Tax Refund After Chapter 7 Discharge

Tax Refund After Chapter 7 Discharge - Use a bankruptcy exemption to protect a tax refund you'll receive after filing chapter 7. A chapter 7 debtor's refund from a tax year before the bankruptcy was filed is property of the bankruptcy estate. As disposable income, a tax refund qualifies as an asset in bankruptcy. Keep reading for specific strategies. Code § 522 (d) (5), bankruptcy filers can claim a. Under some circumstances, your tax refund may be considered an asset that can be liquidated in chapter 7 bankruptcy. A tax refund is treated as cash or any other monetary asset when you file for chapter seven bankruptcy. The amount of money you have on.

A tax refund is treated as cash or any other monetary asset when you file for chapter seven bankruptcy. Code § 522 (d) (5), bankruptcy filers can claim a. Under some circumstances, your tax refund may be considered an asset that can be liquidated in chapter 7 bankruptcy. As disposable income, a tax refund qualifies as an asset in bankruptcy. A chapter 7 debtor's refund from a tax year before the bankruptcy was filed is property of the bankruptcy estate. Use a bankruptcy exemption to protect a tax refund you'll receive after filing chapter 7. Keep reading for specific strategies. The amount of money you have on.

Use a bankruptcy exemption to protect a tax refund you'll receive after filing chapter 7. As disposable income, a tax refund qualifies as an asset in bankruptcy. A chapter 7 debtor's refund from a tax year before the bankruptcy was filed is property of the bankruptcy estate. Keep reading for specific strategies. A tax refund is treated as cash or any other monetary asset when you file for chapter seven bankruptcy. Code § 522 (d) (5), bankruptcy filers can claim a. Under some circumstances, your tax refund may be considered an asset that can be liquidated in chapter 7 bankruptcy. The amount of money you have on.

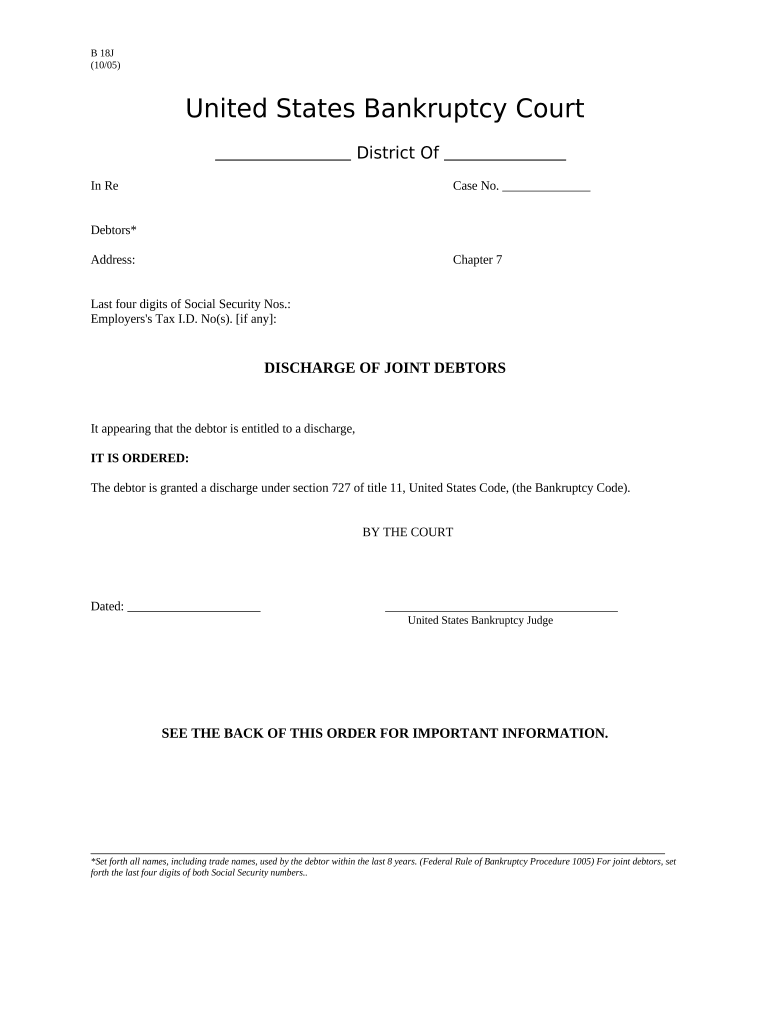

Discharge 7 Complete with ease airSlate SignNow

As disposable income, a tax refund qualifies as an asset in bankruptcy. Code § 522 (d) (5), bankruptcy filers can claim a. Under some circumstances, your tax refund may be considered an asset that can be liquidated in chapter 7 bankruptcy. A tax refund is treated as cash or any other monetary asset when you file for chapter seven bankruptcy..

The Chapter 7 Discharge Chapter 7 Bankruptcy Attorneys ARM Lawyers

The amount of money you have on. Keep reading for specific strategies. As disposable income, a tax refund qualifies as an asset in bankruptcy. A chapter 7 debtor's refund from a tax year before the bankruptcy was filed is property of the bankruptcy estate. A tax refund is treated as cash or any other monetary asset when you file for.

discharge of debtor chapter 7 YouTube

Code § 522 (d) (5), bankruptcy filers can claim a. A tax refund is treated as cash or any other monetary asset when you file for chapter seven bankruptcy. Keep reading for specific strategies. A chapter 7 debtor's refund from a tax year before the bankruptcy was filed is property of the bankruptcy estate. Use a bankruptcy exemption to protect.

SOLUTION Chapter 7 discharge Studypool

Use a bankruptcy exemption to protect a tax refund you'll receive after filing chapter 7. Keep reading for specific strategies. The amount of money you have on. As disposable income, a tax refund qualifies as an asset in bankruptcy. Under some circumstances, your tax refund may be considered an asset that can be liquidated in chapter 7 bankruptcy.

What is a Chapter 7 Discharge and How to Get a Copy Law & Crime News

Keep reading for specific strategies. As disposable income, a tax refund qualifies as an asset in bankruptcy. Under some circumstances, your tax refund may be considered an asset that can be liquidated in chapter 7 bankruptcy. Code § 522 (d) (5), bankruptcy filers can claim a. A tax refund is treated as cash or any other monetary asset when you.

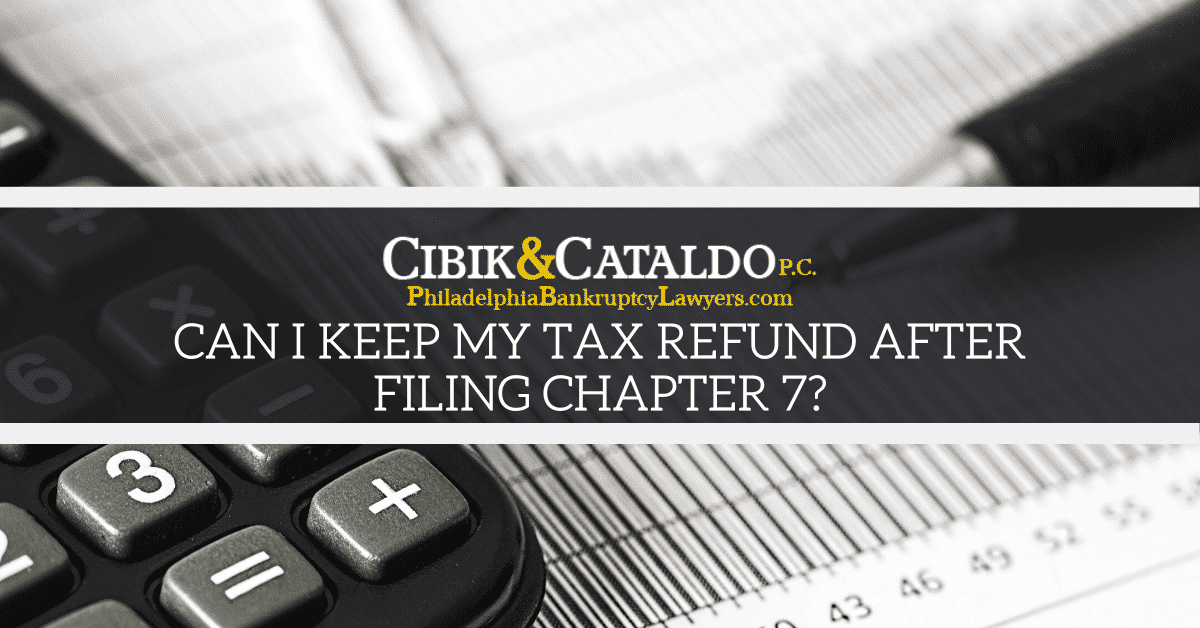

Can I Keep My Tax Refund After Filing Chapter 7? Cibik Law

Code § 522 (d) (5), bankruptcy filers can claim a. The amount of money you have on. Under some circumstances, your tax refund may be considered an asset that can be liquidated in chapter 7 bankruptcy. Keep reading for specific strategies. A tax refund is treated as cash or any other monetary asset when you file for chapter seven bankruptcy.

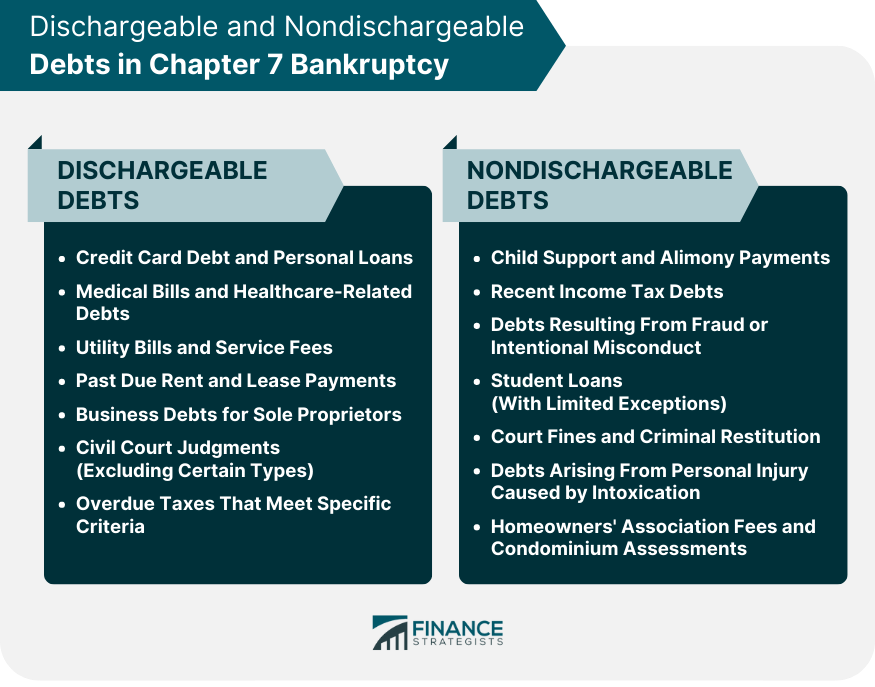

What Debts Are Discharged in Chapter 7 Bankruptcy?

As disposable income, a tax refund qualifies as an asset in bankruptcy. Use a bankruptcy exemption to protect a tax refund you'll receive after filing chapter 7. A chapter 7 debtor's refund from a tax year before the bankruptcy was filed is property of the bankruptcy estate. A tax refund is treated as cash or any other monetary asset when.

Chapter 7 and Chapter 13 Bankruptcy Tax Refund Eric Wilson

As disposable income, a tax refund qualifies as an asset in bankruptcy. A chapter 7 debtor's refund from a tax year before the bankruptcy was filed is property of the bankruptcy estate. A tax refund is treated as cash or any other monetary asset when you file for chapter seven bankruptcy. The amount of money you have on. Code §.

Chapter 7 Discharged Now What?! YouTube

As disposable income, a tax refund qualifies as an asset in bankruptcy. A chapter 7 debtor's refund from a tax year before the bankruptcy was filed is property of the bankruptcy estate. A tax refund is treated as cash or any other monetary asset when you file for chapter seven bankruptcy. Code § 522 (d) (5), bankruptcy filers can claim.

What happens to tax liens that survive the Chapter 7 discharge? YouTube

The amount of money you have on. A chapter 7 debtor's refund from a tax year before the bankruptcy was filed is property of the bankruptcy estate. Keep reading for specific strategies. A tax refund is treated as cash or any other monetary asset when you file for chapter seven bankruptcy. Code § 522 (d) (5), bankruptcy filers can claim.

Use A Bankruptcy Exemption To Protect A Tax Refund You'll Receive After Filing Chapter 7.

A tax refund is treated as cash or any other monetary asset when you file for chapter seven bankruptcy. Keep reading for specific strategies. The amount of money you have on. A chapter 7 debtor's refund from a tax year before the bankruptcy was filed is property of the bankruptcy estate.

As Disposable Income, A Tax Refund Qualifies As An Asset In Bankruptcy.

Under some circumstances, your tax refund may be considered an asset that can be liquidated in chapter 7 bankruptcy. Code § 522 (d) (5), bankruptcy filers can claim a.