Tax Lien Certificates In Texas

Tax Lien Certificates In Texas - A tax certificate issued through fraud or collusion is void. The mhd tax lien database system is designed to allow taxing entities the ability to release their own liens as well as the liens for the entities. Texas does not sell tax lien. Tax liens which are evidence a tax delinquency are satisfied only by the sale of the property in texas. Tax lien certificates and tax liens in. The fee is $10 and certificates are ready in three to five business days. The property tax assistance division at the texas comptroller of public accounts. Anyone can request a tax certificate.

The mhd tax lien database system is designed to allow taxing entities the ability to release their own liens as well as the liens for the entities. A tax certificate issued through fraud or collusion is void. Tax lien certificates and tax liens in. The fee is $10 and certificates are ready in three to five business days. Texas does not sell tax lien. The property tax assistance division at the texas comptroller of public accounts. Anyone can request a tax certificate. Tax liens which are evidence a tax delinquency are satisfied only by the sale of the property in texas.

Tax liens which are evidence a tax delinquency are satisfied only by the sale of the property in texas. The fee is $10 and certificates are ready in three to five business days. Anyone can request a tax certificate. The property tax assistance division at the texas comptroller of public accounts. The mhd tax lien database system is designed to allow taxing entities the ability to release their own liens as well as the liens for the entities. Tax lien certificates and tax liens in. A tax certificate issued through fraud or collusion is void. Texas does not sell tax lien.

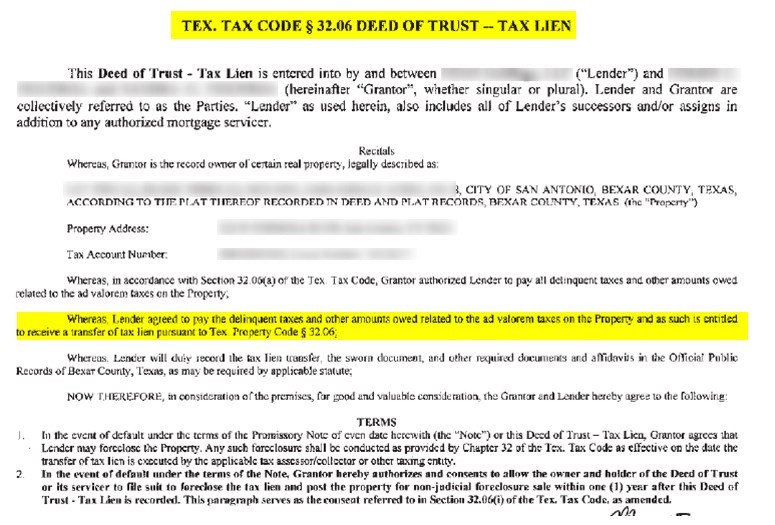

Tax Lien Tax Lien Certificates Texas

The mhd tax lien database system is designed to allow taxing entities the ability to release their own liens as well as the liens for the entities. The property tax assistance division at the texas comptroller of public accounts. The fee is $10 and certificates are ready in three to five business days. A tax certificate issued through fraud or.

Texas Property Tax Sales Tax Lien Certificate and Tax Deed Authority

Anyone can request a tax certificate. The mhd tax lien database system is designed to allow taxing entities the ability to release their own liens as well as the liens for the entities. Tax liens which are evidence a tax delinquency are satisfied only by the sale of the property in texas. The property tax assistance division at the texas.

Tax Lien Texas State Tax Lien

Tax lien certificates and tax liens in. A tax certificate issued through fraud or collusion is void. Anyone can request a tax certificate. The fee is $10 and certificates are ready in three to five business days. The mhd tax lien database system is designed to allow taxing entities the ability to release their own liens as well as the.

Tax Lien Tax Lien Certificates Texas

Anyone can request a tax certificate. Tax lien certificates and tax liens in. Texas does not sell tax lien. The property tax assistance division at the texas comptroller of public accounts. Tax liens which are evidence a tax delinquency are satisfied only by the sale of the property in texas.

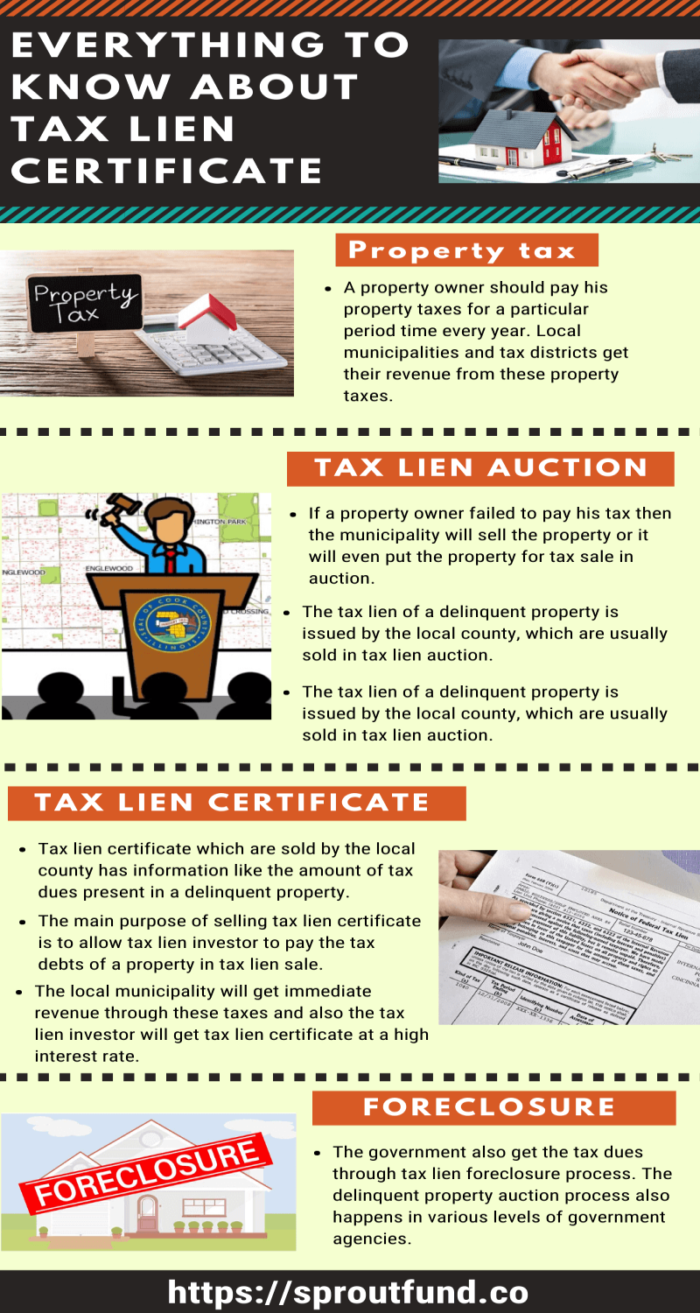

Everything to know about tax lien certificate Latest Infographics

The property tax assistance division at the texas comptroller of public accounts. Texas does not sell tax lien. Anyone can request a tax certificate. A tax certificate issued through fraud or collusion is void. Tax lien certificates and tax liens in.

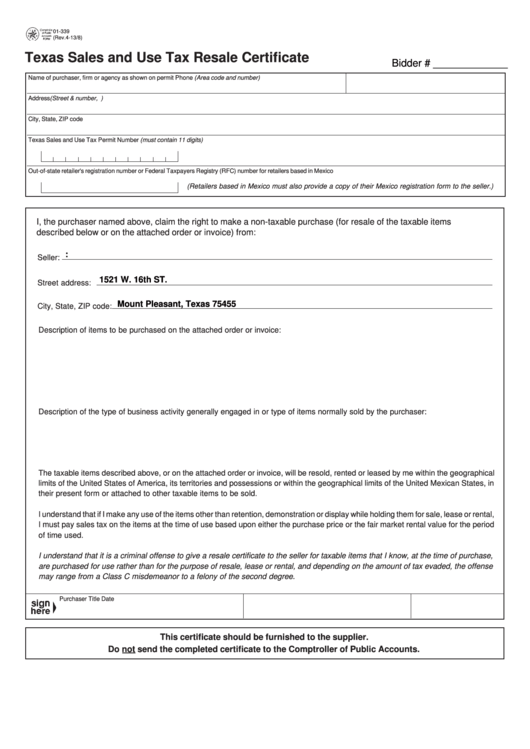

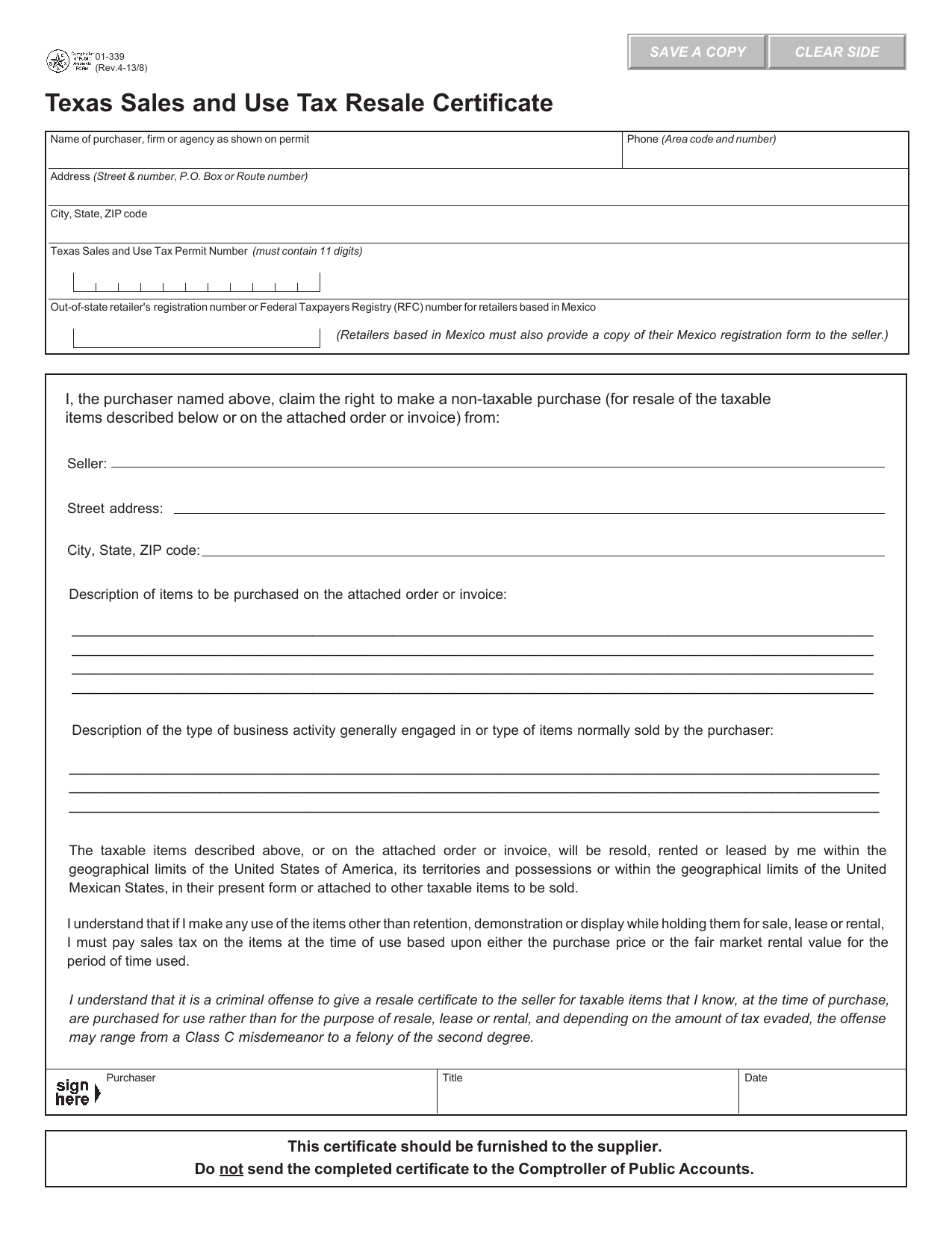

Texas Sales and Use Tax Resale Certificate SAVE A COPY CLEAR SIDE

Texas does not sell tax lien. The fee is $10 and certificates are ready in three to five business days. Tax liens which are evidence a tax delinquency are satisfied only by the sale of the property in texas. The property tax assistance division at the texas comptroller of public accounts. Tax lien certificates and tax liens in.

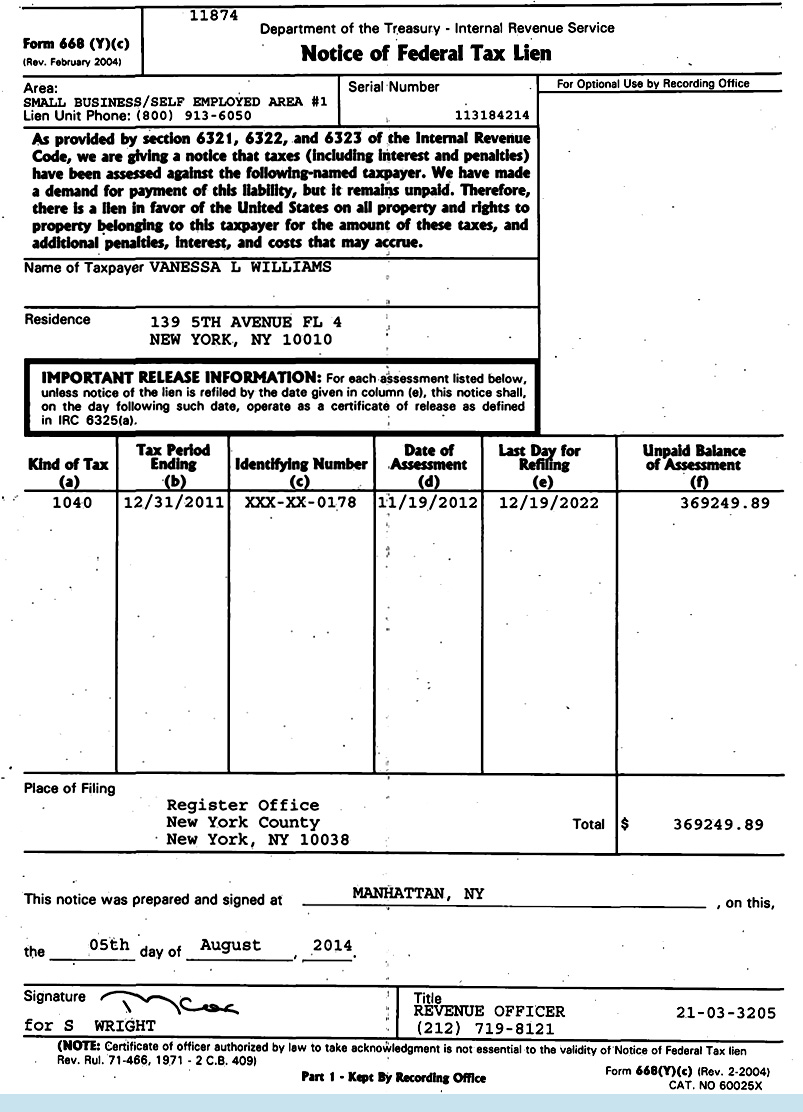

[L6] Resumo Aula Tax Lien e Tax Deed O Caçador de Títulos

Tax liens which are evidence a tax delinquency are satisfied only by the sale of the property in texas. Texas does not sell tax lien. The property tax assistance division at the texas comptroller of public accounts. Tax lien certificates and tax liens in. The fee is $10 and certificates are ready in three to five business days.

What is a Tax Lien Certificate? How do they Work Explained! YouTube

The mhd tax lien database system is designed to allow taxing entities the ability to release their own liens as well as the liens for the entities. Tax liens which are evidence a tax delinquency are satisfied only by the sale of the property in texas. A tax certificate issued through fraud or collusion is void. Tax lien certificates and.

Title Search on Property in Texas, TX Title Service Company

The mhd tax lien database system is designed to allow taxing entities the ability to release their own liens as well as the liens for the entities. Texas does not sell tax lien. The property tax assistance division at the texas comptroller of public accounts. The fee is $10 and certificates are ready in three to five business days. Tax.

Fillable Form 01339 Texas Sales And Use Tax Resale Certificate

The mhd tax lien database system is designed to allow taxing entities the ability to release their own liens as well as the liens for the entities. Anyone can request a tax certificate. Texas does not sell tax lien. The fee is $10 and certificates are ready in three to five business days. Tax lien certificates and tax liens in.

Texas Does Not Sell Tax Lien.

Tax lien certificates and tax liens in. A tax certificate issued through fraud or collusion is void. The fee is $10 and certificates are ready in three to five business days. The mhd tax lien database system is designed to allow taxing entities the ability to release their own liens as well as the liens for the entities.

Anyone Can Request A Tax Certificate.

The property tax assistance division at the texas comptroller of public accounts. Tax liens which are evidence a tax delinquency are satisfied only by the sale of the property in texas.

![[L6] Resumo Aula Tax Lien e Tax Deed O Caçador de Títulos](https://ocacadordetitulos.com/wp-content/uploads/2023/05/Tax-Lien-Certificate-Cheat-Sheet.jpg)