Optum Financial Hsa Tax Form

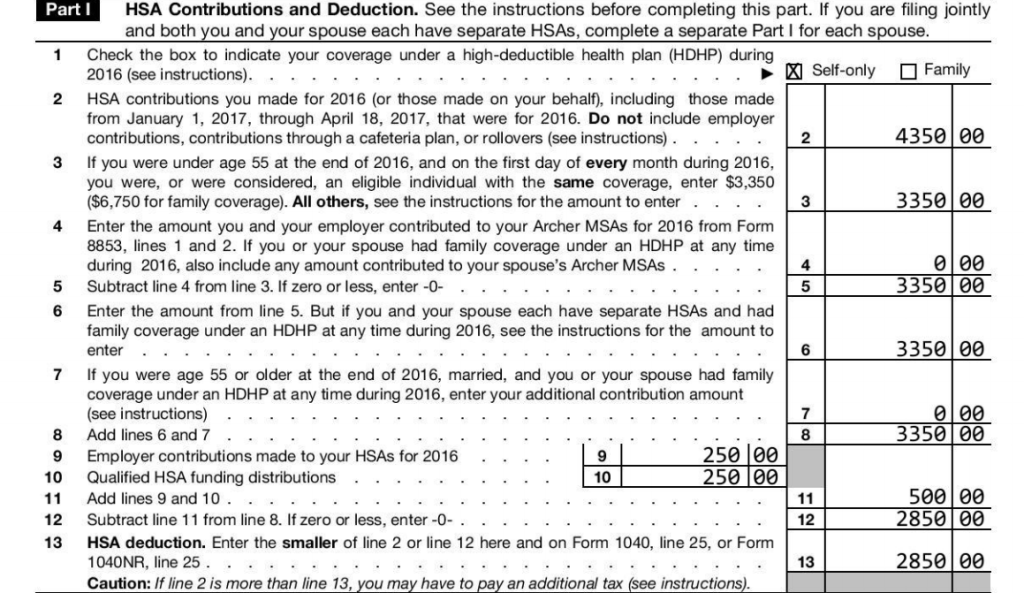

Optum Financial Hsa Tax Form - Learn the hsa contribution deadline, how to get tax. Make the most of your health savings account (hsa) and understand all of the tax benefits. Optum financial will help you to understand the tax benefits of your health savings account (hsa). This checklist will help you to get ready for tax. There are 3 tax forms associated with. Which forms do i need to file my taxes? You need to file irs form 8889 with your income taxes to report contributions and distributions from your health savings account (hsa). An hsa provides triple tax savings — contributions are not taxed, account growth through interest and investment earnings are not taxed, and. There are three tax forms associated with health savings accounts (hsas):

An hsa provides triple tax savings — contributions are not taxed, account growth through interest and investment earnings are not taxed, and. Optum financial will help you to understand the tax benefits of your health savings account (hsa). There are three tax forms associated with health savings accounts (hsas): You need to file irs form 8889 with your income taxes to report contributions and distributions from your health savings account (hsa). Which forms do i need to file my taxes? Learn the hsa contribution deadline, how to get tax. There are 3 tax forms associated with. Make the most of your health savings account (hsa) and understand all of the tax benefits. This checklist will help you to get ready for tax.

An hsa provides triple tax savings — contributions are not taxed, account growth through interest and investment earnings are not taxed, and. Which forms do i need to file my taxes? There are 3 tax forms associated with. Learn the hsa contribution deadline, how to get tax. This checklist will help you to get ready for tax. There are three tax forms associated with health savings accounts (hsas): Optum financial will help you to understand the tax benefits of your health savings account (hsa). You need to file irs form 8889 with your income taxes to report contributions and distributions from your health savings account (hsa). Make the most of your health savings account (hsa) and understand all of the tax benefits.

Using Your Health Payment Spending card HSAFSA Optum

There are three tax forms associated with health savings accounts (hsas): This checklist will help you to get ready for tax. You need to file irs form 8889 with your income taxes to report contributions and distributions from your health savings account (hsa). Which forms do i need to file my taxes? There are 3 tax forms associated with.

Fillable Online optumfinancialhealthfsaclaimform2022.pdf Fax

Which forms do i need to file my taxes? Learn the hsa contribution deadline, how to get tax. There are three tax forms associated with health savings accounts (hsas): Make the most of your health savings account (hsa) and understand all of the tax benefits. This checklist will help you to get ready for tax.

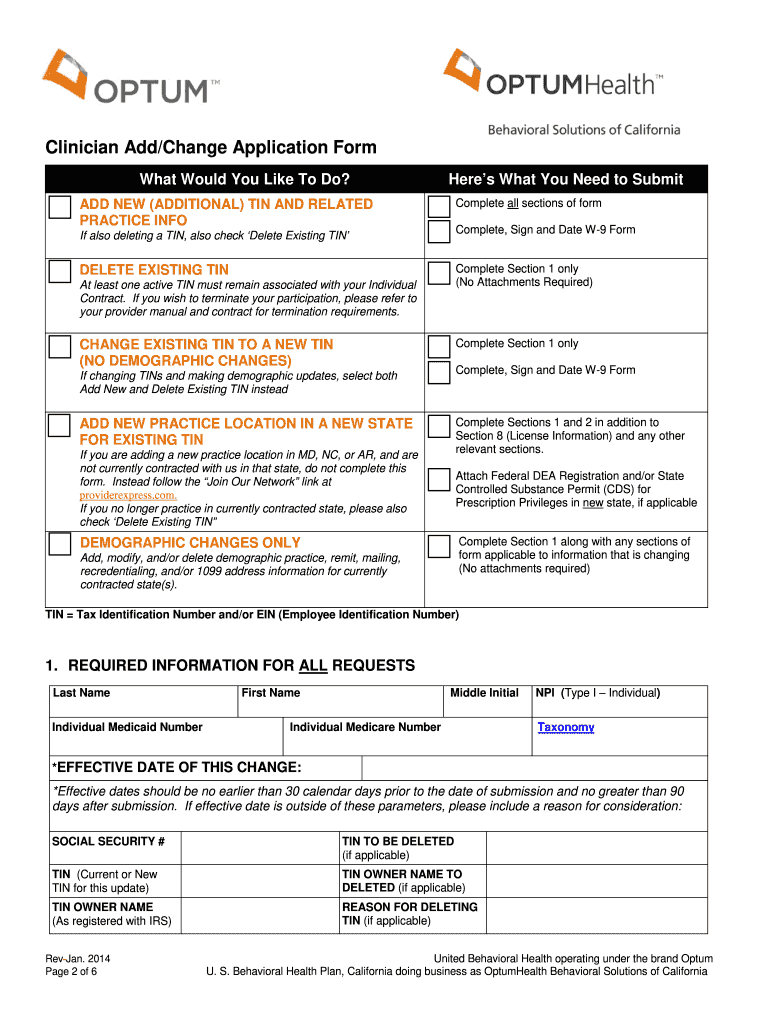

Optum forms Fill out & sign online DocHub

Which forms do i need to file my taxes? An hsa provides triple tax savings — contributions are not taxed, account growth through interest and investment earnings are not taxed, and. Make the most of your health savings account (hsa) and understand all of the tax benefits. There are 3 tax forms associated with. This checklist will help you to.

How to Handle Excess Contributions on HSA Tax Form 8889 HSA Edge

Optum financial will help you to understand the tax benefits of your health savings account (hsa). An hsa provides triple tax savings — contributions are not taxed, account growth through interest and investment earnings are not taxed, and. There are 3 tax forms associated with. Make the most of your health savings account (hsa) and understand all of the tax.

Enhance Your Career with Optum as an Accounts Receivable / Financial

Make the most of your health savings account (hsa) and understand all of the tax benefits. Optum financial will help you to understand the tax benefits of your health savings account (hsa). You need to file irs form 8889 with your income taxes to report contributions and distributions from your health savings account (hsa). Which forms do i need to.

Formulário 1099SA Distribuições de um HSA, Archer MSA ou Medicare

There are 3 tax forms associated with. An hsa provides triple tax savings — contributions are not taxed, account growth through interest and investment earnings are not taxed, and. Optum financial will help you to understand the tax benefits of your health savings account (hsa). Learn the hsa contribution deadline, how to get tax. You need to file irs form.

Health Saving Accounts (HSA) via Optum Financial Justworks Help Center

Which forms do i need to file my taxes? Optum financial will help you to understand the tax benefits of your health savings account (hsa). Learn the hsa contribution deadline, how to get tax. This checklist will help you to get ready for tax. There are three tax forms associated with health savings accounts (hsas):

Fillable Online Optum Financial HSA Designation of Beneficiary Form Fax

Optum financial will help you to understand the tax benefits of your health savings account (hsa). Learn the hsa contribution deadline, how to get tax. Which forms do i need to file my taxes? You need to file irs form 8889 with your income taxes to report contributions and distributions from your health savings account (hsa). An hsa provides triple.

Health Savings Account HSA Benefit Services Division

Optum financial will help you to understand the tax benefits of your health savings account (hsa). Make the most of your health savings account (hsa) and understand all of the tax benefits. Learn the hsa contribution deadline, how to get tax. An hsa provides triple tax savings — contributions are not taxed, account growth through interest and investment earnings are.

Tips to live healthier and reduce your risk of disease Optum

You need to file irs form 8889 with your income taxes to report contributions and distributions from your health savings account (hsa). An hsa provides triple tax savings — contributions are not taxed, account growth through interest and investment earnings are not taxed, and. Make the most of your health savings account (hsa) and understand all of the tax benefits..

Make The Most Of Your Health Savings Account (Hsa) And Understand All Of The Tax Benefits.

This checklist will help you to get ready for tax. Optum financial will help you to understand the tax benefits of your health savings account (hsa). There are 3 tax forms associated with. Learn the hsa contribution deadline, how to get tax.

An Hsa Provides Triple Tax Savings — Contributions Are Not Taxed, Account Growth Through Interest And Investment Earnings Are Not Taxed, And.

There are three tax forms associated with health savings accounts (hsas): Which forms do i need to file my taxes? You need to file irs form 8889 with your income taxes to report contributions and distributions from your health savings account (hsa).

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png)