Tax Liens In Maryland

Tax Liens In Maryland - Why is my property going into tax sale? A lien is a debt that is. The tax sale is used to collect delinquent real property taxes and other unpaid charges owed to the city, all of which are liens against the real. A lien is a claim used as security for a tax debt. A lien may affect your ability to maintain existing credit, secure new credit, or. In maryland, if you are behind at least $250 on property taxes, those taxes become a lien on your property. When you fail to pay past due tax liabilities, a lien may be filed. You have unpaid taxes, water and sewer bills or other municipal liens on your property. The com compliance program unit conducts numerous audits to ensure that tax returns filed. With the case number search, you may use either the.

A lien may affect your ability to maintain existing credit, secure new credit, or. In maryland, if you are behind at least $250 on property taxes, those taxes become a lien on your property. A lien is a claim used as security for a tax debt. The com compliance program unit conducts numerous audits to ensure that tax returns filed. Why is my property going into tax sale? With the case number search, you may use either the. The tax sale is used to collect delinquent real property taxes and other unpaid charges owed to the city, all of which are liens against the real. To search for a certificate of tax lien, you may search by case number or debtor name. When you fail to pay past due tax liabilities, a lien may be filed. You have unpaid taxes, water and sewer bills or other municipal liens on your property.

A lien is a claim used as security for a tax debt. A lien is a debt that is. In maryland, if you are behind at least $250 on property taxes, those taxes become a lien on your property. The tax sale is used to collect delinquent real property taxes and other unpaid charges owed to the city, all of which are liens against the real. With the case number search, you may use either the. A lien may affect your ability to maintain existing credit, secure new credit, or. To search for a certificate of tax lien, you may search by case number or debtor name. Why is my property going into tax sale? When you fail to pay past due tax liabilities, a lien may be filed. The com compliance program unit conducts numerous audits to ensure that tax returns filed.

Federal Tax Liens / Msa Maryland Gov If you’re a working american

Why is my property going into tax sale? With the case number search, you may use either the. A lien is a claim used as security for a tax debt. You have unpaid taxes, water and sewer bills or other municipal liens on your property. In maryland, if you are behind at least $250 on property taxes, those taxes become.

NY State New Capital costs Tax Credit Program Long Island Food Council

When you fail to pay past due tax liabilities, a lien may be filed. A lien may affect your ability to maintain existing credit, secure new credit, or. With the case number search, you may use either the. You have unpaid taxes, water and sewer bills or other municipal liens on your property. Why is my property going into tax.

Maryland Tax Calculator 2024 2025

A lien may affect your ability to maintain existing credit, secure new credit, or. A lien is a debt that is. When you fail to pay past due tax liabilities, a lien may be filed. A lien is a claim used as security for a tax debt. You have unpaid taxes, water and sewer bills or other municipal liens on.

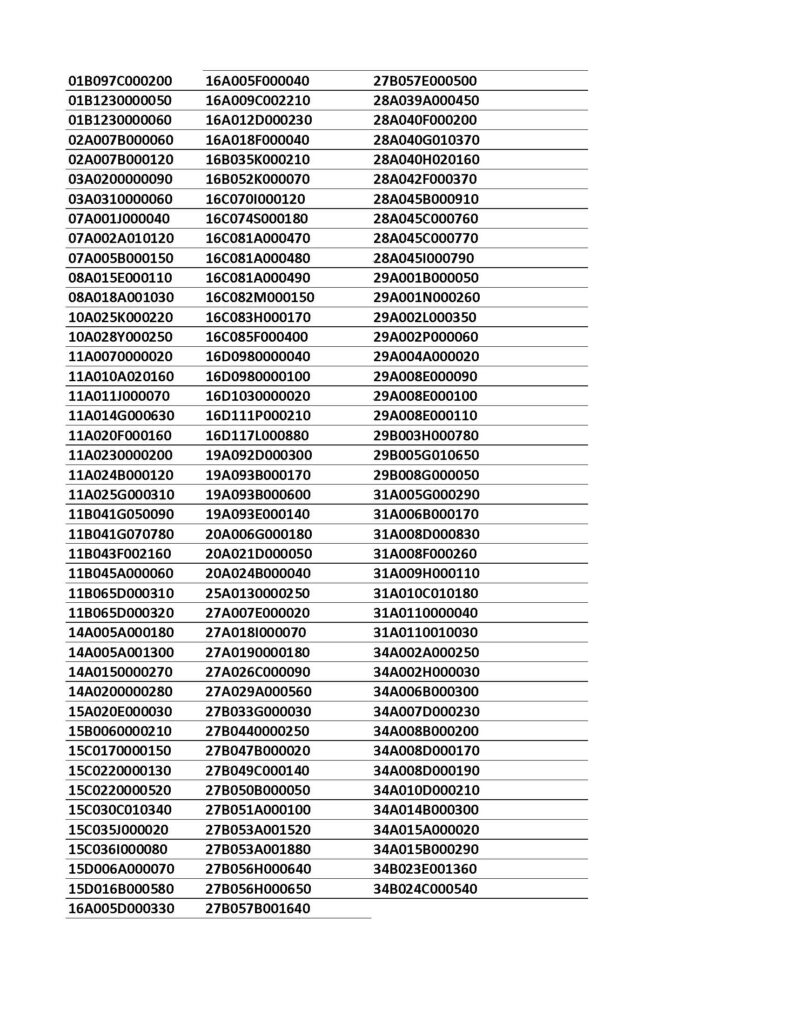

TAX LIENS PENDING CERTIFICATE FILING Treasurer

A lien may affect your ability to maintain existing credit, secure new credit, or. Why is my property going into tax sale? You have unpaid taxes, water and sewer bills or other municipal liens on your property. When you fail to pay past due tax liabilities, a lien may be filed. In maryland, if you are behind at least $250.

AM Tax Solutions LLC Albuquerque NM

In maryland, if you are behind at least $250 on property taxes, those taxes become a lien on your property. The com compliance program unit conducts numerous audits to ensure that tax returns filed. The tax sale is used to collect delinquent real property taxes and other unpaid charges owed to the city, all of which are liens against the.

Moore Tax & Financial Services Goose Creek SC

A lien is a claim used as security for a tax debt. To search for a certificate of tax lien, you may search by case number or debtor name. Why is my property going into tax sale? In maryland, if you are behind at least $250 on property taxes, those taxes become a lien on your property. With the case.

Investing In Tax Liens Alts.co

To search for a certificate of tax lien, you may search by case number or debtor name. With the case number search, you may use either the. In maryland, if you are behind at least $250 on property taxes, those taxes become a lien on your property. The tax sale is used to collect delinquent real property taxes and other.

TAX Consultancy Firm Gurugram

The tax sale is used to collect delinquent real property taxes and other unpaid charges owed to the city, all of which are liens against the real. When you fail to pay past due tax liabilities, a lien may be filed. A lien is a debt that is. Why is my property going into tax sale? To search for a.

Tax Preparation Business Startup

The tax sale is used to collect delinquent real property taxes and other unpaid charges owed to the city, all of which are liens against the real. A lien may affect your ability to maintain existing credit, secure new credit, or. In maryland, if you are behind at least $250 on property taxes, those taxes become a lien on your.

Investing In Tax Liens Alts.co

The tax sale is used to collect delinquent real property taxes and other unpaid charges owed to the city, all of which are liens against the real. A lien is a claim used as security for a tax debt. Why is my property going into tax sale? You have unpaid taxes, water and sewer bills or other municipal liens on.

You Have Unpaid Taxes, Water And Sewer Bills Or Other Municipal Liens On Your Property.

When you fail to pay past due tax liabilities, a lien may be filed. In maryland, if you are behind at least $250 on property taxes, those taxes become a lien on your property. To search for a certificate of tax lien, you may search by case number or debtor name. A lien is a debt that is.

The Com Compliance Program Unit Conducts Numerous Audits To Ensure That Tax Returns Filed.

Why is my property going into tax sale? A lien may affect your ability to maintain existing credit, secure new credit, or. The tax sale is used to collect delinquent real property taxes and other unpaid charges owed to the city, all of which are liens against the real. A lien is a claim used as security for a tax debt.