Pa Local Tax Collection Law

Pa Local Tax Collection Law - (1) to levy, assess and collect or provide for the levying, assessment and collection of any tax on the transfer of real property when the transfer is. The definition of tax collector or elected tax collector in section 2 of the act of may 25, 1945 (p.l.1050, no.394), known as the. Find the full text of the local tax collection law, which regulates the collection and payment of taxes in pennsylvania.

(1) to levy, assess and collect or provide for the levying, assessment and collection of any tax on the transfer of real property when the transfer is. Find the full text of the local tax collection law, which regulates the collection and payment of taxes in pennsylvania. The definition of tax collector or elected tax collector in section 2 of the act of may 25, 1945 (p.l.1050, no.394), known as the.

(1) to levy, assess and collect or provide for the levying, assessment and collection of any tax on the transfer of real property when the transfer is. The definition of tax collector or elected tax collector in section 2 of the act of may 25, 1945 (p.l.1050, no.394), known as the. Find the full text of the local tax collection law, which regulates the collection and payment of taxes in pennsylvania.

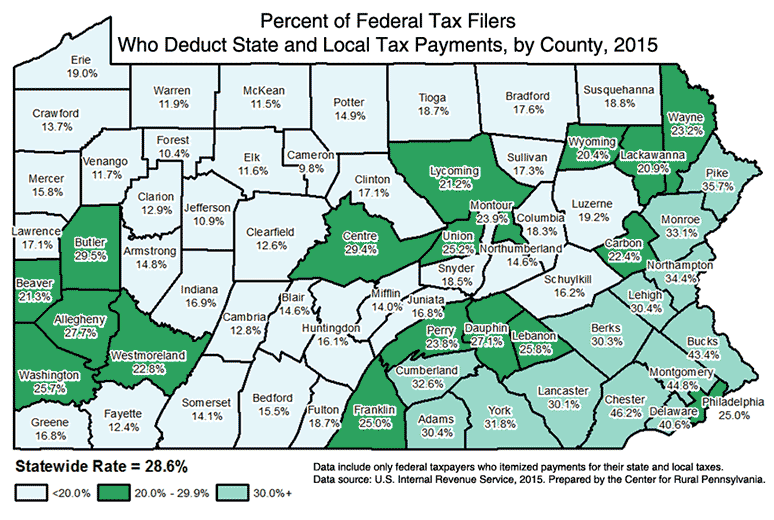

DataGrams Center for Rural PA

Find the full text of the local tax collection law, which regulates the collection and payment of taxes in pennsylvania. (1) to levy, assess and collect or provide for the levying, assessment and collection of any tax on the transfer of real property when the transfer is. The definition of tax collector or elected tax collector in section 2 of.

Analysis of Local Tax Collection Procedures and Remedies According to

The definition of tax collector or elected tax collector in section 2 of the act of may 25, 1945 (p.l.1050, no.394), known as the. Find the full text of the local tax collection law, which regulates the collection and payment of taxes in pennsylvania. (1) to levy, assess and collect or provide for the levying, assessment and collection of any.

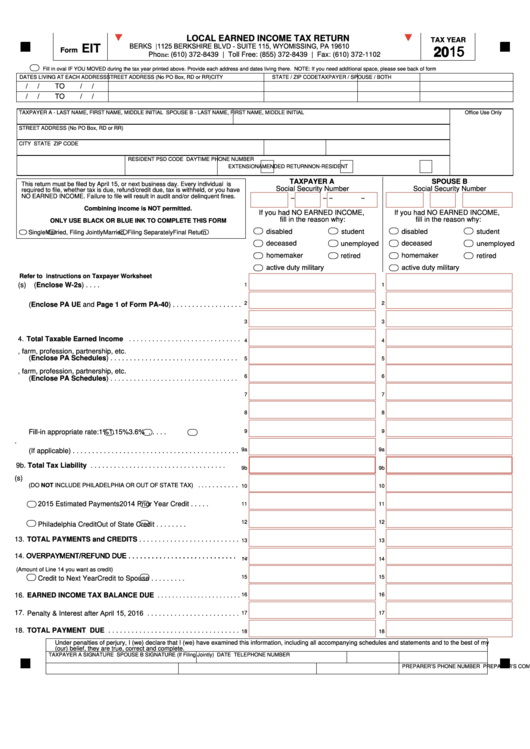

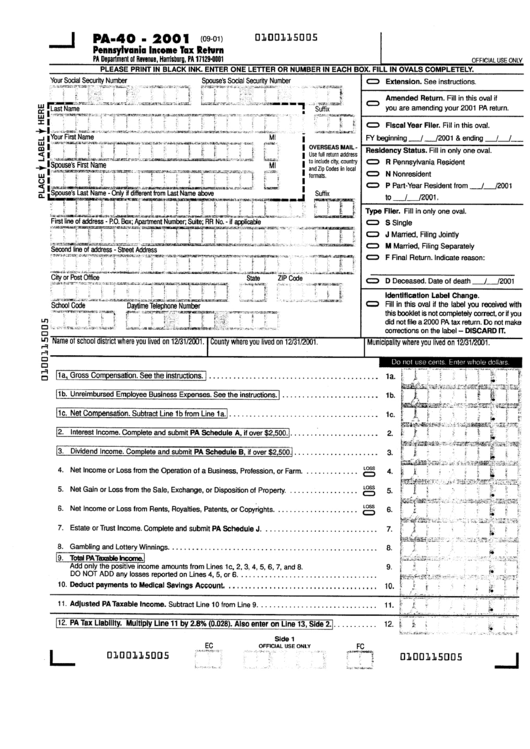

Printable Pa Local Tax Return Form Printable Forms Free Online

The definition of tax collector or elected tax collector in section 2 of the act of may 25, 1945 (p.l.1050, no.394), known as the. (1) to levy, assess and collect or provide for the levying, assessment and collection of any tax on the transfer of real property when the transfer is. Find the full text of the local tax collection.

Printable Pa Local Tax Form Printable Forms Free Online

(1) to levy, assess and collect or provide for the levying, assessment and collection of any tax on the transfer of real property when the transfer is. Find the full text of the local tax collection law, which regulates the collection and payment of taxes in pennsylvania. The definition of tax collector or elected tax collector in section 2 of.

Pa 2024 Tax Forms Deny

Find the full text of the local tax collection law, which regulates the collection and payment of taxes in pennsylvania. The definition of tax collector or elected tax collector in section 2 of the act of may 25, 1945 (p.l.1050, no.394), known as the. (1) to levy, assess and collect or provide for the levying, assessment and collection of any.

Printable Pa Local Tax Form Printable Forms Free Online

(1) to levy, assess and collect or provide for the levying, assessment and collection of any tax on the transfer of real property when the transfer is. Find the full text of the local tax collection law, which regulates the collection and payment of taxes in pennsylvania. The definition of tax collector or elected tax collector in section 2 of.

Amendment to Pennsylvania’s Local Tax Collection Law Maher Duessel CPAs

Find the full text of the local tax collection law, which regulates the collection and payment of taxes in pennsylvania. (1) to levy, assess and collect or provide for the levying, assessment and collection of any tax on the transfer of real property when the transfer is. The definition of tax collector or elected tax collector in section 2 of.

Pa State Tax Deadline 2024 Amye Kellen

Find the full text of the local tax collection law, which regulates the collection and payment of taxes in pennsylvania. (1) to levy, assess and collect or provide for the levying, assessment and collection of any tax on the transfer of real property when the transfer is. The definition of tax collector or elected tax collector in section 2 of.

Printable Pa Tax Forms

(1) to levy, assess and collect or provide for the levying, assessment and collection of any tax on the transfer of real property when the transfer is. The definition of tax collector or elected tax collector in section 2 of the act of may 25, 1945 (p.l.1050, no.394), known as the. Find the full text of the local tax collection.

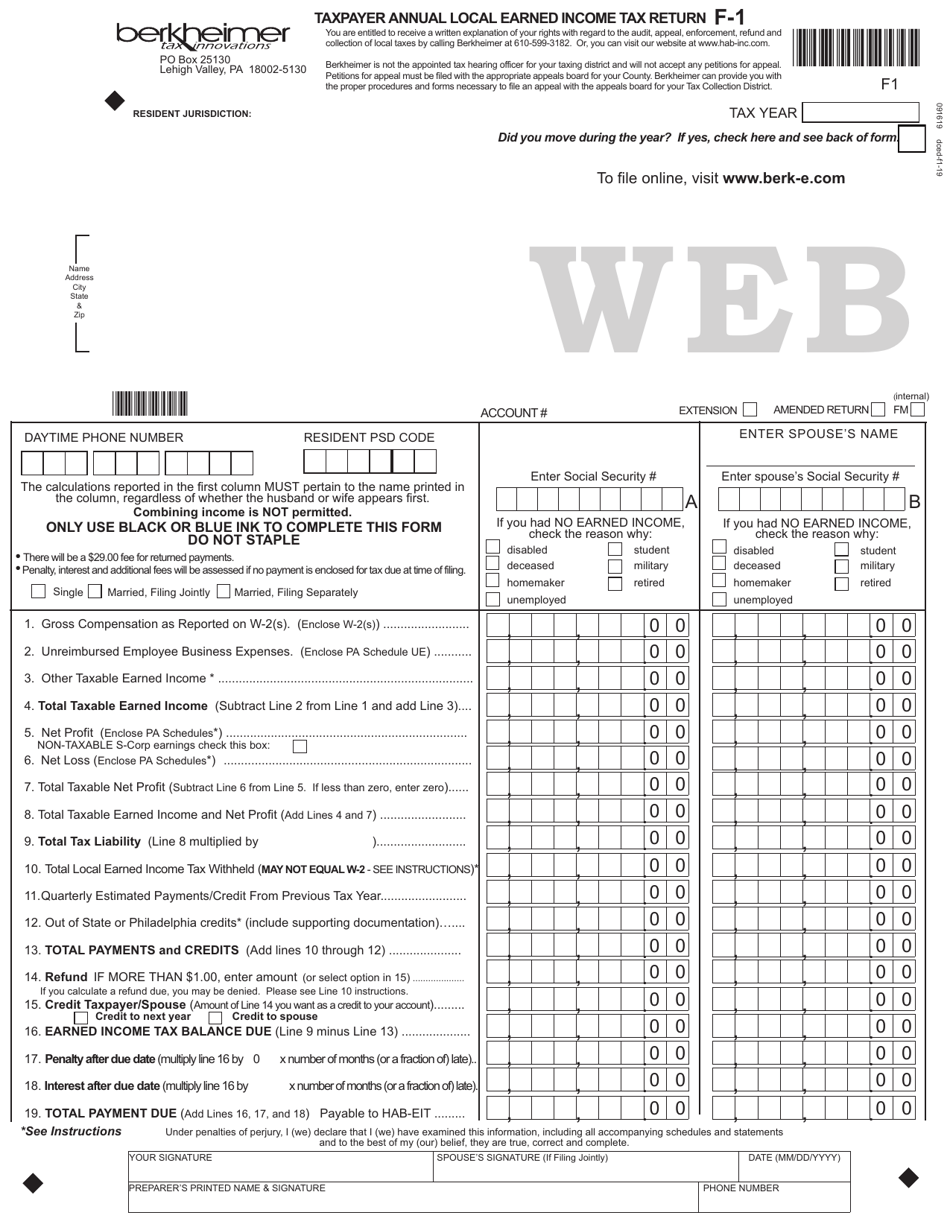

Perry County Pa Local Tax Form

Find the full text of the local tax collection law, which regulates the collection and payment of taxes in pennsylvania. The definition of tax collector or elected tax collector in section 2 of the act of may 25, 1945 (p.l.1050, no.394), known as the. (1) to levy, assess and collect or provide for the levying, assessment and collection of any.

The Definition Of Tax Collector Or Elected Tax Collector In Section 2 Of The Act Of May 25, 1945 (P.l.1050, No.394), Known As The.

Find the full text of the local tax collection law, which regulates the collection and payment of taxes in pennsylvania. (1) to levy, assess and collect or provide for the levying, assessment and collection of any tax on the transfer of real property when the transfer is.