Property Tax Foreclosure

Property Tax Foreclosure - Tax lien foreclosure is a legal process that occurs when a property owner fails to pay their property taxes. A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other. If you’ve lost your home to a tax sale and want to learn more about setting the sale aside or redeeming the property, consider. All unpaid taxes must be turned over to the delinquent tax. All real estate taxes are due to our office by december 31st of the current tax year.

A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other. Tax lien foreclosure is a legal process that occurs when a property owner fails to pay their property taxes. All real estate taxes are due to our office by december 31st of the current tax year. If you’ve lost your home to a tax sale and want to learn more about setting the sale aside or redeeming the property, consider. All unpaid taxes must be turned over to the delinquent tax.

All real estate taxes are due to our office by december 31st of the current tax year. If you’ve lost your home to a tax sale and want to learn more about setting the sale aside or redeeming the property, consider. All unpaid taxes must be turned over to the delinquent tax. Tax lien foreclosure is a legal process that occurs when a property owner fails to pay their property taxes. A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other.

Delinquent Property Taxes Houston Tax Foreclosure Jarrett Law Firm

If you’ve lost your home to a tax sale and want to learn more about setting the sale aside or redeeming the property, consider. All unpaid taxes must be turned over to the delinquent tax. A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other. Tax lien foreclosure is a.

stop property tax foreclosure

Tax lien foreclosure is a legal process that occurs when a property owner fails to pay their property taxes. All unpaid taxes must be turned over to the delinquent tax. If you’ve lost your home to a tax sale and want to learn more about setting the sale aside or redeeming the property, consider. All real estate taxes are due.

How to Stop Property Tax Foreclosure Jarrett Law Firm

Tax lien foreclosure is a legal process that occurs when a property owner fails to pay their property taxes. All real estate taxes are due to our office by december 31st of the current tax year. A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other. If you’ve lost your.

stop property tax foreclosure

Tax lien foreclosure is a legal process that occurs when a property owner fails to pay their property taxes. All real estate taxes are due to our office by december 31st of the current tax year. All unpaid taxes must be turned over to the delinquent tax. A tax lien foreclosure is one of two methods employed by government authorities.

What is a property Tax Lien? Real Estate Articles by

If you’ve lost your home to a tax sale and want to learn more about setting the sale aside or redeeming the property, consider. All unpaid taxes must be turned over to the delinquent tax. Tax lien foreclosure is a legal process that occurs when a property owner fails to pay their property taxes. All real estate taxes are due.

Property Tax Foreclosure Chemung County, NY

A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other. Tax lien foreclosure is a legal process that occurs when a property owner fails to pay their property taxes. If you’ve lost your home to a tax sale and want to learn more about setting the sale aside or redeeming.

Property Tax Foreclosure Auction Set Keweenaw Report

All unpaid taxes must be turned over to the delinquent tax. A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other. If you’ve lost your home to a tax sale and want to learn more about setting the sale aside or redeeming the property, consider. All real estate taxes are.

How to Stop Property Tax Foreclosure Property Nation™

Tax lien foreclosure is a legal process that occurs when a property owner fails to pay their property taxes. All real estate taxes are due to our office by december 31st of the current tax year. All unpaid taxes must be turned over to the delinquent tax. If you’ve lost your home to a tax sale and want to learn.

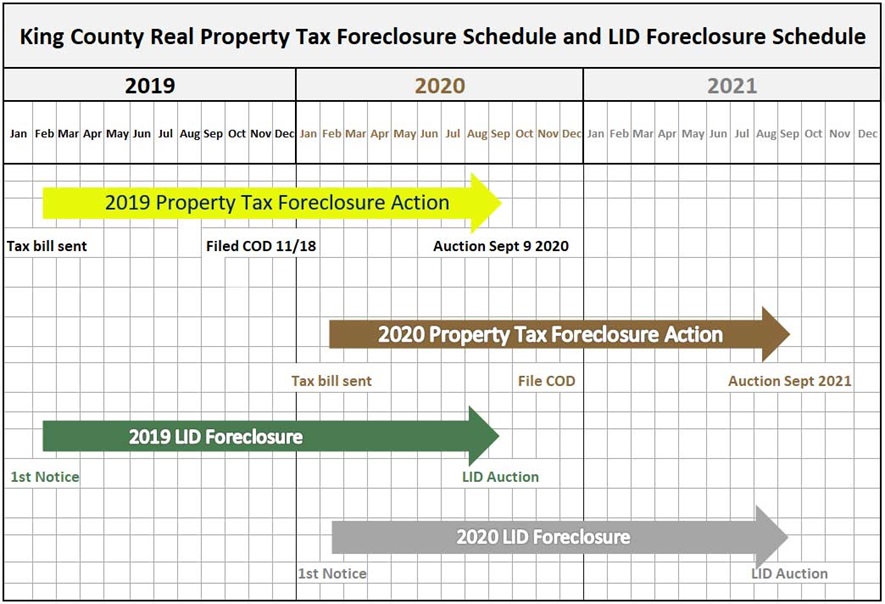

King County Property Tax Foreclosure List Tooyul Adventure

All real estate taxes are due to our office by december 31st of the current tax year. If you’ve lost your home to a tax sale and want to learn more about setting the sale aside or redeeming the property, consider. All unpaid taxes must be turned over to the delinquent tax. Tax lien foreclosure is a legal process that.

stop property tax foreclosure

Tax lien foreclosure is a legal process that occurs when a property owner fails to pay their property taxes. A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other. If you’ve lost your home to a tax sale and want to learn more about setting the sale aside or redeeming.

Tax Lien Foreclosure Is A Legal Process That Occurs When A Property Owner Fails To Pay Their Property Taxes.

If you’ve lost your home to a tax sale and want to learn more about setting the sale aside or redeeming the property, consider. All real estate taxes are due to our office by december 31st of the current tax year. All unpaid taxes must be turned over to the delinquent tax. A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other.