State Or Local Income Tax Refund

State Or Local Income Tax Refund - Generally, an irs or federal tax refund from last year is not taxable on the subsequent tax year federal or state income tax. You may need to claim all or part of it if: It is possible that your state refund is taxable income. You received a state or local income tax refund,. If you transferred last year’s tax data to this year's return, your state and local. You'll need info on last year’s agi or accessing a prior year return. If you receive a refund of (or credit for) state or local income taxes in a year after the year in which you paid them, you may have to include.

It is possible that your state refund is taxable income. You received a state or local income tax refund,. You'll need info on last year’s agi or accessing a prior year return. You may need to claim all or part of it if: If you receive a refund of (or credit for) state or local income taxes in a year after the year in which you paid them, you may have to include. If you transferred last year’s tax data to this year's return, your state and local. Generally, an irs or federal tax refund from last year is not taxable on the subsequent tax year federal or state income tax.

If you transferred last year’s tax data to this year's return, your state and local. You'll need info on last year’s agi or accessing a prior year return. Generally, an irs or federal tax refund from last year is not taxable on the subsequent tax year federal or state income tax. If you receive a refund of (or credit for) state or local income taxes in a year after the year in which you paid them, you may have to include. It is possible that your state refund is taxable income. You may need to claim all or part of it if: You received a state or local income tax refund,.

Taxable Refunds, Credits, or Offsets of State and Local Taxes

You'll need info on last year’s agi or accessing a prior year return. If you receive a refund of (or credit for) state or local income taxes in a year after the year in which you paid them, you may have to include. It is possible that your state refund is taxable income. You received a state or local income.

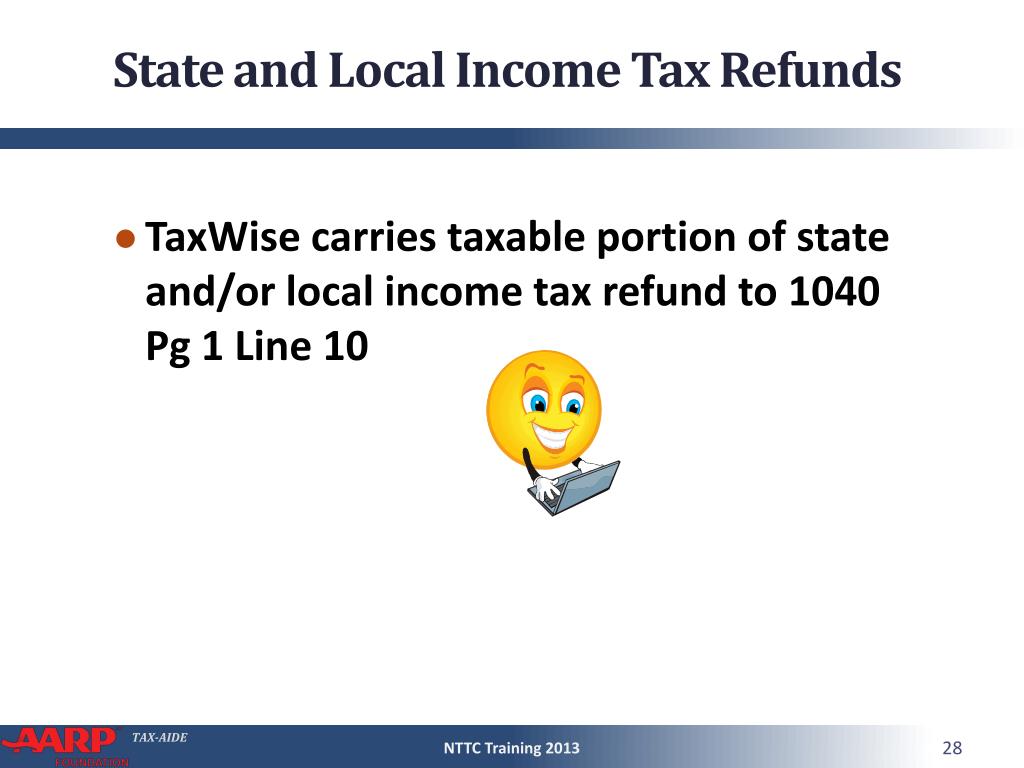

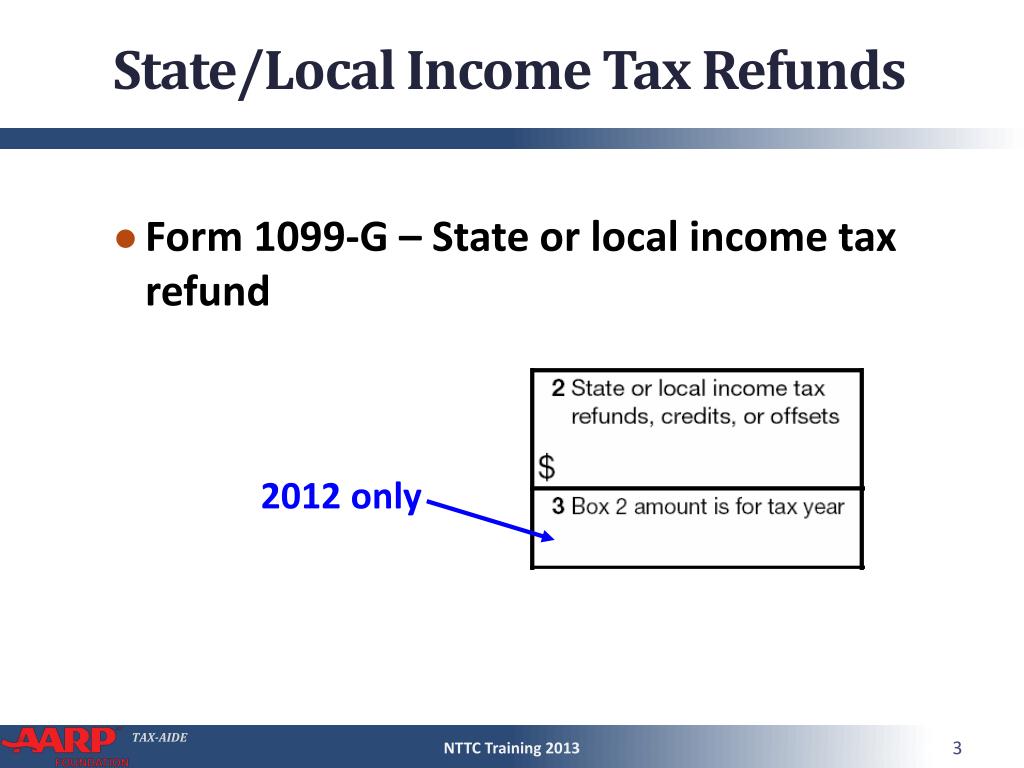

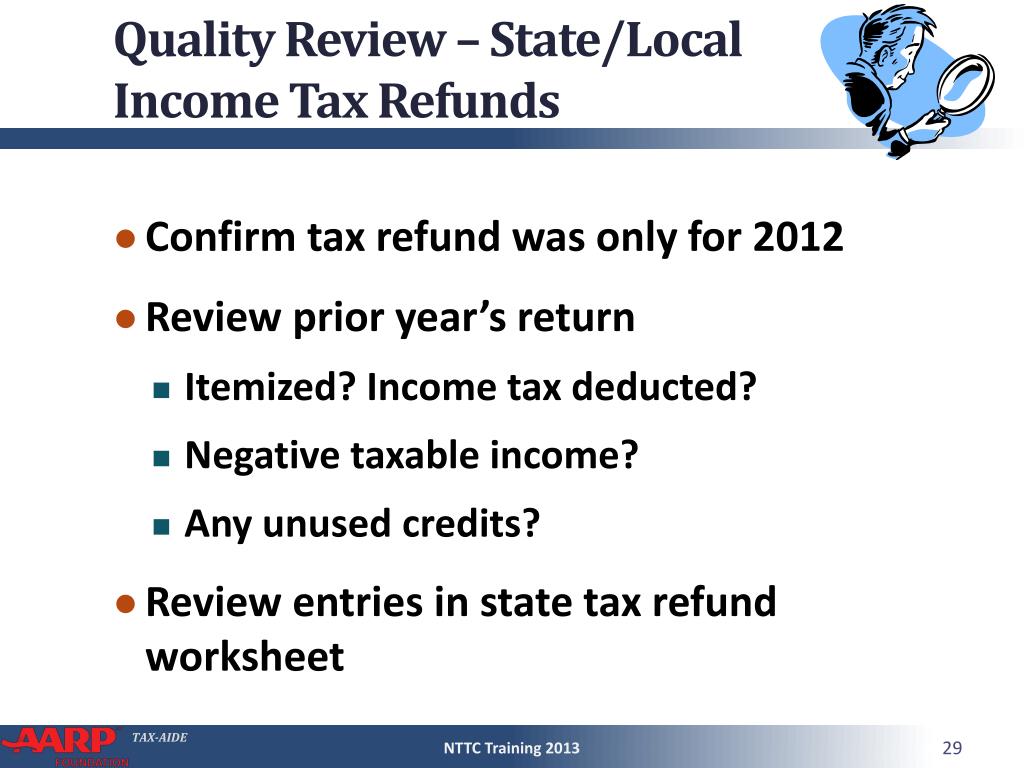

PPT State/Local Tax Refunds PowerPoint Presentation, free

It is possible that your state refund is taxable income. Generally, an irs or federal tax refund from last year is not taxable on the subsequent tax year federal or state income tax. If you receive a refund of (or credit for) state or local income taxes in a year after the year in which you paid them, you may.

State Tax Refund How To Report State Tax Refund

Generally, an irs or federal tax refund from last year is not taxable on the subsequent tax year federal or state income tax. It is possible that your state refund is taxable income. You received a state or local income tax refund,. You'll need info on last year’s agi or accessing a prior year return. If you receive a refund.

Form W2 Copy 2 To Be Filed With Employee's State, City, or Local

If you receive a refund of (or credit for) state or local income taxes in a year after the year in which you paid them, you may have to include. Generally, an irs or federal tax refund from last year is not taxable on the subsequent tax year federal or state income tax. You may need to claim all or.

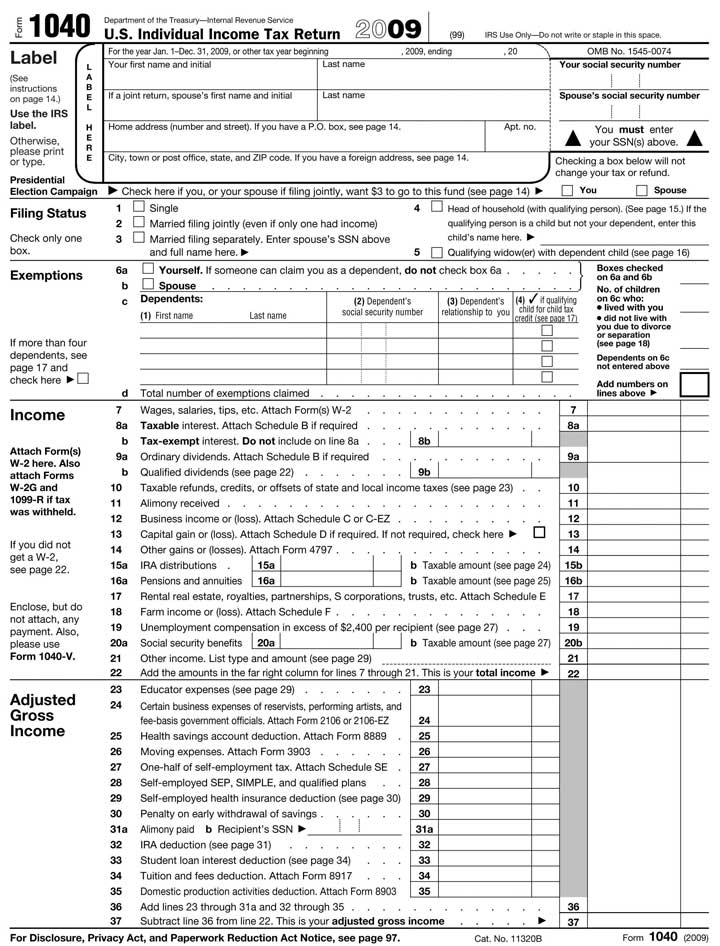

Form 1040 State And Local Tax Refund Worksheet

Generally, an irs or federal tax refund from last year is not taxable on the subsequent tax year federal or state income tax. You may need to claim all or part of it if: It is possible that your state refund is taxable income. You received a state or local income tax refund,. If you transferred last year’s tax data.

PPT State/Local Tax Refunds PowerPoint Presentation, free

It is possible that your state refund is taxable income. Generally, an irs or federal tax refund from last year is not taxable on the subsequent tax year federal or state income tax. You'll need info on last year’s agi or accessing a prior year return. You may need to claim all or part of it if: If you receive.

State And Local Tax Refund Worksheet 2019

Generally, an irs or federal tax refund from last year is not taxable on the subsequent tax year federal or state income tax. It is possible that your state refund is taxable income. If you transferred last year’s tax data to this year's return, your state and local. You may need to claim all or part of it if: You'll.

PPT State/Local Tax Refunds PowerPoint Presentation, free

If you transferred last year’s tax data to this year's return, your state and local. If you receive a refund of (or credit for) state or local income taxes in a year after the year in which you paid them, you may have to include. Generally, an irs or federal tax refund from last year is not taxable on the.

Taxable Refunds, Credits, or Offsets of State and Local Taxes

You received a state or local income tax refund,. If you receive a refund of (or credit for) state or local income taxes in a year after the year in which you paid them, you may have to include. It is possible that your state refund is taxable income. You may need to claim all or part of it if:.

PPT State/Local Tax Refunds PowerPoint Presentation, free

You received a state or local income tax refund,. If you receive a refund of (or credit for) state or local income taxes in a year after the year in which you paid them, you may have to include. If you transferred last year’s tax data to this year's return, your state and local. You'll need info on last year’s.

You'll Need Info On Last Year’s Agi Or Accessing A Prior Year Return.

If you receive a refund of (or credit for) state or local income taxes in a year after the year in which you paid them, you may have to include. If you transferred last year’s tax data to this year's return, your state and local. Generally, an irs or federal tax refund from last year is not taxable on the subsequent tax year federal or state income tax. You may need to claim all or part of it if:

You Received A State Or Local Income Tax Refund,.

It is possible that your state refund is taxable income.