Quickbooks Should I Use Journal Entry Or Invoice

Quickbooks Should I Use Journal Entry Or Invoice - You can only do that by using a journal entry in qbo. Ap accruals are common especially for invoices not received by month. Obviously, the alternative to doing this monthly posting by invoice/cash receipt is to use a journal entry but that is not best practices. Qb has a reverse option at the make journal entry function. I often read recommendations to not use journal entry as much as possible when making adjustments in quickbooks. The expense entry only shows bank and current asset accounts which is why your.

The expense entry only shows bank and current asset accounts which is why your. Ap accruals are common especially for invoices not received by month. Qb has a reverse option at the make journal entry function. You can only do that by using a journal entry in qbo. I often read recommendations to not use journal entry as much as possible when making adjustments in quickbooks. Obviously, the alternative to doing this monthly posting by invoice/cash receipt is to use a journal entry but that is not best practices.

I often read recommendations to not use journal entry as much as possible when making adjustments in quickbooks. You can only do that by using a journal entry in qbo. Ap accruals are common especially for invoices not received by month. Qb has a reverse option at the make journal entry function. Obviously, the alternative to doing this monthly posting by invoice/cash receipt is to use a journal entry but that is not best practices. The expense entry only shows bank and current asset accounts which is why your.

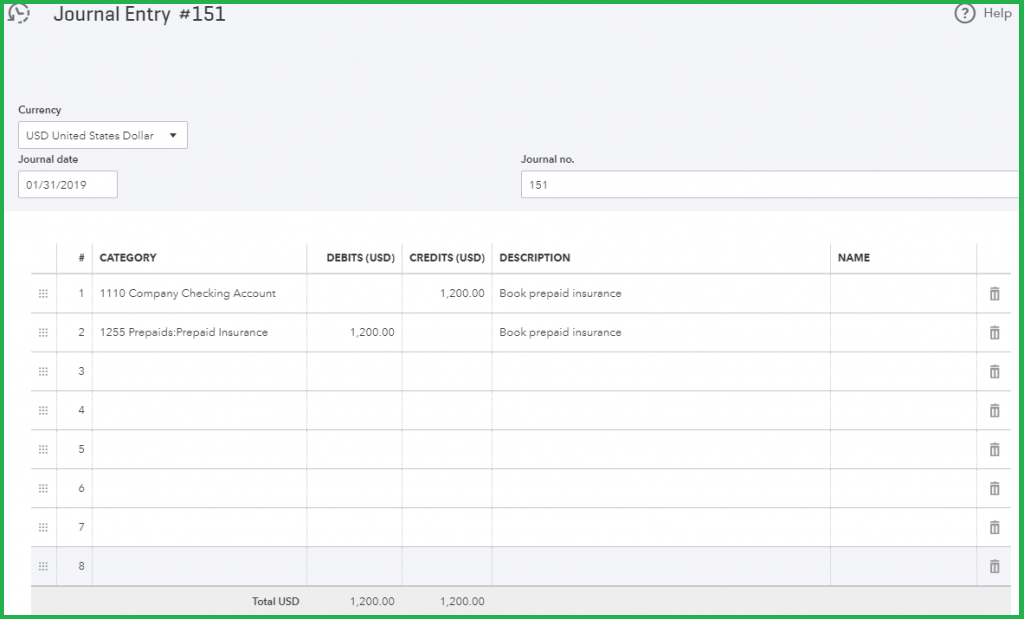

Quickbooks Online Journal Entry Tutorial YouTube

You can only do that by using a journal entry in qbo. Ap accruals are common especially for invoices not received by month. Obviously, the alternative to doing this monthly posting by invoice/cash receipt is to use a journal entry but that is not best practices. I often read recommendations to not use journal entry as much as possible when.

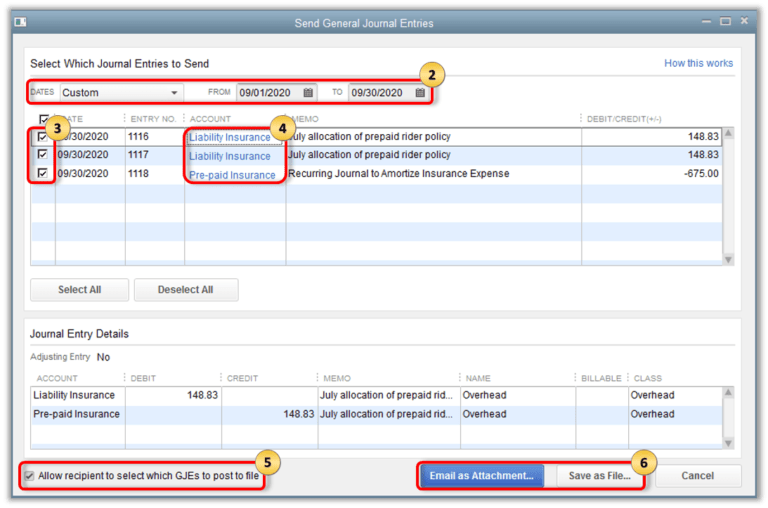

General Journal Entries Quickbooks

Ap accruals are common especially for invoices not received by month. The expense entry only shows bank and current asset accounts which is why your. I often read recommendations to not use journal entry as much as possible when making adjustments in quickbooks. You can only do that by using a journal entry in qbo. Qb has a reverse option.

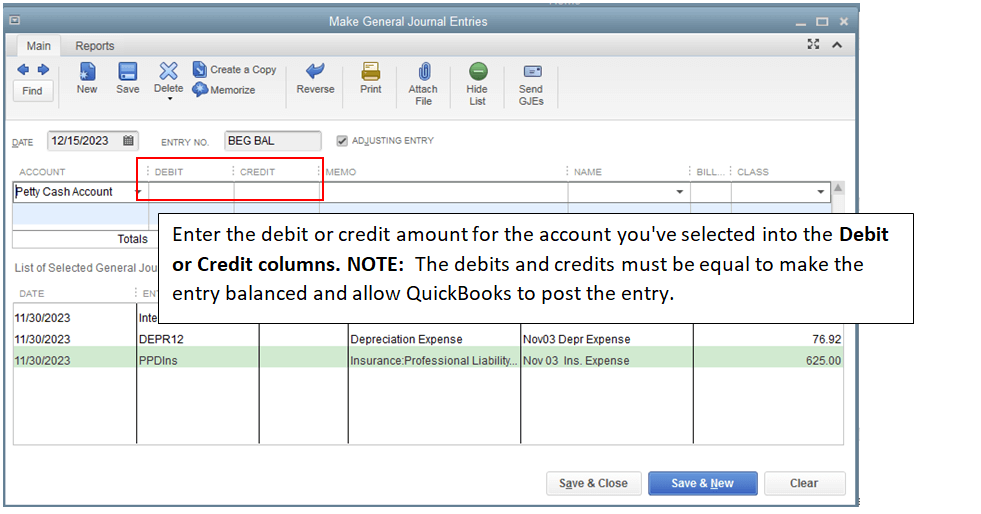

How to make a journal entry in quickbooks desktop pro 2017 galstashok

Obviously, the alternative to doing this monthly posting by invoice/cash receipt is to use a journal entry but that is not best practices. You can only do that by using a journal entry in qbo. I often read recommendations to not use journal entry as much as possible when making adjustments in quickbooks. Ap accruals are common especially for invoices.

How to Make a Journal Entry in QuickBooks Online? QAsolved

Ap accruals are common especially for invoices not received by month. Obviously, the alternative to doing this monthly posting by invoice/cash receipt is to use a journal entry but that is not best practices. Qb has a reverse option at the make journal entry function. I often read recommendations to not use journal entry as much as possible when making.

What is General Journal Entry in QuickBooks? Zaviad

The expense entry only shows bank and current asset accounts which is why your. You can only do that by using a journal entry in qbo. Qb has a reverse option at the make journal entry function. Ap accruals are common especially for invoices not received by month. Obviously, the alternative to doing this monthly posting by invoice/cash receipt is.

How to Make a Journal Entry in QuickBooks LiveFlow

You can only do that by using a journal entry in qbo. I often read recommendations to not use journal entry as much as possible when making adjustments in quickbooks. Obviously, the alternative to doing this monthly posting by invoice/cash receipt is to use a journal entry but that is not best practices. Ap accruals are common especially for invoices.

Journal Entries in QuickBooks Enterprise Fishbowl, a QuickBooks

Ap accruals are common especially for invoices not received by month. Obviously, the alternative to doing this monthly posting by invoice/cash receipt is to use a journal entry but that is not best practices. You can only do that by using a journal entry in qbo. Qb has a reverse option at the make journal entry function. I often read.

Quickbooks Journal Entry Template

The expense entry only shows bank and current asset accounts which is why your. Obviously, the alternative to doing this monthly posting by invoice/cash receipt is to use a journal entry but that is not best practices. Qb has a reverse option at the make journal entry function. You can only do that by using a journal entry in qbo..

How to Record a Journal Entry in QuickBooks Online Fundera

Ap accruals are common especially for invoices not received by month. Qb has a reverse option at the make journal entry function. You can only do that by using a journal entry in qbo. I often read recommendations to not use journal entry as much as possible when making adjustments in quickbooks. The expense entry only shows bank and current.

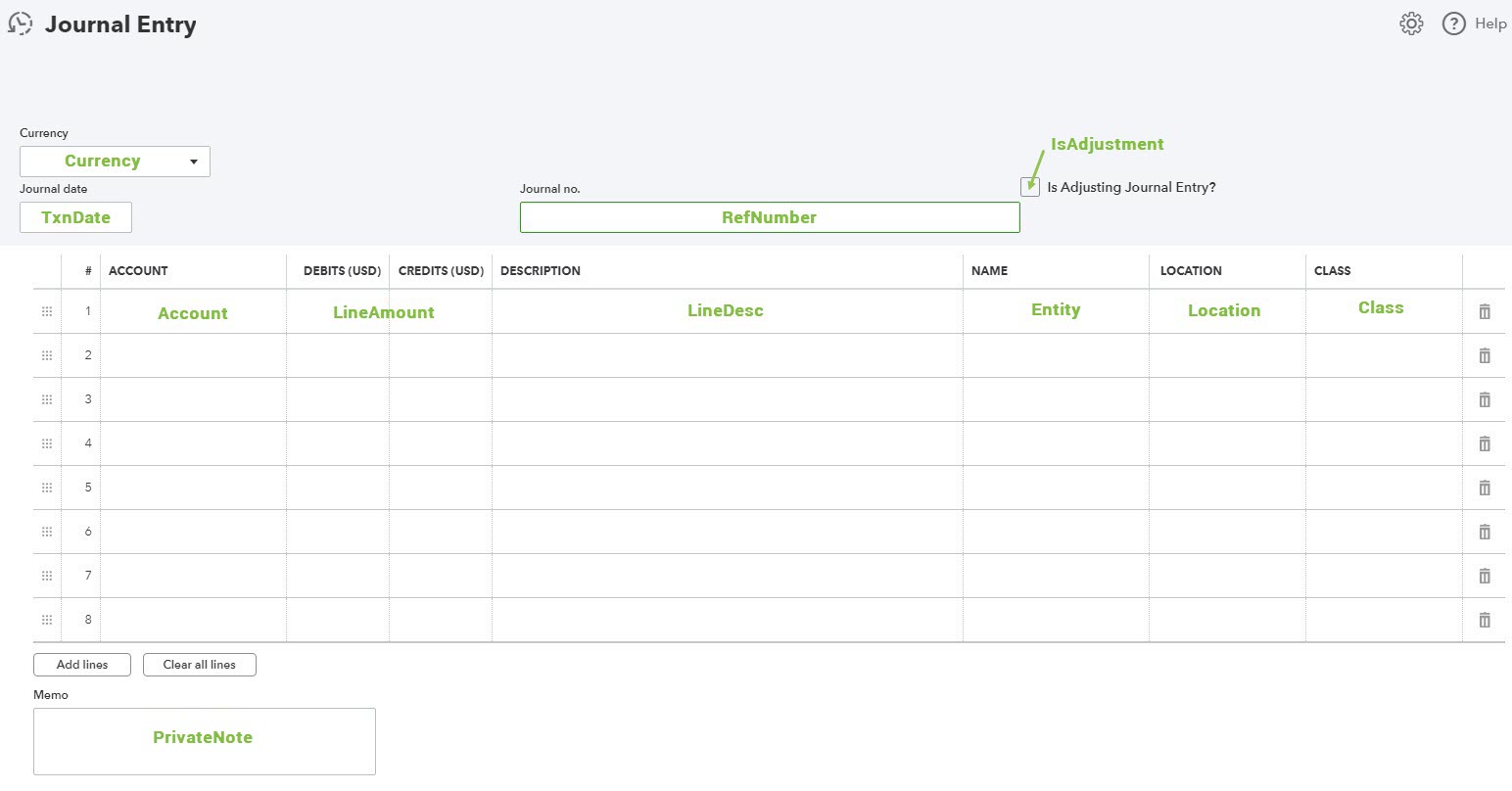

Import Journal Entries into QuickBooks Online Transaction Pro

Ap accruals are common especially for invoices not received by month. Obviously, the alternative to doing this monthly posting by invoice/cash receipt is to use a journal entry but that is not best practices. Qb has a reverse option at the make journal entry function. You can only do that by using a journal entry in qbo. I often read.

Ap Accruals Are Common Especially For Invoices Not Received By Month.

Obviously, the alternative to doing this monthly posting by invoice/cash receipt is to use a journal entry but that is not best practices. I often read recommendations to not use journal entry as much as possible when making adjustments in quickbooks. You can only do that by using a journal entry in qbo. The expense entry only shows bank and current asset accounts which is why your.