Schedule 8812 Line 5 Worksheet 2021

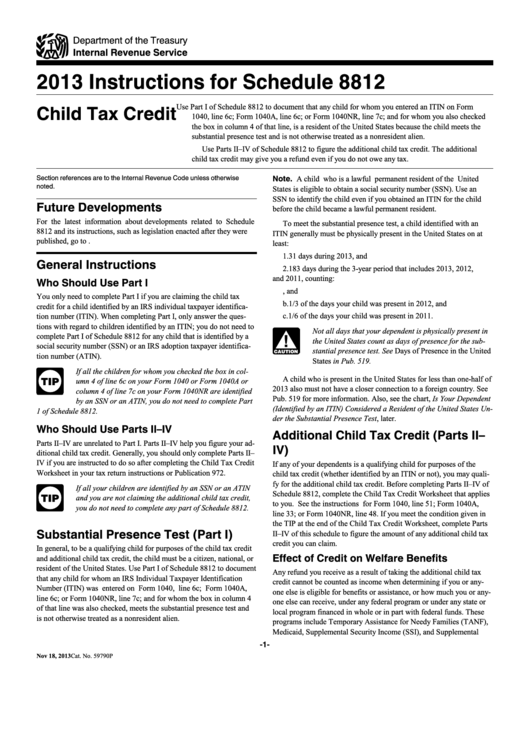

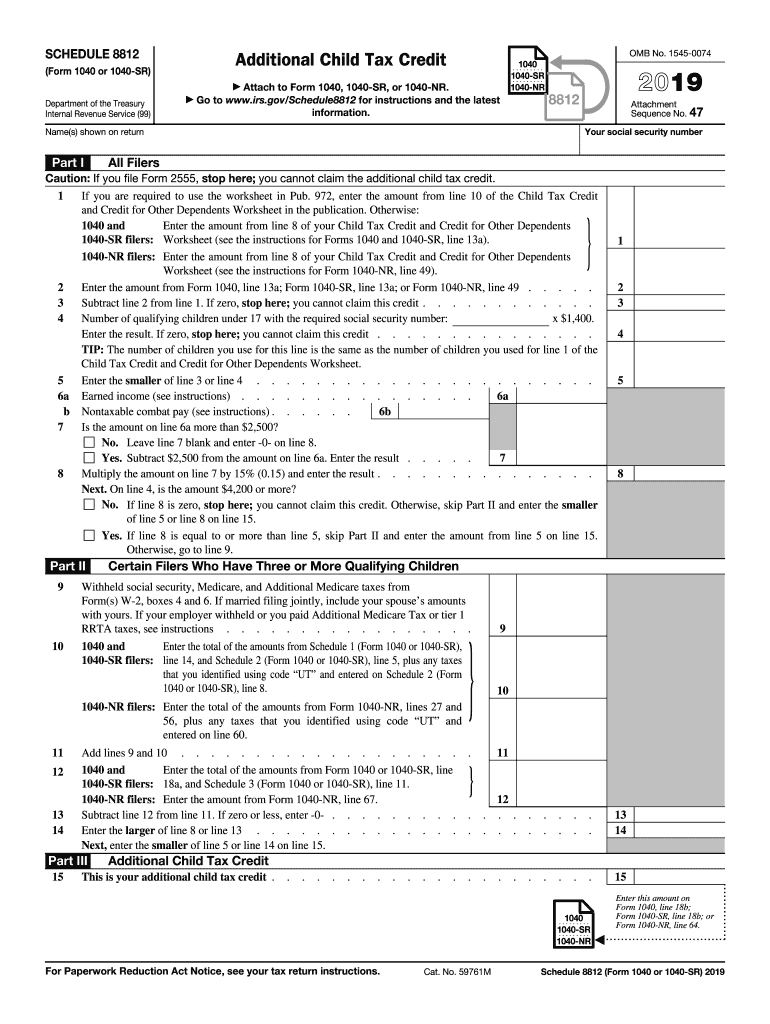

Schedule 8812 Line 5 Worksheet 2021 - Your additional child tax credit will be computed for you using the following formula: Unfortunately, turbotax does not show the line 5 worksheet for their calculations. You can manually fill out the worksheet from. 15% times the net amount of your earned. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure.

Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure. 15% times the net amount of your earned. You can manually fill out the worksheet from. Your additional child tax credit will be computed for you using the following formula: Unfortunately, turbotax does not show the line 5 worksheet for their calculations.

Your additional child tax credit will be computed for you using the following formula: You can manually fill out the worksheet from. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. 15% times the net amount of your earned. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure.

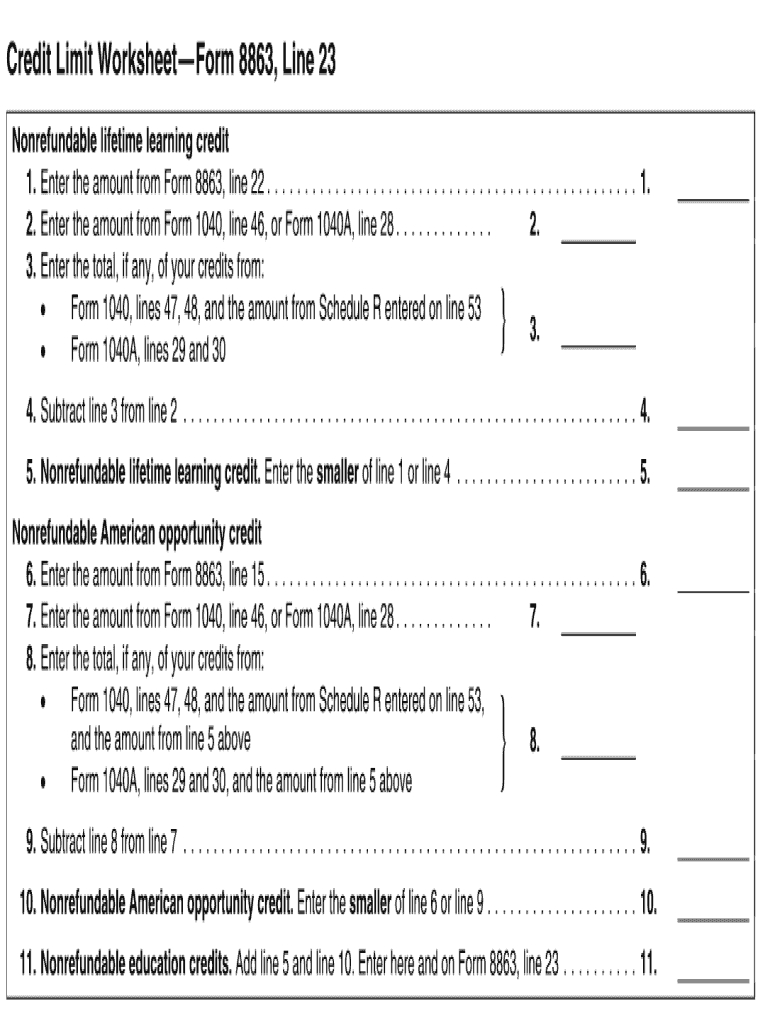

2021 Irs Form 8812 Credit Limit Worksheet A

15% times the net amount of your earned. Your additional child tax credit will be computed for you using the following formula: Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. You.

Form 8812 Line 5 Worksheet

Unfortunately, turbotax does not show the line 5 worksheet for their calculations. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure. Your additional child tax credit will be computed for you using the following formula: 15% times the net amount of your earned. You.

2021 Irs Form 8812 Line 5 Worksheet Form example download

Your additional child tax credit will be computed for you using the following formula: Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure. 15% times the net amount of your earned. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. You.

Fillable Online Child Tax Credit Form 8812 Line 5 worksheet Fax Email

Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. Your additional child tax credit will be computed for you using the following formula: 15% times the net amount of your earned. You.

Schedule 8812 Line 5 Worksheet

Unfortunately, turbotax does not show the line 5 worksheet for their calculations. 15% times the net amount of your earned. You can manually fill out the worksheet from. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure. Your additional child tax credit will be.

8812 Credit Limit Worksheet A

You can manually fill out the worksheet from. Your additional child tax credit will be computed for you using the following formula: 15% times the net amount of your earned. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments.

8812 Credit Limit Worksheet A

You can manually fill out the worksheet from. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. 15% times the net amount of your earned. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure. Your additional child tax credit will be.

8812 for 20202024 Form Fill Out and Sign Printable PDF Template

Your additional child tax credit will be computed for you using the following formula: 15% times the net amount of your earned. You can manually fill out the worksheet from. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments.

Schedule 8812 Line 5 Worksheet

Your additional child tax credit will be computed for you using the following formula: 15% times the net amount of your earned. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. You can manually fill out the worksheet from. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments.

Schedule 8812 walkthrough (Credits for Qualifying Children and Other

15% times the net amount of your earned. You can manually fill out the worksheet from. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. Your additional child tax credit will be.

Unfortunately, Turbotax Does Not Show The Line 5 Worksheet For Their Calculations.

15% times the net amount of your earned. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure. You can manually fill out the worksheet from. Your additional child tax credit will be computed for you using the following formula: