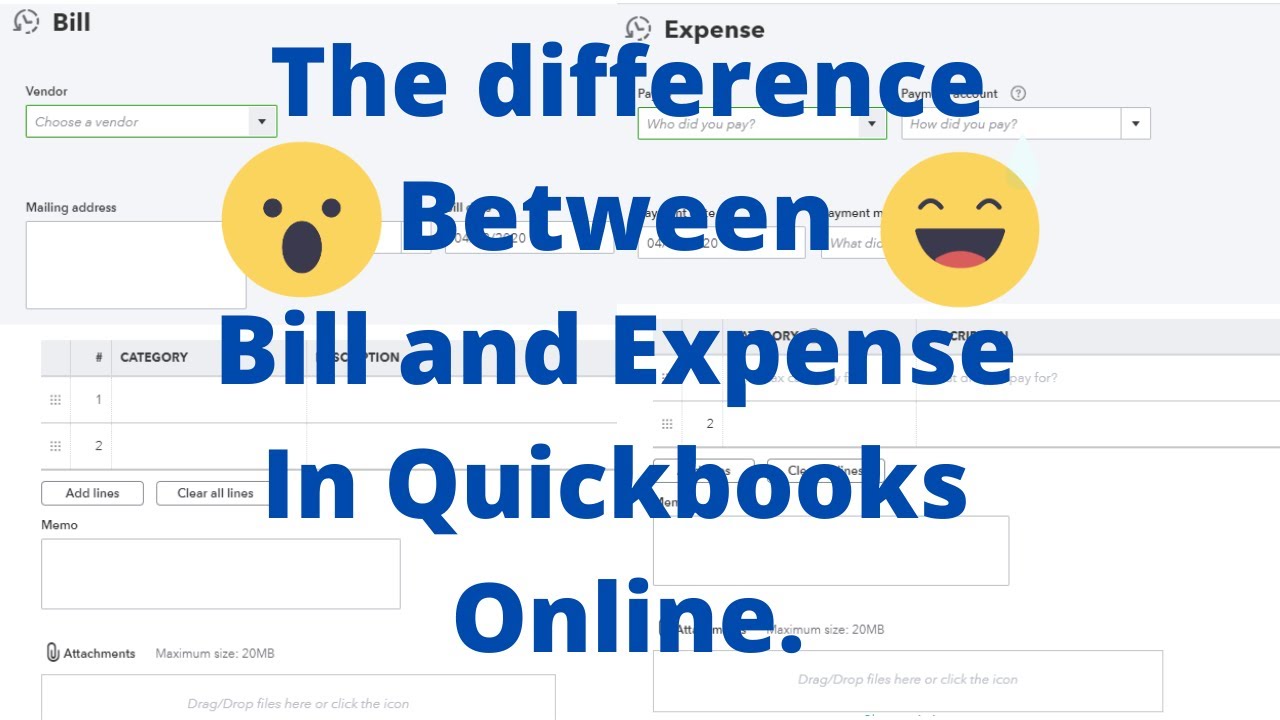

Quickbooks Difference Between Expense And Bill

Quickbooks Difference Between Expense And Bill - Bills create a snapshot of your current liabilities, helping you manage cash flow by keeping tabs on upcoming payments. Learn how to record a bill payment cheque or pay a bill using credit or debit card. If you’re recording money coming out of your business in quickbooks online, it can be confusing to look at the options and see that. While bills are for payables (received services or items to be paid later) check and expenses are for services or items paid on. When to record cheques or expenses.

Bills create a snapshot of your current liabilities, helping you manage cash flow by keeping tabs on upcoming payments. While bills are for payables (received services or items to be paid later) check and expenses are for services or items paid on. If you’re recording money coming out of your business in quickbooks online, it can be confusing to look at the options and see that. Learn how to record a bill payment cheque or pay a bill using credit or debit card. When to record cheques or expenses.

While bills are for payables (received services or items to be paid later) check and expenses are for services or items paid on. Learn how to record a bill payment cheque or pay a bill using credit or debit card. When to record cheques or expenses. Bills create a snapshot of your current liabilities, helping you manage cash flow by keeping tabs on upcoming payments. If you’re recording money coming out of your business in quickbooks online, it can be confusing to look at the options and see that.

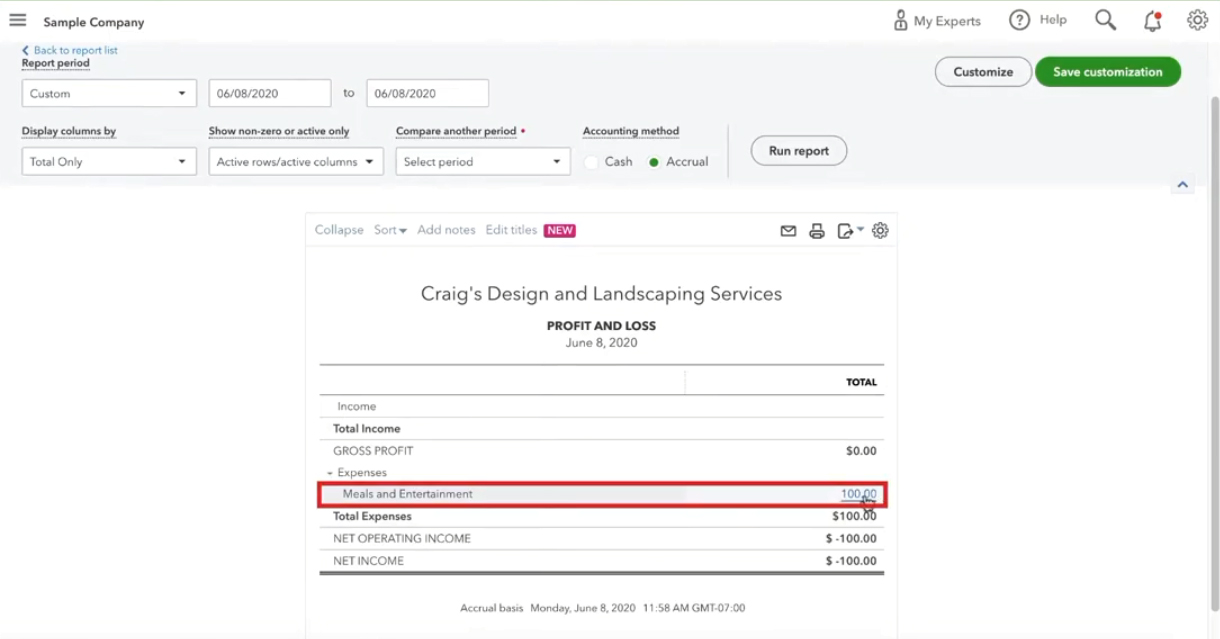

The Difference between Bill and Expense in QuickBooks Online YouTube

If you’re recording money coming out of your business in quickbooks online, it can be confusing to look at the options and see that. While bills are for payables (received services or items to be paid later) check and expenses are for services or items paid on. Bills create a snapshot of your current liabilities, helping you manage cash flow.

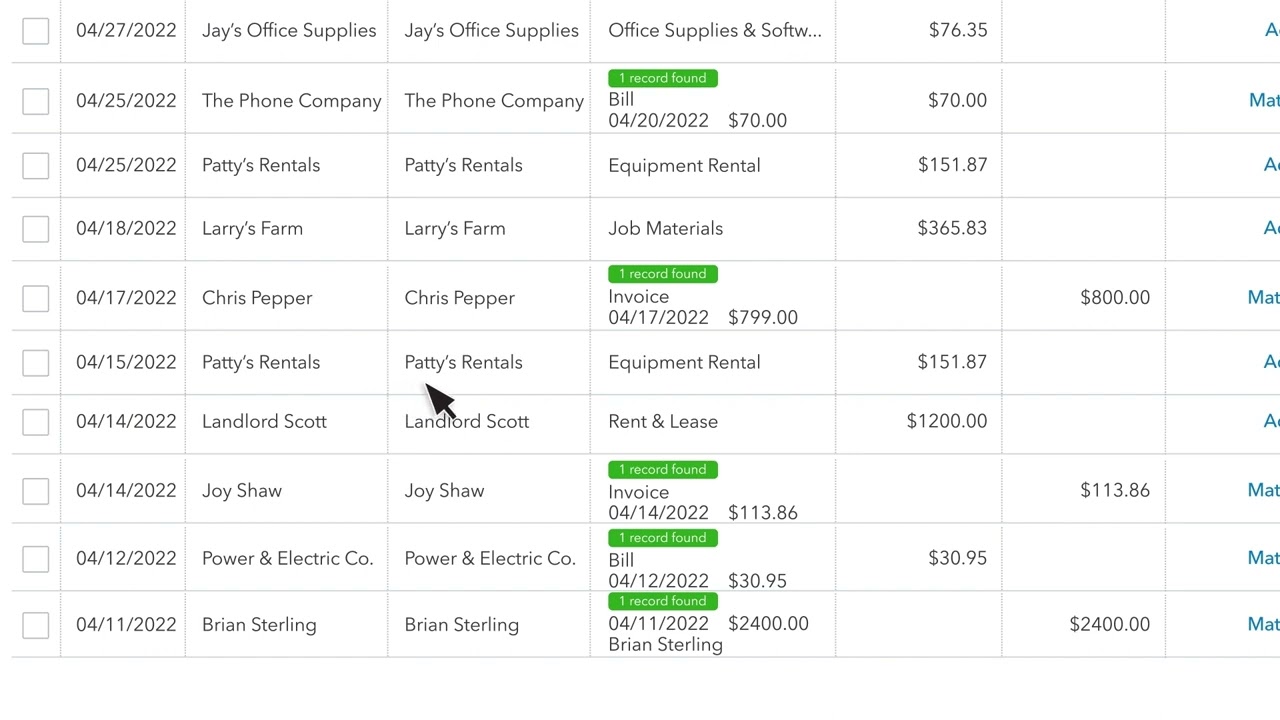

How to Categorise Transactions in QuickBooks Online Introduction to

When to record cheques or expenses. Learn how to record a bill payment cheque or pay a bill using credit or debit card. If you’re recording money coming out of your business in quickbooks online, it can be confusing to look at the options and see that. Bills create a snapshot of your current liabilities, helping you manage cash flow.

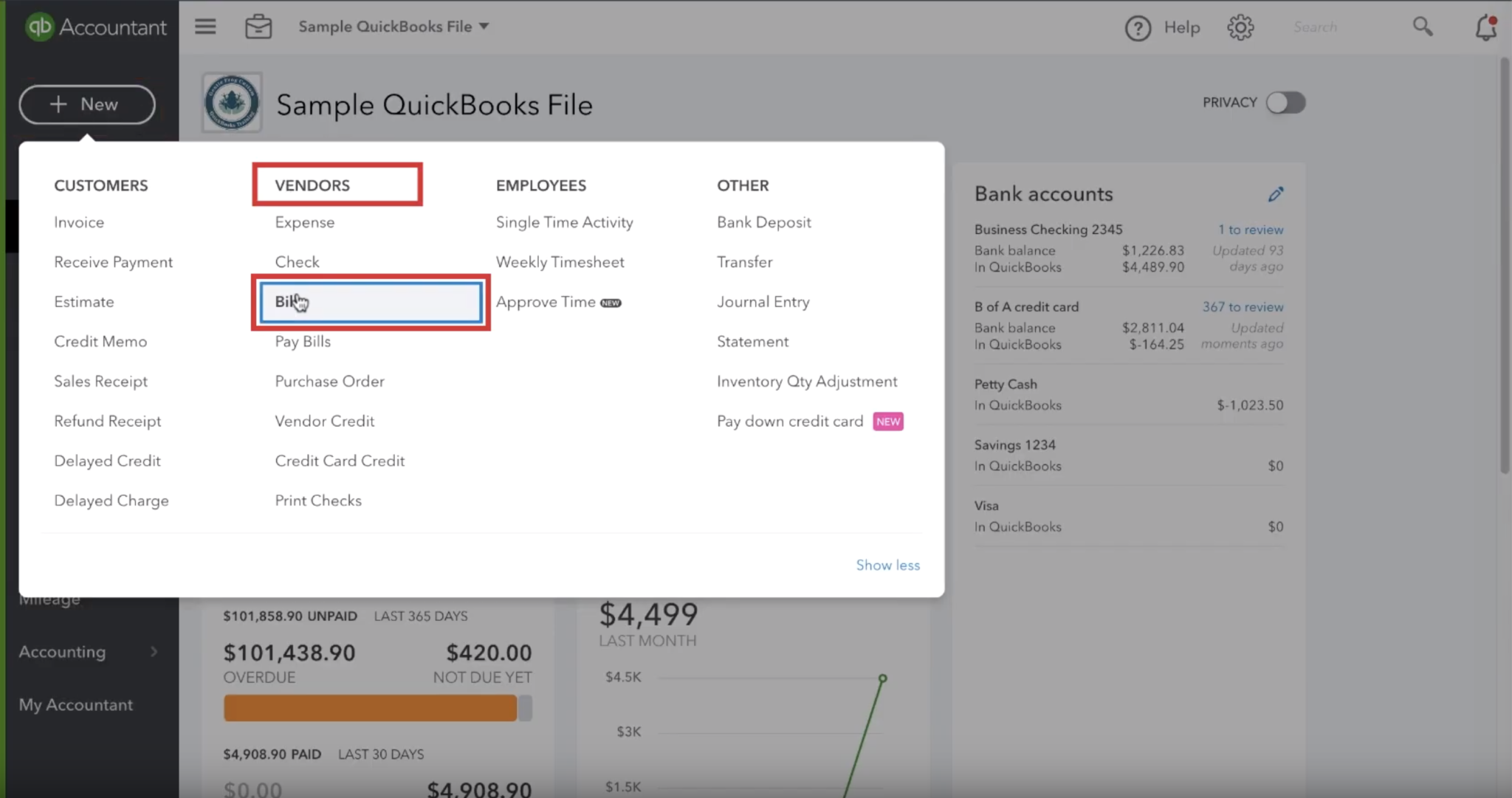

Bill vs Expense in QuickBooks, What's the Difference? Gentle Frog

When to record cheques or expenses. Learn how to record a bill payment cheque or pay a bill using credit or debit card. Bills create a snapshot of your current liabilities, helping you manage cash flow by keeping tabs on upcoming payments. While bills are for payables (received services or items to be paid later) check and expenses are for.

What Is The Difference Between Salaries Payable And Salaries Expense

When to record cheques or expenses. While bills are for payables (received services or items to be paid later) check and expenses are for services or items paid on. Bills create a snapshot of your current liabilities, helping you manage cash flow by keeping tabs on upcoming payments. If you’re recording money coming out of your business in quickbooks online,.

What Is The Difference Between And QuickBooks Online?

Learn how to record a bill payment cheque or pay a bill using credit or debit card. Bills create a snapshot of your current liabilities, helping you manage cash flow by keeping tabs on upcoming payments. When to record cheques or expenses. If you’re recording money coming out of your business in quickbooks online, it can be confusing to look.

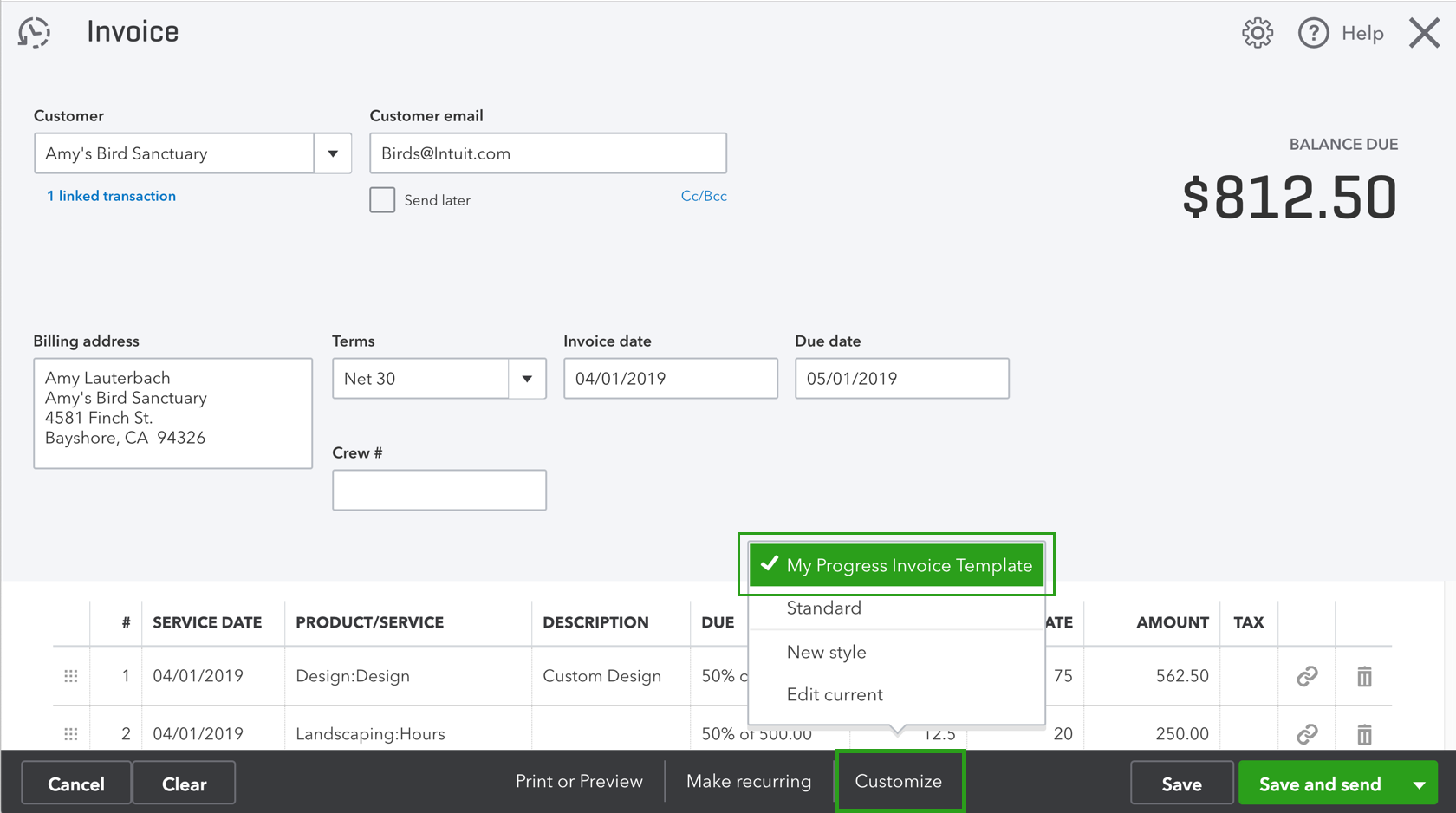

Invoice vs Bill vs Receipt What’s The Difference?

While bills are for payables (received services or items to be paid later) check and expenses are for services or items paid on. When to record cheques or expenses. If you’re recording money coming out of your business in quickbooks online, it can be confusing to look at the options and see that. Learn how to record a bill payment.

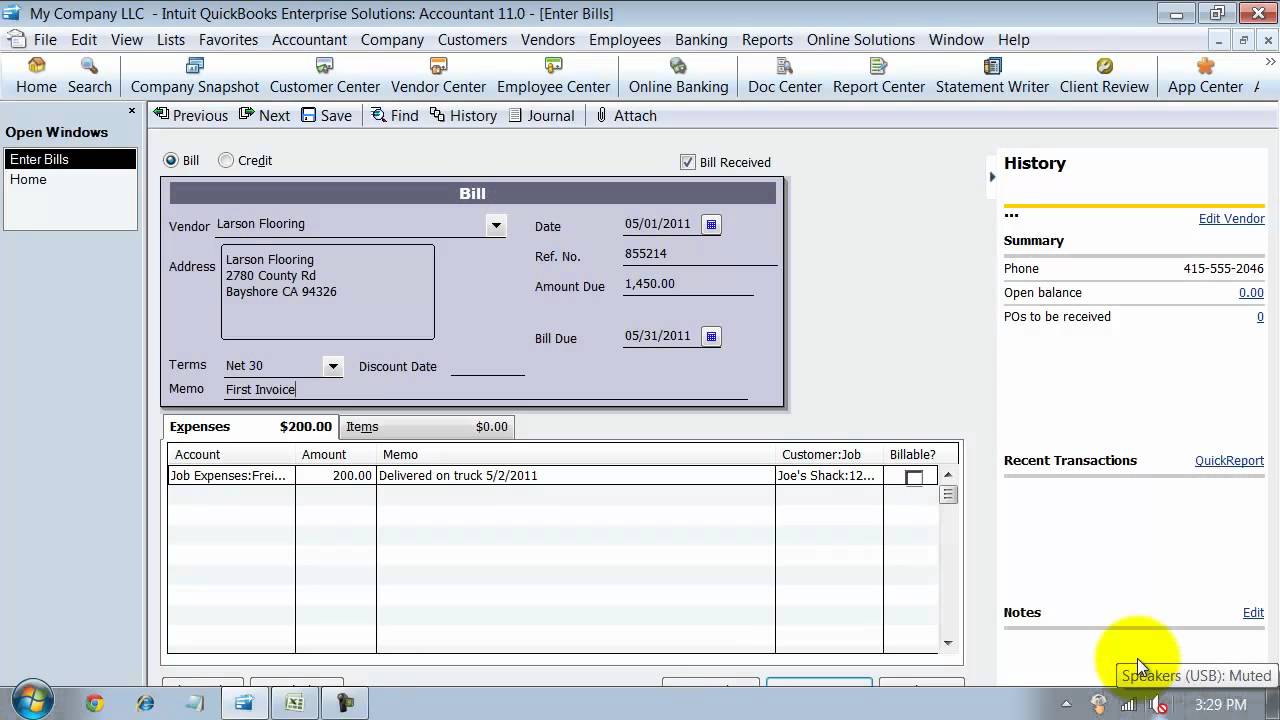

Quickbooks Online Tutorial for Beginners Difference Between Entering

When to record cheques or expenses. While bills are for payables (received services or items to be paid later) check and expenses are for services or items paid on. Bills create a snapshot of your current liabilities, helping you manage cash flow by keeping tabs on upcoming payments. If you’re recording money coming out of your business in quickbooks online,.

Bill vs Expense in QuickBooks, What's the Difference? Gentle Frog

While bills are for payables (received services or items to be paid later) check and expenses are for services or items paid on. When to record cheques or expenses. If you’re recording money coming out of your business in quickbooks online, it can be confusing to look at the options and see that. Bills create a snapshot of your current.

Bill vs Expense in Quickbooks What's the Difference? My Vao

When to record cheques or expenses. Learn how to record a bill payment cheque or pay a bill using credit or debit card. If you’re recording money coming out of your business in quickbooks online, it can be confusing to look at the options and see that. Bills create a snapshot of your current liabilities, helping you manage cash flow.

QuickBooks Training Enter Bills Item and Expense YouTube

When to record cheques or expenses. Learn how to record a bill payment cheque or pay a bill using credit or debit card. While bills are for payables (received services or items to be paid later) check and expenses are for services or items paid on. If you’re recording money coming out of your business in quickbooks online, it can.

When To Record Cheques Or Expenses.

Learn how to record a bill payment cheque or pay a bill using credit or debit card. If you’re recording money coming out of your business in quickbooks online, it can be confusing to look at the options and see that. While bills are for payables (received services or items to be paid later) check and expenses are for services or items paid on. Bills create a snapshot of your current liabilities, helping you manage cash flow by keeping tabs on upcoming payments.