Quickbook Payments Fees

Quickbook Payments Fees - Learn about payment processing fees.if you use quickbooks payments to take payments from quickbooks, there's a. Quickbooks payments charges a fee each time you process a transaction. If you process more than $2,500 in payments each month, you could save money on fees by switching to quickbooks. The fees vary, depending on your sales volume, the amount of your average credit card sales transaction, and the funding time. Quickbooks payments seamlessly integrates with quickbooks and includes ecommerce support, invoicing, and ach. Fees will be determined depending on how you process the payments. Please refer to these rates: This fee varies depending on how the transaction is.

Learn about payment processing fees.if you use quickbooks payments to take payments from quickbooks, there's a. The fees vary, depending on your sales volume, the amount of your average credit card sales transaction, and the funding time. Quickbooks payments charges a fee each time you process a transaction. Please refer to these rates: Quickbooks payments seamlessly integrates with quickbooks and includes ecommerce support, invoicing, and ach. If you process more than $2,500 in payments each month, you could save money on fees by switching to quickbooks. This fee varies depending on how the transaction is. Fees will be determined depending on how you process the payments.

Quickbooks payments seamlessly integrates with quickbooks and includes ecommerce support, invoicing, and ach. If you process more than $2,500 in payments each month, you could save money on fees by switching to quickbooks. Learn about payment processing fees.if you use quickbooks payments to take payments from quickbooks, there's a. Fees will be determined depending on how you process the payments. This fee varies depending on how the transaction is. Please refer to these rates: Quickbooks payments charges a fee each time you process a transaction. The fees vary, depending on your sales volume, the amount of your average credit card sales transaction, and the funding time.

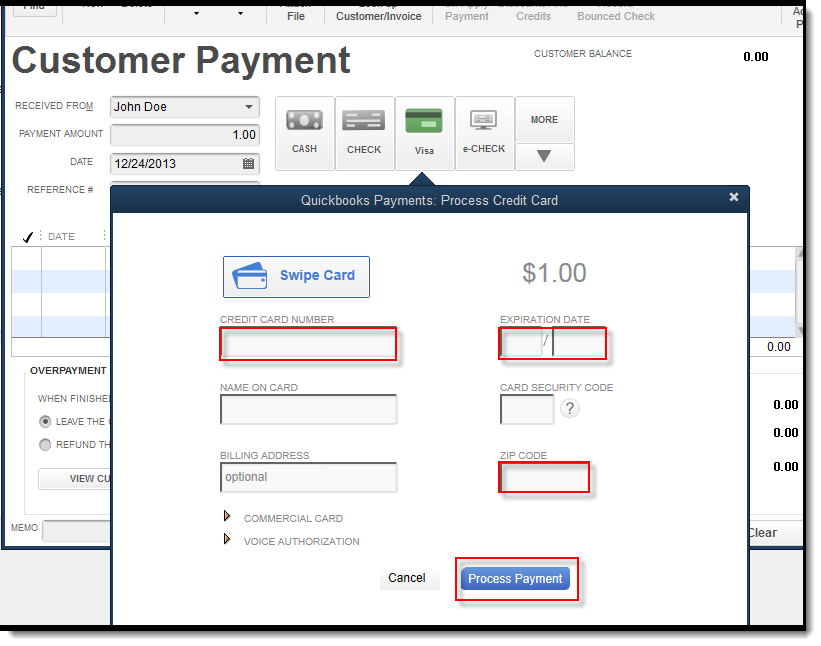

Process a credit card payment in QuickBooks Desktop QuickBooks Learn

Learn about payment processing fees.if you use quickbooks payments to take payments from quickbooks, there's a. Quickbooks payments charges a fee each time you process a transaction. This fee varies depending on how the transaction is. The fees vary, depending on your sales volume, the amount of your average credit card sales transaction, and the funding time. Please refer to.

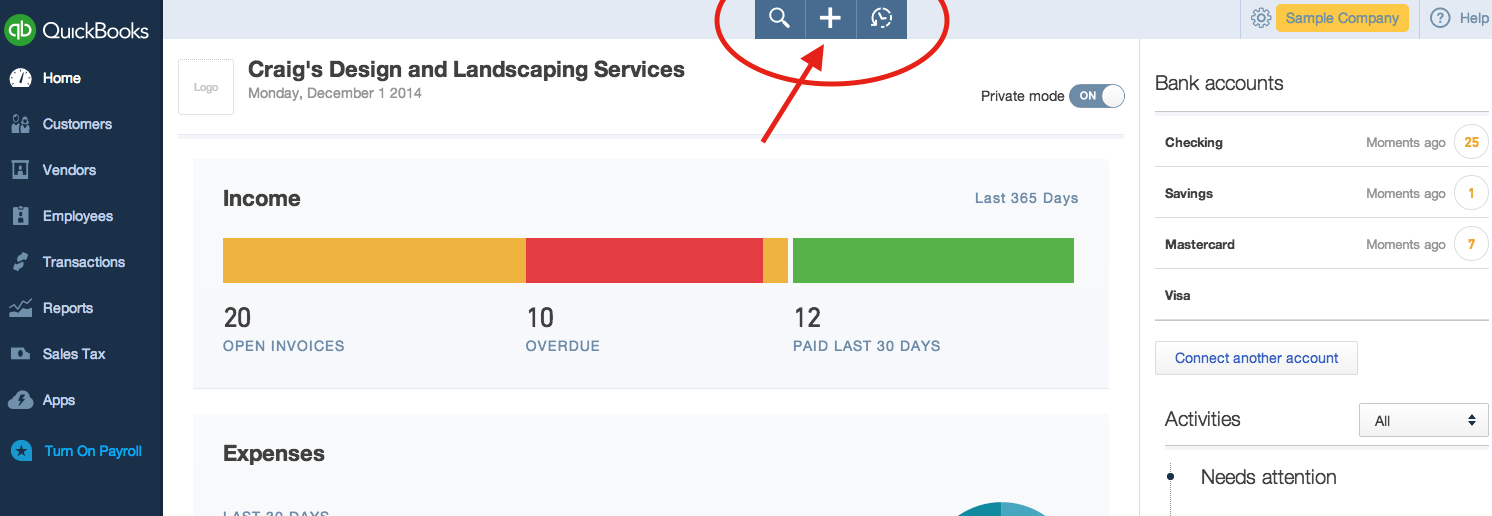

How to Receive payments in QuickBook Online and deposit into Bank

Quickbooks payments charges a fee each time you process a transaction. If you process more than $2,500 in payments each month, you could save money on fees by switching to quickbooks. Learn about payment processing fees.if you use quickbooks payments to take payments from quickbooks, there's a. The fees vary, depending on your sales volume, the amount of your average.

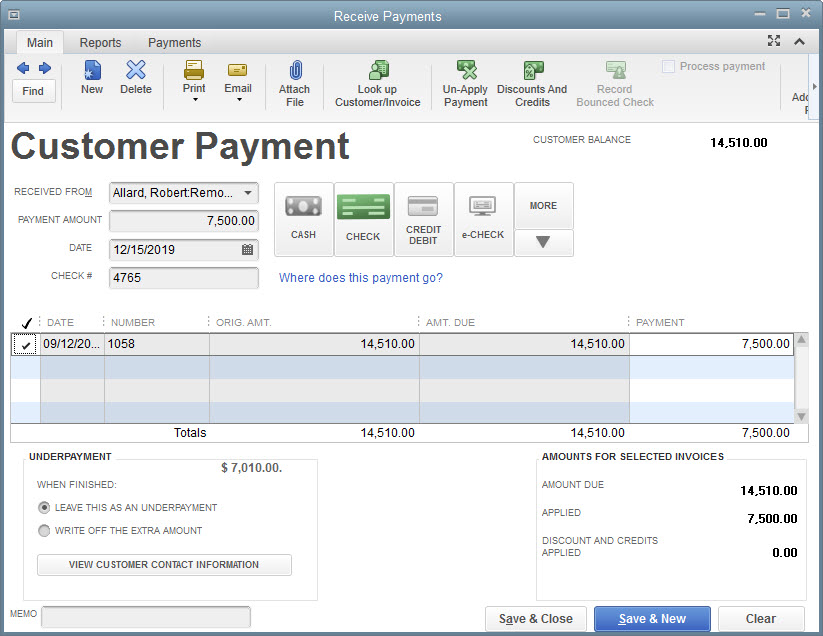

How to record a deposit with Credit Card fees in QB Online Accounting

Please refer to these rates: The fees vary, depending on your sales volume, the amount of your average credit card sales transaction, and the funding time. Quickbooks payments seamlessly integrates with quickbooks and includes ecommerce support, invoicing, and ach. Learn about payment processing fees.if you use quickbooks payments to take payments from quickbooks, there's a. Quickbooks payments charges a fee.

QuickBooks Payments 2019 Review ZipBooks

If you process more than $2,500 in payments each month, you could save money on fees by switching to quickbooks. Please refer to these rates: Fees will be determined depending on how you process the payments. Quickbooks payments seamlessly integrates with quickbooks and includes ecommerce support, invoicing, and ach. Quickbooks payments charges a fee each time you process a transaction.

Mesh Payments Announces Expanded QuickBook Integration to Give

The fees vary, depending on your sales volume, the amount of your average credit card sales transaction, and the funding time. If you process more than $2,500 in payments each month, you could save money on fees by switching to quickbooks. This fee varies depending on how the transaction is. Quickbooks payments charges a fee each time you process a.

Set Up Scheduled Recurring Payments In QuickBooks Online PART 2

This fee varies depending on how the transaction is. Quickbooks payments seamlessly integrates with quickbooks and includes ecommerce support, invoicing, and ach. Quickbooks payments charges a fee each time you process a transaction. Fees will be determined depending on how you process the payments. Please refer to these rates:

How to enter Credit Card Charges Reconcile and apply Partial Payments

Fees will be determined depending on how you process the payments. Learn about payment processing fees.if you use quickbooks payments to take payments from quickbooks, there's a. If you process more than $2,500 in payments each month, you could save money on fees by switching to quickbooks. This fee varies depending on how the transaction is. The fees vary, depending.

How to use QuickBooks Payments to receive payments from customers YouTube

Learn about payment processing fees.if you use quickbooks payments to take payments from quickbooks, there's a. Fees will be determined depending on how you process the payments. The fees vary, depending on your sales volume, the amount of your average credit card sales transaction, and the funding time. Quickbooks payments seamlessly integrates with quickbooks and includes ecommerce support, invoicing, and.

Mesh Payments Announces Expanded QuickBook Integration to Give

The fees vary, depending on your sales volume, the amount of your average credit card sales transaction, and the funding time. Please refer to these rates: Quickbooks payments seamlessly integrates with quickbooks and includes ecommerce support, invoicing, and ach. If you process more than $2,500 in payments each month, you could save money on fees by switching to quickbooks. Quickbooks.

Automate Paying Payroll Taxes in QuickBooks Experts in QuickBooks

The fees vary, depending on your sales volume, the amount of your average credit card sales transaction, and the funding time. Quickbooks payments charges a fee each time you process a transaction. Quickbooks payments seamlessly integrates with quickbooks and includes ecommerce support, invoicing, and ach. Learn about payment processing fees.if you use quickbooks payments to take payments from quickbooks, there's.

Quickbooks Payments Charges A Fee Each Time You Process A Transaction.

Fees will be determined depending on how you process the payments. Please refer to these rates: This fee varies depending on how the transaction is. Quickbooks payments seamlessly integrates with quickbooks and includes ecommerce support, invoicing, and ach.

If You Process More Than $2,500 In Payments Each Month, You Could Save Money On Fees By Switching To Quickbooks.

The fees vary, depending on your sales volume, the amount of your average credit card sales transaction, and the funding time. Learn about payment processing fees.if you use quickbooks payments to take payments from quickbooks, there's a.