Notional Derivatives

Notional Derivatives - Notional value is a fundamental concept in finance, particularly within the realm of derivatives and complex financial instruments. Understanding notional amounts is essential for anyone dealing with derivatives, swaps, and options, as it helps gauge potential. The total value of the underlying asset in a contract is referred to as notional value, a term that derivatives traders frequently use.

Notional value is a fundamental concept in finance, particularly within the realm of derivatives and complex financial instruments. Understanding notional amounts is essential for anyone dealing with derivatives, swaps, and options, as it helps gauge potential. The total value of the underlying asset in a contract is referred to as notional value, a term that derivatives traders frequently use.

Notional value is a fundamental concept in finance, particularly within the realm of derivatives and complex financial instruments. The total value of the underlying asset in a contract is referred to as notional value, a term that derivatives traders frequently use. Understanding notional amounts is essential for anyone dealing with derivatives, swaps, and options, as it helps gauge potential.

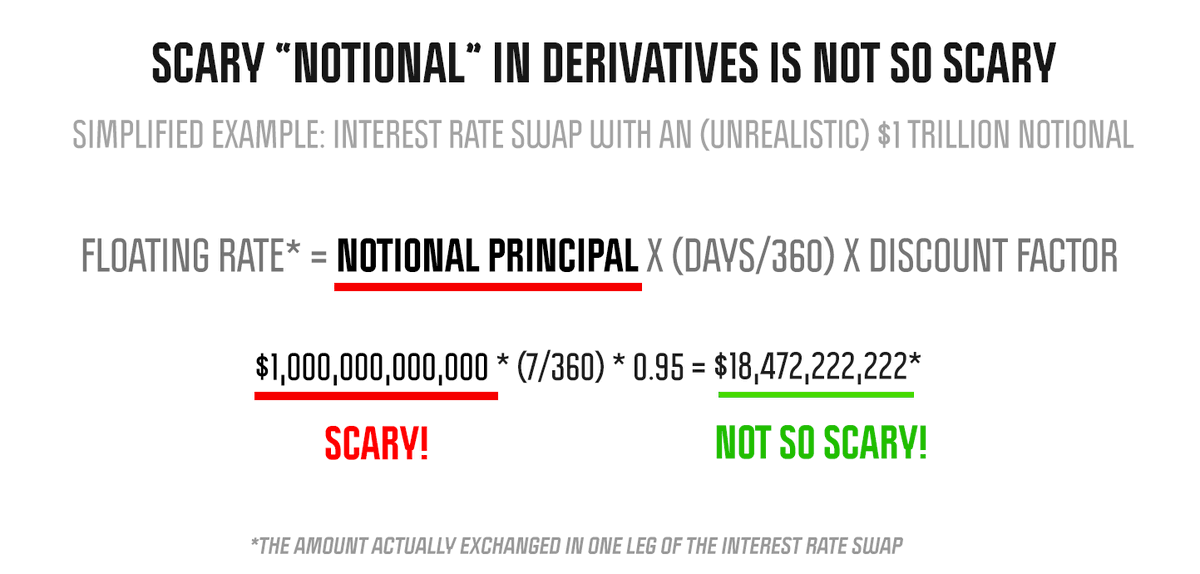

What Is the Notional Value of Derivatives?

Understanding notional amounts is essential for anyone dealing with derivatives, swaps, and options, as it helps gauge potential. Notional value is a fundamental concept in finance, particularly within the realm of derivatives and complex financial instruments. The total value of the underlying asset in a contract is referred to as notional value, a term that derivatives traders frequently use.

Notional Value AwesomeFinTech Blog

The total value of the underlying asset in a contract is referred to as notional value, a term that derivatives traders frequently use. Notional value is a fundamental concept in finance, particularly within the realm of derivatives and complex financial instruments. Understanding notional amounts is essential for anyone dealing with derivatives, swaps, and options, as it helps gauge potential.

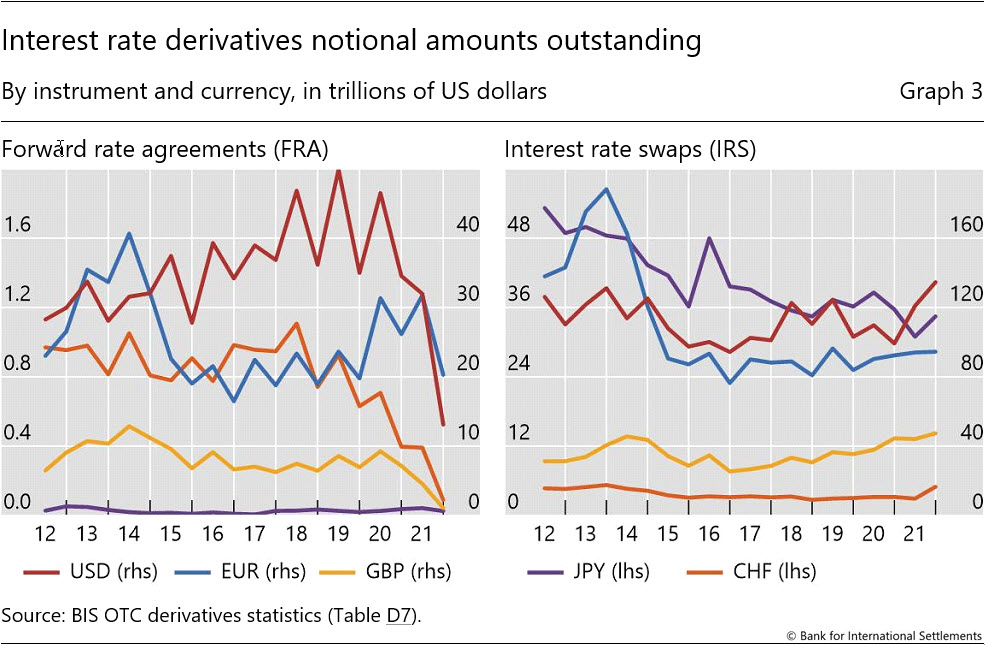

Notional amounts outstanding in OTC derivatives markets, in trillions

The total value of the underlying asset in a contract is referred to as notional value, a term that derivatives traders frequently use. Understanding notional amounts is essential for anyone dealing with derivatives, swaps, and options, as it helps gauge potential. Notional value is a fundamental concept in finance, particularly within the realm of derivatives and complex financial instruments.

OTC derivatives statistics at endDecember 2021

Understanding notional amounts is essential for anyone dealing with derivatives, swaps, and options, as it helps gauge potential. The total value of the underlying asset in a contract is referred to as notional value, a term that derivatives traders frequently use. Notional value is a fundamental concept in finance, particularly within the realm of derivatives and complex financial instruments.

Notional value of overthecounter derivatives, 19982017. See

The total value of the underlying asset in a contract is referred to as notional value, a term that derivatives traders frequently use. Notional value is a fundamental concept in finance, particularly within the realm of derivatives and complex financial instruments. Understanding notional amounts is essential for anyone dealing with derivatives, swaps, and options, as it helps gauge potential.

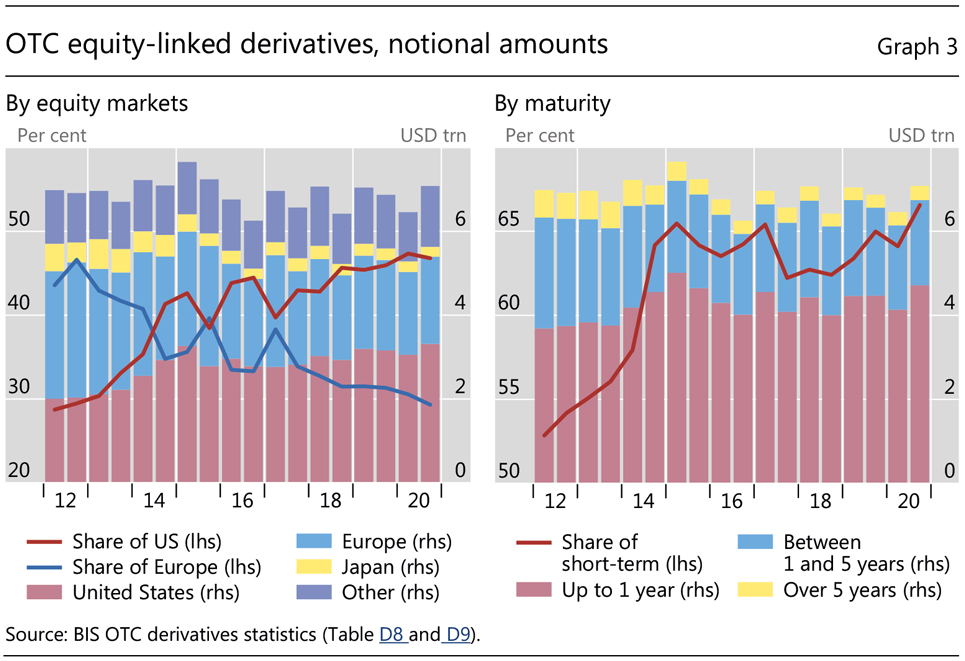

Derivatives Exposure Adjusting Notional Amounts Asset Management

Understanding notional amounts is essential for anyone dealing with derivatives, swaps, and options, as it helps gauge potential. The total value of the underlying asset in a contract is referred to as notional value, a term that derivatives traders frequently use. Notional value is a fundamental concept in finance, particularly within the realm of derivatives and complex financial instruments.

OTC derivatives statistics at endDecember 2020

Notional value is a fundamental concept in finance, particularly within the realm of derivatives and complex financial instruments. The total value of the underlying asset in a contract is referred to as notional value, a term that derivatives traders frequently use. Understanding notional amounts is essential for anyone dealing with derivatives, swaps, and options, as it helps gauge potential.

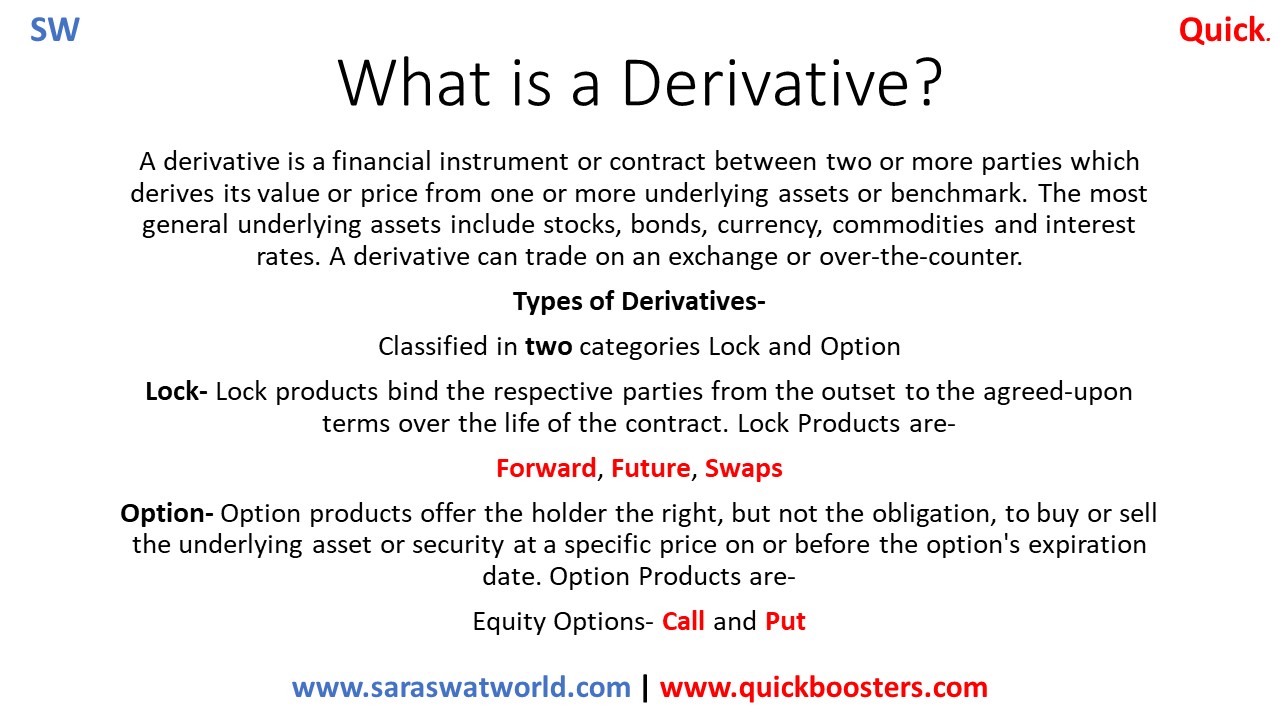

What is a Derivative? Saraswat World Source of Knowledge and

Notional value is a fundamental concept in finance, particularly within the realm of derivatives and complex financial instruments. The total value of the underlying asset in a contract is referred to as notional value, a term that derivatives traders frequently use. Understanding notional amounts is essential for anyone dealing with derivatives, swaps, and options, as it helps gauge potential.

The Federal Reserve has initiated the ultimate rug pull, but trillions

Notional value is a fundamental concept in finance, particularly within the realm of derivatives and complex financial instruments. The total value of the underlying asset in a contract is referred to as notional value, a term that derivatives traders frequently use. Understanding notional amounts is essential for anyone dealing with derivatives, swaps, and options, as it helps gauge potential.

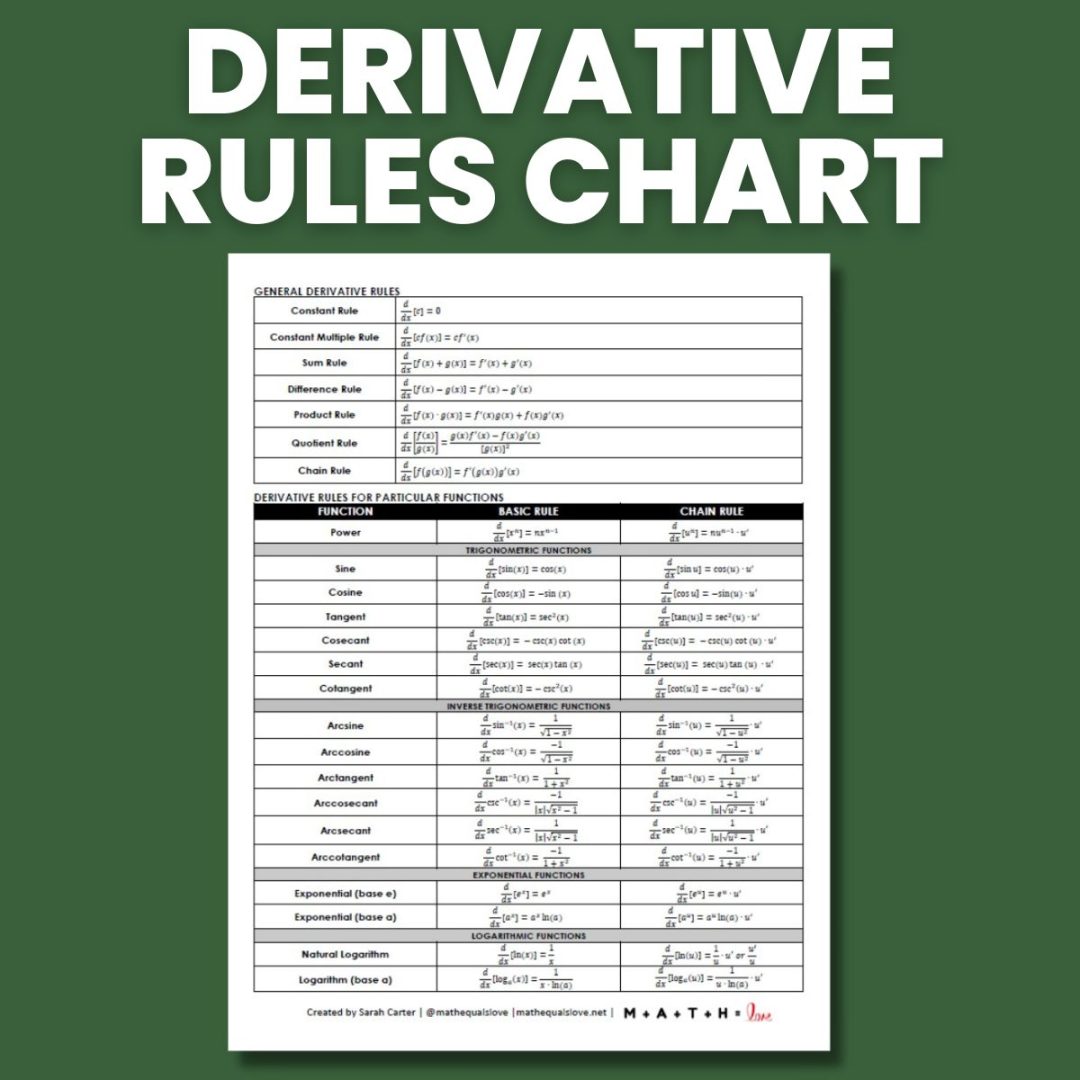

Free Printable Derivatives Formula Chart (PDF) Math = Love

The total value of the underlying asset in a contract is referred to as notional value, a term that derivatives traders frequently use. Understanding notional amounts is essential for anyone dealing with derivatives, swaps, and options, as it helps gauge potential. Notional value is a fundamental concept in finance, particularly within the realm of derivatives and complex financial instruments.

Notional Value Is A Fundamental Concept In Finance, Particularly Within The Realm Of Derivatives And Complex Financial Instruments.

Understanding notional amounts is essential for anyone dealing with derivatives, swaps, and options, as it helps gauge potential. The total value of the underlying asset in a contract is referred to as notional value, a term that derivatives traders frequently use.

:max_bytes(150000):strip_icc()/GettyImages-1256062609-0d0c68aeeb2545dfafac0d1a25be9761.jpg)