Local State Tax Rate Texas

Local State Tax Rate Texas - With local taxes, the total sales tax rate is between 6.250% and 8.250%. Welcome to the new sales tax rate locator. If you have questions about local sales and use tax rate information,. If you cannot find the tax rate for the address you've entered, or if you received an error message or have a technical question, contact. In the tabs below, discover new map and latitude/longitude search options alongside the. View the printable version of city rates (pdf). The state sales tax rate in texas is 6.250%. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services.

Welcome to the new sales tax rate locator. With local taxes, the total sales tax rate is between 6.250% and 8.250%. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. In the tabs below, discover new map and latitude/longitude search options alongside the. If you cannot find the tax rate for the address you've entered, or if you received an error message or have a technical question, contact. If you have questions about local sales and use tax rate information,. The state sales tax rate in texas is 6.250%. View the printable version of city rates (pdf).

If you have questions about local sales and use tax rate information,. If you cannot find the tax rate for the address you've entered, or if you received an error message or have a technical question, contact. With local taxes, the total sales tax rate is between 6.250% and 8.250%. Welcome to the new sales tax rate locator. View the printable version of city rates (pdf). The state sales tax rate in texas is 6.250%. In the tabs below, discover new map and latitude/longitude search options alongside the. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services.

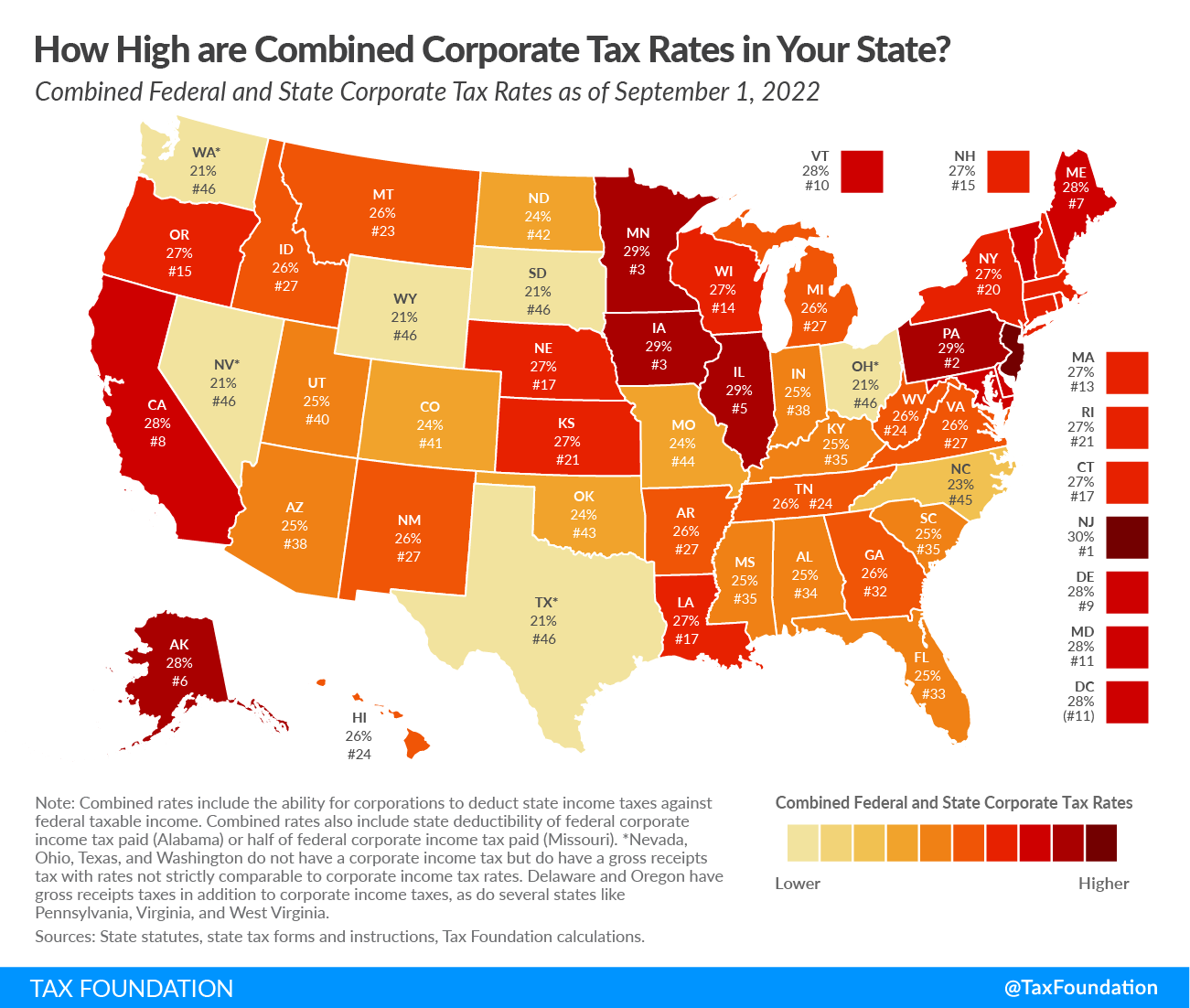

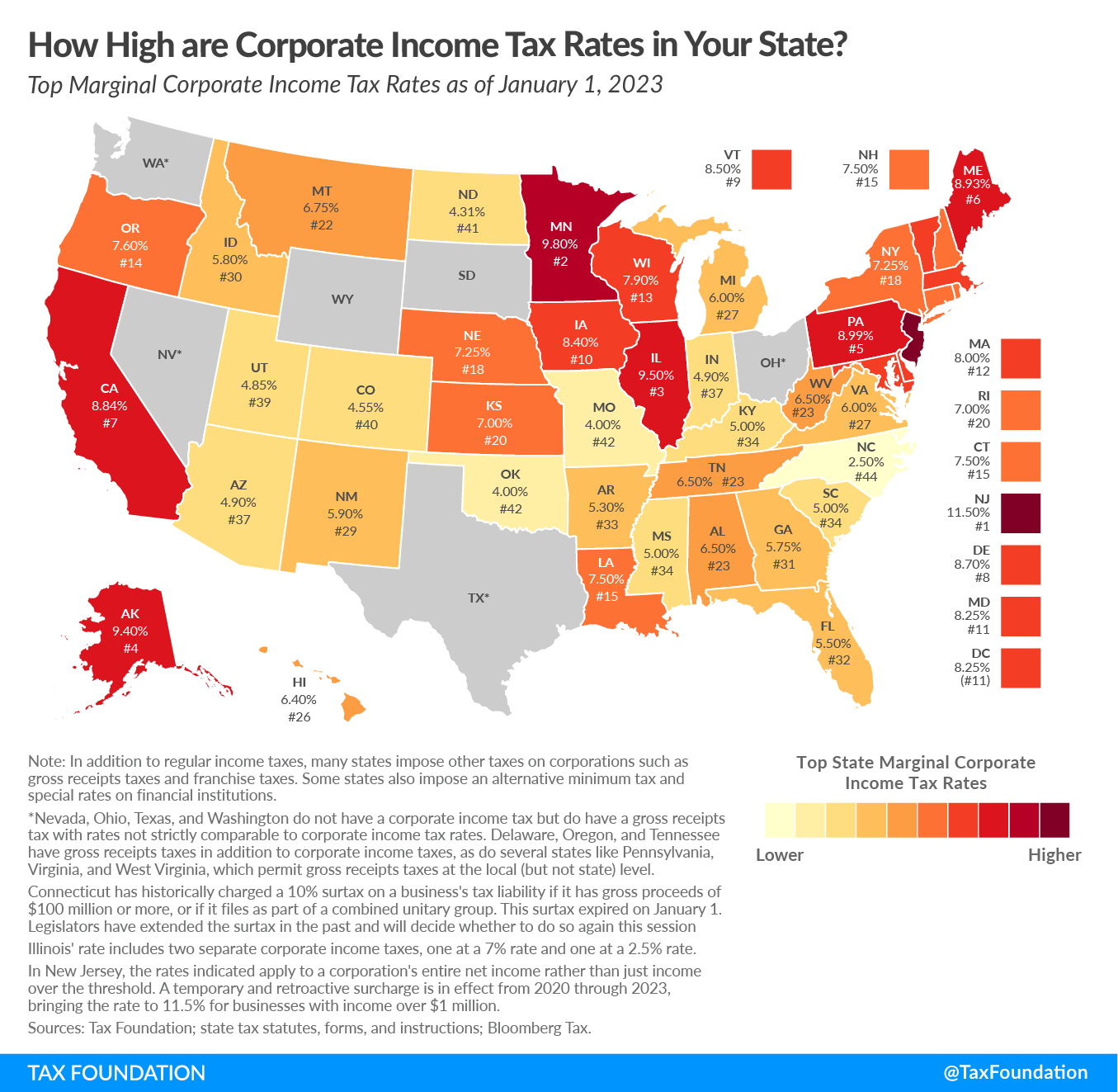

State Corporate Tax Rates and Brackets for 2023 CashReview

Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. With local taxes, the total sales tax rate is between 6.250% and 8.250%. Welcome to the new sales tax rate locator. The state sales tax rate in texas is 6.250%. In the tabs below, discover.

taxes scolaires granby

In the tabs below, discover new map and latitude/longitude search options alongside the. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. If you have questions about local sales and use tax rate information,. View the printable version of city rates (pdf). The state.

Effective State Tax Rate at Various Household Levels by State

In the tabs below, discover new map and latitude/longitude search options alongside the. If you have questions about local sales and use tax rate information,. If you cannot find the tax rate for the address you've entered, or if you received an error message or have a technical question, contact. View the printable version of city rates (pdf). The state.

2024 State Corporate Tax Rates & Brackets

Welcome to the new sales tax rate locator. With local taxes, the total sales tax rate is between 6.250% and 8.250%. If you have questions about local sales and use tax rate information,. If you cannot find the tax rate for the address you've entered, or if you received an error message or have a technical question, contact. Texas imposes.

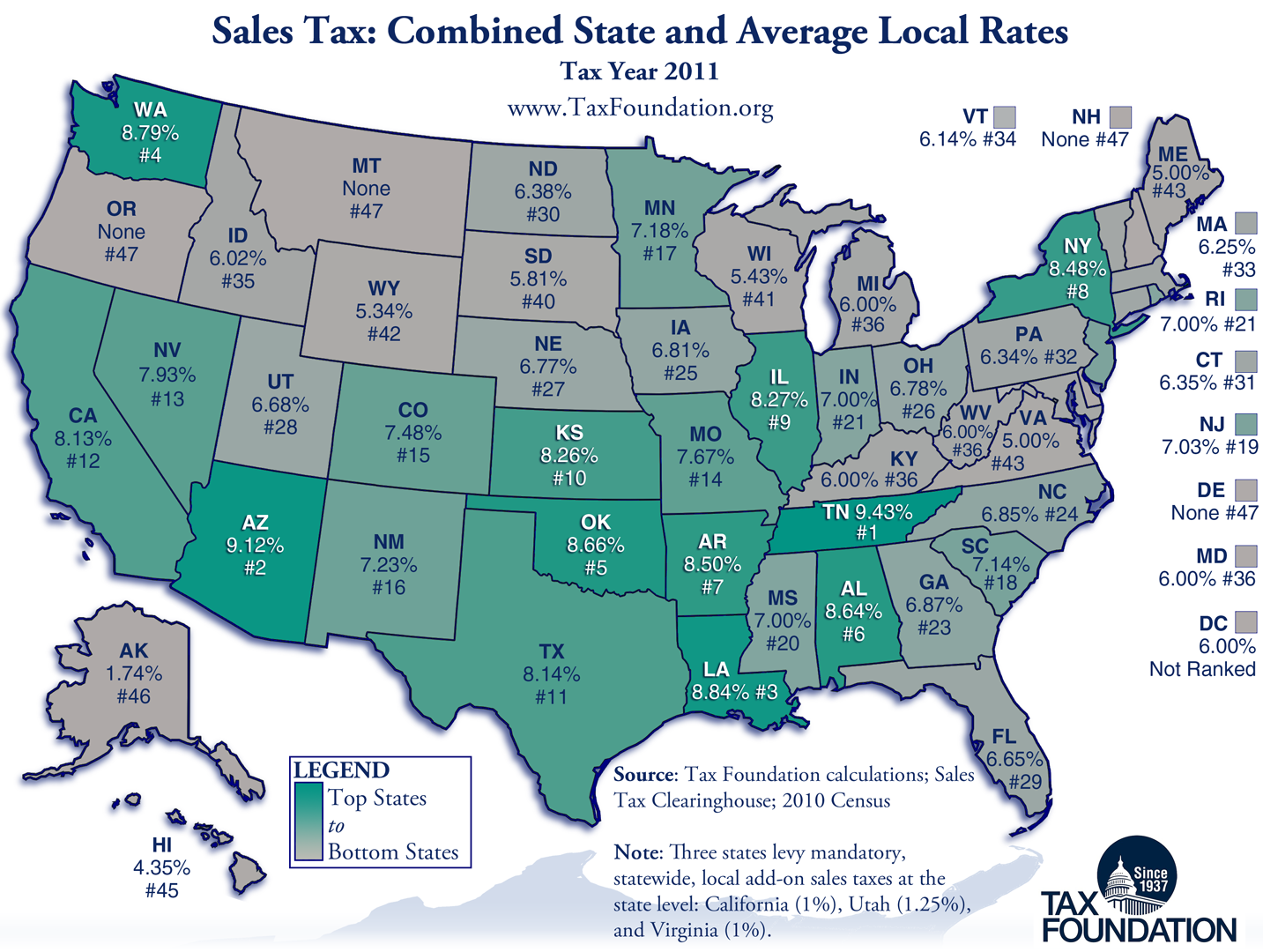

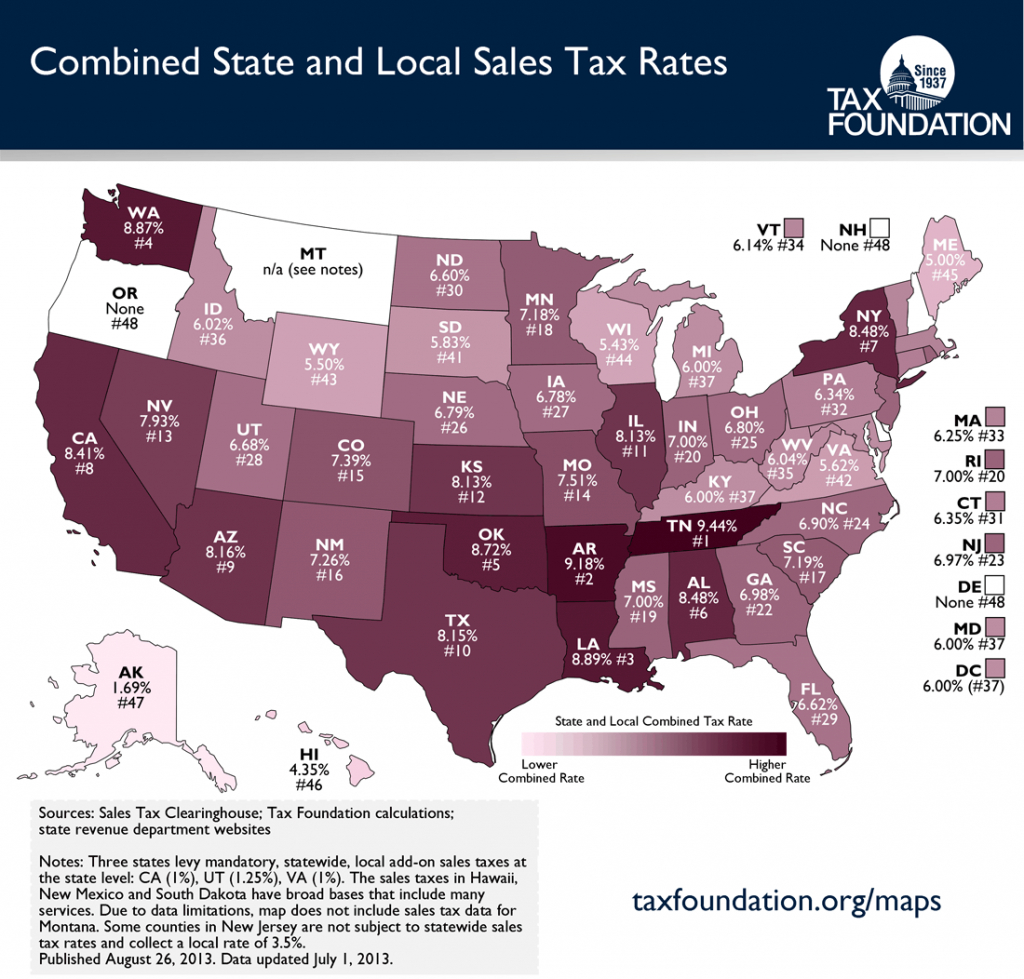

State And Local Sales Tax Rates Midyear 2013 Tax Foundation Texas

If you cannot find the tax rate for the address you've entered, or if you received an error message or have a technical question, contact. View the printable version of city rates (pdf). If you have questions about local sales and use tax rate information,. In the tabs below, discover new map and latitude/longitude search options alongside the. Texas imposes.

How to Solve Clients’ Sales Tax Compliance Headaches with Smart

Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. In the tabs below, discover new map and latitude/longitude search options alongside the. The state sales tax rate in texas is 6.250%. Welcome to the new sales tax rate locator. View the printable version of.

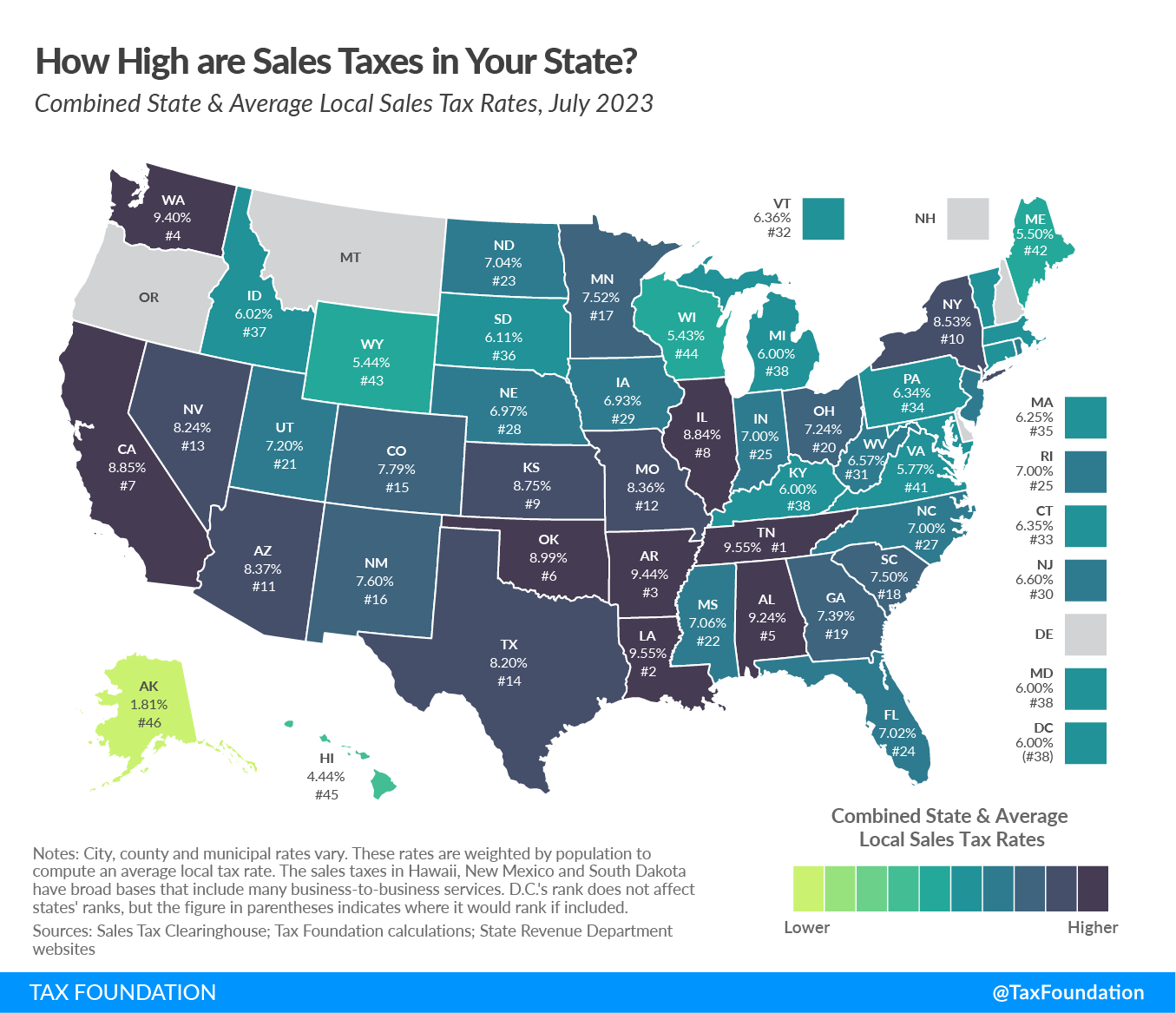

State and Local Sales Tax Rates Sales Taxes Tax Foundation

Welcome to the new sales tax rate locator. In the tabs below, discover new map and latitude/longitude search options alongside the. The state sales tax rate in texas is 6.250%. With local taxes, the total sales tax rate is between 6.250% and 8.250%. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals.

Monday Map Combined State and Local Sales Tax Rates

View the printable version of city rates (pdf). If you have questions about local sales and use tax rate information,. With local taxes, the total sales tax rate is between 6.250% and 8.250%. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. If you.

How High are Combined Corporate Tax Rates in Your State? Tax

Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. The state sales tax rate in texas is 6.250%. View the printable version of city rates (pdf). In the tabs below, discover new map and latitude/longitude search options alongside the. If you have questions about.

How Liberals Explain the Decision to Leave California WSJ

Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. In the tabs below, discover new map and latitude/longitude search options alongside the. If you have questions about local sales and use tax rate information,. With local taxes, the total sales tax rate is between.

With Local Taxes, The Total Sales Tax Rate Is Between 6.250% And 8.250%.

In the tabs below, discover new map and latitude/longitude search options alongside the. Welcome to the new sales tax rate locator. The state sales tax rate in texas is 6.250%. If you cannot find the tax rate for the address you've entered, or if you received an error message or have a technical question, contact.

If You Have Questions About Local Sales And Use Tax Rate Information,.

Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. View the printable version of city rates (pdf).

.png)