Taxpayer Annual Local Earned Income Tax Return

Taxpayer Annual Local Earned Income Tax Return - Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. File with the local earned income tax collector for each tax collection district in which you lived during the year. Remit to the local earned income tax collector for every tax collection district in which you lived during the year. Our mission is to improve the quality of life for pennsylvania citizens while assuring transparency and accountability in the. Remit to the local earned income tax collector for every tax collection district in which you lived during the year. January 1 through december 31, unless otherwise noted. Learn about the definition, exemptions, credits and filing requirements of the local earned income tax in pennsylvania. File a local earned income tax return for each taxing jurisdiction.

Our mission is to improve the quality of life for pennsylvania citizens while assuring transparency and accountability in the. Learn about the definition, exemptions, credits and filing requirements of the local earned income tax in pennsylvania. Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. File with the local earned income tax collector for each tax collection district in which you lived during the year. Remit to the local earned income tax collector for every tax collection district in which you lived during the year. January 1 through december 31, unless otherwise noted. Remit to the local earned income tax collector for every tax collection district in which you lived during the year. File a local earned income tax return for each taxing jurisdiction.

File a local earned income tax return for each taxing jurisdiction. File with the local earned income tax collector for each tax collection district in which you lived during the year. January 1 through december 31, unless otherwise noted. Learn about the definition, exemptions, credits and filing requirements of the local earned income tax in pennsylvania. Our mission is to improve the quality of life for pennsylvania citizens while assuring transparency and accountability in the. Remit to the local earned income tax collector for every tax collection district in which you lived during the year. Remit to the local earned income tax collector for every tax collection district in which you lived during the year. Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence.

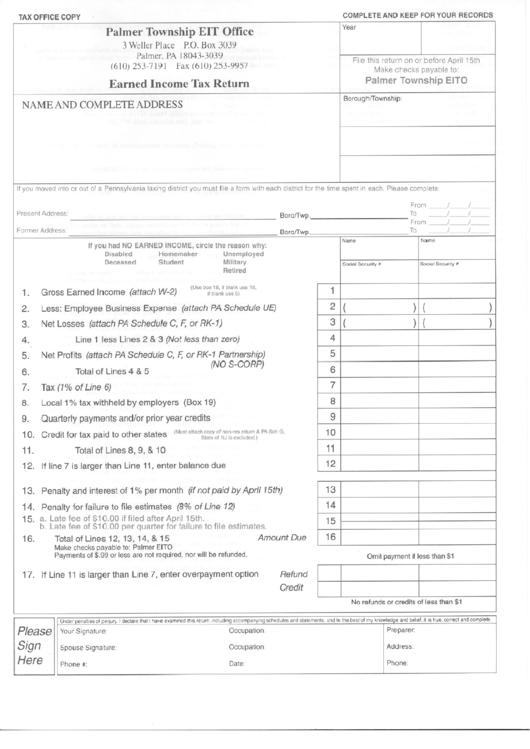

Earned Tax Return Form Palmer Township printable pdf download

Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. January 1 through december 31, unless otherwise noted. File with the local earned income tax collector for each tax collection district in which you lived during the year. Remit to the local earned income tax collector for every.

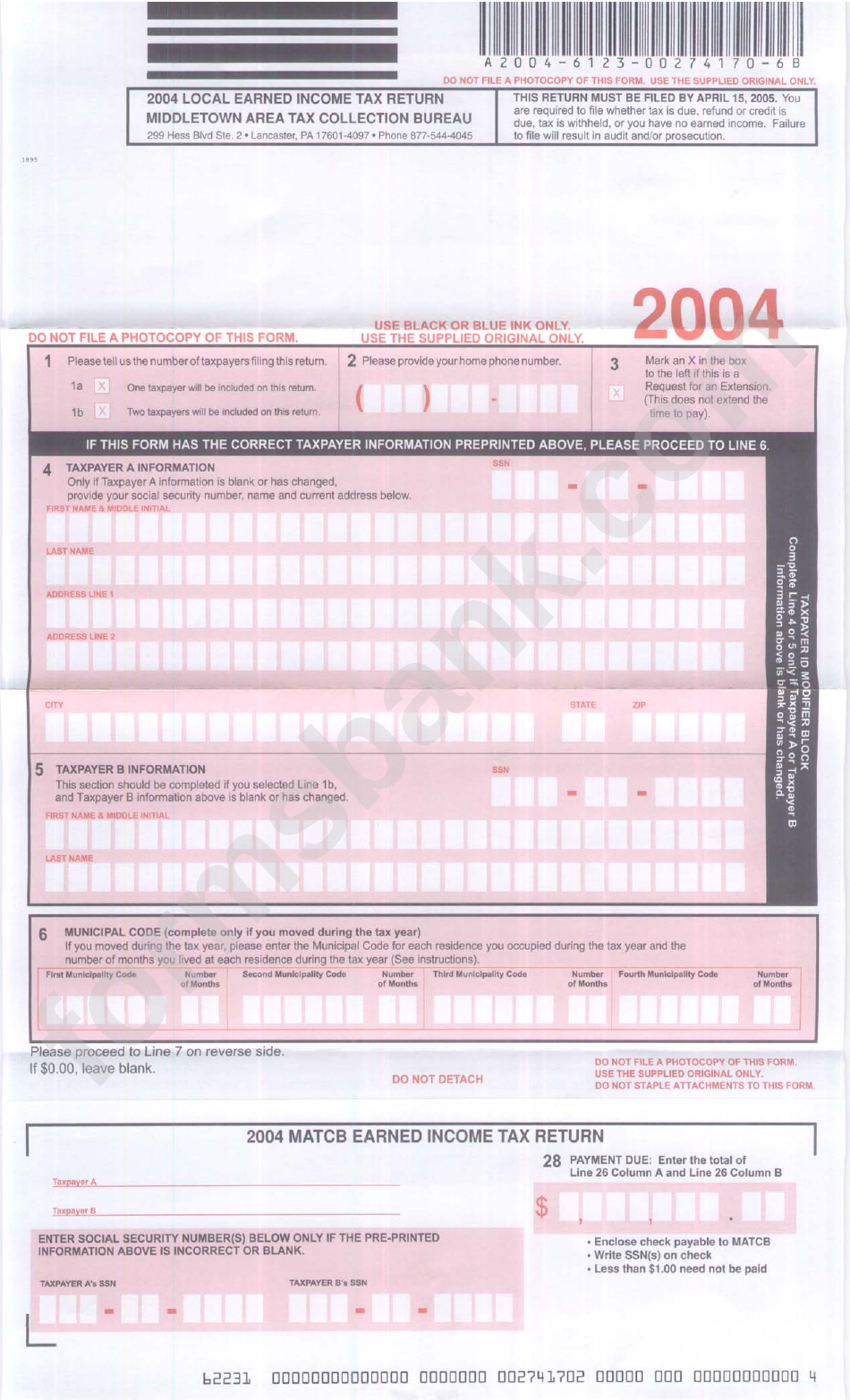

Local Earned Tax Return Form Middletown Area Tax Collection

Remit to the local earned income tax collector for every tax collection district in which you lived during the year. Our mission is to improve the quality of life for pennsylvania citizens while assuring transparency and accountability in the. January 1 through december 31, unless otherwise noted. Part year resident eit worksheet use this form if you have moved during.

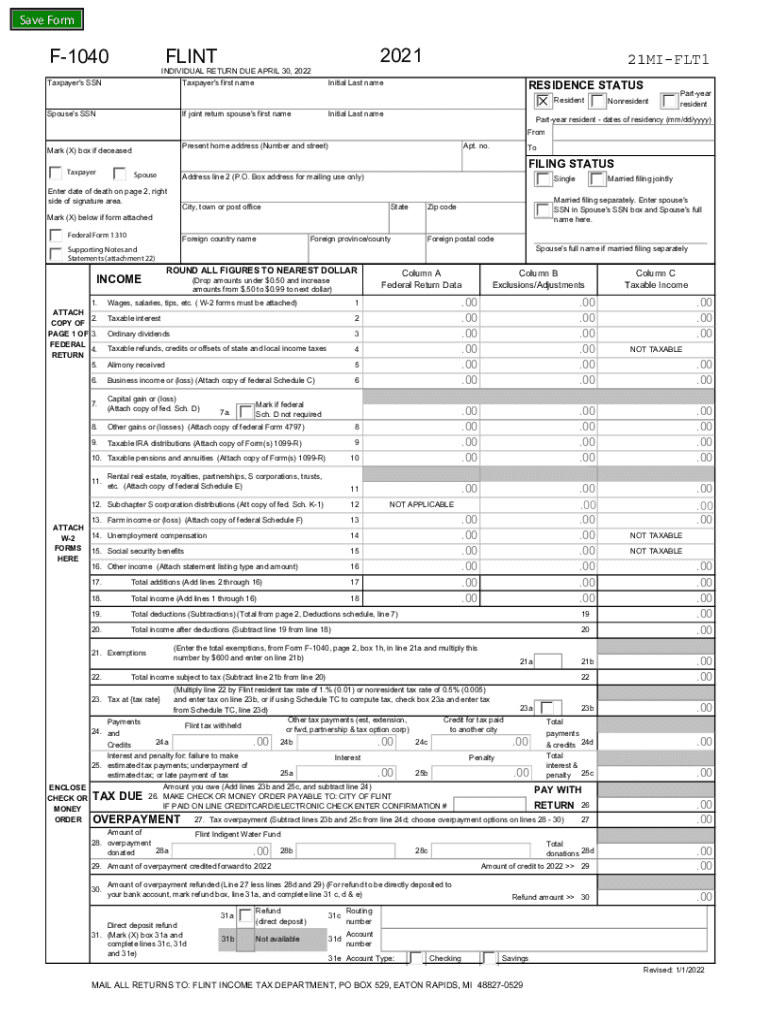

Fillable Online wpcontent uploadsTAXPAYER ANNUAL LOCAL

Remit to the local earned income tax collector for every tax collection district in which you lived during the year. Our mission is to improve the quality of life for pennsylvania citizens while assuring transparency and accountability in the. File a local earned income tax return for each taxing jurisdiction. January 1 through december 31, unless otherwise noted. Learn about.

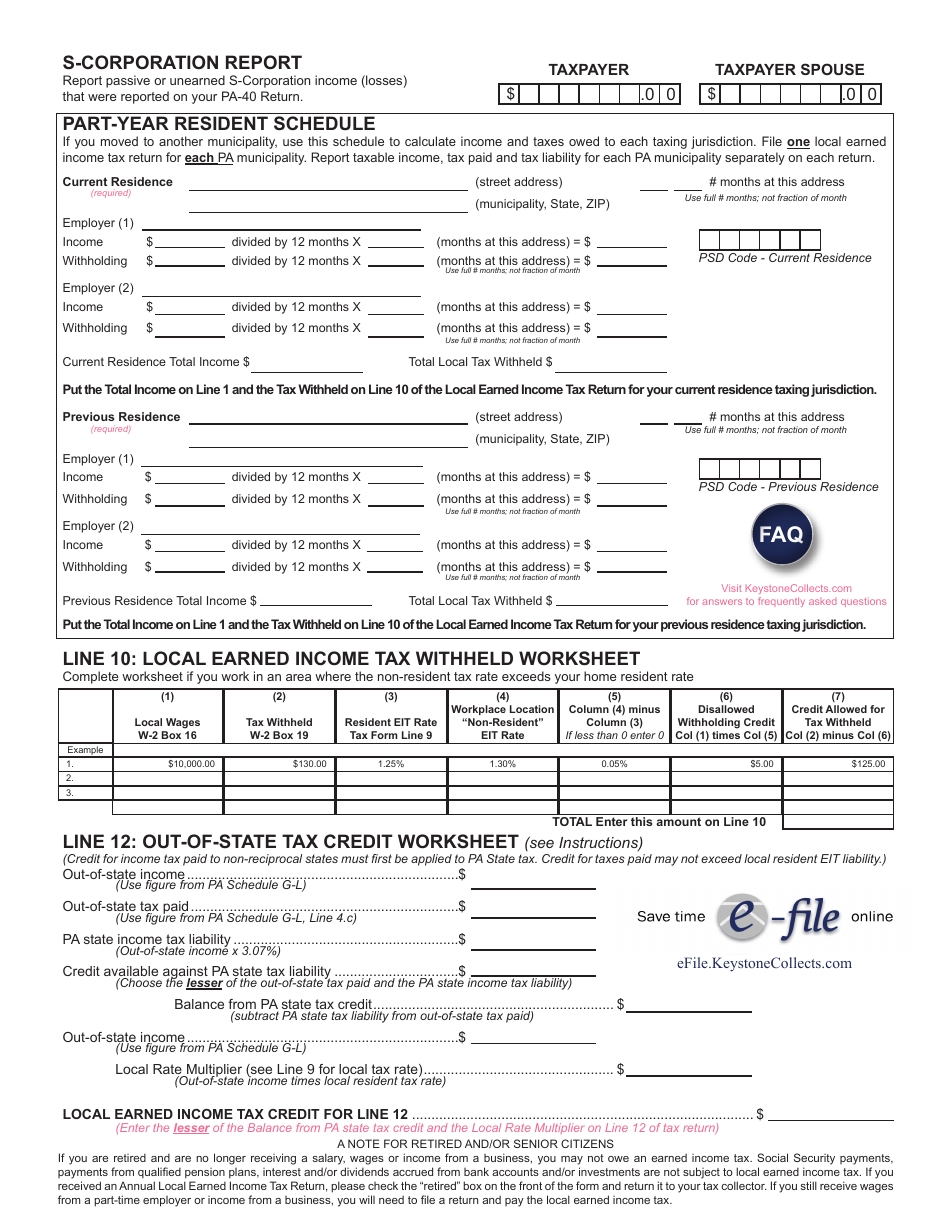

Local Earned Tax Return Form printable pdf download

File with the local earned income tax collector for each tax collection district in which you lived during the year. Remit to the local earned income tax collector for every tax collection district in which you lived during the year. Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to.

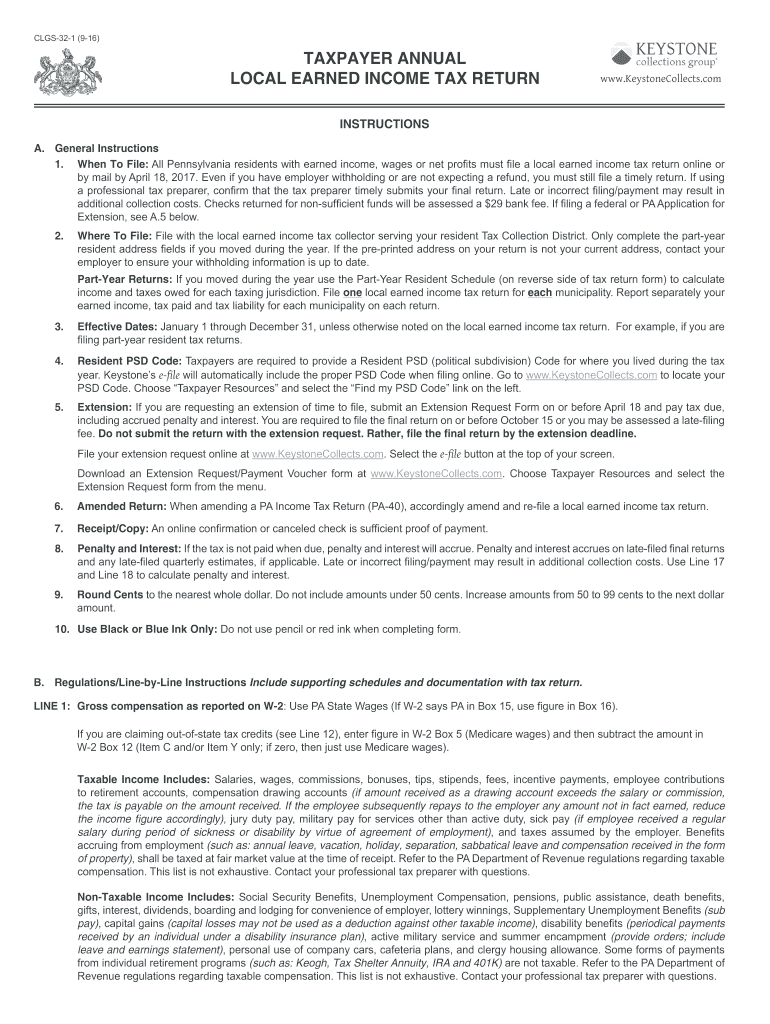

Form CLGS321 Download Fillable PDF or Fill Online Taxpayer Annual

Remit to the local earned income tax collector for every tax collection district in which you lived during the year. Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. File a local earned income tax return for each taxing jurisdiction. Our mission is to improve the quality.

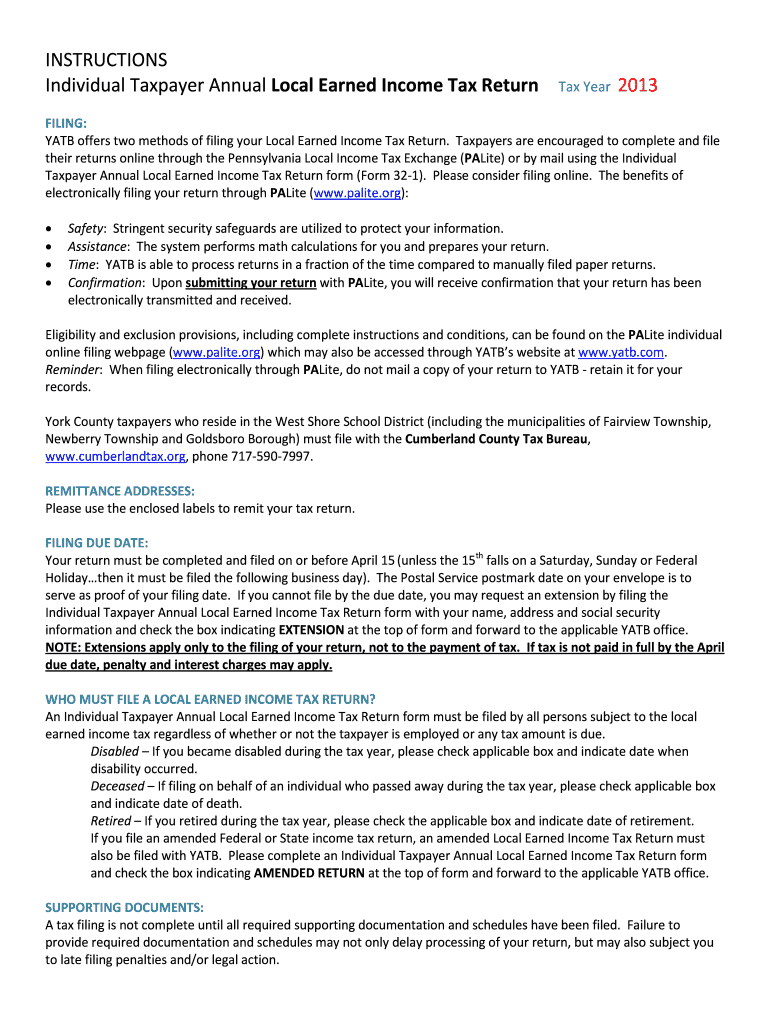

Fillable Online Individual Taxpayer Annual Local Earned Tax

Remit to the local earned income tax collector for every tax collection district in which you lived during the year. Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. Remit to the local earned income tax collector for every tax collection district in which you lived during.

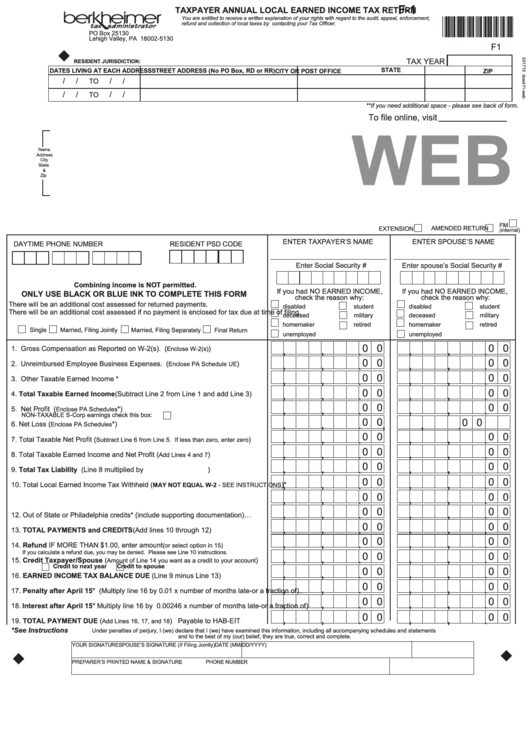

Fillable Form F 1 Taxpayer Annual Local Earned Tax Return

Learn about the definition, exemptions, credits and filing requirements of the local earned income tax in pennsylvania. January 1 through december 31, unless otherwise noted. Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. Remit to the local earned income tax collector for every tax collection district.

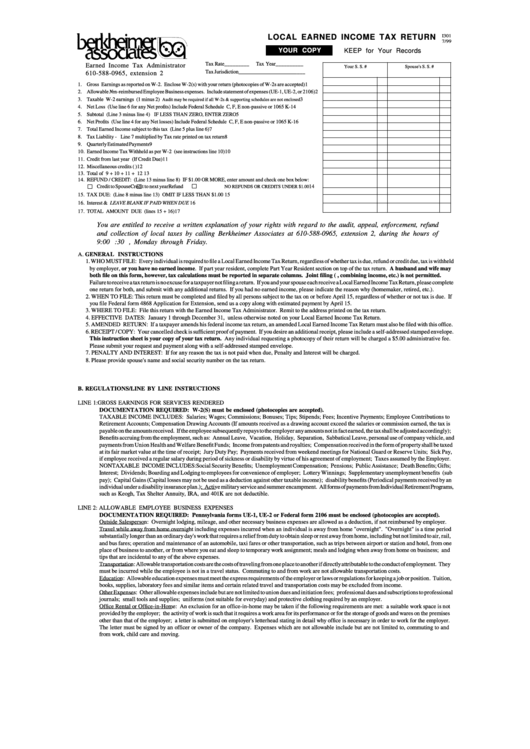

Local Earned Tax Return Form Berkheimer printable pdf download

January 1 through december 31, unless otherwise noted. Remit to the local earned income tax collector for every tax collection district in which you lived during the year. Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. File with the local earned income tax collector for each.

Fill LOCAL EARNED TAX RETURN TAXPAYER ANNUAL

File with the local earned income tax collector for each tax collection district in which you lived during the year. Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. Remit to the local earned income tax collector for every tax collection district in which you lived during.

Clgs 32 1 Fill out & sign online DocHub

File a local earned income tax return for each taxing jurisdiction. Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. January 1 through december 31, unless otherwise noted. Remit to the local earned income tax collector for every tax collection district in which you lived during the.

Our Mission Is To Improve The Quality Of Life For Pennsylvania Citizens While Assuring Transparency And Accountability In The.

Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. File a local earned income tax return for each taxing jurisdiction. January 1 through december 31, unless otherwise noted. Remit to the local earned income tax collector for every tax collection district in which you lived during the year.

Remit To The Local Earned Income Tax Collector For Every Tax Collection District In Which You Lived During The Year.

Learn about the definition, exemptions, credits and filing requirements of the local earned income tax in pennsylvania. File with the local earned income tax collector for each tax collection district in which you lived during the year.