Tax Extension Form California

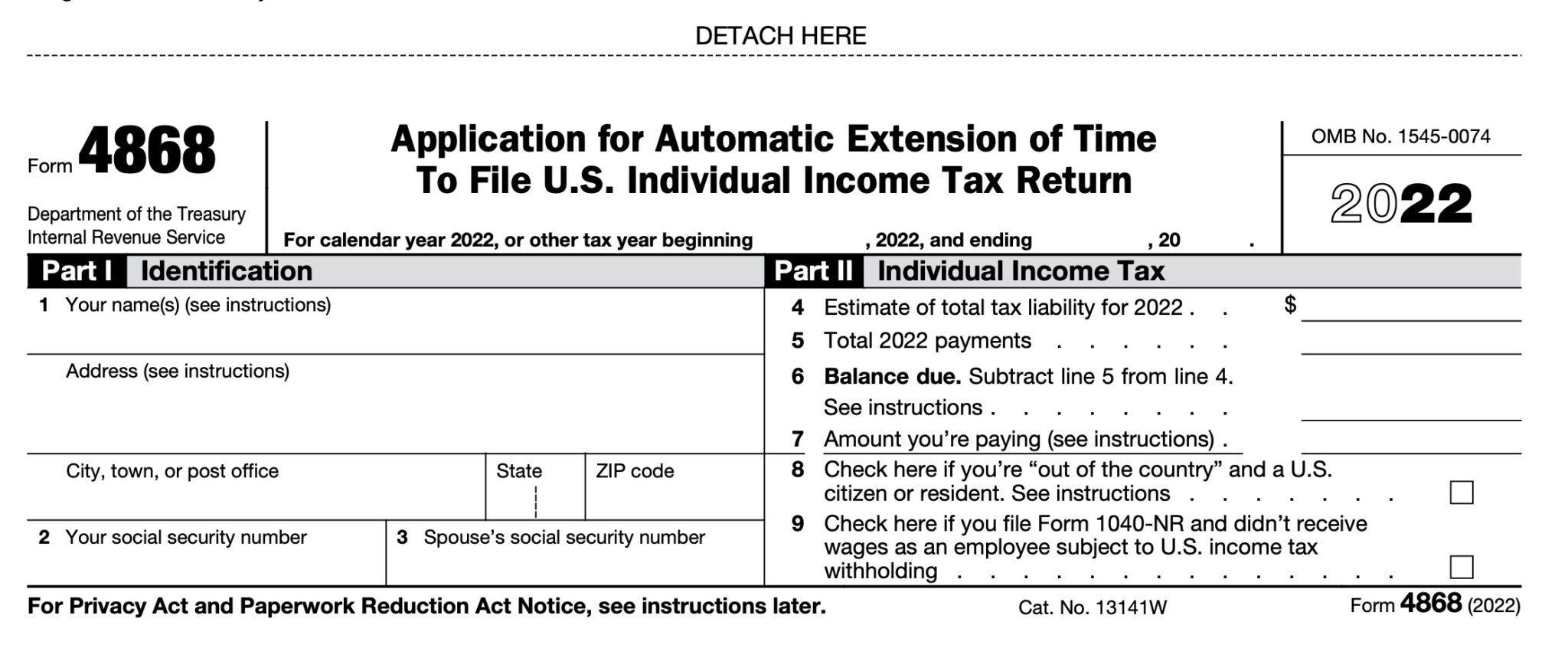

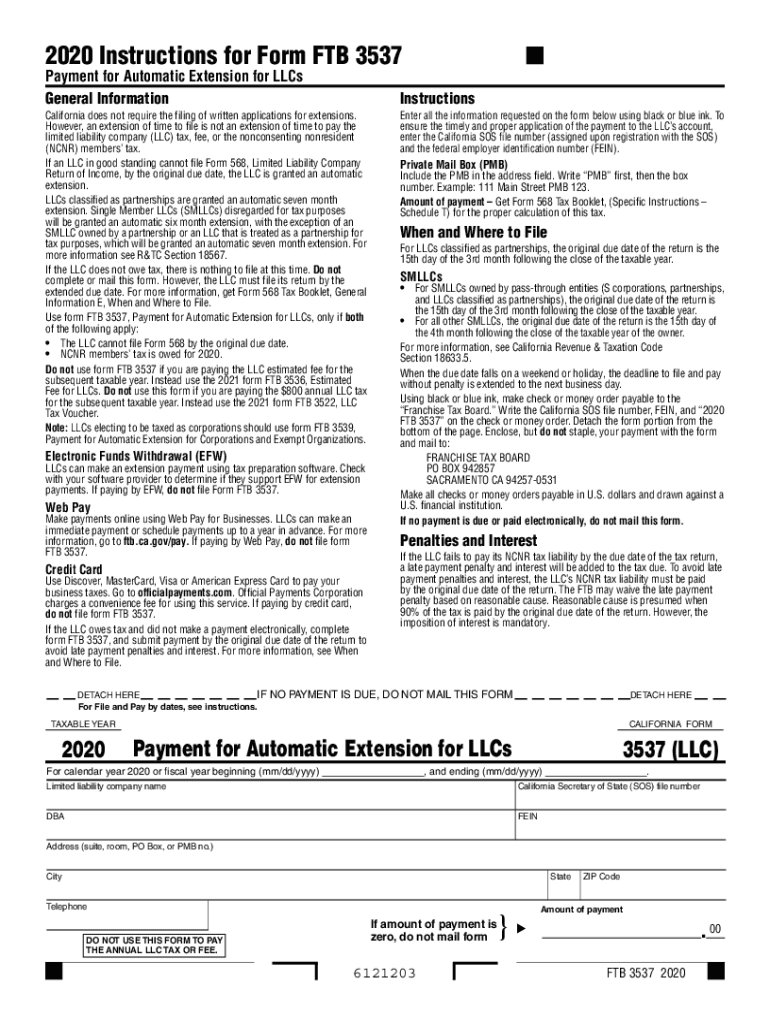

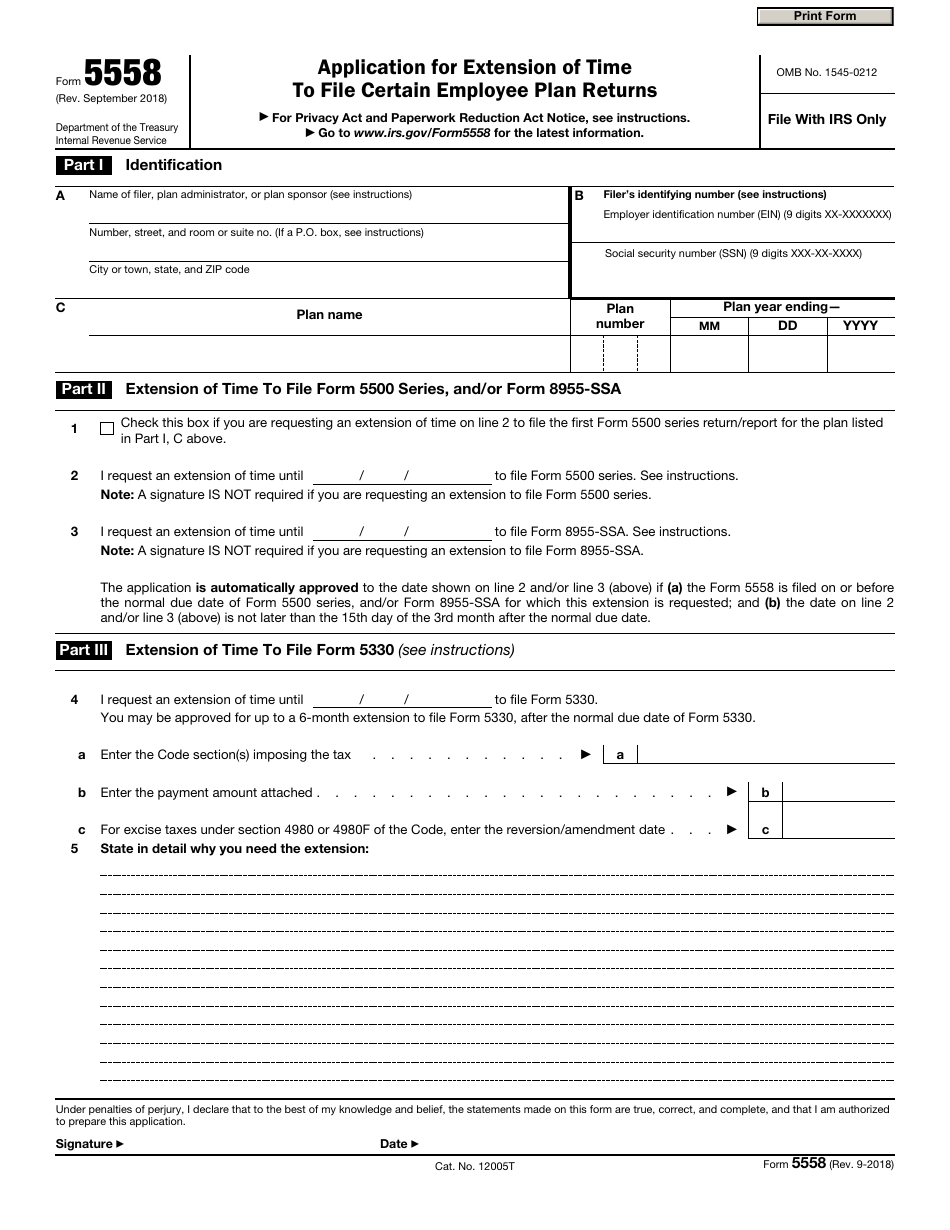

Tax Extension Form California - Use an automatic extension form to make a payment if both of. Individual income tax return (pdf) (form 4868) on or before the regular due date of your return. Here are the different options to file a ca extension: Find out how to get an extension of time to file your income tax return. If you do not file your tax return by october 16, 2023, you will incur a late filing penalty plus. Pay your additional tax with another form ftb 3519. File automatic extension of time to file u.s. If you do not file your tax return by october 15, 2024, you will incur a late filing penalty plus. Pay your additional tax with another form ftb 3519. Pay all or some of your california income taxes online via:

Find out how to get an extension of time to file your income tax return. If you do not file your tax return by october 16, 2023, you will incur a late filing penalty plus. Pay your additional tax with another form ftb 3519. Here are the different options to file a ca extension: Pay your additional tax with another form ftb 3519. If you do not file your tax return by october 15, 2024, you will incur a late filing penalty plus. Individual income tax return (pdf) (form 4868) on or before the regular due date of your return. Pay all or some of your california income taxes online via: An extension to file your tax return is not an extension to pay. File automatic extension of time to file u.s.

Find out how to get an extension of time to file your income tax return. Use an automatic extension form to make a payment if both of. If you do not file your tax return by october 15, 2024, you will incur a late filing penalty plus. File automatic extension of time to file u.s. Pay all or some of your california income taxes online via: An extension to file your tax return is not an extension to pay. Here are the different options to file a ca extension: Pay your additional tax with another form ftb 3519. Individual income tax return (pdf) (form 4868) on or before the regular due date of your return. If you do not file your tax return by october 16, 2023, you will incur a late filing penalty plus.

What it Means to File a Tax Extension The Tech Savvy CPA

An extension to file your tax return is not an extension to pay. If you do not file your tax return by october 15, 2024, you will incur a late filing penalty plus. Find out how to get an extension of time to file your income tax return. Use an automatic extension form to make a payment if both of..

tax extension form 2019 Fill Online, Printable, Fillable Blank irs

Pay your additional tax with another form ftb 3519. Pay all or some of your california income taxes online via: Find out how to get an extension of time to file your income tax return. Individual income tax return (pdf) (form 4868) on or before the regular due date of your return. If you do not file your tax return.

How Long Is Irs Tax Extension 2024 California Pauly Betteann

File automatic extension of time to file u.s. An extension to file your tax return is not an extension to pay. Pay all or some of your california income taxes online via: Individual income tax return (pdf) (form 4868) on or before the regular due date of your return. If you do not file your tax return by october 15,.

CA FTB 3537 20202022 Fill out Tax Template Online US Legal Forms

Here are the different options to file a ca extension: Individual income tax return (pdf) (form 4868) on or before the regular due date of your return. If you do not file your tax return by october 16, 2023, you will incur a late filing penalty plus. Pay your additional tax with another form ftb 3519. Pay your additional tax.

Tax Return Extension Form 2023 Printable Forms Free Online

An extension to file your tax return is not an extension to pay. Here are the different options to file a ca extension: File automatic extension of time to file u.s. Pay your additional tax with another form ftb 3519. If you do not file your tax return by october 15, 2024, you will incur a late filing penalty plus.

Filing a Tax Extension What Traders Should Know TradeLog

Individual income tax return (pdf) (form 4868) on or before the regular due date of your return. If you do not file your tax return by october 15, 2024, you will incur a late filing penalty plus. If you do not file your tax return by october 16, 2023, you will incur a late filing penalty plus. Pay your additional.

Is Filing an Extension a Bad Thing? What Do I Need To Know About Tax

An extension to file your tax return is not an extension to pay. Here are the different options to file a ca extension: Pay your additional tax with another form ftb 3519. If you do not file your tax return by october 16, 2023, you will incur a late filing penalty plus. Individual income tax return (pdf) (form 4868) on.

California Tax Extension Form 2024 Carol Cristen

Pay all or some of your california income taxes online via: Pay your additional tax with another form ftb 3519. An extension to file your tax return is not an extension to pay. Pay your additional tax with another form ftb 3519. Individual income tax return (pdf) (form 4868) on or before the regular due date of your return.

Tax Extensions Explained How to Avoid LateFiling Penalties and Stress

Pay your additional tax with another form ftb 3519. Here are the different options to file a ca extension: If you do not file your tax return by october 16, 2023, you will incur a late filing penalty plus. An extension to file your tax return is not an extension to pay. Find out how to get an extension of.

California Tax Extension Form 2024 Suki Marcille

Pay all or some of your california income taxes online via: If you do not file your tax return by october 16, 2023, you will incur a late filing penalty plus. File automatic extension of time to file u.s. If you do not file your tax return by october 15, 2024, you will incur a late filing penalty plus. Use.

Pay All Or Some Of Your California Income Taxes Online Via:

Individual income tax return (pdf) (form 4868) on or before the regular due date of your return. Pay your additional tax with another form ftb 3519. Find out how to get an extension of time to file your income tax return. Here are the different options to file a ca extension:

Pay Your Additional Tax With Another Form Ftb 3519.

If you do not file your tax return by october 16, 2023, you will incur a late filing penalty plus. Use an automatic extension form to make a payment if both of. An extension to file your tax return is not an extension to pay. File automatic extension of time to file u.s.