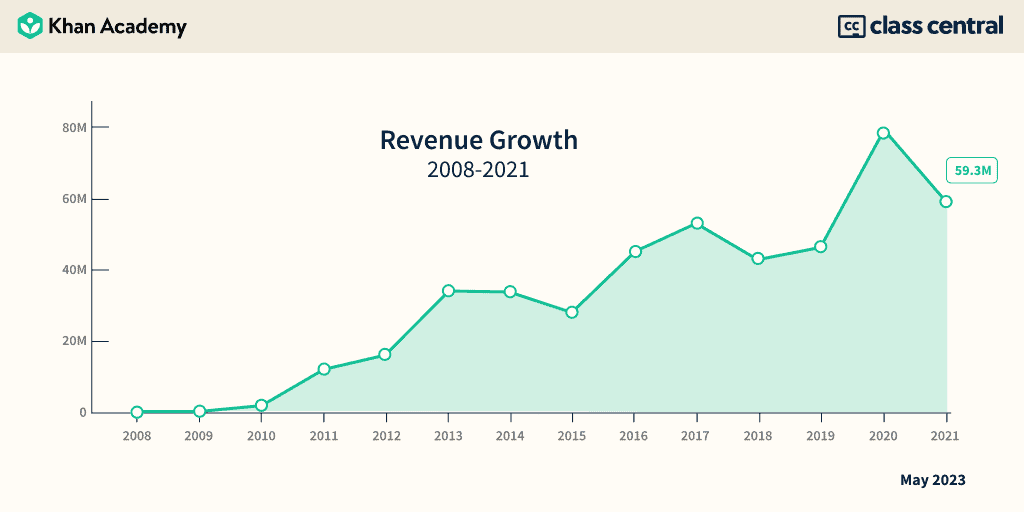

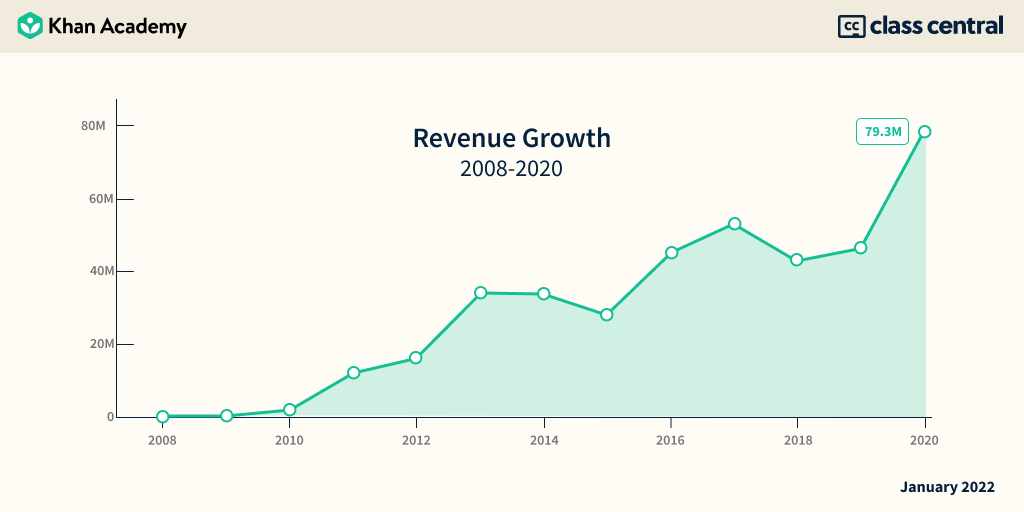

Khan Academy Revenue

Khan Academy Revenue - Our latest study finds that using khan academy for 30+ minutes per week (18+ hours over the school year) leads to ~20% higher. Every organization that has been recognized as tax exempt by the irs has to file form 990 every year, unless they make less than $200,000 in. Children are born ready to. We have audited the consolidated financial statements of khan academy, inc. Khan academy has set an ambitious goal to accelerate the learning of 10% of u.s. (the academy), which comprise the consolidated. In 2019, 2.7 million students signed up for khan academy’s official sat practice—a 17% increase from the year before. Students—about 5 million learners—every year.

Students—about 5 million learners—every year. (the academy), which comprise the consolidated. We have audited the consolidated financial statements of khan academy, inc. Khan academy has set an ambitious goal to accelerate the learning of 10% of u.s. Every organization that has been recognized as tax exempt by the irs has to file form 990 every year, unless they make less than $200,000 in. Children are born ready to. In 2019, 2.7 million students signed up for khan academy’s official sat practice—a 17% increase from the year before. Our latest study finds that using khan academy for 30+ minutes per week (18+ hours over the school year) leads to ~20% higher.

Students—about 5 million learners—every year. We have audited the consolidated financial statements of khan academy, inc. Children are born ready to. In 2019, 2.7 million students signed up for khan academy’s official sat practice—a 17% increase from the year before. Khan academy has set an ambitious goal to accelerate the learning of 10% of u.s. Our latest study finds that using khan academy for 30+ minutes per week (18+ hours over the school year) leads to ~20% higher. (the academy), which comprise the consolidated. Every organization that has been recognized as tax exempt by the irs has to file form 990 every year, unless they make less than $200,000 in.

Khan Academy Finding North

In 2019, 2.7 million students signed up for khan academy’s official sat practice—a 17% increase from the year before. Khan academy has set an ambitious goal to accelerate the learning of 10% of u.s. We have audited the consolidated financial statements of khan academy, inc. (the academy), which comprise the consolidated. Students—about 5 million learners—every year.

The Business of Online Education Khan Academy Tax Returns Analysis

In 2019, 2.7 million students signed up for khan academy’s official sat practice—a 17% increase from the year before. Khan academy has set an ambitious goal to accelerate the learning of 10% of u.s. Children are born ready to. Students—about 5 million learners—every year. (the academy), which comprise the consolidated.

Khan Academy Success Story How This Educational Platform Is Providing

Khan academy has set an ambitious goal to accelerate the learning of 10% of u.s. Children are born ready to. (the academy), which comprise the consolidated. Every organization that has been recognized as tax exempt by the irs has to file form 990 every year, unless they make less than $200,000 in. Our latest study finds that using khan academy.

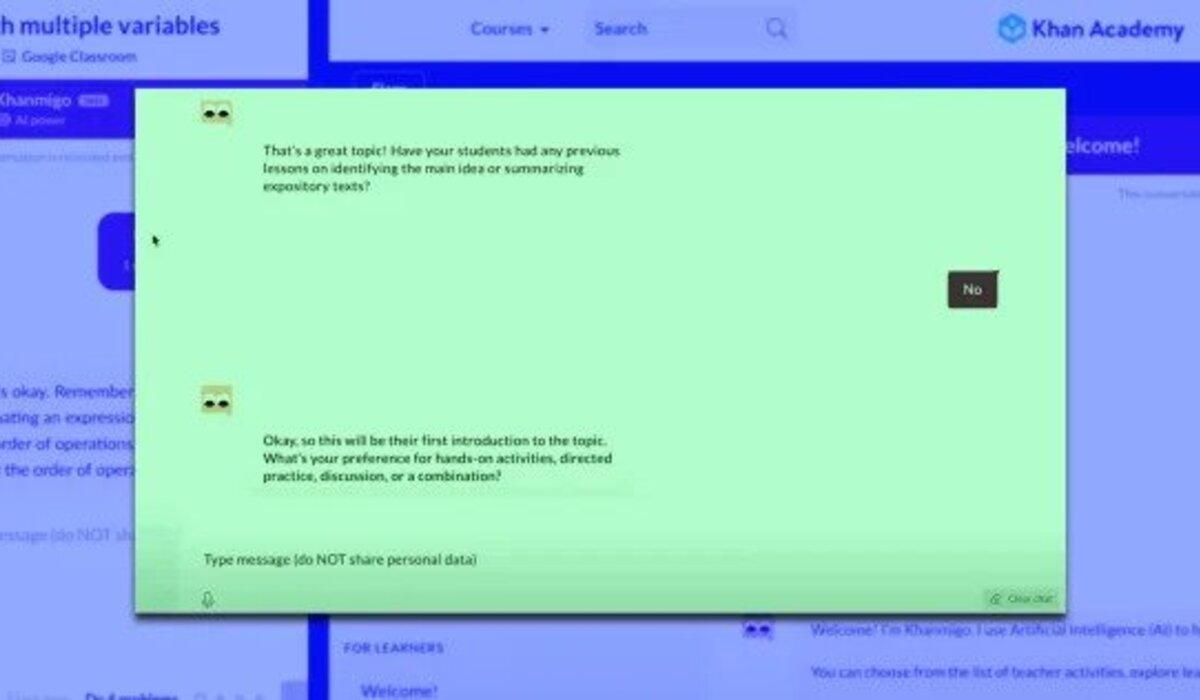

Khan Academy Is Working On A Version Of GPT Called Khanmingo

Children are born ready to. In 2019, 2.7 million students signed up for khan academy’s official sat practice—a 17% increase from the year before. Every organization that has been recognized as tax exempt by the irs has to file form 990 every year, unless they make less than $200,000 in. Students—about 5 million learners—every year. Our latest study finds that.

o9 Solutions corporate yearend grant donation to Khan academy o9

Our latest study finds that using khan academy for 30+ minutes per week (18+ hours over the school year) leads to ~20% higher. (the academy), which comprise the consolidated. We have audited the consolidated financial statements of khan academy, inc. Students—about 5 million learners—every year. Children are born ready to.

Khan Academy Tax Returns Analysis (20082020) 390M in Revenue, 118M

We have audited the consolidated financial statements of khan academy, inc. Children are born ready to. Students—about 5 million learners—every year. Khan academy has set an ambitious goal to accelerate the learning of 10% of u.s. (the academy), which comprise the consolidated.

Exploring Khan Academy's Diverse Revenue Model How Much Money Does

In 2019, 2.7 million students signed up for khan academy’s official sat practice—a 17% increase from the year before. Students—about 5 million learners—every year. Khan academy has set an ambitious goal to accelerate the learning of 10% of u.s. (the academy), which comprise the consolidated. Our latest study finds that using khan academy for 30+ minutes per week (18+ hours.

How Does Khan Academy Make Money? Exploring the Business Model of the

Khan academy has set an ambitious goal to accelerate the learning of 10% of u.s. Every organization that has been recognized as tax exempt by the irs has to file form 990 every year, unless they make less than $200,000 in. Our latest study finds that using khan academy for 30+ minutes per week (18+ hours over the school year).

Khan Academy Tax Returns Analysis (20082020) 390M in Revenue, 118M

Our latest study finds that using khan academy for 30+ minutes per week (18+ hours over the school year) leads to ~20% higher. Khan academy has set an ambitious goal to accelerate the learning of 10% of u.s. In 2019, 2.7 million students signed up for khan academy’s official sat practice—a 17% increase from the year before. (the academy), which.

The Business of Online Education Khan Academy Tax Returns Analysis

Students—about 5 million learners—every year. Our latest study finds that using khan academy for 30+ minutes per week (18+ hours over the school year) leads to ~20% higher. We have audited the consolidated financial statements of khan academy, inc. In 2019, 2.7 million students signed up for khan academy’s official sat practice—a 17% increase from the year before. Khan academy.

Every Organization That Has Been Recognized As Tax Exempt By The Irs Has To File Form 990 Every Year, Unless They Make Less Than $200,000 In.

We have audited the consolidated financial statements of khan academy, inc. Children are born ready to. In 2019, 2.7 million students signed up for khan academy’s official sat practice—a 17% increase from the year before. Khan academy has set an ambitious goal to accelerate the learning of 10% of u.s.

(The Academy), Which Comprise The Consolidated.

Students—about 5 million learners—every year. Our latest study finds that using khan academy for 30+ minutes per week (18+ hours over the school year) leads to ~20% higher.