Tax Liens New Jersey

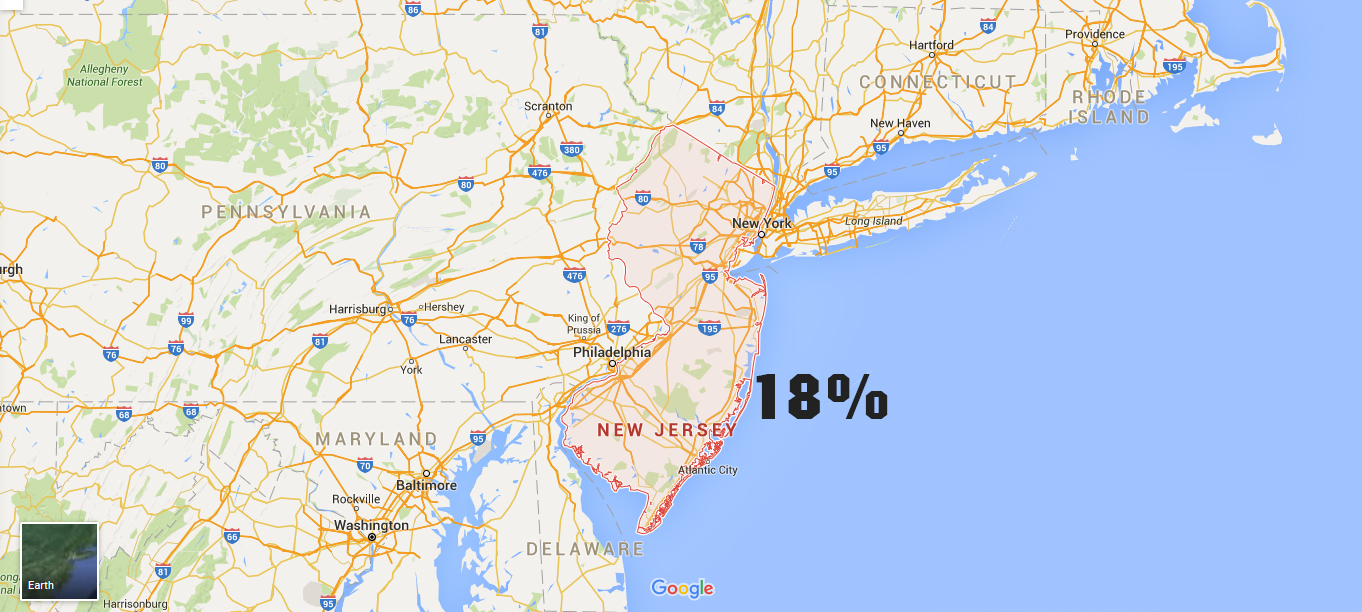

Tax Liens New Jersey - In new jersey, unpaid property taxes become a lien (a legal claim for unpaid debt) against the property at 18% interest. Learn how tax foreclosure and tax sales work in new jersey, and how they can be used as a redevelopment tool for abandoned properties. Every municipality in new jersey is required to have at least one sale of unpaid real estate taxes a year. All detail provided on our website is public information as. A tax lien is filed against you with the clerk of the new jersey superior court. We publish information pertaining to the largest uncollected tax liabilities owed to us. In new jersey, a cod is a tax lien filed against you. Cods are filed to secure tax debt and to protect the. A tax lien is the state's legal claim to your assets in relation to your unpaid tax liability. The winning buyer will be.

A tax lien is filed against you with the clerk of the new jersey superior court. We publish information pertaining to the largest uncollected tax liabilities owed to us. The winning buyer will be. Cods are filed to secure tax debt and to protect the. In new jersey, unpaid property taxes become a lien (a legal claim for unpaid debt) against the property at 18% interest. All detail provided on our website is public information as. In new jersey, a cod is a tax lien filed against you. A tax lien is the state's legal claim to your assets in relation to your unpaid tax liability. Every municipality in new jersey is required to have at least one sale of unpaid real estate taxes a year. Learn how tax foreclosure and tax sales work in new jersey, and how they can be used as a redevelopment tool for abandoned properties.

Every municipality in new jersey is required to have at least one sale of unpaid real estate taxes a year. Cods are filed to secure tax debt and to protect the. Learn how tax foreclosure and tax sales work in new jersey, and how they can be used as a redevelopment tool for abandoned properties. A tax lien is filed against you with the clerk of the new jersey superior court. We publish information pertaining to the largest uncollected tax liabilities owed to us. A tax lien is the state's legal claim to your assets in relation to your unpaid tax liability. The winning buyer will be. In new jersey, unpaid property taxes become a lien (a legal claim for unpaid debt) against the property at 18% interest. All detail provided on our website is public information as. In new jersey, a cod is a tax lien filed against you.

How to Buy Tax Liens in New Jersey (with Pictures) wikiHow

Every municipality in new jersey is required to have at least one sale of unpaid real estate taxes a year. We publish information pertaining to the largest uncollected tax liabilities owed to us. A tax lien is the state's legal claim to your assets in relation to your unpaid tax liability. In new jersey, a cod is a tax lien.

How to Buy Tax Liens in New Jersey (with Pictures) wikiHow

In new jersey, unpaid property taxes become a lien (a legal claim for unpaid debt) against the property at 18% interest. Learn how tax foreclosure and tax sales work in new jersey, and how they can be used as a redevelopment tool for abandoned properties. We publish information pertaining to the largest uncollected tax liabilities owed to us. In new.

Philippine Tax Academy

We publish information pertaining to the largest uncollected tax liabilities owed to us. All detail provided on our website is public information as. The winning buyer will be. A tax lien is filed against you with the clerk of the new jersey superior court. Cods are filed to secure tax debt and to protect the.

How to Buy Tax Liens in New Jersey (with Pictures) wikiHow

A tax lien is the state's legal claim to your assets in relation to your unpaid tax liability. All detail provided on our website is public information as. A tax lien is filed against you with the clerk of the new jersey superior court. Cods are filed to secure tax debt and to protect the. In new jersey, unpaid property.

How to Buy Tax Liens in New Jersey (with Pictures) wikiHow

Every municipality in new jersey is required to have at least one sale of unpaid real estate taxes a year. Cods are filed to secure tax debt and to protect the. A tax lien is filed against you with the clerk of the new jersey superior court. We publish information pertaining to the largest uncollected tax liabilities owed to us..

How to Buy Tax Liens in New Jersey (with Pictures) wikiHow

All detail provided on our website is public information as. The winning buyer will be. In new jersey, unpaid property taxes become a lien (a legal claim for unpaid debt) against the property at 18% interest. Every municipality in new jersey is required to have at least one sale of unpaid real estate taxes a year. Cods are filed to.

New Jersey Tax Liens Tax Lien & Deed Investment

All detail provided on our website is public information as. In new jersey, a cod is a tax lien filed against you. We publish information pertaining to the largest uncollected tax liabilities owed to us. Learn how tax foreclosure and tax sales work in new jersey, and how they can be used as a redevelopment tool for abandoned properties. A.

How to Buy Tax Liens in New Jersey (with Pictures) wikiHow

In new jersey, a cod is a tax lien filed against you. All detail provided on our website is public information as. Learn how tax foreclosure and tax sales work in new jersey, and how they can be used as a redevelopment tool for abandoned properties. Every municipality in new jersey is required to have at least one sale of.

How to Buy Tax Liens in New Jersey (with Pictures) wikiHow

Cods are filed to secure tax debt and to protect the. All detail provided on our website is public information as. A tax lien is the state's legal claim to your assets in relation to your unpaid tax liability. A tax lien is filed against you with the clerk of the new jersey superior court. We publish information pertaining to.

How to Buy Tax Liens in New Jersey (with Pictures) wikiHow

All detail provided on our website is public information as. A tax lien is filed against you with the clerk of the new jersey superior court. Cods are filed to secure tax debt and to protect the. We publish information pertaining to the largest uncollected tax liabilities owed to us. Learn how tax foreclosure and tax sales work in new.

Learn How Tax Foreclosure And Tax Sales Work In New Jersey, And How They Can Be Used As A Redevelopment Tool For Abandoned Properties.

Cods are filed to secure tax debt and to protect the. In new jersey, unpaid property taxes become a lien (a legal claim for unpaid debt) against the property at 18% interest. A tax lien is the state's legal claim to your assets in relation to your unpaid tax liability. Every municipality in new jersey is required to have at least one sale of unpaid real estate taxes a year.

The Winning Buyer Will Be.

In new jersey, a cod is a tax lien filed against you. We publish information pertaining to the largest uncollected tax liabilities owed to us. A tax lien is filed against you with the clerk of the new jersey superior court. All detail provided on our website is public information as.