Orange County Ca Tax Liens

Orange County Ca Tax Liens - Review and pay your property taxes online by echeck using your bank account (no cost) or a credit card (2.29% convenience fee with a. To redeem the certificate, the owner of the property must pay the tax collector all delinquent taxes plus accrued interests, and. If your property tax payment is not received in the tax collector’s office by 4:30 p.m., friday, may 31, 2023, a lien will be placed against your property. To obtain recorded documents such as deeds, judgments and liens contact the county of orange at the following area offices: If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. These properties has become subject. This lien prevents the assessee from recording. Search by property address parcel number (apn) tax default number

These properties has become subject. To obtain recorded documents such as deeds, judgments and liens contact the county of orange at the following area offices: This lien prevents the assessee from recording. Review and pay your property taxes online by echeck using your bank account (no cost) or a credit card (2.29% convenience fee with a. If your property tax payment is not received in the tax collector’s office by 4:30 p.m., friday, may 31, 2023, a lien will be placed against your property. Search by property address parcel number (apn) tax default number If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. To redeem the certificate, the owner of the property must pay the tax collector all delinquent taxes plus accrued interests, and.

This lien prevents the assessee from recording. To obtain recorded documents such as deeds, judgments and liens contact the county of orange at the following area offices: To redeem the certificate, the owner of the property must pay the tax collector all delinquent taxes plus accrued interests, and. These properties has become subject. Search by property address parcel number (apn) tax default number If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. Review and pay your property taxes online by echeck using your bank account (no cost) or a credit card (2.29% convenience fee with a. If your property tax payment is not received in the tax collector’s office by 4:30 p.m., friday, may 31, 2023, a lien will be placed against your property.

The Highest and Lowest Areas in Orange County, CA

To redeem the certificate, the owner of the property must pay the tax collector all delinquent taxes plus accrued interests, and. This lien prevents the assessee from recording. If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. These properties has become subject. To obtain recorded documents such as deeds, judgments and liens.

A Closer Look Orange County Tax Collector’s Office

This lien prevents the assessee from recording. If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. Search by property address parcel number (apn) tax default number These properties has become subject. If your property tax payment is not received in the tax collector’s office by 4:30 p.m., friday, may 31, 2023, a.

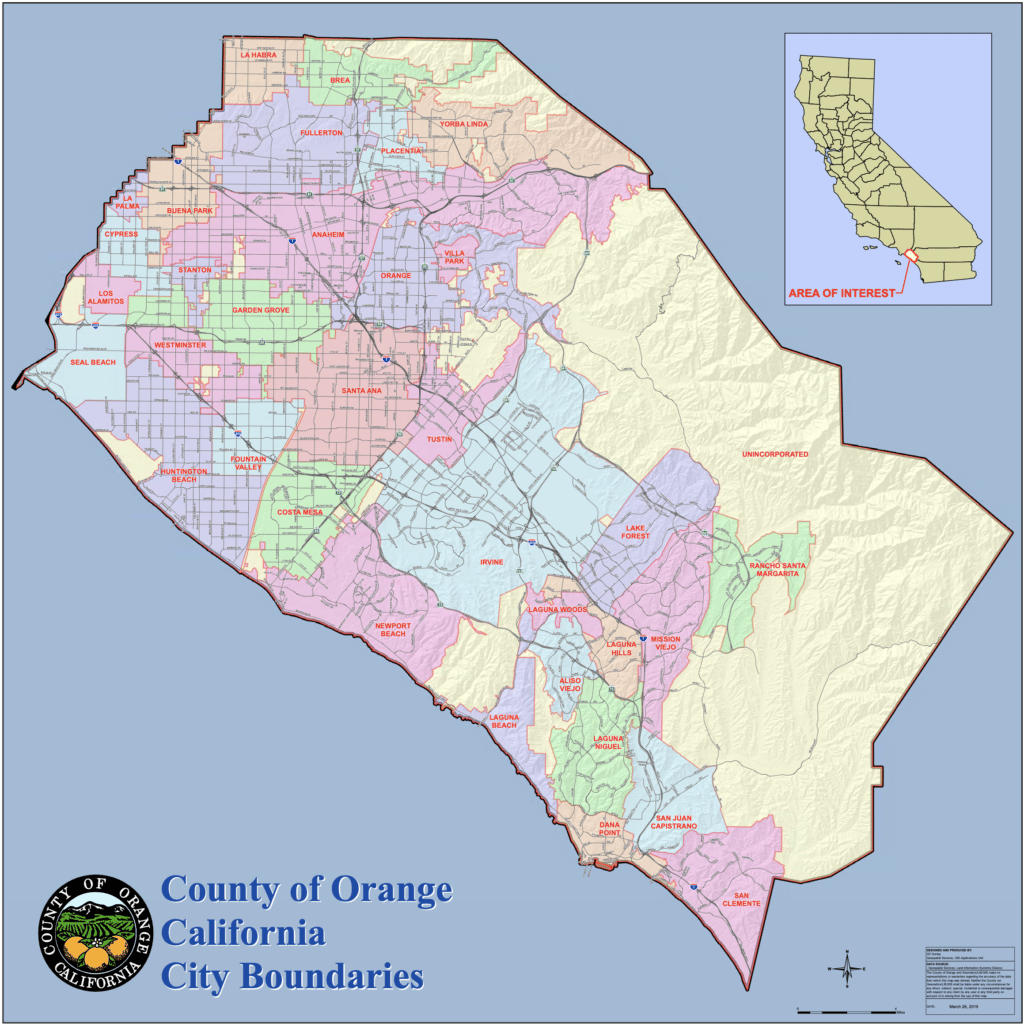

Cities in Orange County, California

Review and pay your property taxes online by echeck using your bank account (no cost) or a credit card (2.29% convenience fee with a. Search by property address parcel number (apn) tax default number These properties has become subject. This lien prevents the assessee from recording. If your property tax payment is not received in the tax collector’s office by.

Race, Diversity, and Ethnicity in Orange County, CA

To obtain recorded documents such as deeds, judgments and liens contact the county of orange at the following area offices: These properties has become subject. Review and pay your property taxes online by echeck using your bank account (no cost) or a credit card (2.29% convenience fee with a. This lien prevents the assessee from recording. Search by property address.

Orange County

If your property tax payment is not received in the tax collector’s office by 4:30 p.m., friday, may 31, 2023, a lien will be placed against your property. If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. These properties has become subject. Review and pay your property taxes online by echeck using.

Cities in Orange County, California

Search by property address parcel number (apn) tax default number To obtain recorded documents such as deeds, judgments and liens contact the county of orange at the following area offices: If your property tax payment is not received in the tax collector’s office by 4:30 p.m., friday, may 31, 2023, a lien will be placed against your property. Review and.

Orange County CA Heroes Housing

Review and pay your property taxes online by echeck using your bank account (no cost) or a credit card (2.29% convenience fee with a. These properties has become subject. This lien prevents the assessee from recording. If your property tax payment is not received in the tax collector’s office by 4:30 p.m., friday, may 31, 2023, a lien will be.

Orange County California Community Economic Development

If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. To obtain recorded documents such as deeds, judgments and liens contact the county of orange at the following area offices: If your property tax payment is not received in the tax collector’s office by 4:30 p.m., friday, may 31, 2023, a lien will.

Orange County Ca Tax Deadline 2024 Rena Krista

This lien prevents the assessee from recording. To obtain recorded documents such as deeds, judgments and liens contact the county of orange at the following area offices: If your property tax payment is not received in the tax collector’s office by 4:30 p.m., friday, may 31, 2023, a lien will be placed against your property. Review and pay your property.

Orange County Tax Collector In California Lamarcounty.us

If your property tax payment is not received in the tax collector’s office by 4:30 p.m., friday, may 31, 2023, a lien will be placed against your property. These properties has become subject. This lien prevents the assessee from recording. Search by property address parcel number (apn) tax default number Review and pay your property taxes online by echeck using.

If Unsecured Taxes Become Delinquent, A Tax Lien May Be Recorded In The Name Of The Assessee.

If your property tax payment is not received in the tax collector’s office by 4:30 p.m., friday, may 31, 2023, a lien will be placed against your property. To obtain recorded documents such as deeds, judgments and liens contact the county of orange at the following area offices: This lien prevents the assessee from recording. Review and pay your property taxes online by echeck using your bank account (no cost) or a credit card (2.29% convenience fee with a.

To Redeem The Certificate, The Owner Of The Property Must Pay The Tax Collector All Delinquent Taxes Plus Accrued Interests, And.

These properties has become subject. Search by property address parcel number (apn) tax default number