Lowest Home Equity Line Rates

Lowest Home Equity Line Rates - A home equity line of credit (heloc) gives homeowners with at least 15% to 20% equity access to flexible financing. Find the best heloc offer for your unique borrowing needs. Citizens offers helocs with loan amounts starting at $17,500; 18, its lowest level in almost a year and a half, according to bankrate’s nationwide survey. However, you must have a credit line of more than $200,000 to get the lowest annual percentage rate (apr) available. The average rate on a home equity line of credit (heloc) dropped to 8.52 percent as of dec.

18, its lowest level in almost a year and a half, according to bankrate’s nationwide survey. A home equity line of credit (heloc) gives homeowners with at least 15% to 20% equity access to flexible financing. The average rate on a home equity line of credit (heloc) dropped to 8.52 percent as of dec. However, you must have a credit line of more than $200,000 to get the lowest annual percentage rate (apr) available. Citizens offers helocs with loan amounts starting at $17,500; Find the best heloc offer for your unique borrowing needs.

18, its lowest level in almost a year and a half, according to bankrate’s nationwide survey. Find the best heloc offer for your unique borrowing needs. Citizens offers helocs with loan amounts starting at $17,500; A home equity line of credit (heloc) gives homeowners with at least 15% to 20% equity access to flexible financing. However, you must have a credit line of more than $200,000 to get the lowest annual percentage rate (apr) available. The average rate on a home equity line of credit (heloc) dropped to 8.52 percent as of dec.

Home Equity Loan vs Line of Credit Finance Strategists

A home equity line of credit (heloc) gives homeowners with at least 15% to 20% equity access to flexible financing. However, you must have a credit line of more than $200,000 to get the lowest annual percentage rate (apr) available. Citizens offers helocs with loan amounts starting at $17,500; 18, its lowest level in almost a year and a half,.

What is the Interest Rate on a Home Equity Loan? Lionsgate Financial

However, you must have a credit line of more than $200,000 to get the lowest annual percentage rate (apr) available. Find the best heloc offer for your unique borrowing needs. 18, its lowest level in almost a year and a half, according to bankrate’s nationwide survey. The average rate on a home equity line of credit (heloc) dropped to 8.52.

Home Equity Loan vs. Line of Credit Cobalt Credit Union

The average rate on a home equity line of credit (heloc) dropped to 8.52 percent as of dec. A home equity line of credit (heloc) gives homeowners with at least 15% to 20% equity access to flexible financing. 18, its lowest level in almost a year and a half, according to bankrate’s nationwide survey. However, you must have a credit.

Home Equity Line of Credit What Are They and How Do They Work? Earnest

A home equity line of credit (heloc) gives homeowners with at least 15% to 20% equity access to flexible financing. The average rate on a home equity line of credit (heloc) dropped to 8.52 percent as of dec. Citizens offers helocs with loan amounts starting at $17,500; 18, its lowest level in almost a year and a half, according to.

A Home Equity Loan Alterra Home Loans

Citizens offers helocs with loan amounts starting at $17,500; 18, its lowest level in almost a year and a half, according to bankrate’s nationwide survey. The average rate on a home equity line of credit (heloc) dropped to 8.52 percent as of dec. However, you must have a credit line of more than $200,000 to get the lowest annual percentage.

Rising mortgage rates keep home equity line of credit usage down

Citizens offers helocs with loan amounts starting at $17,500; Find the best heloc offer for your unique borrowing needs. The average rate on a home equity line of credit (heloc) dropped to 8.52 percent as of dec. 18, its lowest level in almost a year and a half, according to bankrate’s nationwide survey. A home equity line of credit (heloc).

What are the pros and cons of pulling equity from your home? Leia aqui

Citizens offers helocs with loan amounts starting at $17,500; The average rate on a home equity line of credit (heloc) dropped to 8.52 percent as of dec. However, you must have a credit line of more than $200,000 to get the lowest annual percentage rate (apr) available. 18, its lowest level in almost a year and a half, according to.

Guide to Understanding Home Equity Lines (HELOC) and Loans AmeriSave

Citizens offers helocs with loan amounts starting at $17,500; Find the best heloc offer for your unique borrowing needs. However, you must have a credit line of more than $200,000 to get the lowest annual percentage rate (apr) available. A home equity line of credit (heloc) gives homeowners with at least 15% to 20% equity access to flexible financing. The.

Are Home Equity Lines of Credit a Good Idea? Lionsgate Financial Group

18, its lowest level in almost a year and a half, according to bankrate’s nationwide survey. Find the best heloc offer for your unique borrowing needs. However, you must have a credit line of more than $200,000 to get the lowest annual percentage rate (apr) available. The average rate on a home equity line of credit (heloc) dropped to 8.52.

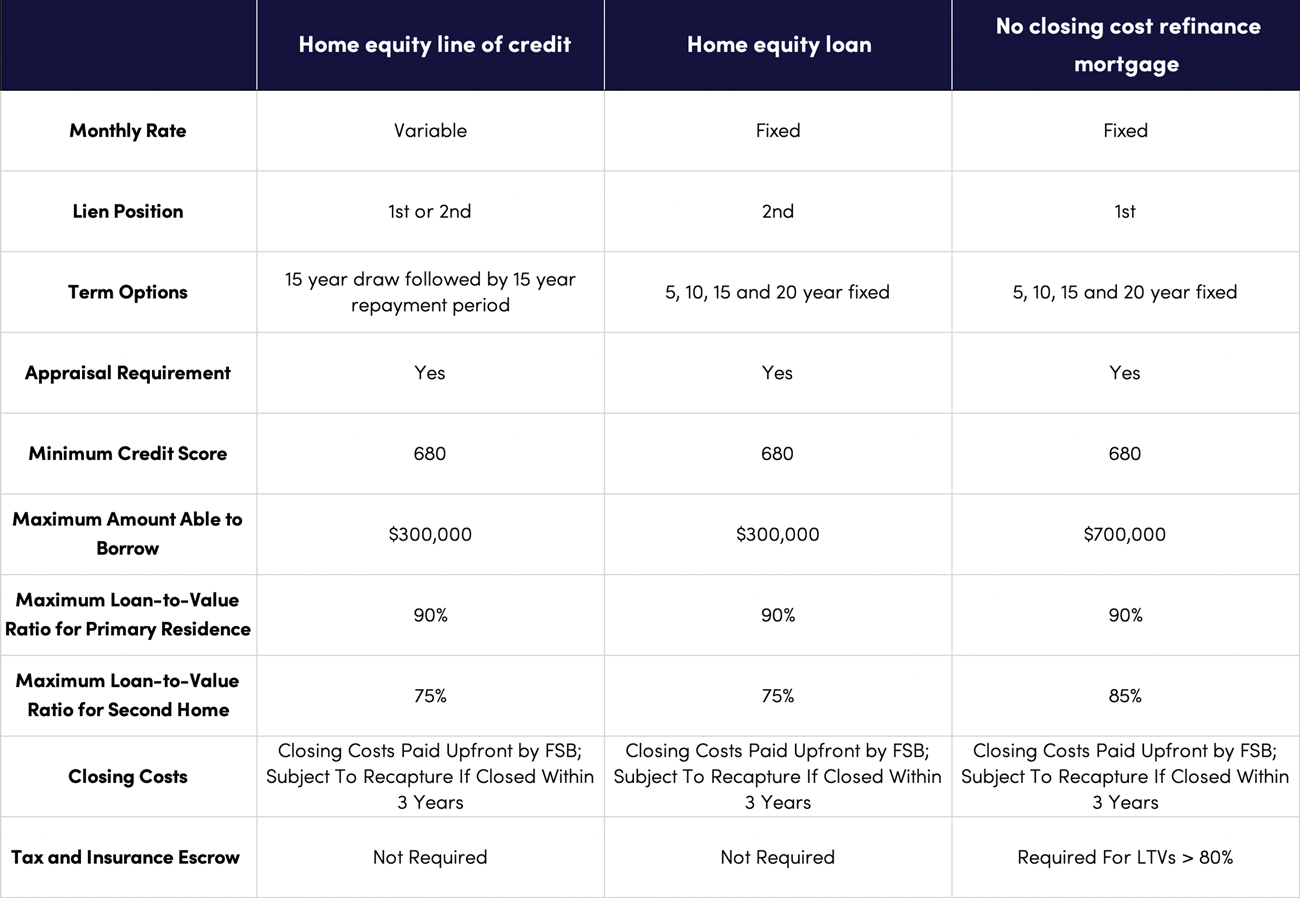

home equity › Five Star Bank

A home equity line of credit (heloc) gives homeowners with at least 15% to 20% equity access to flexible financing. 18, its lowest level in almost a year and a half, according to bankrate’s nationwide survey. The average rate on a home equity line of credit (heloc) dropped to 8.52 percent as of dec. Citizens offers helocs with loan amounts.

The Average Rate On A Home Equity Line Of Credit (Heloc) Dropped To 8.52 Percent As Of Dec.

A home equity line of credit (heloc) gives homeowners with at least 15% to 20% equity access to flexible financing. Citizens offers helocs with loan amounts starting at $17,500; However, you must have a credit line of more than $200,000 to get the lowest annual percentage rate (apr) available. 18, its lowest level in almost a year and a half, according to bankrate’s nationwide survey.

:max_bytes(150000):strip_icc()/homeequityloan-e11896bf4ac1475a9806a55f92e0c312.jpg)