Local Income Tax Pittsburgh

Local Income Tax Pittsburgh - The local services tax of $52 is to be deducted evenly from pay checks throughout the year. This format is accepted by 48* of the 69 tax collection districts in pennsylvania. View and sort psd codes & eit rates by county, municipality, and school district. Make sure your local earned income taxes go to work for you and your community! If the employer does not withhold the proper amount. The annual local service tax reconciliation is not being required for 2023 or. The local services tax may be. The first two (2) digits of a psd code represent the tax. Since 2012, employers in pennsylvania have been required. Click here for more details.

The first two (2) digits of a psd code represent the tax. If the employer does not withhold the proper amount. View and sort psd codes & eit rates by county, municipality, and school district. Find your withholding rates by address. Click here for more details. The local services tax of $52 is to be deducted evenly from pay checks throughout the year. Since 2012, employers in pennsylvania have been required. This format is suitable for filing. This format is accepted by 48* of the 69 tax collection districts in pennsylvania. The local services tax may be.

View and sort psd codes & eit rates by county, municipality, and school district. The first two (2) digits of a psd code represent the tax. The annual local service tax reconciliation is not being required for 2023 or. Make sure your local earned income taxes go to work for you and your community! This format is suitable for filing. The local services tax may be. The local services tax of $52 is to be deducted evenly from pay checks throughout the year. Click here for more details. Our clients consist of more than 85 boroughs, townships and authorities and 30 school districts, as well as allegheny county and the city and. If the employer does not withhold the proper amount.

The Highest and Lowest Areas in Pittsburgh, PA

This format is accepted by 48* of the 69 tax collection districts in pennsylvania. The annual local service tax reconciliation is not being required for 2023 or. The first two (2) digits of a psd code represent the tax. Make sure your local earned income taxes go to work for you and your community! The local services tax of $52.

News Archives Pittsburgh Innovation District

The local services tax may be. Click here for more details. Make sure your local earned income taxes go to work for you and your community! If the employer does not withhold the proper amount. Since 2012, employers in pennsylvania have been required.

Local Taxes by State Local Tax Data Tax Foundation

The annual local service tax reconciliation is not being required for 2023 or. The local services tax of $52 is to be deducted evenly from pay checks throughout the year. Find your withholding rates by address. This format is suitable for filing. Since 2012, employers in pennsylvania have been required.

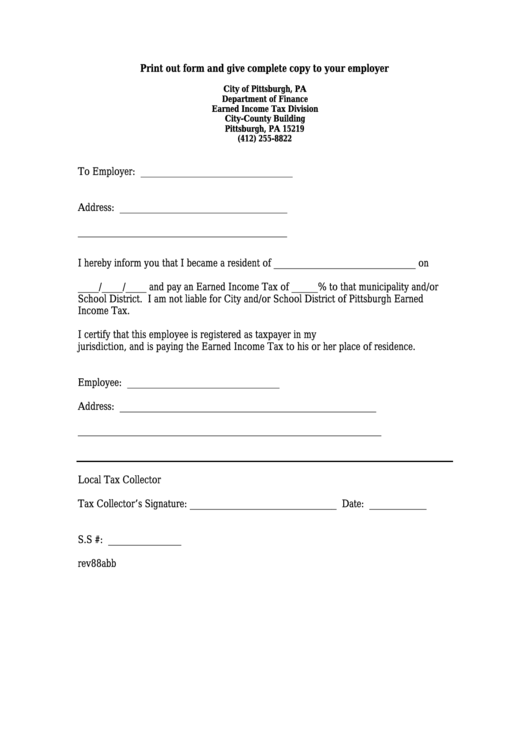

Earned Tax Exemption Form City Of Pittsburgh printable pdf

The local services tax may be. This format is accepted by 48* of the 69 tax collection districts in pennsylvania. View and sort psd codes & eit rates by county, municipality, and school district. Our clients consist of more than 85 boroughs, townships and authorities and 30 school districts, as well as allegheny county and the city and. Click here.

State and Local Tax Deduction by State Tax Policy Center

Our clients consist of more than 85 boroughs, townships and authorities and 30 school districts, as well as allegheny county and the city and. The first two (2) digits of a psd code represent the tax. Find your withholding rates by address. The local services tax of $52 is to be deducted evenly from pay checks throughout the year. The.

Local Taxes in 2019 Local Tax City & County Level

Click here for more details. Since 2012, employers in pennsylvania have been required. The local services tax of $52 is to be deducted evenly from pay checks throughout the year. Find your withholding rates by address. The local services tax may be.

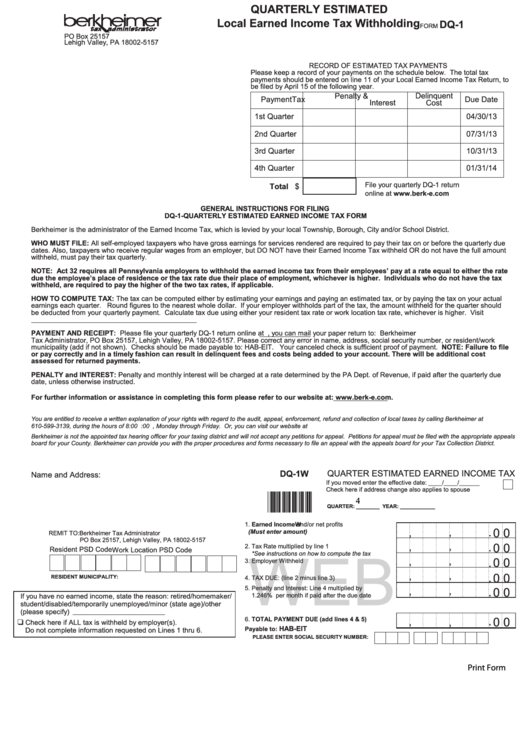

Pennsylvania Local Earned Tax Withholding Form

The local services tax may be. Click here for more details. If the employer does not withhold the proper amount. This format is suitable for filing. The first two (2) digits of a psd code represent the tax.

Mifflin County Local Tax Forms

If the employer does not withhold the proper amount. The annual local service tax reconciliation is not being required for 2023 or. Make sure your local earned income taxes go to work for you and your community! The first two (2) digits of a psd code represent the tax. The local services tax may be.

Local Taxes in 2019 Local Tax City & County Level

The local services tax of $52 is to be deducted evenly from pay checks throughout the year. This format is suitable for filing. The local services tax may be. Find your withholding rates by address. Since 2012, employers in pennsylvania have been required.

Looking for things to do this weekend in Pittsburgh? 👀 Don’t worry we

This format is accepted by 48* of the 69 tax collection districts in pennsylvania. Since 2012, employers in pennsylvania have been required. Find your withholding rates by address. Make sure your local earned income taxes go to work for you and your community! The first two (2) digits of a psd code represent the tax.

This Format Is Accepted By 48* Of The 69 Tax Collection Districts In Pennsylvania.

If the employer does not withhold the proper amount. Click here for more details. This format is suitable for filing. Since 2012, employers in pennsylvania have been required.

Find Your Withholding Rates By Address.

The local services tax of $52 is to be deducted evenly from pay checks throughout the year. Our clients consist of more than 85 boroughs, townships and authorities and 30 school districts, as well as allegheny county and the city and. The first two (2) digits of a psd code represent the tax. The local services tax may be.

View And Sort Psd Codes & Eit Rates By County, Municipality, And School District.

The annual local service tax reconciliation is not being required for 2023 or. Make sure your local earned income taxes go to work for you and your community!