Permanent Establishment Malaysia

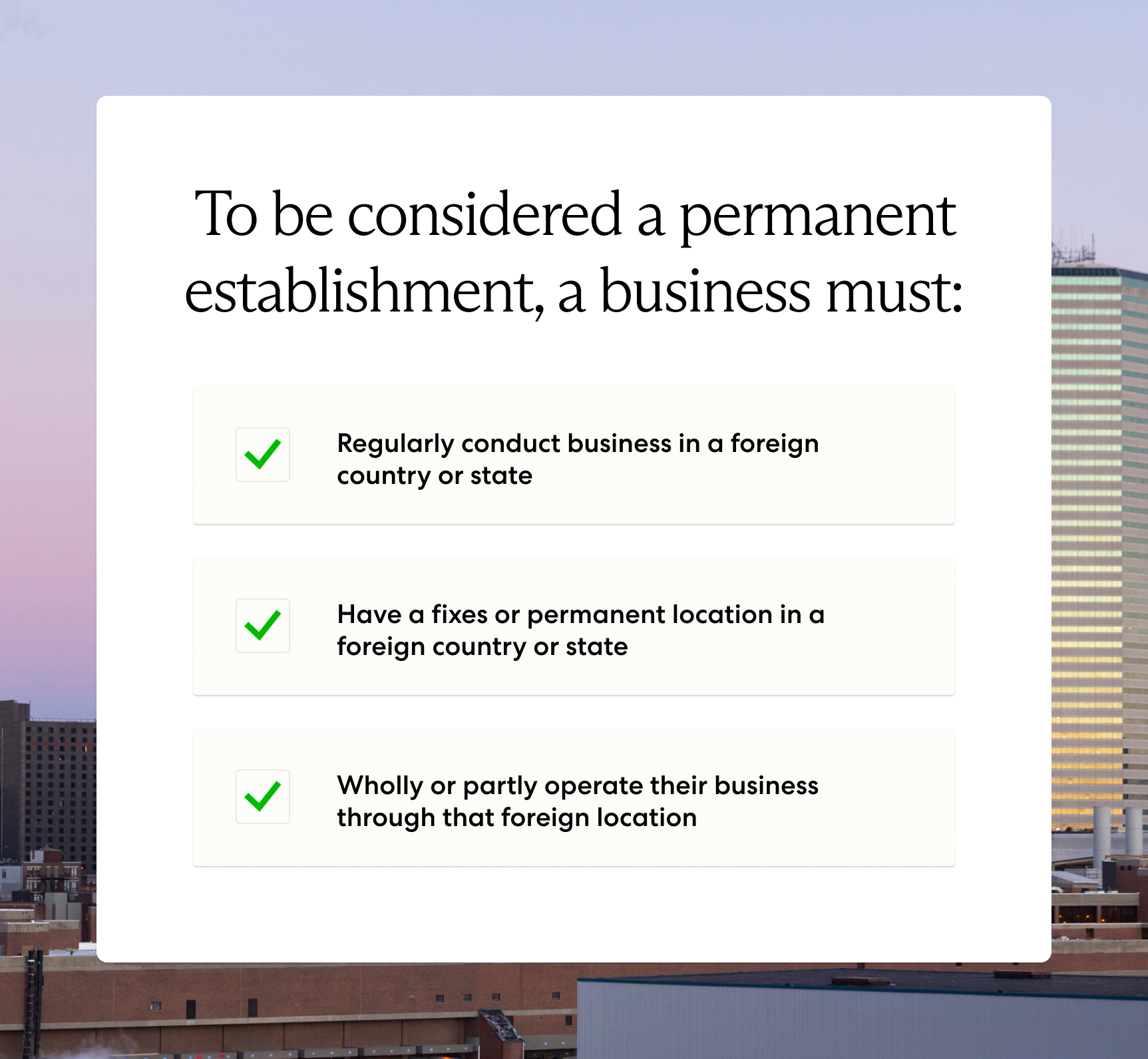

Permanent Establishment Malaysia - Permanent establishment (pe) means having a taxable presence outside your company’s state of residence. This public ruling explains the criteria and procedures for determining the residence status of companies and bodies of persons in malaysia. Liable to malaysian tax when it carries on a business through a permanent establishment in malaysia and assessable on income accruing. Tax authorities are adapting beyond.

Tax authorities are adapting beyond. Permanent establishment (pe) means having a taxable presence outside your company’s state of residence. This public ruling explains the criteria and procedures for determining the residence status of companies and bodies of persons in malaysia. Liable to malaysian tax when it carries on a business through a permanent establishment in malaysia and assessable on income accruing.

This public ruling explains the criteria and procedures for determining the residence status of companies and bodies of persons in malaysia. Liable to malaysian tax when it carries on a business through a permanent establishment in malaysia and assessable on income accruing. Permanent establishment (pe) means having a taxable presence outside your company’s state of residence. Tax authorities are adapting beyond.

Permanent Resident Malaysia

Liable to malaysian tax when it carries on a business through a permanent establishment in malaysia and assessable on income accruing. This public ruling explains the criteria and procedures for determining the residence status of companies and bodies of persons in malaysia. Permanent establishment (pe) means having a taxable presence outside your company’s state of residence. Tax authorities are adapting.

The Tax Implications of Permanent Establishment in Mexico

Permanent establishment (pe) means having a taxable presence outside your company’s state of residence. Tax authorities are adapting beyond. Liable to malaysian tax when it carries on a business through a permanent establishment in malaysia and assessable on income accruing. This public ruling explains the criteria and procedures for determining the residence status of companies and bodies of persons in.

Permanent establishment playbook Vistra

This public ruling explains the criteria and procedures for determining the residence status of companies and bodies of persons in malaysia. Permanent establishment (pe) means having a taxable presence outside your company’s state of residence. Tax authorities are adapting beyond. Liable to malaysian tax when it carries on a business through a permanent establishment in malaysia and assessable on income.

What Is Permanent Establishment? Learn the Risks to Avoid

Permanent establishment (pe) means having a taxable presence outside your company’s state of residence. Tax authorities are adapting beyond. Liable to malaysian tax when it carries on a business through a permanent establishment in malaysia and assessable on income accruing. This public ruling explains the criteria and procedures for determining the residence status of companies and bodies of persons in.

Permanent Establishment Anteo

Tax authorities are adapting beyond. Permanent establishment (pe) means having a taxable presence outside your company’s state of residence. Liable to malaysian tax when it carries on a business through a permanent establishment in malaysia and assessable on income accruing. This public ruling explains the criteria and procedures for determining the residence status of companies and bodies of persons in.

Malaysia Permanent establishment a total revamp or just a formality?

Permanent establishment (pe) means having a taxable presence outside your company’s state of residence. Tax authorities are adapting beyond. Liable to malaysian tax when it carries on a business through a permanent establishment in malaysia and assessable on income accruing. This public ruling explains the criteria and procedures for determining the residence status of companies and bodies of persons in.

How to avoid Permanent Establishment in India IndiaConnected

This public ruling explains the criteria and procedures for determining the residence status of companies and bodies of persons in malaysia. Liable to malaysian tax when it carries on a business through a permanent establishment in malaysia and assessable on income accruing. Permanent establishment (pe) means having a taxable presence outside your company’s state of residence. Tax authorities are adapting.

An Overview of the 3 Types of Permanent Establishment—With Examples

This public ruling explains the criteria and procedures for determining the residence status of companies and bodies of persons in malaysia. Permanent establishment (pe) means having a taxable presence outside your company’s state of residence. Tax authorities are adapting beyond. Liable to malaysian tax when it carries on a business through a permanent establishment in malaysia and assessable on income.

Permanent Establishment Checklist for Global Companies iiPay

This public ruling explains the criteria and procedures for determining the residence status of companies and bodies of persons in malaysia. Tax authorities are adapting beyond. Permanent establishment (pe) means having a taxable presence outside your company’s state of residence. Liable to malaysian tax when it carries on a business through a permanent establishment in malaysia and assessable on income.

What Is Permanent Establishment? Learn the Risks to Avoid

Liable to malaysian tax when it carries on a business through a permanent establishment in malaysia and assessable on income accruing. Permanent establishment (pe) means having a taxable presence outside your company’s state of residence. This public ruling explains the criteria and procedures for determining the residence status of companies and bodies of persons in malaysia. Tax authorities are adapting.

This Public Ruling Explains The Criteria And Procedures For Determining The Residence Status Of Companies And Bodies Of Persons In Malaysia.

Liable to malaysian tax when it carries on a business through a permanent establishment in malaysia and assessable on income accruing. Tax authorities are adapting beyond. Permanent establishment (pe) means having a taxable presence outside your company’s state of residence.