New Tax Form For Llc 2024

New Tax Form For Llc 2024 - Although the exact nature of. Congress has passed the corporate. For llcs formed before january 1, 2024: Companies newly created on or after january 1, 2024 will need to register within 30 days after creation. For limited liability companies (llcs), the year 2024 could potentially bring a new set of tax forms and regulations. The beneficial ownership information (boi) report. You have until have until january 1, 2025, to file your initial report. New federal reporting requirements for llcs, corporations and business entities. There's a new form for companies to know about and file in 2024: Review information about a limited liability company (llc) and the federal tax classification process.

The beneficial ownership information (boi) report. Review information about a limited liability company (llc) and the federal tax classification process. There's a new form for companies to know about and file in 2024: Although the exact nature of. Companies newly created on or after january 1, 2024 will need to register within 30 days after creation. New federal reporting requirements for llcs, corporations and business entities. For limited liability companies (llcs), the year 2024 could potentially bring a new set of tax forms and regulations. For llcs formed before january 1, 2024: You have until have until january 1, 2025, to file your initial report. Congress has passed the corporate.

Review information about a limited liability company (llc) and the federal tax classification process. For llcs formed before january 1, 2024: Although the exact nature of. You have until have until january 1, 2025, to file your initial report. There's a new form for companies to know about and file in 2024: For limited liability companies (llcs), the year 2024 could potentially bring a new set of tax forms and regulations. Companies newly created on or after january 1, 2024 will need to register within 30 days after creation. The beneficial ownership information (boi) report. Congress has passed the corporate. New federal reporting requirements for llcs, corporations and business entities.

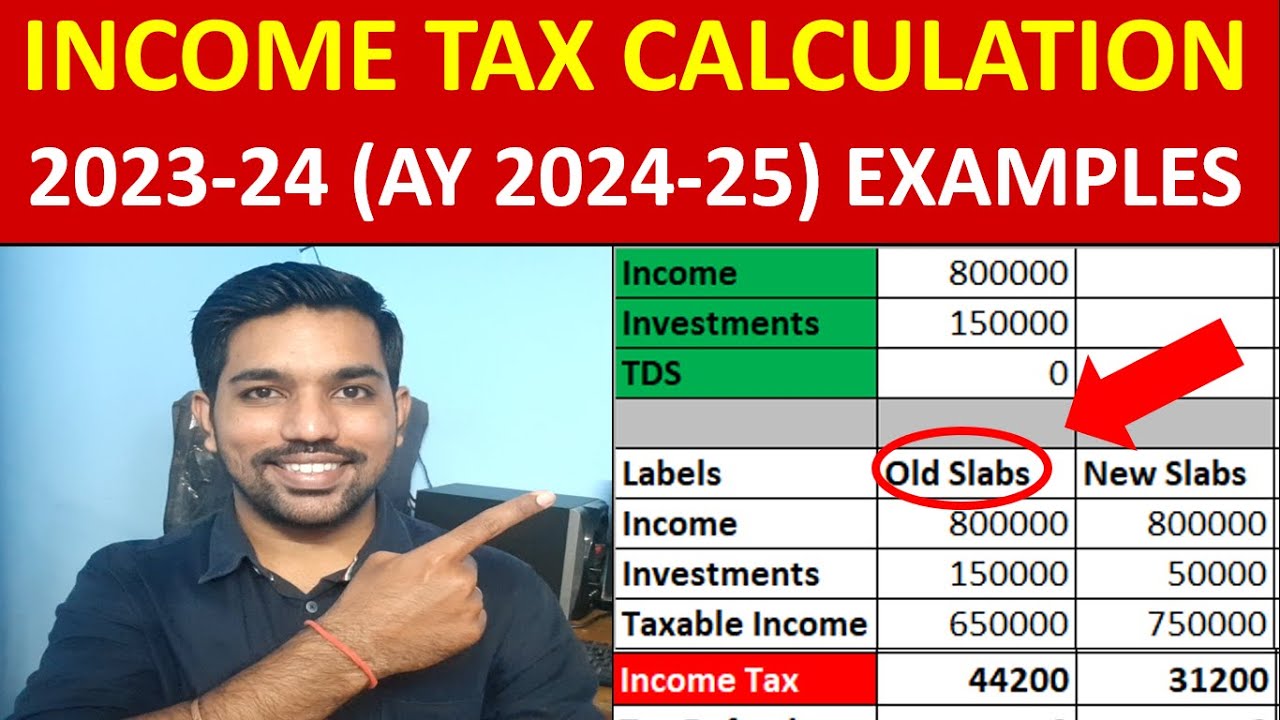

Tax Calculation for FY 202324 [Examples] FinCalC Blog

New federal reporting requirements for llcs, corporations and business entities. Review information about a limited liability company (llc) and the federal tax classification process. For llcs formed before january 1, 2024: You have until have until january 1, 2025, to file your initial report. There's a new form for companies to know about and file in 2024:

2016 minnesota tax forms Fill out & sign online DocHub

You have until have until january 1, 2025, to file your initial report. Although the exact nature of. For llcs formed before january 1, 2024: Review information about a limited liability company (llc) and the federal tax classification process. New federal reporting requirements for llcs, corporations and business entities.

Tax rates for the 2024 year of assessment Just One Lap

You have until have until january 1, 2025, to file your initial report. Companies newly created on or after january 1, 2024 will need to register within 30 days after creation. New federal reporting requirements for llcs, corporations and business entities. For llcs formed before january 1, 2024: Although the exact nature of.

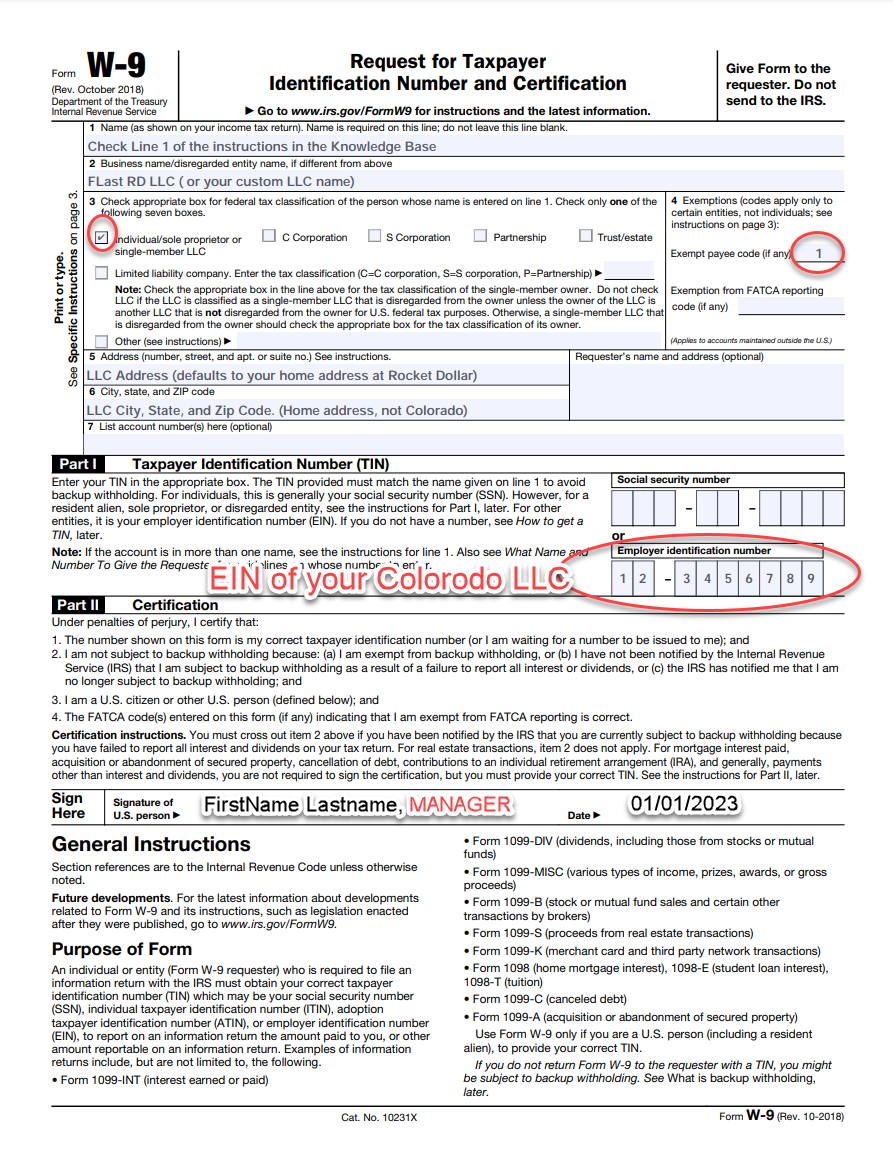

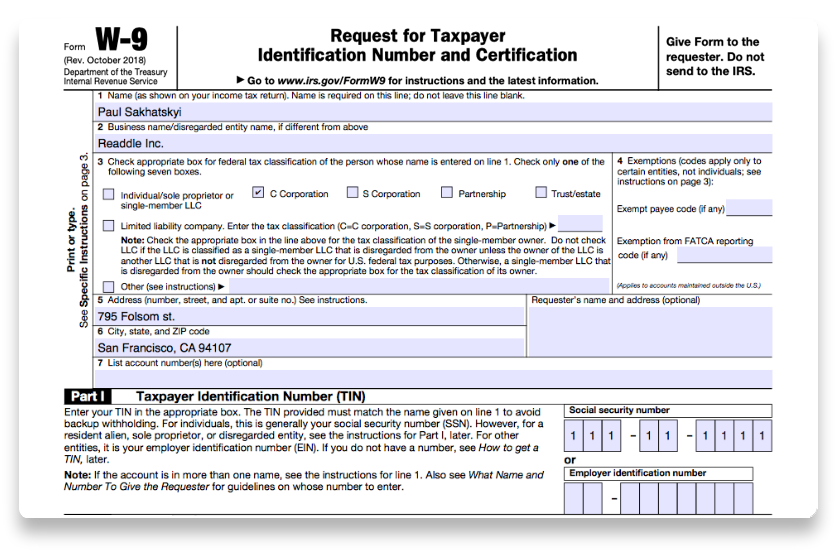

W9 Form 2024 Massachusetts Wally Jordanna

Although the exact nature of. You have until have until january 1, 2025, to file your initial report. Companies newly created on or after january 1, 2024 will need to register within 30 days after creation. For llcs formed before january 1, 2024: There's a new form for companies to know about and file in 2024:

Tax Books & Forms Available!

You have until have until january 1, 2025, to file your initial report. The beneficial ownership information (boi) report. Companies newly created on or after january 1, 2024 will need to register within 30 days after creation. For limited liability companies (llcs), the year 2024 could potentially bring a new set of tax forms and regulations. For llcs formed before.

2024 W9 Form Irs Laina Justine

New federal reporting requirements for llcs, corporations and business entities. Companies newly created on or after january 1, 2024 will need to register within 30 days after creation. For limited liability companies (llcs), the year 2024 could potentially bring a new set of tax forms and regulations. There's a new form for companies to know about and file in 2024:.

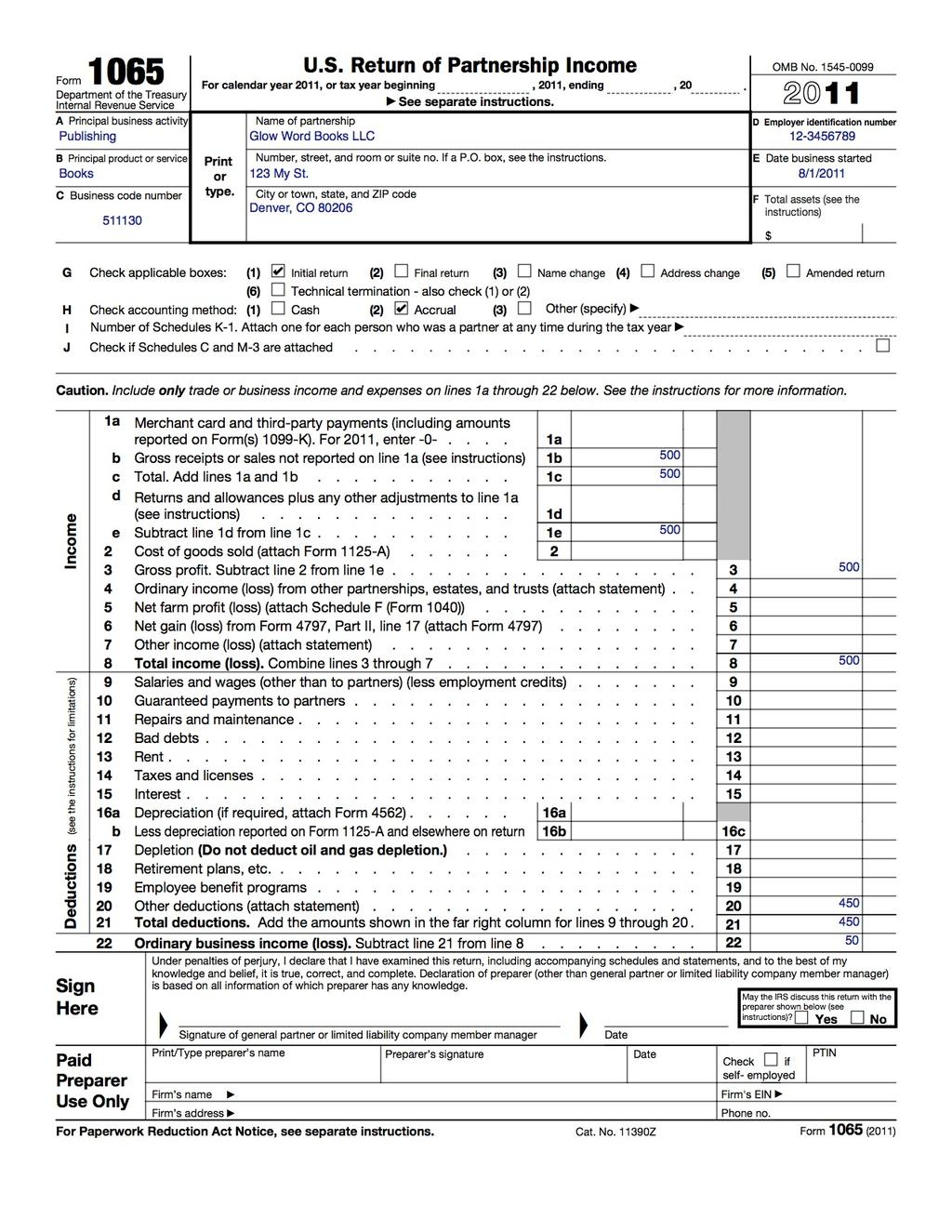

Llc Capital Account Spreadsheet Within How To Fill Out An Llc 1065 Irs

Congress has passed the corporate. Companies newly created on or after january 1, 2024 will need to register within 30 days after creation. There's a new form for companies to know about and file in 2024: For llcs formed before january 1, 2024: New federal reporting requirements for llcs, corporations and business entities.

Taxes 2023 When does tax season start and what documents do I need

For limited liability companies (llcs), the year 2024 could potentially bring a new set of tax forms and regulations. Review information about a limited liability company (llc) and the federal tax classification process. New federal reporting requirements for llcs, corporations and business entities. You have until have until january 1, 2025, to file your initial report. Although the exact nature.

What Form To Use For Llc Tax Return Ethel Hernandez's Templates

Although the exact nature of. For limited liability companies (llcs), the year 2024 could potentially bring a new set of tax forms and regulations. You have until have until january 1, 2025, to file your initial report. There's a new form for companies to know about and file in 2024: For llcs formed before january 1, 2024:

Tax Calculator New Regime 2024 25 Image to u

There's a new form for companies to know about and file in 2024: For llcs formed before january 1, 2024: Congress has passed the corporate. For limited liability companies (llcs), the year 2024 could potentially bring a new set of tax forms and regulations. Although the exact nature of.

Companies Newly Created On Or After January 1, 2024 Will Need To Register Within 30 Days After Creation.

For llcs formed before january 1, 2024: For limited liability companies (llcs), the year 2024 could potentially bring a new set of tax forms and regulations. Review information about a limited liability company (llc) and the federal tax classification process. New federal reporting requirements for llcs, corporations and business entities.

Although The Exact Nature Of.

The beneficial ownership information (boi) report. You have until have until january 1, 2025, to file your initial report. There's a new form for companies to know about and file in 2024: Congress has passed the corporate.

![Tax Calculation for FY 202324 [Examples] FinCalC Blog](https://fincalc-blog.in/wp-content/uploads/2023/03/income-tax-calculation-examples-FY-2023-24-AY-2024-25-video-1024x576.webp)