Tax Lien Auctions Florida

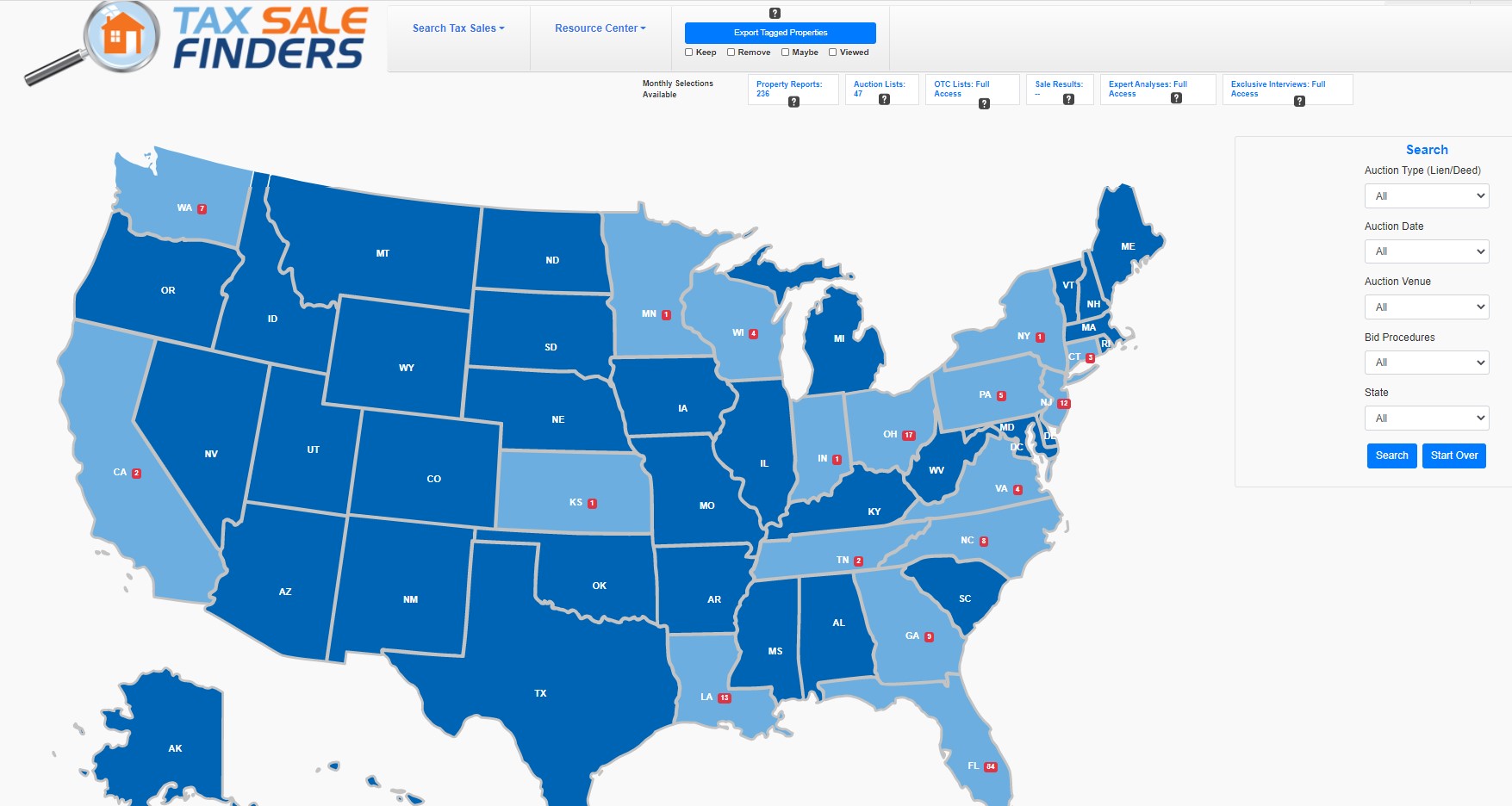

Tax Lien Auctions Florida - On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. In florida, if the delinquent taxes are not paid within two years, the county tax collector can enforce the tax lien by selling it in a public. The user has several search options. A tax deed sale is the process of selling real property at auction to recover delinquent taxes, and the cost of bringing the property to auction. Tax deed sales are the auction of property on which tax certificates have been sold by the tax collector’s office for delinquent real estate. From the tax deed auctions page, under the tax deed options menu, select view tax deed files online.

From the tax deed auctions page, under the tax deed options menu, select view tax deed files online. In florida, if the delinquent taxes are not paid within two years, the county tax collector can enforce the tax lien by selling it in a public. A tax deed sale is the process of selling real property at auction to recover delinquent taxes, and the cost of bringing the property to auction. On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. Tax deed sales are the auction of property on which tax certificates have been sold by the tax collector’s office for delinquent real estate. The user has several search options.

The user has several search options. From the tax deed auctions page, under the tax deed options menu, select view tax deed files online. Tax deed sales are the auction of property on which tax certificates have been sold by the tax collector’s office for delinquent real estate. On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. In florida, if the delinquent taxes are not paid within two years, the county tax collector can enforce the tax lien by selling it in a public. A tax deed sale is the process of selling real property at auction to recover delinquent taxes, and the cost of bringing the property to auction.

Tax Lien Certificates in Florida Over 1 Million Available!

The user has several search options. Tax deed sales are the auction of property on which tax certificates have been sold by the tax collector’s office for delinquent real estate. In florida, if the delinquent taxes are not paid within two years, the county tax collector can enforce the tax lien by selling it in a public. On or before.

tax lien PDF Free Download

Tax deed sales are the auction of property on which tax certificates have been sold by the tax collector’s office for delinquent real estate. On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. A tax deed sale is the process of selling real property at auction.

Exploring Tax Lien Certificate Auctions in Florida Opportunities and

Tax deed sales are the auction of property on which tax certificates have been sold by the tax collector’s office for delinquent real estate. In florida, if the delinquent taxes are not paid within two years, the county tax collector can enforce the tax lien by selling it in a public. From the tax deed auctions page, under the tax.

How To Participate in Tax Lien Auctions Tax Lien Wealth Builders

A tax deed sale is the process of selling real property at auction to recover delinquent taxes, and the cost of bringing the property to auction. From the tax deed auctions page, under the tax deed options menu, select view tax deed files online. Tax deed sales are the auction of property on which tax certificates have been sold by.

Tax Lien Investing Tips Tax Lien Investing Tips brought to you by

In florida, if the delinquent taxes are not paid within two years, the county tax collector can enforce the tax lien by selling it in a public. A tax deed sale is the process of selling real property at auction to recover delinquent taxes, and the cost of bringing the property to auction. Tax deed sales are the auction of.

Florida County Held Tax Lien Certificates Tax Lien Foreclosure

A tax deed sale is the process of selling real property at auction to recover delinquent taxes, and the cost of bringing the property to auction. On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. Tax deed sales are the auction of property on which tax.

About Apartment Foreclosures, Auctions, and Tax Lien Deeds

The user has several search options. From the tax deed auctions page, under the tax deed options menu, select view tax deed files online. On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. Tax deed sales are the auction of property on which tax certificates have.

Investing in Tax Lien Seminars and Courses

On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. A tax deed sale is the process of selling real property at auction to recover delinquent taxes, and the cost of bringing the property to auction. The user has several search options. From the tax deed auctions.

Tax Lien Sale Download Free PDF Tax Lien Taxes

Tax deed sales are the auction of property on which tax certificates have been sold by the tax collector’s office for delinquent real estate. A tax deed sale is the process of selling real property at auction to recover delinquent taxes, and the cost of bringing the property to auction. From the tax deed auctions page, under the tax deed.

My Open path

In florida, if the delinquent taxes are not paid within two years, the county tax collector can enforce the tax lien by selling it in a public. The user has several search options. Tax deed sales are the auction of property on which tax certificates have been sold by the tax collector’s office for delinquent real estate. From the tax.

Tax Deed Sales Are The Auction Of Property On Which Tax Certificates Have Been Sold By The Tax Collector’s Office For Delinquent Real Estate.

The user has several search options. In florida, if the delinquent taxes are not paid within two years, the county tax collector can enforce the tax lien by selling it in a public. On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. A tax deed sale is the process of selling real property at auction to recover delinquent taxes, and the cost of bringing the property to auction.