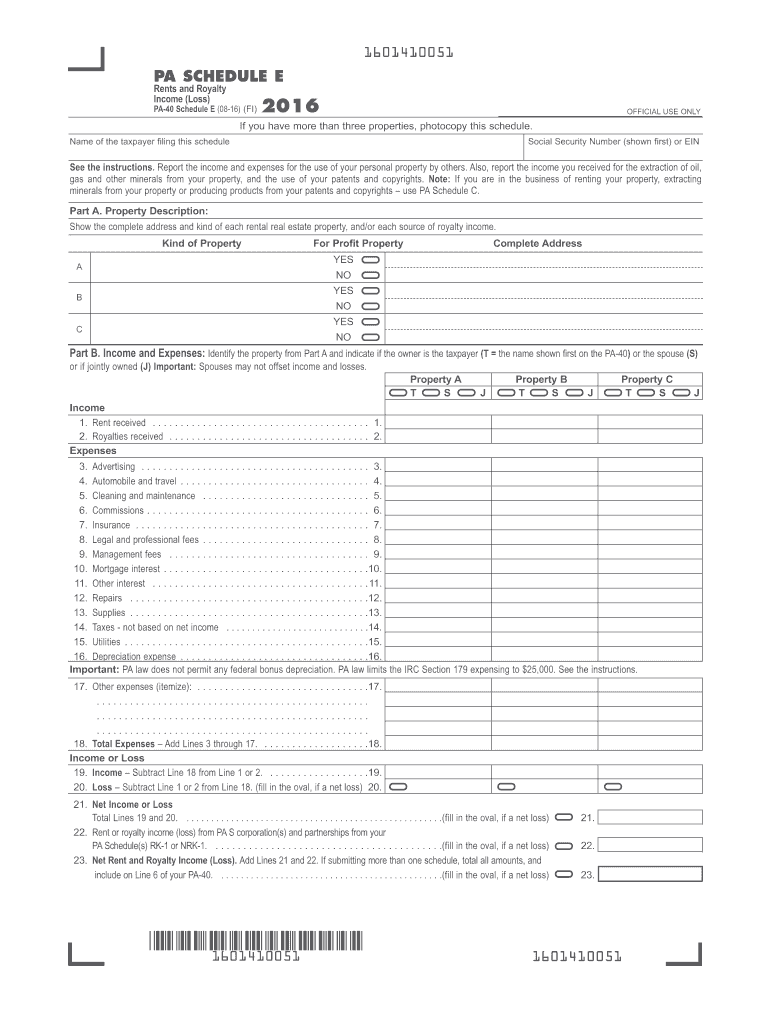

Local Income Tax Pennsylvania

Local Income Tax Pennsylvania - Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. Employers with worksites located in pennsylvania are required. To connect with the governor’s center for local government services (gclgs) by phone, call 888.223.6837. How do i find local earned. You can click on any city or county for more details, including. We have information on the local income tax rates in 12 localities in pennsylvania. We specialize in all pennsylvania act 32 and act 50 tax administration services. Dced local government services act 32: We are the trusted partner for 32 tcds and provide services to.

Employers with worksites located in pennsylvania are required. We have information on the local income tax rates in 12 localities in pennsylvania. How do i find local earned. We specialize in all pennsylvania act 32 and act 50 tax administration services. Dced local government services act 32: To connect with the governor’s center for local government services (gclgs) by phone, call 888.223.6837. We are the trusted partner for 32 tcds and provide services to. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. You can click on any city or county for more details, including.

We have information on the local income tax rates in 12 localities in pennsylvania. We are the trusted partner for 32 tcds and provide services to. We specialize in all pennsylvania act 32 and act 50 tax administration services. How do i find local earned. Employers with worksites located in pennsylvania are required. To connect with the governor’s center for local government services (gclgs) by phone, call 888.223.6837. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. Dced local government services act 32: You can click on any city or county for more details, including.

Pennsylvania State Tax 2024 2025

You can click on any city or county for more details, including. To connect with the governor’s center for local government services (gclgs) by phone, call 888.223.6837. We have information on the local income tax rates in 12 localities in pennsylvania. We specialize in all pennsylvania act 32 and act 50 tax administration services. Employers with worksites located in pennsylvania.

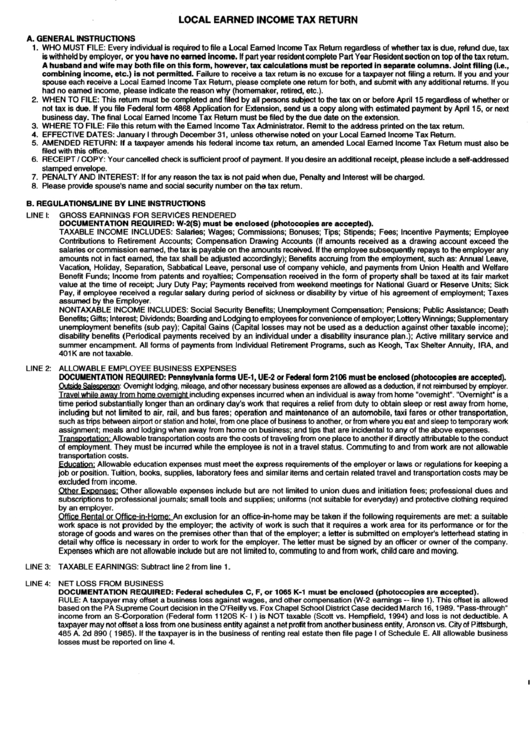

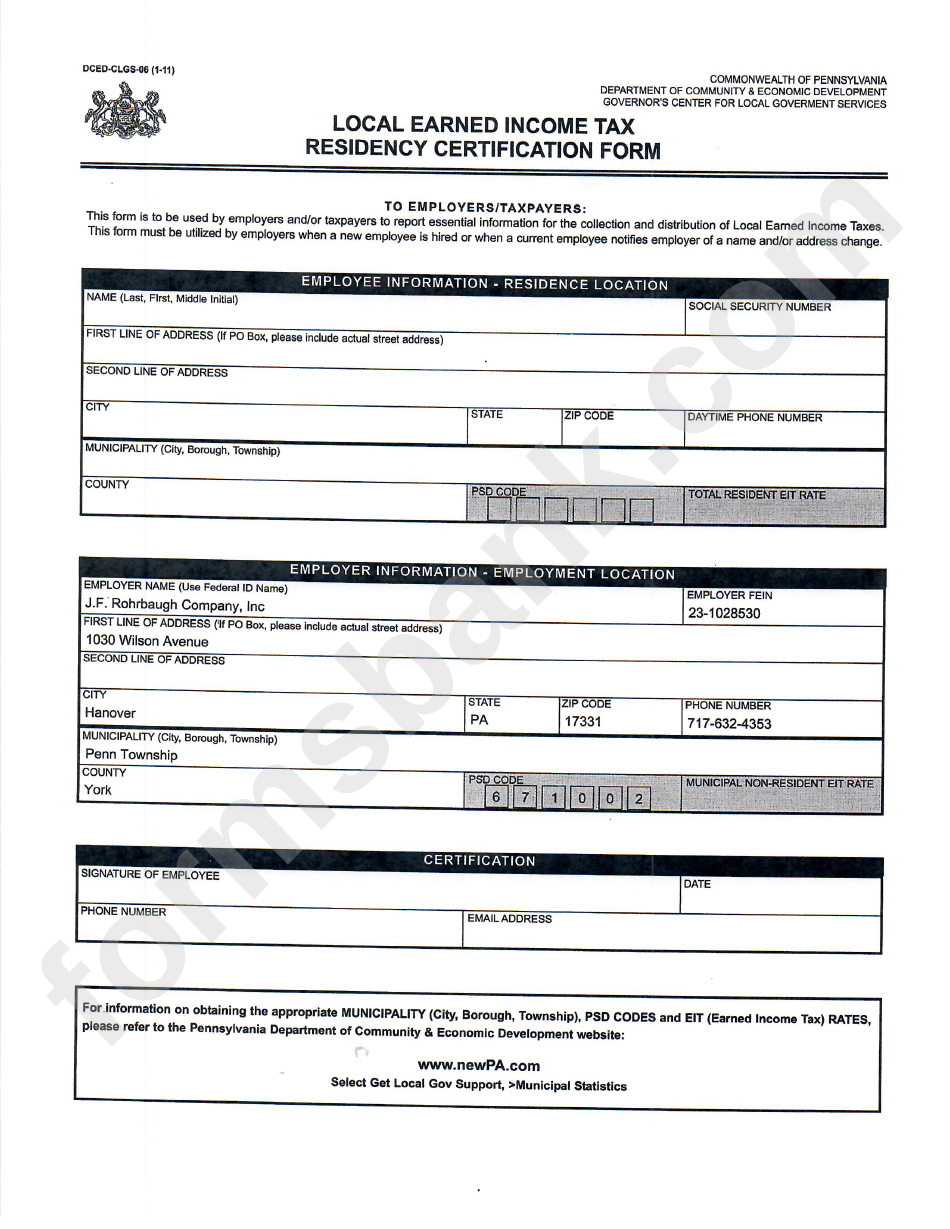

Instructions For Local Earned Tax Return Form Pennsylvania

You can click on any city or county for more details, including. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. To connect with the governor’s center for local government services (gclgs) by phone, call 888.223.6837. Dced local government services act 32: We have information on.

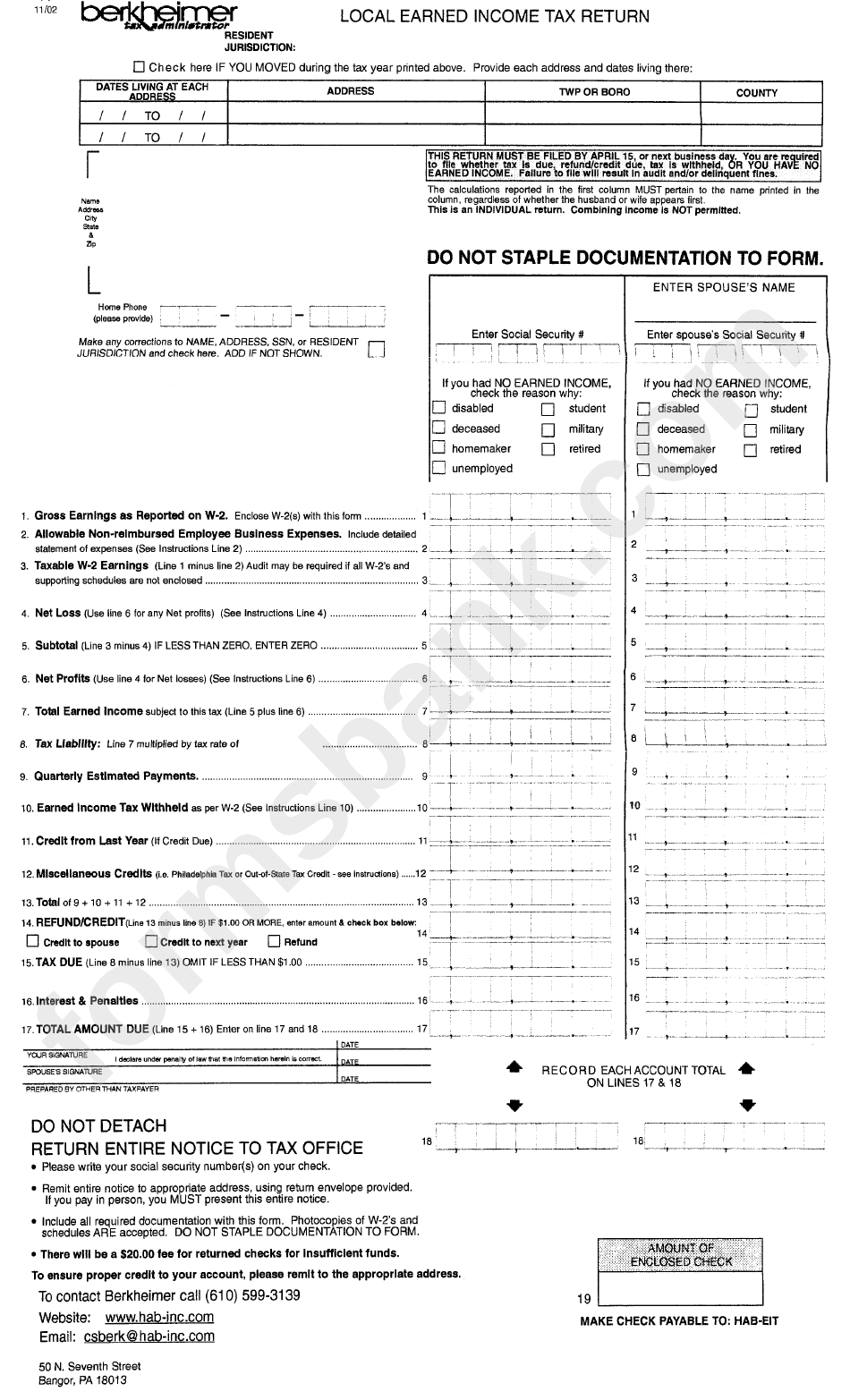

Local Earned Tax Return Form Berkheimer Tax Administrator

We are the trusted partner for 32 tcds and provide services to. You can click on any city or county for more details, including. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. We have information on the local income tax rates in 12 localities in.

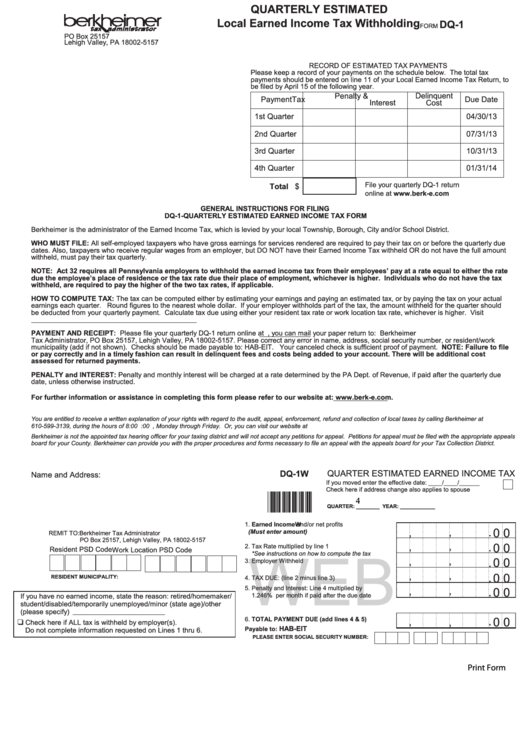

Pennsylvania Local Earned Tax Withholding Form

We specialize in all pennsylvania act 32 and act 50 tax administration services. To connect with the governor’s center for local government services (gclgs) by phone, call 888.223.6837. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. We are the trusted partner for 32 tcds and.

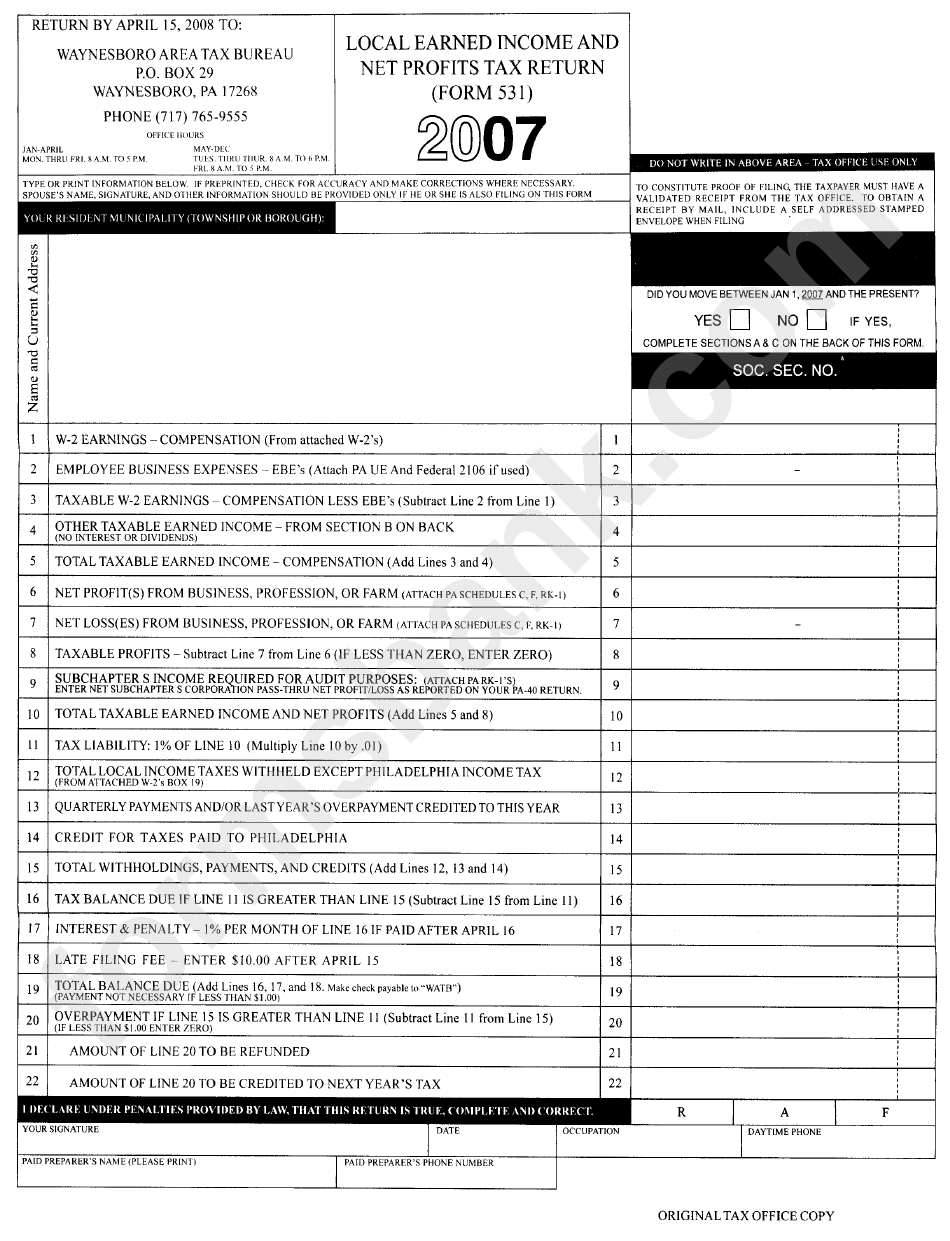

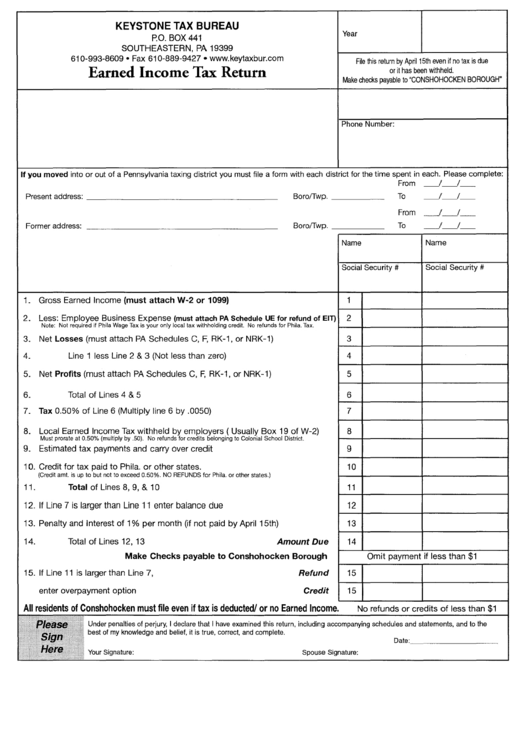

Form 531 Local Earned And Net Profits Tax Return 2007

Dced local government services act 32: How do i find local earned. We specialize in all pennsylvania act 32 and act 50 tax administration services. We are the trusted partner for 32 tcds and provide services to. We have information on the local income tax rates in 12 localities in pennsylvania.

Local Taxes in 2019 Local Tax City & County Level

Employers with worksites located in pennsylvania are required. You can click on any city or county for more details, including. How do i find local earned. We specialize in all pennsylvania act 32 and act 50 tax administration services. Dced local government services act 32:

Pennsylvania Tax Return PA 40 Revenue Pa Gov Fill Out and Sign

We have information on the local income tax rates in 12 localities in pennsylvania. Employers with worksites located in pennsylvania are required. We are the trusted partner for 32 tcds and provide services to. To connect with the governor’s center for local government services (gclgs) by phone, call 888.223.6837. Dced local government services act 32:

Fillable Local Earned Tax Form Pa Printable Forms Free Online

We have information on the local income tax rates in 12 localities in pennsylvania. We are the trusted partner for 32 tcds and provide services to. We specialize in all pennsylvania act 32 and act 50 tax administration services. To connect with the governor’s center for local government services (gclgs) by phone, call 888.223.6837. Dced local government services act 32:

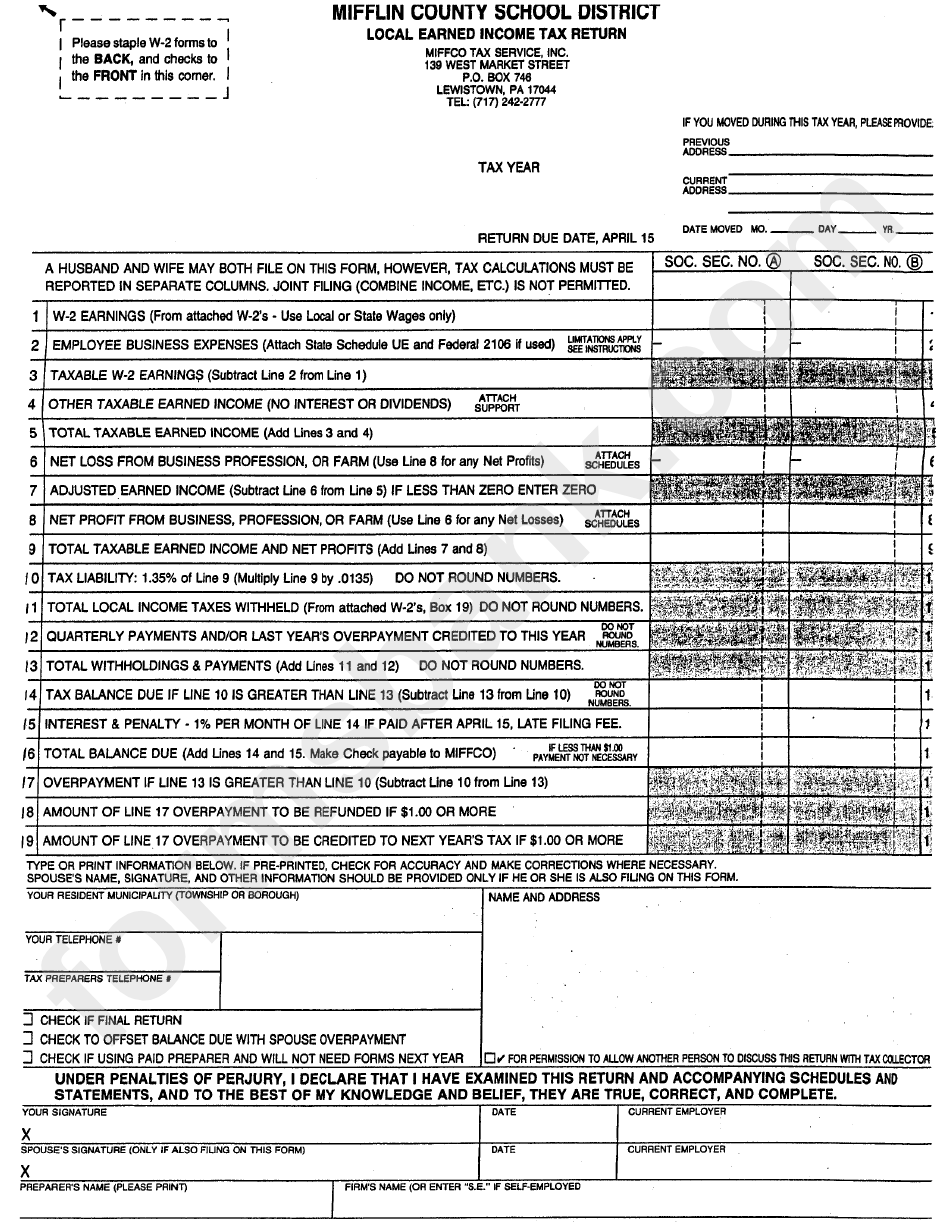

Earned Tax Return Form Pennsylvania printable pdf download

Employers with worksites located in pennsylvania are required. We are the trusted partner for 32 tcds and provide services to. You can click on any city or county for more details, including. We have information on the local income tax rates in 12 localities in pennsylvania. Dced local government services act 32:

Local Earned Tax Return Form Pennsylvania Mifflin County

We are the trusted partner for 32 tcds and provide services to. Dced local government services act 32: You can click on any city or county for more details, including. We have information on the local income tax rates in 12 localities in pennsylvania. Pennsylvania residents with earned income or net profits must file a local earned income tax return.

We Are The Trusted Partner For 32 Tcds And Provide Services To.

How do i find local earned. We specialize in all pennsylvania act 32 and act 50 tax administration services. We have information on the local income tax rates in 12 localities in pennsylvania. You can click on any city or county for more details, including.

Dced Local Government Services Act 32:

To connect with the governor’s center for local government services (gclgs) by phone, call 888.223.6837. Employers with worksites located in pennsylvania are required. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15.