Tennessee Tax Lien Sales

Tennessee Tax Lien Sales - The purpose of a tax sale auction is to collect delinquent revenue and put properties back into. When property taxes are delinquent and suit has been filed, the metropolitan government will.

The purpose of a tax sale auction is to collect delinquent revenue and put properties back into. When property taxes are delinquent and suit has been filed, the metropolitan government will.

When property taxes are delinquent and suit has been filed, the metropolitan government will. The purpose of a tax sale auction is to collect delinquent revenue and put properties back into.

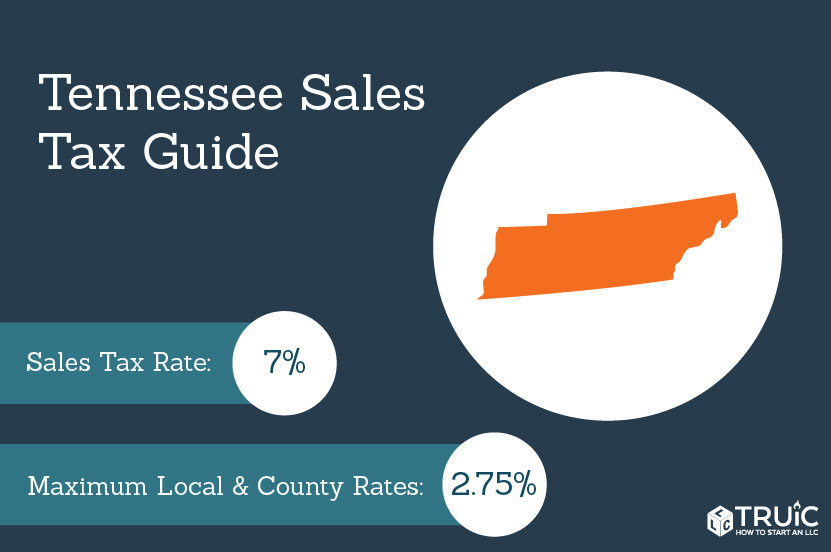

Tennessee Sales Tax Small Business Guide TRUiC

The purpose of a tax sale auction is to collect delinquent revenue and put properties back into. When property taxes are delinquent and suit has been filed, the metropolitan government will.

Tax Lien Investing Tips Which States have tax sales in the next 30

When property taxes are delinquent and suit has been filed, the metropolitan government will. The purpose of a tax sale auction is to collect delinquent revenue and put properties back into.

NC Tax Lien Sales Essential Insights for Investors

When property taxes are delinquent and suit has been filed, the metropolitan government will. The purpose of a tax sale auction is to collect delinquent revenue and put properties back into.

The Wonderful Benefits of Tax Lien Sales Michael Schuett

When property taxes are delinquent and suit has been filed, the metropolitan government will. The purpose of a tax sale auction is to collect delinquent revenue and put properties back into.

Tax Lien Focus Group Real Estate And Profit Acceleration Enjoy Your

When property taxes are delinquent and suit has been filed, the metropolitan government will. The purpose of a tax sale auction is to collect delinquent revenue and put properties back into.

Tax Lien Sale PDF Tax Lien Taxes

The purpose of a tax sale auction is to collect delinquent revenue and put properties back into. When property taxes are delinquent and suit has been filed, the metropolitan government will.

The Other Foreclosure Crisis Property Tax Lien Sales FORECLOSURE FRAUD

When property taxes are delinquent and suit has been filed, the metropolitan government will. The purpose of a tax sale auction is to collect delinquent revenue and put properties back into.

EasytoUnderstand Tax Lien Code Certificates Posteezy

The purpose of a tax sale auction is to collect delinquent revenue and put properties back into. When property taxes are delinquent and suit has been filed, the metropolitan government will.

COVID19 Impact on Tax Lien Sales Nationwide IssueWire

The purpose of a tax sale auction is to collect delinquent revenue and put properties back into. When property taxes are delinquent and suit has been filed, the metropolitan government will.

The Purpose Of A Tax Sale Auction Is To Collect Delinquent Revenue And Put Properties Back Into.

When property taxes are delinquent and suit has been filed, the metropolitan government will.