Orange County Tax Lien Search

Orange County Tax Lien Search - Search by property address parcel number (apn) tax default number On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. This lien prevents the assessee from recording. Tax certificates are sold by the orange county tax collector, located at 200 s orange avenue, 16th. Where can i find tax lien information? The orange county comptroller's official records department records, creates an index, and archives all of the documents that constitute. Review and pay your property taxes online by echeck using your bank account (no cost) or a credit card (2.29% convenience fee with a.

This lien prevents the assessee from recording. Review and pay your property taxes online by echeck using your bank account (no cost) or a credit card (2.29% convenience fee with a. Where can i find tax lien information? If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. The orange county comptroller's official records department records, creates an index, and archives all of the documents that constitute. Tax certificates are sold by the orange county tax collector, located at 200 s orange avenue, 16th. Search by property address parcel number (apn) tax default number

Search by property address parcel number (apn) tax default number Review and pay your property taxes online by echeck using your bank account (no cost) or a credit card (2.29% convenience fee with a. On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. Tax certificates are sold by the orange county tax collector, located at 200 s orange avenue, 16th. If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. This lien prevents the assessee from recording. The orange county comptroller's official records department records, creates an index, and archives all of the documents that constitute. Where can i find tax lien information?

Search Tax Lien Records

On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. Search by property address parcel number (apn) tax default number This lien prevents the assessee from recording. Review and pay your property taxes online by echeck using your bank account (no cost) or a credit card (2.29%.

What Is a Tax Lien? Definition & Impact on Credit TheStreet

Tax certificates are sold by the orange county tax collector, located at 200 s orange avenue, 16th. If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. Search by property address parcel number (apn) tax default number This lien prevents the assessee from recording. Where can i find tax lien information?

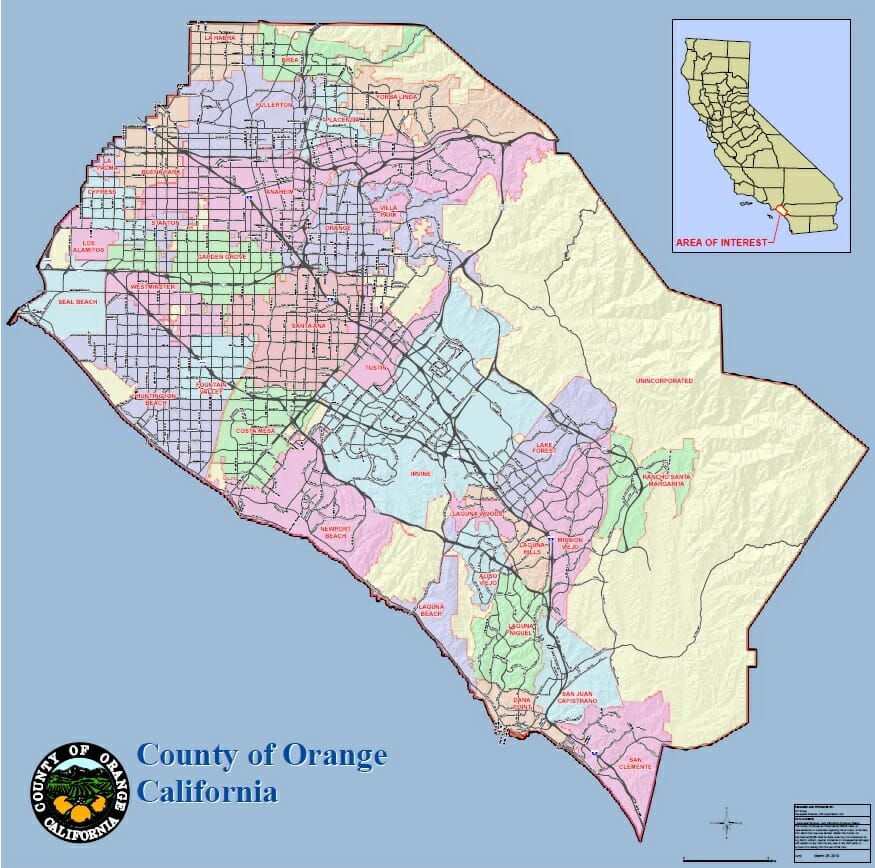

Orange County Maps Enjoy OC

On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. This lien prevents the assessee from recording. Tax certificates are sold by the orange county tax collector, located at 200 s orange avenue, 16th. Review and pay your property taxes online by echeck using your bank account.

Orange County Tax Lien Certificate School

Where can i find tax lien information? Review and pay your property taxes online by echeck using your bank account (no cost) or a credit card (2.29% convenience fee with a. If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. Search by property address parcel number (apn) tax default number The orange.

Anne Arundel County Tax Lien Certificates prosecution2012

Review and pay your property taxes online by echeck using your bank account (no cost) or a credit card (2.29% convenience fee with a. Tax certificates are sold by the orange county tax collector, located at 200 s orange avenue, 16th. Where can i find tax lien information? Search by property address parcel number (apn) tax default number The orange.

Orange County

Where can i find tax lien information? Tax certificates are sold by the orange county tax collector, located at 200 s orange avenue, 16th. Review and pay your property taxes online by echeck using your bank account (no cost) or a credit card (2.29% convenience fee with a. Search by property address parcel number (apn) tax default number On or.

Snap Tax & Lien Search_Logo_REDcircle_V Snap Tax & Lien Search

This lien prevents the assessee from recording. If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. Where can i find tax lien information? The orange county comptroller's official records department records, creates an index, and archives all of the documents that constitute. Tax certificates are sold by the orange county tax collector,.

Suffolk County Tax Lien Sale 2024 Marne Sharona

On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. Search by property address parcel number (apn) tax default number The orange county comptroller's official records department records, creates an index, and archives all of the documents that constitute. Tax certificates are sold by the orange county.

Property Tax Lien Search Nationwide Title Insurance

The orange county comptroller's official records department records, creates an index, and archives all of the documents that constitute. Review and pay your property taxes online by echeck using your bank account (no cost) or a credit card (2.29% convenience fee with a. On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid.

Tax Administration Orange County, NC

Search by property address parcel number (apn) tax default number On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. Where can i find tax lien information? This lien prevents the assessee from recording. Review and pay your property taxes online by echeck using your bank account.

Review And Pay Your Property Taxes Online By Echeck Using Your Bank Account (No Cost) Or A Credit Card (2.29% Convenience Fee With A.

If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. Tax certificates are sold by the orange county tax collector, located at 200 s orange avenue, 16th. This lien prevents the assessee from recording. On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property.

The Orange County Comptroller's Official Records Department Records, Creates An Index, And Archives All Of The Documents That Constitute.

Search by property address parcel number (apn) tax default number Where can i find tax lien information?