Reo Foreclosures Meaning

Reo Foreclosures Meaning - Reo is a term for property owned by a lender after a failed foreclosure auction. Real estate owned, or reo, is a term used in the united states to describe a class of property owned by a lender—typically a bank,. Learn how reo properties are acquired, sold, and what. Reo, short for real estate owned, refers to property owned by a lender—often a bank or mortgage company—after an unsuccessful.

Reo, short for real estate owned, refers to property owned by a lender—often a bank or mortgage company—after an unsuccessful. Learn how reo properties are acquired, sold, and what. Reo is a term for property owned by a lender after a failed foreclosure auction. Real estate owned, or reo, is a term used in the united states to describe a class of property owned by a lender—typically a bank,.

Real estate owned, or reo, is a term used in the united states to describe a class of property owned by a lender—typically a bank,. Reo is a term for property owned by a lender after a failed foreclosure auction. Learn how reo properties are acquired, sold, and what. Reo, short for real estate owned, refers to property owned by a lender—often a bank or mortgage company—after an unsuccessful.

Kauai REO, Kauai Foreclosures, December, 2015 List.

Reo, short for real estate owned, refers to property owned by a lender—often a bank or mortgage company—after an unsuccessful. Learn how reo properties are acquired, sold, and what. Reo is a term for property owned by a lender after a failed foreclosure auction. Real estate owned, or reo, is a term used in the united states to describe a.

Types Of Foreclosures Two Common Foreclosures

Reo is a term for property owned by a lender after a failed foreclosure auction. Reo, short for real estate owned, refers to property owned by a lender—often a bank or mortgage company—after an unsuccessful. Learn how reo properties are acquired, sold, and what. Real estate owned, or reo, is a term used in the united states to describe a.

REO Foreclosures HUD Homes City Group Properties

Reo is a term for property owned by a lender after a failed foreclosure auction. Reo, short for real estate owned, refers to property owned by a lender—often a bank or mortgage company—after an unsuccessful. Learn how reo properties are acquired, sold, and what. Real estate owned, or reo, is a term used in the united states to describe a.

Explore Reo Meaning, Origin & Popularity

Learn how reo properties are acquired, sold, and what. Real estate owned, or reo, is a term used in the united states to describe a class of property owned by a lender—typically a bank,. Reo, short for real estate owned, refers to property owned by a lender—often a bank or mortgage company—after an unsuccessful. Reo is a term for property.

Foreclosures 910Lifestyle

Reo, short for real estate owned, refers to property owned by a lender—often a bank or mortgage company—after an unsuccessful. Real estate owned, or reo, is a term used in the united states to describe a class of property owned by a lender—typically a bank,. Reo is a term for property owned by a lender after a failed foreclosure auction..

Kauai Foreclosures, Kauai REO, August 2020

Reo is a term for property owned by a lender after a failed foreclosure auction. Reo, short for real estate owned, refers to property owned by a lender—often a bank or mortgage company—after an unsuccessful. Learn how reo properties are acquired, sold, and what. Real estate owned, or reo, is a term used in the united states to describe a.

What Are REO Foreclosures and How Do I Buy Them Cheap? PropertyOnion

Reo is a term for property owned by a lender after a failed foreclosure auction. Learn how reo properties are acquired, sold, and what. Real estate owned, or reo, is a term used in the united states to describe a class of property owned by a lender—typically a bank,. Reo, short for real estate owned, refers to property owned by.

Foreclosure Center

Reo, short for real estate owned, refers to property owned by a lender—often a bank or mortgage company—after an unsuccessful. Reo is a term for property owned by a lender after a failed foreclosure auction. Real estate owned, or reo, is a term used in the united states to describe a class of property owned by a lender—typically a bank,..

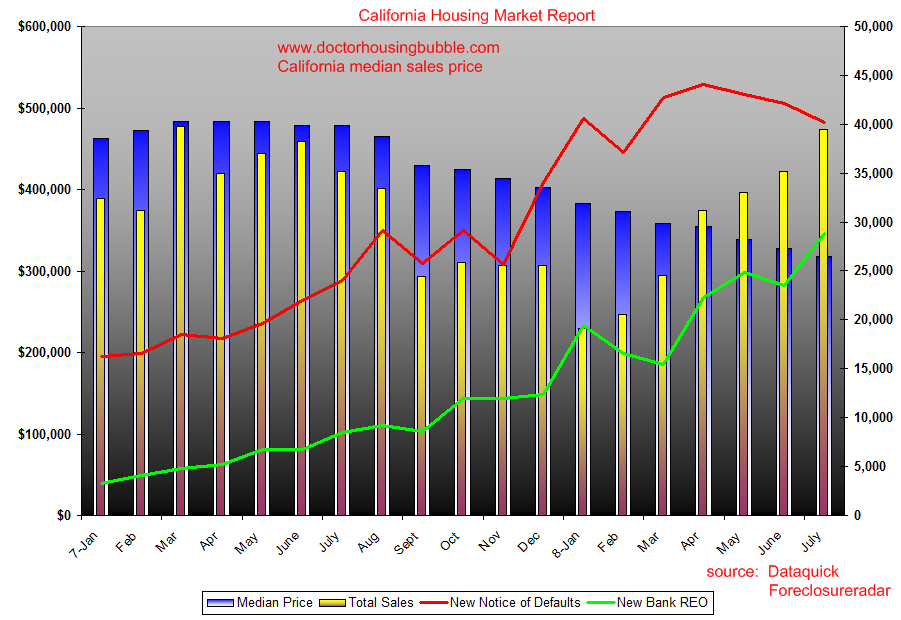

California Foreclosures Foreclosures and Charting the REO Trend. Lord

Real estate owned, or reo, is a term used in the united states to describe a class of property owned by a lender—typically a bank,. Reo is a term for property owned by a lender after a failed foreclosure auction. Reo, short for real estate owned, refers to property owned by a lender—often a bank or mortgage company—after an unsuccessful..

Foreclosures Information Mortgage Las Vegas

Real estate owned, or reo, is a term used in the united states to describe a class of property owned by a lender—typically a bank,. Learn how reo properties are acquired, sold, and what. Reo is a term for property owned by a lender after a failed foreclosure auction. Reo, short for real estate owned, refers to property owned by.

Real Estate Owned, Or Reo, Is A Term Used In The United States To Describe A Class Of Property Owned By A Lender—Typically A Bank,.

Learn how reo properties are acquired, sold, and what. Reo is a term for property owned by a lender after a failed foreclosure auction. Reo, short for real estate owned, refers to property owned by a lender—often a bank or mortgage company—after an unsuccessful.