State Tax Lien Maryland

State Tax Lien Maryland - A tax lien may damage your credit. A tax lien allows the state to seize accounts, wages, and property to resolve your back taxes. With the case number search, you may use either the. A lien may affect your ability to maintain existing credit, secure new credit, or. The lien serves to give notice to your creditors of the outstanding tax liability and extends to all property and rights to property, real and. To search for a certificate of tax lien, you may search by case number or debtor name. You have unpaid taxes, water and sewer bills or other municipal liens on your property. When you fail to pay past due tax liabilities, a lien may be filed. At the tax sale, does the bidder buy my property?

A tax lien allows the state to seize accounts, wages, and property to resolve your back taxes. You have unpaid taxes, water and sewer bills or other municipal liens on your property. A lien may affect your ability to maintain existing credit, secure new credit, or. At the tax sale, does the bidder buy my property? The lien serves to give notice to your creditors of the outstanding tax liability and extends to all property and rights to property, real and. A tax lien may damage your credit. To search for a certificate of tax lien, you may search by case number or debtor name. When you fail to pay past due tax liabilities, a lien may be filed. With the case number search, you may use either the.

At the tax sale, does the bidder buy my property? When you fail to pay past due tax liabilities, a lien may be filed. With the case number search, you may use either the. A tax lien may damage your credit. You have unpaid taxes, water and sewer bills or other municipal liens on your property. The lien serves to give notice to your creditors of the outstanding tax liability and extends to all property and rights to property, real and. To search for a certificate of tax lien, you may search by case number or debtor name. A tax lien allows the state to seize accounts, wages, and property to resolve your back taxes. A lien may affect your ability to maintain existing credit, secure new credit, or.

Tax Lien Form Free Word Templates

You have unpaid taxes, water and sewer bills or other municipal liens on your property. A tax lien may damage your credit. A tax lien allows the state to seize accounts, wages, and property to resolve your back taxes. The lien serves to give notice to your creditors of the outstanding tax liability and extends to all property and rights.

tax lien PDF Free Download

With the case number search, you may use either the. The lien serves to give notice to your creditors of the outstanding tax liability and extends to all property and rights to property, real and. A tax lien may damage your credit. A tax lien allows the state to seize accounts, wages, and property to resolve your back taxes. A.

IRS Federal and State Tax Lien Help — Genesis Tax Consultants

At the tax sale, does the bidder buy my property? You have unpaid taxes, water and sewer bills or other municipal liens on your property. When you fail to pay past due tax liabilities, a lien may be filed. A tax lien may damage your credit. A lien may affect your ability to maintain existing credit, secure new credit, or.

How to Avoid a Maryland State Tax Lien SH Block Tax Services

To search for a certificate of tax lien, you may search by case number or debtor name. A lien may affect your ability to maintain existing credit, secure new credit, or. When you fail to pay past due tax liabilities, a lien may be filed. At the tax sale, does the bidder buy my property? A tax lien may damage.

The Importance of Hiring a Tax Lien Attorney for Your Insurance

The lien serves to give notice to your creditors of the outstanding tax liability and extends to all property and rights to property, real and. A tax lien may damage your credit. You have unpaid taxes, water and sewer bills or other municipal liens on your property. With the case number search, you may use either the. To search for.

The Ultimate Maryland Tax Lien FAQ The Pendergraft Firm, LLC.

The lien serves to give notice to your creditors of the outstanding tax liability and extends to all property and rights to property, real and. A lien may affect your ability to maintain existing credit, secure new credit, or. To search for a certificate of tax lien, you may search by case number or debtor name. A tax lien allows.

Maryland Lien Certificates and Certificate of Tax Liens LodeStar

A tax lien allows the state to seize accounts, wages, and property to resolve your back taxes. To search for a certificate of tax lien, you may search by case number or debtor name. With the case number search, you may use either the. At the tax sale, does the bidder buy my property? When you fail to pay past.

The Complete Guide to Maryland Lien & Notice Deadlines National Lien

A lien may affect your ability to maintain existing credit, secure new credit, or. With the case number search, you may use either the. When you fail to pay past due tax liabilities, a lien may be filed. To search for a certificate of tax lien, you may search by case number or debtor name. At the tax sale, does.

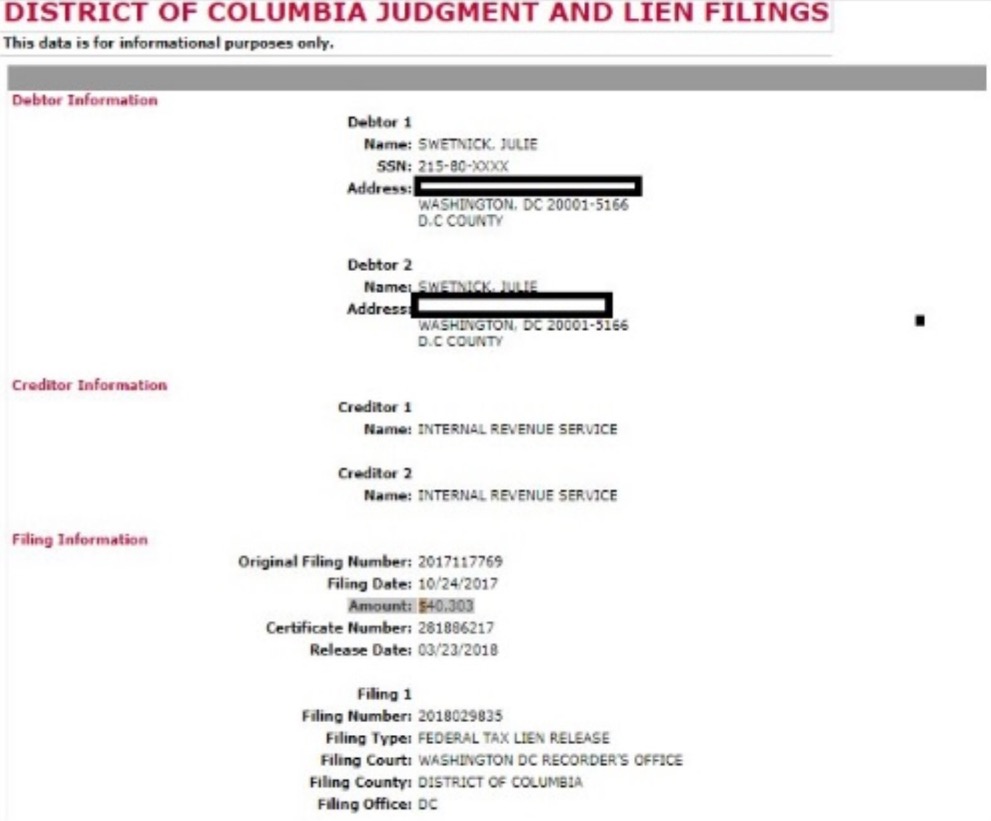

Julie Swetnick's Tax Lien History in D.C. & Maryland

At the tax sale, does the bidder buy my property? A tax lien allows the state to seize accounts, wages, and property to resolve your back taxes. When you fail to pay past due tax liabilities, a lien may be filed. A tax lien may damage your credit. The lien serves to give notice to your creditors of the outstanding.

Investing in Tax Lien Seminars and Courses

A tax lien may damage your credit. A tax lien allows the state to seize accounts, wages, and property to resolve your back taxes. At the tax sale, does the bidder buy my property? The lien serves to give notice to your creditors of the outstanding tax liability and extends to all property and rights to property, real and. When.

With The Case Number Search, You May Use Either The.

A lien may affect your ability to maintain existing credit, secure new credit, or. A tax lien allows the state to seize accounts, wages, and property to resolve your back taxes. When you fail to pay past due tax liabilities, a lien may be filed. The lien serves to give notice to your creditors of the outstanding tax liability and extends to all property and rights to property, real and.

At The Tax Sale, Does The Bidder Buy My Property?

A tax lien may damage your credit. You have unpaid taxes, water and sewer bills or other municipal liens on your property. To search for a certificate of tax lien, you may search by case number or debtor name.