Tax Lien Sale California

Tax Lien Sale California - The tax sale is conducted pursuant to the california revenue and taxation code beginning with section 3691. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. Refer to section 3712 of the california revenue and taxation code regarding liens and encumbrances on a property sold at a.

Refer to section 3712 of the california revenue and taxation code regarding liens and encumbrances on a property sold at a. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. The tax sale is conducted pursuant to the california revenue and taxation code beginning with section 3691.

The tax sale is conducted pursuant to the california revenue and taxation code beginning with section 3691. Refer to section 3712 of the california revenue and taxation code regarding liens and encumbrances on a property sold at a. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more.

NYC Tax Lien Sale Reform Conference EastNewYorkCLT

The tax sale is conducted pursuant to the california revenue and taxation code beginning with section 3691. Refer to section 3712 of the california revenue and taxation code regarding liens and encumbrances on a property sold at a. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for.

EasytoUnderstand Tax Lien Code Certificates Posteezy

Refer to section 3712 of the california revenue and taxation code regarding liens and encumbrances on a property sold at a. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. The tax sale is conducted pursuant to the california revenue and taxation code beginning.

Tax Lien Foreclosure Update Levitt & Slafkes, P.C.

Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. The tax sale is conducted pursuant to the california revenue and taxation code beginning with section 3691. Refer to section 3712 of the california revenue and taxation code regarding liens and encumbrances on a property.

NYC Tax Lien Sale Information Session Jamaica311

Refer to section 3712 of the california revenue and taxation code regarding liens and encumbrances on a property sold at a. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. The tax sale is conducted pursuant to the california revenue and taxation code beginning.

Property Tax Lien Sale Program Extended by City Council CityLand CityLand

Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. The tax sale is conducted pursuant to the california revenue and taxation code beginning with section 3691. Refer to section 3712 of the california revenue and taxation code regarding liens and encumbrances on a property.

Tax Lien Focus Group Real Estate And Profit Acceleration Enjoy Your

Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. Refer to section 3712 of the california revenue and taxation code regarding liens and encumbrances on a property sold at a. The tax sale is conducted pursuant to the california revenue and taxation code beginning.

Informational Brochure About the Tax Lien Sale EastNewYorkCLT

The tax sale is conducted pursuant to the california revenue and taxation code beginning with section 3691. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. Refer to section 3712 of the california revenue and taxation code regarding liens and encumbrances on a property.

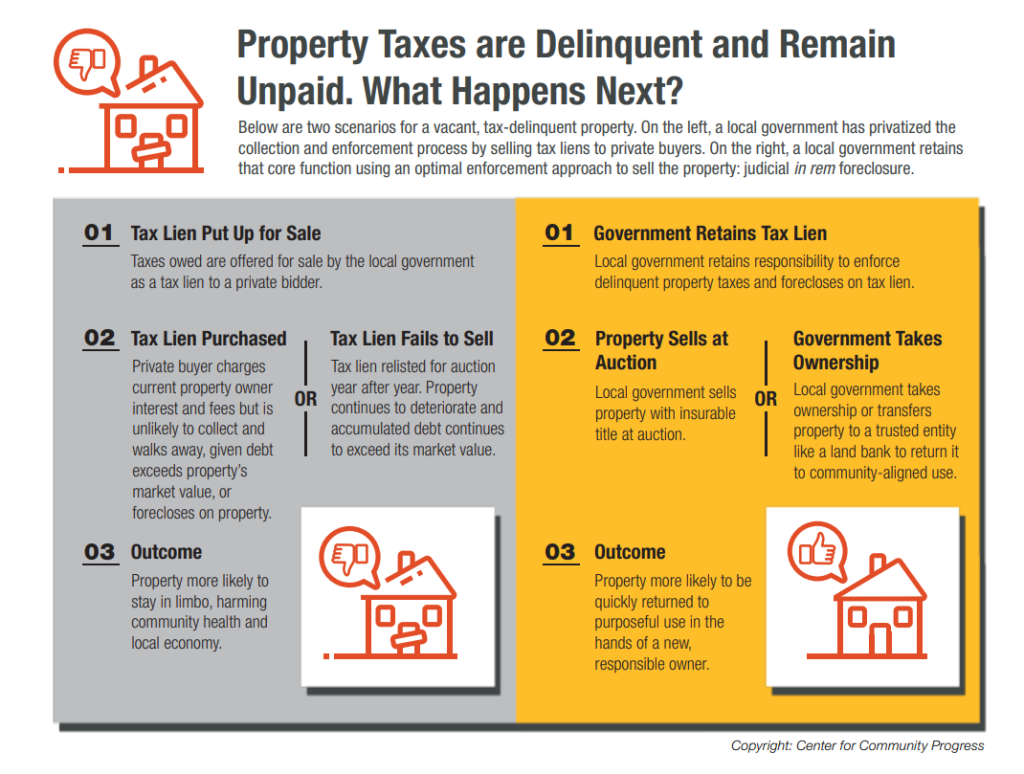

What Is a Tax Lien Sale and Why Is It a Bad Way of Dealing with Vacant

The tax sale is conducted pursuant to the california revenue and taxation code beginning with section 3691. Refer to section 3712 of the california revenue and taxation code regarding liens and encumbrances on a property sold at a. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for.

Pursuant to the Tax Lien, Tax May be Collected from Estate Property in

Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. The tax sale is conducted pursuant to the california revenue and taxation code beginning with section 3691. Refer to section 3712 of the california revenue and taxation code regarding liens and encumbrances on a property.

Tax Lien Sale San Juan County

Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. The tax sale is conducted pursuant to the california revenue and taxation code beginning with section 3691. Refer to section 3712 of the california revenue and taxation code regarding liens and encumbrances on a property.

The Tax Sale Is Conducted Pursuant To The California Revenue And Taxation Code Beginning With Section 3691.

Refer to section 3712 of the california revenue and taxation code regarding liens and encumbrances on a property sold at a. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more.