Look Up State Tax Lien

Look Up State Tax Lien - A notice of state tax lien is a public claim against a taxpayer's property or rights to property, both owned at the time the lien is filed and. Your property includes real estate,. Select tax debtor name above the search box. Beginning january 1, 2015, the mississippi department of revenue will enroll tax liens for unpaid tax debts online on the state tax lien. As of november 1, 2019, the scdor records state tax liens online in our comprehensive state tax lien registry at dor.sc.gov/lienregistry. Type the debtor name into the search box. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. A state tax lien is the government’s legal claim against your property when you don’t pay your tax debt in full.

As of november 1, 2019, the scdor records state tax liens online in our comprehensive state tax lien registry at dor.sc.gov/lienregistry. A state tax lien is the government’s legal claim against your property when you don’t pay your tax debt in full. Select tax debtor name above the search box. Type the debtor name into the search box. A notice of state tax lien is a public claim against a taxpayer's property or rights to property, both owned at the time the lien is filed and. Beginning january 1, 2015, the mississippi department of revenue will enroll tax liens for unpaid tax debts online on the state tax lien. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. Your property includes real estate,.

Type the debtor name into the search box. As of november 1, 2019, the scdor records state tax liens online in our comprehensive state tax lien registry at dor.sc.gov/lienregistry. A state tax lien is the government’s legal claim against your property when you don’t pay your tax debt in full. A notice of state tax lien is a public claim against a taxpayer's property or rights to property, both owned at the time the lien is filed and. Your property includes real estate,. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. Select tax debtor name above the search box. Beginning january 1, 2015, the mississippi department of revenue will enroll tax liens for unpaid tax debts online on the state tax lien.

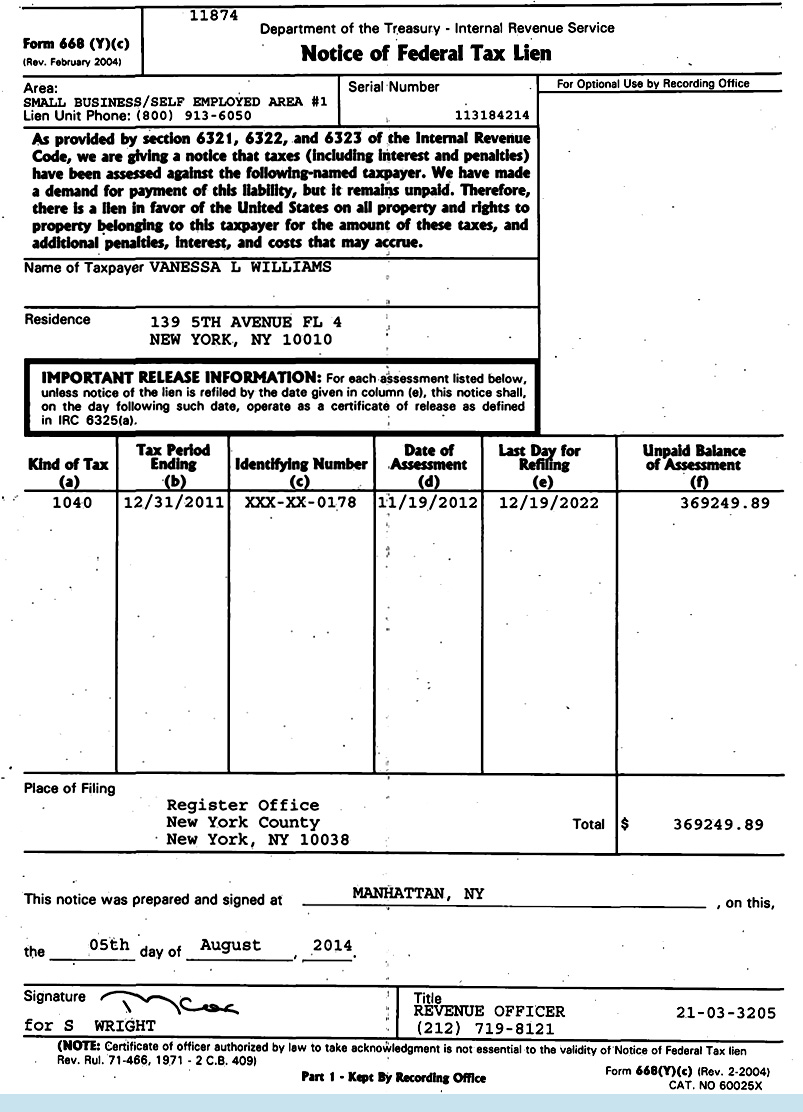

Tax Lien Form Free Word Templates

Beginning january 1, 2015, the mississippi department of revenue will enroll tax liens for unpaid tax debts online on the state tax lien. Type the debtor name into the search box. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. A state tax lien.

Tax Lien Mailing List Spectrum Mailing Lists

Beginning january 1, 2015, the mississippi department of revenue will enroll tax liens for unpaid tax debts online on the state tax lien. As of november 1, 2019, the scdor records state tax liens online in our comprehensive state tax lien registry at dor.sc.gov/lienregistry. Your property includes real estate,. A notice of state tax lien is a public claim against.

State Tax Lien vs. Federal Tax Lien How to Remove Them

A notice of state tax lien is a public claim against a taxpayer's property or rights to property, both owned at the time the lien is filed and. Select tax debtor name above the search box. A state tax lien is the government’s legal claim against your property when you don’t pay your tax debt in full. Your property includes.

Tax Lien Texas State Tax Lien

Your property includes real estate,. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. Type the debtor name into the search box. A notice of state tax lien is a public claim against a taxpayer's property or rights to property, both owned at the.

Tax Lien Arkansas State Tax Lien

Your property includes real estate,. Select tax debtor name above the search box. Type the debtor name into the search box. Beginning january 1, 2015, the mississippi department of revenue will enroll tax liens for unpaid tax debts online on the state tax lien. A state tax lien is the government’s legal claim against your property when you don’t pay.

IRS Federal and State Tax Lien Help — Genesis Tax Consultants

A notice of state tax lien is a public claim against a taxpayer's property or rights to property, both owned at the time the lien is filed and. Type the debtor name into the search box. A state tax lien is the government’s legal claim against your property when you don’t pay your tax debt in full. Beginning january 1,.

Tax Lien Help Remove IRS (Federal) or State Tax Lien Principal Tax

Beginning january 1, 2015, the mississippi department of revenue will enroll tax liens for unpaid tax debts online on the state tax lien. Your property includes real estate,. A state tax lien is the government’s legal claim against your property when you don’t pay your tax debt in full. Type the debtor name into the search box. As of november.

Tax Lien State Tax Lien California

As of november 1, 2019, the scdor records state tax liens online in our comprehensive state tax lien registry at dor.sc.gov/lienregistry. Beginning january 1, 2015, the mississippi department of revenue will enroll tax liens for unpaid tax debts online on the state tax lien. A state tax lien is the government’s legal claim against your property when you don’t pay.

The Importance of Hiring a Tax Lien Attorney for Your Insurance

A state tax lien is the government’s legal claim against your property when you don’t pay your tax debt in full. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. Beginning january 1, 2015, the mississippi department of revenue will enroll tax liens for.

Federal & State Tax Lien Removal Help Instant Tax Solutions

A state tax lien is the government’s legal claim against your property when you don’t pay your tax debt in full. A notice of state tax lien is a public claim against a taxpayer's property or rights to property, both owned at the time the lien is filed and. Type the debtor name into the search box. Select tax debtor.

A Notice Of State Tax Lien Is A Public Claim Against A Taxpayer's Property Or Rights To Property, Both Owned At The Time The Lien Is Filed And.

Type the debtor name into the search box. Select tax debtor name above the search box. As of november 1, 2019, the scdor records state tax liens online in our comprehensive state tax lien registry at dor.sc.gov/lienregistry. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois.

A State Tax Lien Is The Government’s Legal Claim Against Your Property When You Don’t Pay Your Tax Debt In Full.

Beginning january 1, 2015, the mississippi department of revenue will enroll tax liens for unpaid tax debts online on the state tax lien. Your property includes real estate,.