Stride Tax Instacart

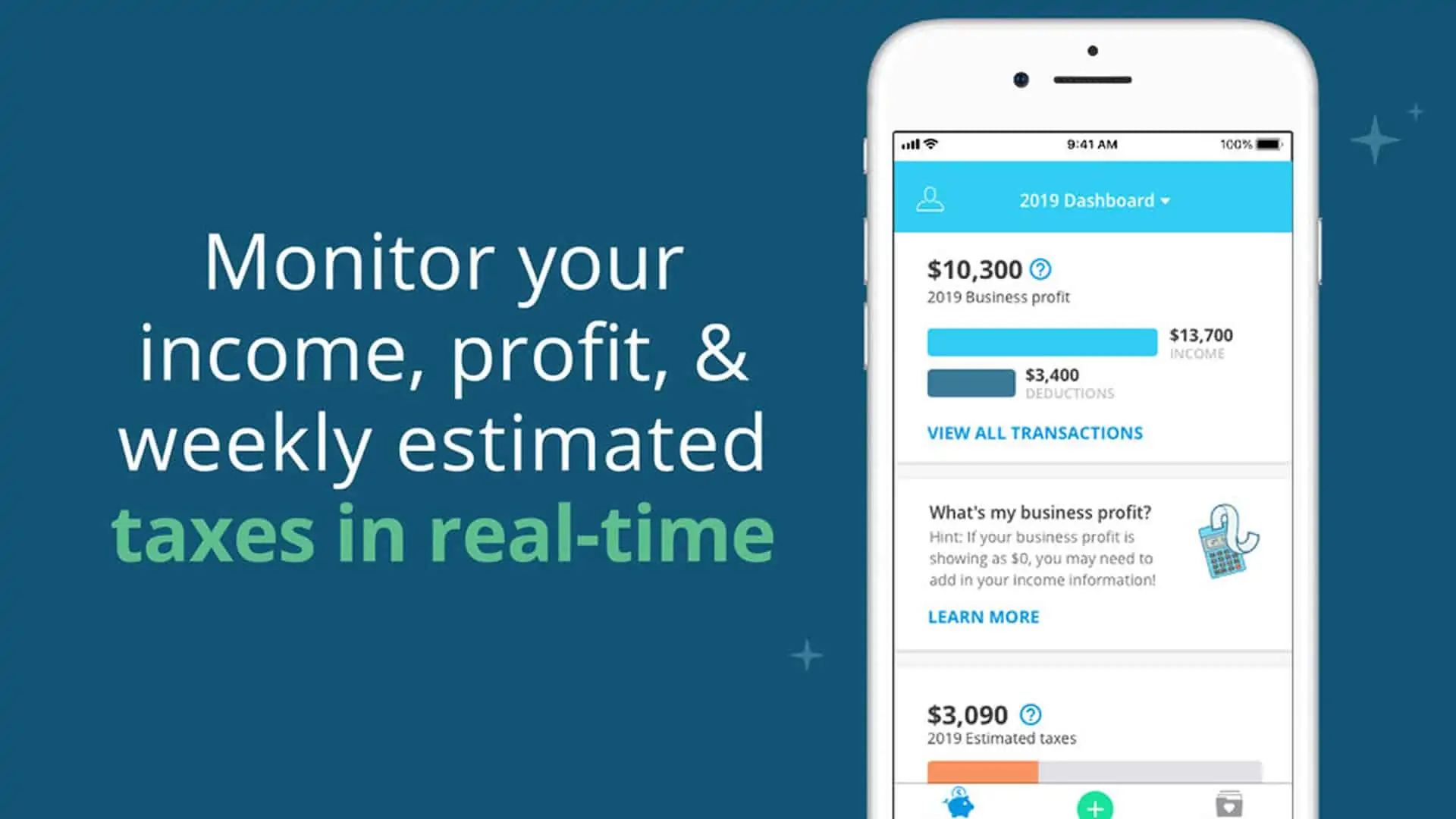

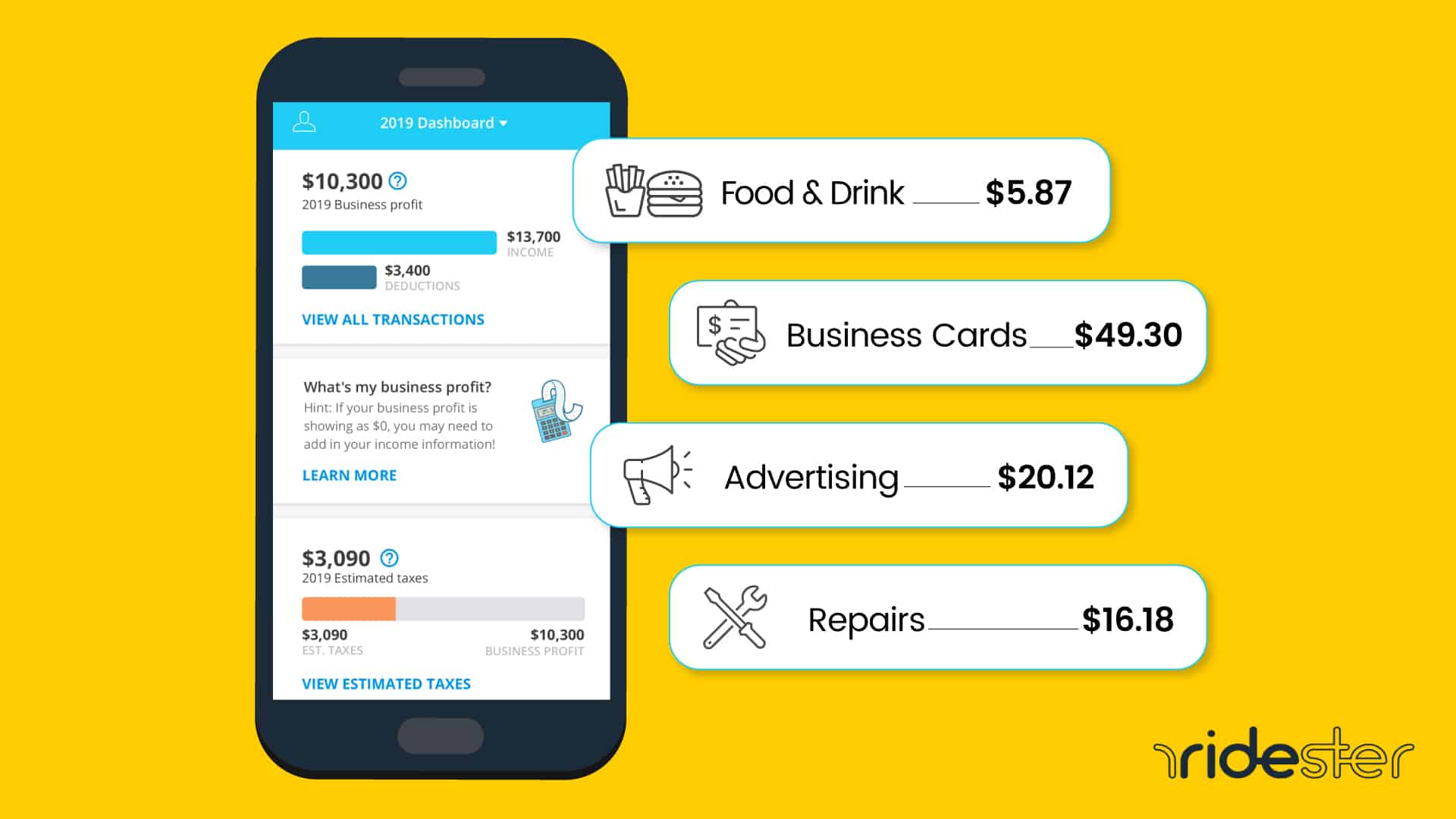

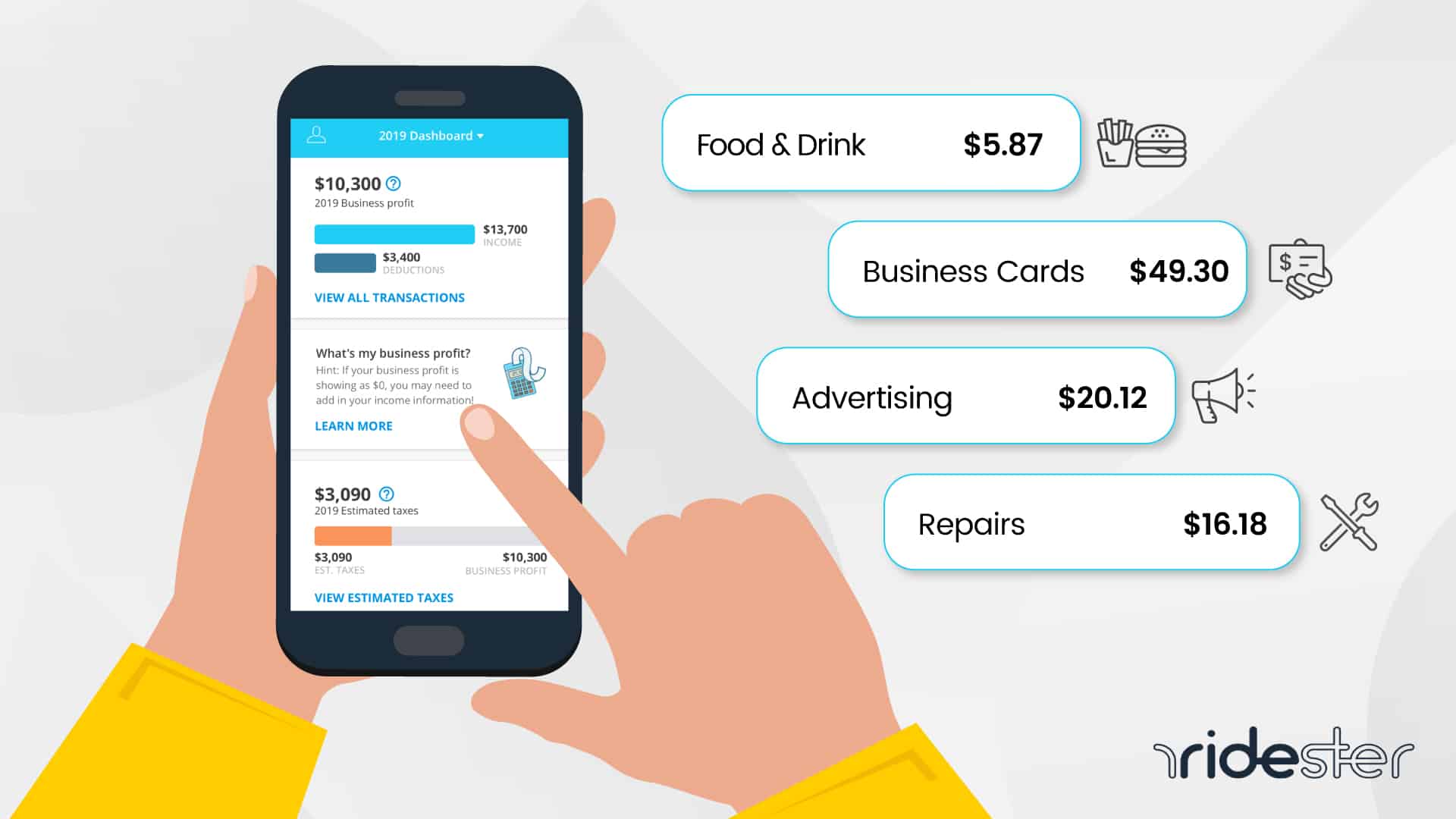

Stride Tax Instacart - You might qualify for savings through tax credits that lower the cost of coverage based on factors like your age, income, and where you live. You’ll need to reach out to instacart to access your 2023 1099 tax form; Plus, we’ll help you find. Check the link to the instacart shopper site to learn more. Track your income, mileage, and expenses with the free stride app so you’re ready to rack up savings at tax time.

Check the link to the instacart shopper site to learn more. You’ll need to reach out to instacart to access your 2023 1099 tax form; You might qualify for savings through tax credits that lower the cost of coverage based on factors like your age, income, and where you live. Track your income, mileage, and expenses with the free stride app so you’re ready to rack up savings at tax time. Plus, we’ll help you find.

Check the link to the instacart shopper site to learn more. You’ll need to reach out to instacart to access your 2023 1099 tax form; Track your income, mileage, and expenses with the free stride app so you’re ready to rack up savings at tax time. Plus, we’ll help you find. You might qualify for savings through tax credits that lower the cost of coverage based on factors like your age, income, and where you live.

The Ultimate Tax Guide for Instacart Shoppers — Stride Blog

You might qualify for savings through tax credits that lower the cost of coverage based on factors like your age, income, and where you live. You’ll need to reach out to instacart to access your 2023 1099 tax form; Check the link to the instacart shopper site to learn more. Plus, we’ll help you find. Track your income, mileage, and.

Stride Tax Accurate Mileage, Expense, and Tax Tracker

You’ll need to reach out to instacart to access your 2023 1099 tax form; Check the link to the instacart shopper site to learn more. Plus, we’ll help you find. You might qualify for savings through tax credits that lower the cost of coverage based on factors like your age, income, and where you live. Track your income, mileage, and.

Tax Planning Advisors Chicago, IL STRIDE Financial

Check the link to the instacart shopper site to learn more. Plus, we’ll help you find. You might qualify for savings through tax credits that lower the cost of coverage based on factors like your age, income, and where you live. Track your income, mileage, and expenses with the free stride app so you’re ready to rack up savings at.

Stride Tax App Review (2021) YouTube

Plus, we’ll help you find. Track your income, mileage, and expenses with the free stride app so you’re ready to rack up savings at tax time. You might qualify for savings through tax credits that lower the cost of coverage based on factors like your age, income, and where you live. Check the link to the instacart shopper site to.

Stride Winterblue Sugarfree Gum (14 ct) Instacart

You might qualify for savings through tax credits that lower the cost of coverage based on factors like your age, income, and where you live. Track your income, mileage, and expenses with the free stride app so you’re ready to rack up savings at tax time. Check the link to the instacart shopper site to learn more. Plus, we’ll help.

Stride Tax Accurate Mileage, Expense, and Tax Tracker

You’ll need to reach out to instacart to access your 2023 1099 tax form; Track your income, mileage, and expenses with the free stride app so you’re ready to rack up savings at tax time. Check the link to the instacart shopper site to learn more. Plus, we’ll help you find. You might qualify for savings through tax credits that.

Stride Mileage & Tax Tracker by Stride Health, Inc.

You might qualify for savings through tax credits that lower the cost of coverage based on factors like your age, income, and where you live. Check the link to the instacart shopper site to learn more. Track your income, mileage, and expenses with the free stride app so you’re ready to rack up savings at tax time. You’ll need to.

Stride Tax Accurate Mileage, Expense, and Tax Tracker

You’ll need to reach out to instacart to access your 2023 1099 tax form; Track your income, mileage, and expenses with the free stride app so you’re ready to rack up savings at tax time. You might qualify for savings through tax credits that lower the cost of coverage based on factors like your age, income, and where you live..

Stride Tax App and Mileage Tracker Here's How to Save Money With It

Check the link to the instacart shopper site to learn more. Plus, we’ll help you find. You’ll need to reach out to instacart to access your 2023 1099 tax form; Track your income, mileage, and expenses with the free stride app so you’re ready to rack up savings at tax time. You might qualify for savings through tax credits that.

Stride Launches Benefits Platform with DoorDash, Postmates and

You might qualify for savings through tax credits that lower the cost of coverage based on factors like your age, income, and where you live. Track your income, mileage, and expenses with the free stride app so you’re ready to rack up savings at tax time. Check the link to the instacart shopper site to learn more. You’ll need to.

Check The Link To The Instacart Shopper Site To Learn More.

You’ll need to reach out to instacart to access your 2023 1099 tax form; Plus, we’ll help you find. Track your income, mileage, and expenses with the free stride app so you’re ready to rack up savings at tax time. You might qualify for savings through tax credits that lower the cost of coverage based on factors like your age, income, and where you live.