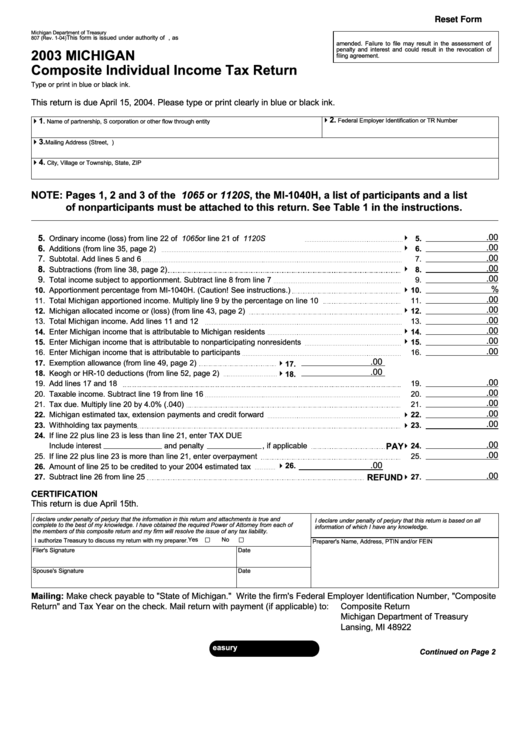

Michigan Sales Use Tax Form

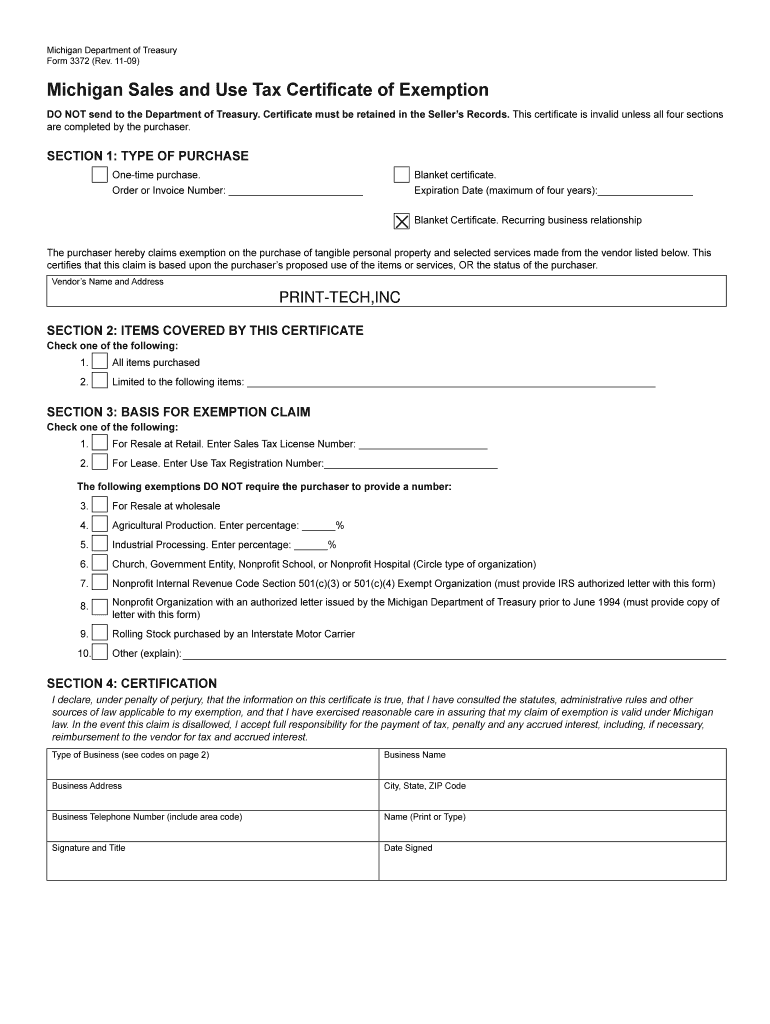

Michigan Sales Use Tax Form - Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. Sales and use tax forms index by year. This is a return for sales tax, use tax and/or withholding tax. The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from. Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. It is the purchaser’s responsibility. A purchaser who claims exemption for “resale at retail” or “for lease” must provide the seller with an exemption certificate. Click the link to see. All fields must be completed;. Michigan department of treasury, suw 3372 (rev.

Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. A purchaser who claims exemption for “resale at retail” or “for lease” must provide the seller with an exemption certificate. Click the link to see the 2024 form instructions. It is the purchaser’s responsibility. Michigan department of treasury, suw 3372 (rev. Click the link to see. The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from. All fields must be completed;. If you received a letter of inquiry regarding annual return for the return period of 2023, visit. This is a return for sales tax, use tax and/or withholding tax.

Click the link to see. All fields must be completed;. Sales and use tax forms index by year. It is the purchaser’s responsibility. Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. This is a return for sales tax, use tax and/or withholding tax. The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from. A purchaser who claims exemption for “resale at retail” or “for lease” must provide the seller with an exemption certificate. Click the link to see the 2024 form instructions. Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions.

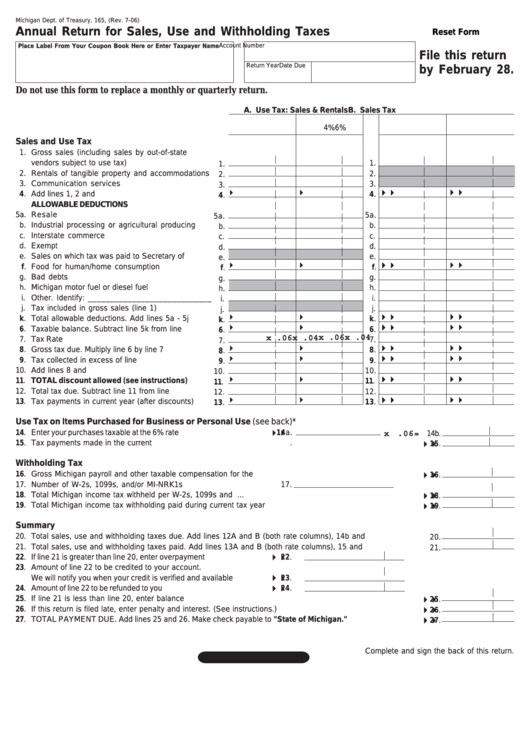

Michigan Sales Use And Withholding Tax Form 5081

If you received a letter of inquiry regarding annual return for the return period of 2023, visit. The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from. Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. Click the link to see.

Michigan tax exempt form Fill out & sign online DocHub

A purchaser who claims exemption for “resale at retail” or “for lease” must provide the seller with an exemption certificate. Sales and use tax forms index by year. Click the link to see the 2024 form instructions. Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. Purchasers may use this form to.

Printable Michigan Tax Forms

This is a return for sales tax, use tax and/or withholding tax. Click the link to see. All fields must be completed;. Click the link to see the 2024 form instructions. Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions.

State Of Michigan Tax Exempt Form 2024 Fredia Susanne

Click the link to see. All fields must be completed;. The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from. This is a return for sales tax, use tax and/or withholding tax. Sales and use tax forms index by year.

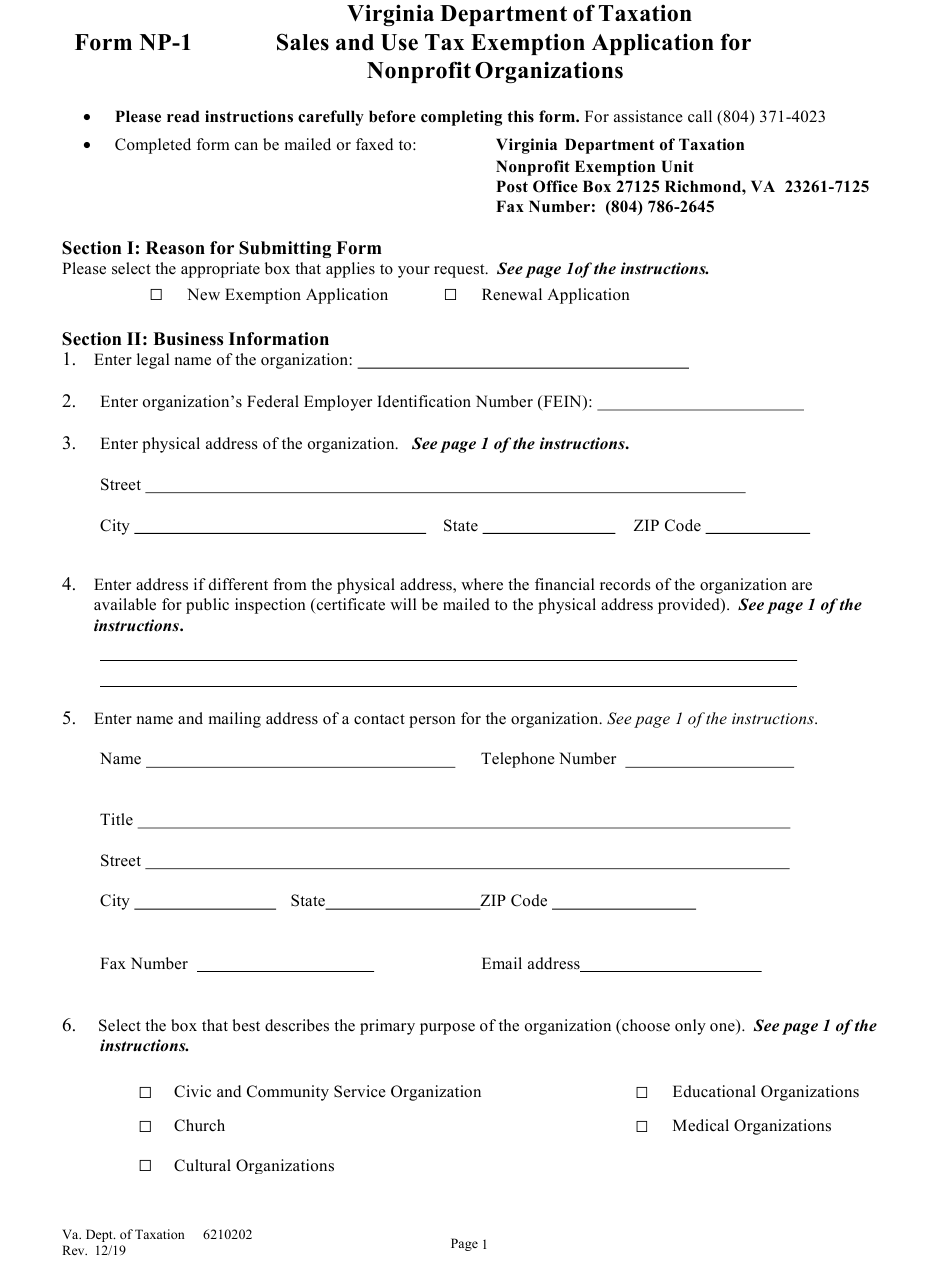

Virginia Sales Tax Exemption Form For Non Profit

Click the link to see the 2024 form instructions. All fields must be completed;. If you received a letter of inquiry regarding annual return for the return period of 2023, visit. A purchaser who claims exemption for “resale at retail” or “for lease” must provide the seller with an exemption certificate. It is the purchaser’s responsibility.

Michigan Sales Use And Withholding Tax Forms And Instructions 2022

Michigan department of treasury, suw 3372 (rev. The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from. A purchaser who claims exemption for “resale at retail” or “for lease” must provide the seller with an exemption certificate. All fields must be completed;. Click the link to see the 2024.

Michigan Sales And Use Tax Form 2024 Karyl Marylin

Click the link to see the 2024 form instructions. A purchaser who claims exemption for “resale at retail” or “for lease” must provide the seller with an exemption certificate. Michigan department of treasury, suw 3372 (rev. If you received a letter of inquiry regarding annual return for the return period of 2023, visit. Sales and use tax forms index by.

913 Michigan Department Of Treasury Forms And Templates free to

All fields must be completed;. Click the link to see the 2024 form instructions. Sales and use tax forms index by year. If you received a letter of inquiry regarding annual return for the return period of 2023, visit. Michigan department of treasury, suw 3372 (rev.

Fillable Online Form 3372, Michigan Sales and Use Tax Certificate of

All fields must be completed;. Michigan department of treasury, suw 3372 (rev. Sales and use tax forms index by year. Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. Click the link to see.

Nd sales tax form Fill out & sign online DocHub

If you received a letter of inquiry regarding annual return for the return period of 2023, visit. The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from. Click the link to see the 2024 form instructions. Purchasers may use this form to claim exemption from michigan sales and use.

Purchasers May Use This Form To Claim Exemption From Michigan Sales And Use Tax On Qualifi Ed Transactions.

Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. All fields must be completed;. If you received a letter of inquiry regarding annual return for the return period of 2023, visit. It is the purchaser’s responsibility.

Michigan Department Of Treasury, Suw 3372 (Rev.

A purchaser who claims exemption for “resale at retail” or “for lease” must provide the seller with an exemption certificate. Click the link to see. Click the link to see the 2024 form instructions. This is a return for sales tax, use tax and/or withholding tax.

Sales And Use Tax Forms Index By Year.

The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from.