Tax Foreclosure Sale

Tax Foreclosure Sale - A tax lien foreclosure is the sale of a property resulting. In some states, the government will seize homes with unpaid property taxes and then. The taxing authority simply executes. Tax lien foreclosures and tax deed sales allow the governmental entity to promptly. In some jurisdictions, though, a sale isn't held. What is a tax lien foreclosure?

What is a tax lien foreclosure? A tax lien foreclosure is the sale of a property resulting. The taxing authority simply executes. In some states, the government will seize homes with unpaid property taxes and then. In some jurisdictions, though, a sale isn't held. Tax lien foreclosures and tax deed sales allow the governmental entity to promptly.

In some jurisdictions, though, a sale isn't held. In some states, the government will seize homes with unpaid property taxes and then. A tax lien foreclosure is the sale of a property resulting. What is a tax lien foreclosure? The taxing authority simply executes. Tax lien foreclosures and tax deed sales allow the governmental entity to promptly.

13 Steps to your FIRST Tax Sale Foreclosure Investment eBooks Real

What is a tax lien foreclosure? A tax lien foreclosure is the sale of a property resulting. In some jurisdictions, though, a sale isn't held. In some states, the government will seize homes with unpaid property taxes and then. Tax lien foreclosures and tax deed sales allow the governmental entity to promptly.

Tax Foreclosure Sales Gaston County, NC

What is a tax lien foreclosure? In some jurisdictions, though, a sale isn't held. A tax lien foreclosure is the sale of a property resulting. The taxing authority simply executes. Tax lien foreclosures and tax deed sales allow the governmental entity to promptly.

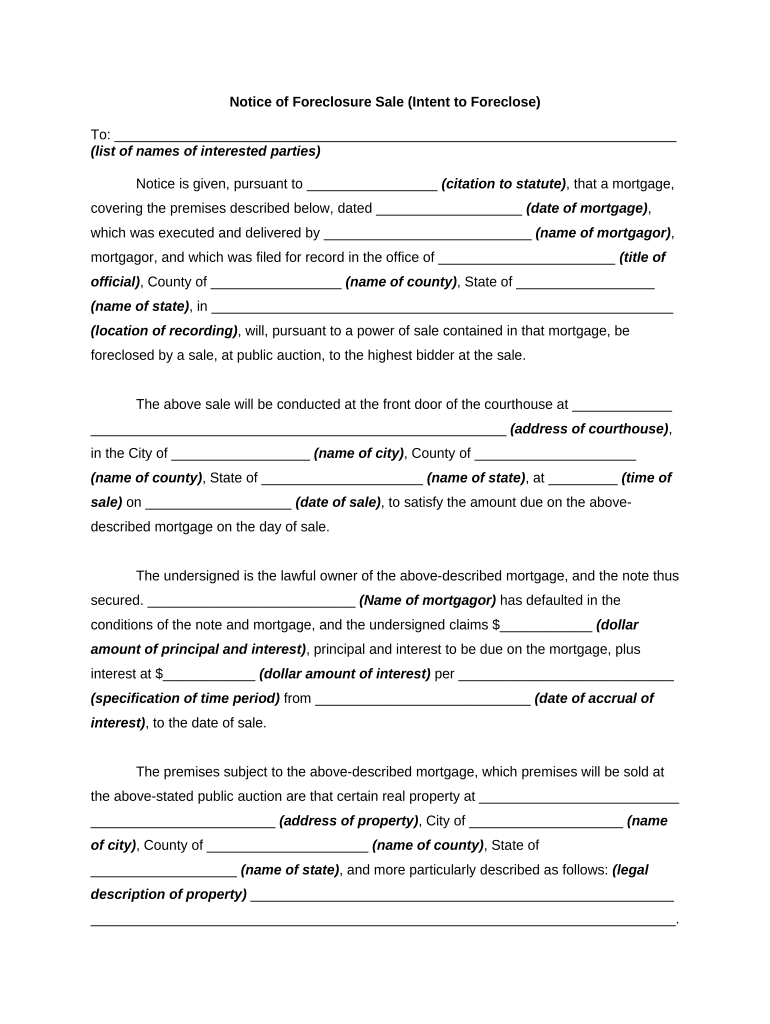

Foreclosure sale Fill out & sign online DocHub

In some states, the government will seize homes with unpaid property taxes and then. A tax lien foreclosure is the sale of a property resulting. Tax lien foreclosures and tax deed sales allow the governmental entity to promptly. In some jurisdictions, though, a sale isn't held. What is a tax lien foreclosure?

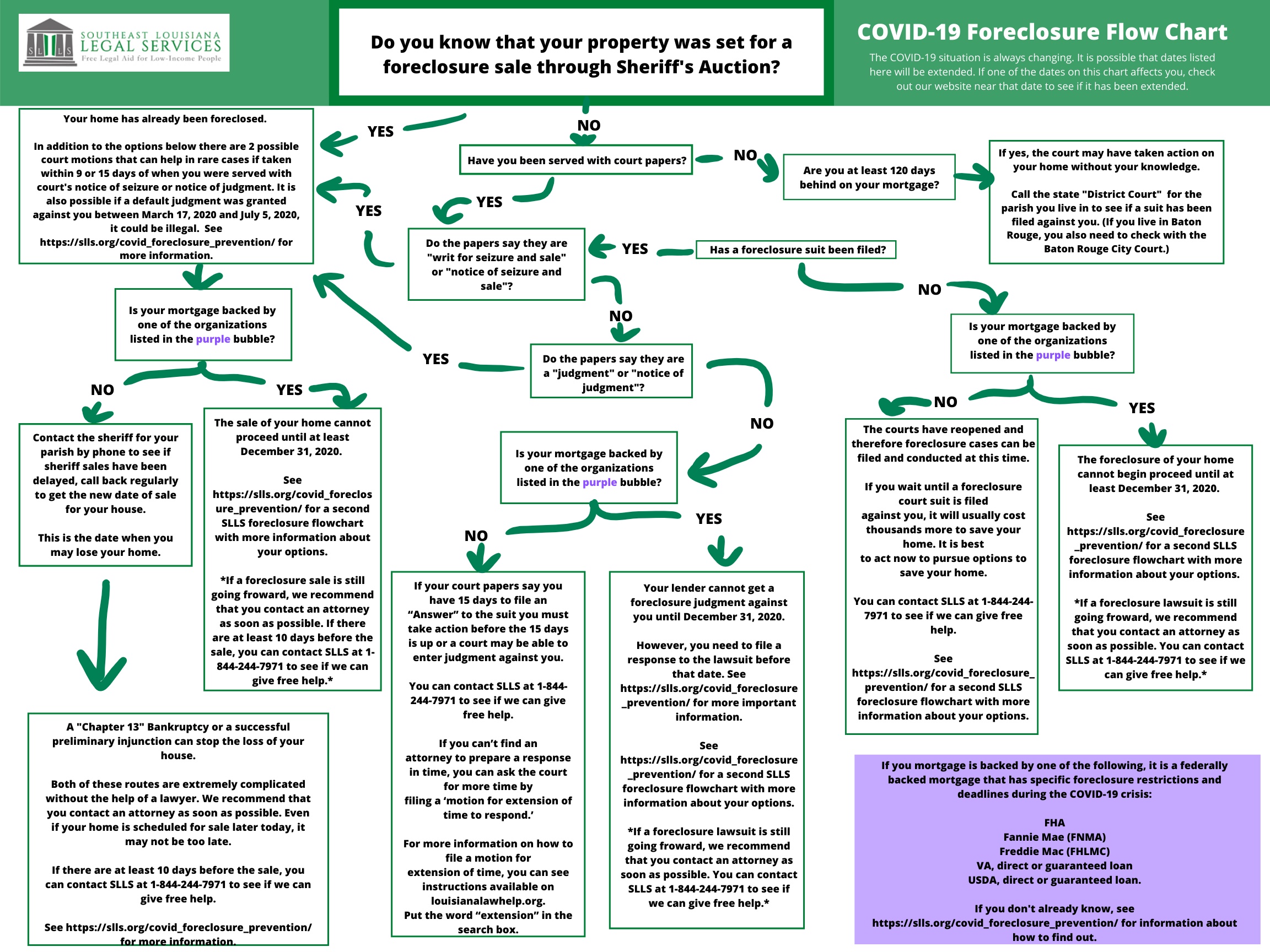

Updated Foreclosure Flow Chart SLLS

In some states, the government will seize homes with unpaid property taxes and then. Tax lien foreclosures and tax deed sales allow the governmental entity to promptly. The taxing authority simply executes. A tax lien foreclosure is the sale of a property resulting. In some jurisdictions, though, a sale isn't held.

Tax Foreclosure Sale Halifax County NC Tax Department

In some jurisdictions, though, a sale isn't held. A tax lien foreclosure is the sale of a property resulting. Tax lien foreclosures and tax deed sales allow the governmental entity to promptly. In some states, the government will seize homes with unpaid property taxes and then. The taxing authority simply executes.

Tax Foreclosure Properties Snohomish County, WA Official Website

A tax lien foreclosure is the sale of a property resulting. Tax lien foreclosures and tax deed sales allow the governmental entity to promptly. The taxing authority simply executes. In some jurisdictions, though, a sale isn't held. What is a tax lien foreclosure?

Tax Foreclosure Sale Halifax County NC Tax Department

A tax lien foreclosure is the sale of a property resulting. In some jurisdictions, though, a sale isn't held. Tax lien foreclosures and tax deed sales allow the governmental entity to promptly. In some states, the government will seize homes with unpaid property taxes and then. What is a tax lien foreclosure?

INTENSIVE Tax Sale Foreclosure Investing Class Movies and Videos

In some jurisdictions, though, a sale isn't held. A tax lien foreclosure is the sale of a property resulting. In some states, the government will seize homes with unpaid property taxes and then. The taxing authority simply executes. What is a tax lien foreclosure?

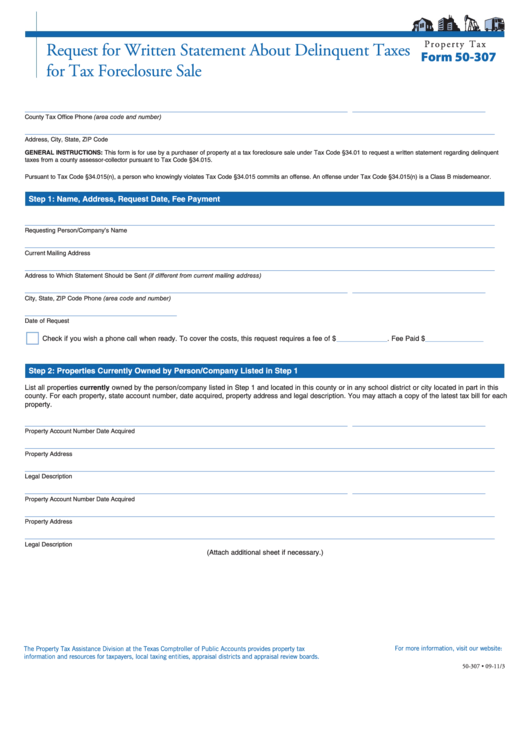

Fillable Property Tax Form 50307 Request For Written Statement About

In some states, the government will seize homes with unpaid property taxes and then. What is a tax lien foreclosure? Tax lien foreclosures and tax deed sales allow the governmental entity to promptly. The taxing authority simply executes. In some jurisdictions, though, a sale isn't held.

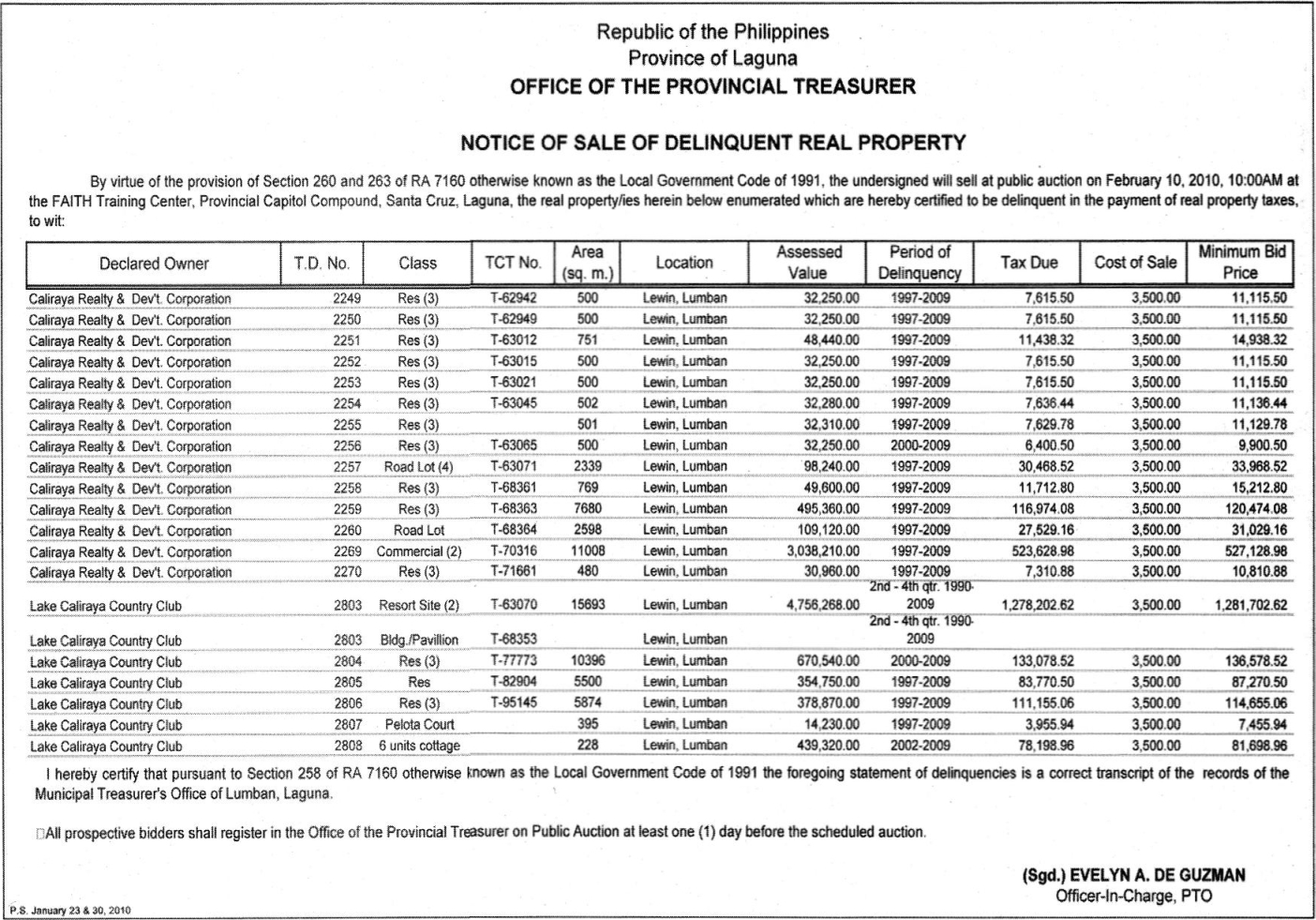

Tax foreclosure sale of delinquent real properties in Laguna slated on

What is a tax lien foreclosure? The taxing authority simply executes. A tax lien foreclosure is the sale of a property resulting. In some jurisdictions, though, a sale isn't held. Tax lien foreclosures and tax deed sales allow the governmental entity to promptly.

Tax Lien Foreclosures And Tax Deed Sales Allow The Governmental Entity To Promptly.

In some jurisdictions, though, a sale isn't held. In some states, the government will seize homes with unpaid property taxes and then. The taxing authority simply executes. A tax lien foreclosure is the sale of a property resulting.