Local Tax Definition

Local Tax Definition - A tax levied and collected by a state/province and or municipality. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Find out the common types of local taxes, such. Learn what local taxes are, how they work, and the pros and cons of paying them. Local taxes are collected in order to fund local government services, but they.

Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. A tax levied and collected by a state/province and or municipality. Find out the common types of local taxes, such. Local taxes are collected in order to fund local government services, but they. Learn what local taxes are, how they work, and the pros and cons of paying them.

A tax levied and collected by a state/province and or municipality. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Find out the common types of local taxes, such. Local taxes are collected in order to fund local government services, but they. Learn what local taxes are, how they work, and the pros and cons of paying them.

Tax Source Group Inc. Southfield MI

Learn what local taxes are, how they work, and the pros and cons of paying them. A tax levied and collected by a state/province and or municipality. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Local taxes are collected in order to fund local government services, but they. Find out the common.

Dad Tax Definition SVG PNG

A tax levied and collected by a state/province and or municipality. Learn what local taxes are, how they work, and the pros and cons of paying them. Local taxes are collected in order to fund local government services, but they. Find out the common types of local taxes, such. Local tax refers to taxes imposed by local government entities such.

What Is A Poll Tax? Definition and Examples

A tax levied and collected by a state/province and or municipality. Find out the common types of local taxes, such. Local taxes are collected in order to fund local government services, but they. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Learn what local taxes are, how they work, and the pros.

TAX Consultancy Firm Gurugram

Find out the common types of local taxes, such. A tax levied and collected by a state/province and or municipality. Learn what local taxes are, how they work, and the pros and cons of paying them. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Local taxes are collected in order to fund.

Tax Preparation Business Startup

Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. A tax levied and collected by a state/province and or municipality. Learn what local taxes are, how they work, and the pros and cons of paying them. Find out the common types of local taxes, such. Local taxes are collected in order to fund.

State and Local Tax XB4 Tax, Assurance and Advisory Services

Learn what local taxes are, how they work, and the pros and cons of paying them. Local taxes are collected in order to fund local government services, but they. Find out the common types of local taxes, such. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. A tax levied and collected by.

Moore Tax & Financial Services Goose Creek SC

Learn what local taxes are, how they work, and the pros and cons of paying them. Find out the common types of local taxes, such. Local taxes are collected in order to fund local government services, but they. A tax levied and collected by a state/province and or municipality. Local tax refers to taxes imposed by local government entities such.

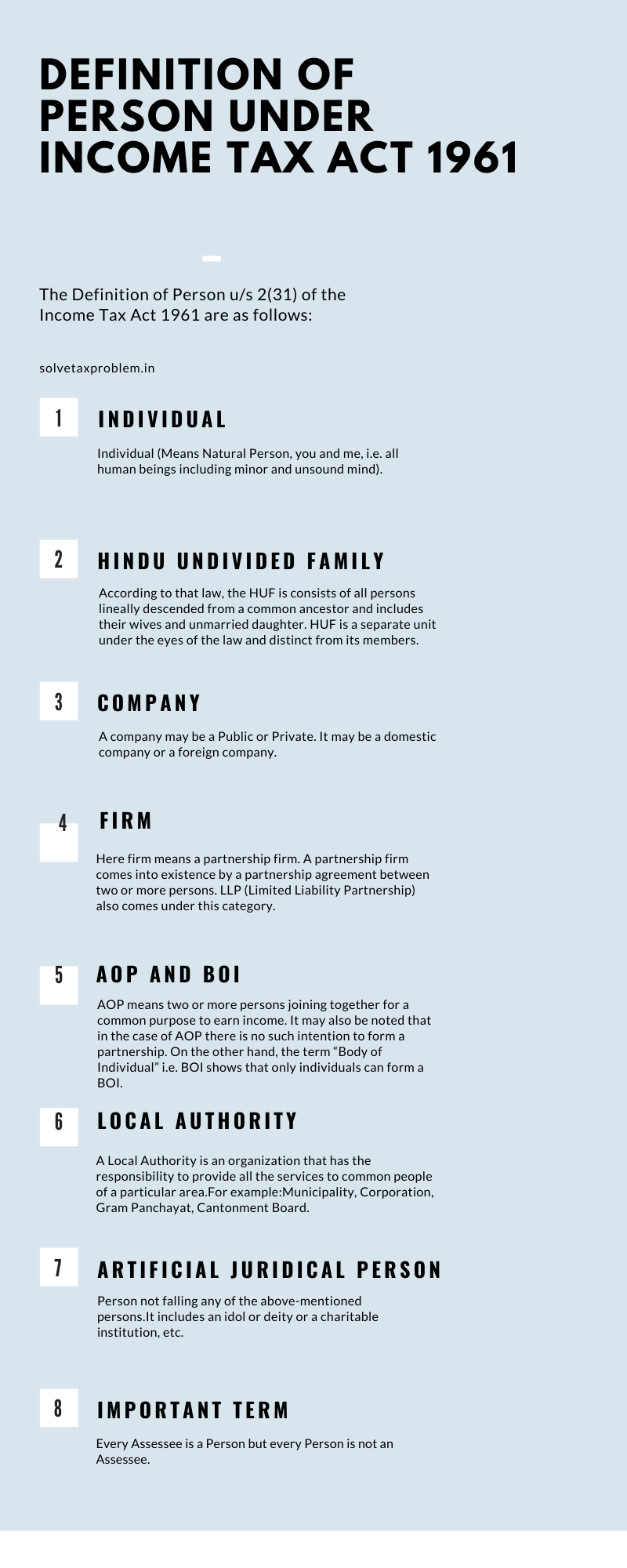

Definition of Person under the Tax Act 1961

Local taxes are collected in order to fund local government services, but they. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Find out the common types of local taxes, such. Learn what local taxes are, how they work, and the pros and cons of paying them. A tax levied and collected by.

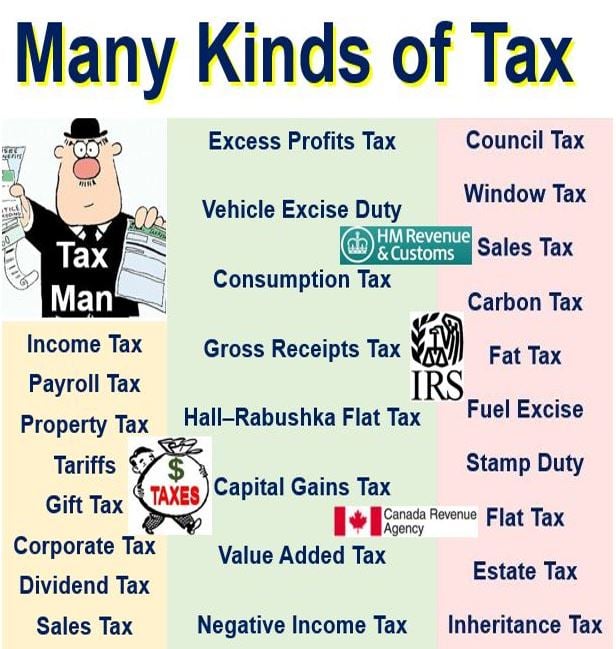

What is tax? Definition and meaning Market Business News

Local taxes are collected in order to fund local government services, but they. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Learn what local taxes are, how they work, and the pros and cons of paying them. A tax levied and collected by a state/province and or municipality. Find out the common.

Elevated Tax & Accounting ETA always on time Tax & Accounting

A tax levied and collected by a state/province and or municipality. Find out the common types of local taxes, such. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Local taxes are collected in order to fund local government services, but they. Learn what local taxes are, how they work, and the pros.

Local Taxes Are Collected In Order To Fund Local Government Services, But They.

A tax levied and collected by a state/province and or municipality. Learn what local taxes are, how they work, and the pros and cons of paying them. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Find out the common types of local taxes, such.

:max_bytes(150000):strip_icc()/GettyImages-1397583930-d9e9db90bb514baa8223f83eac648aae.jpg)