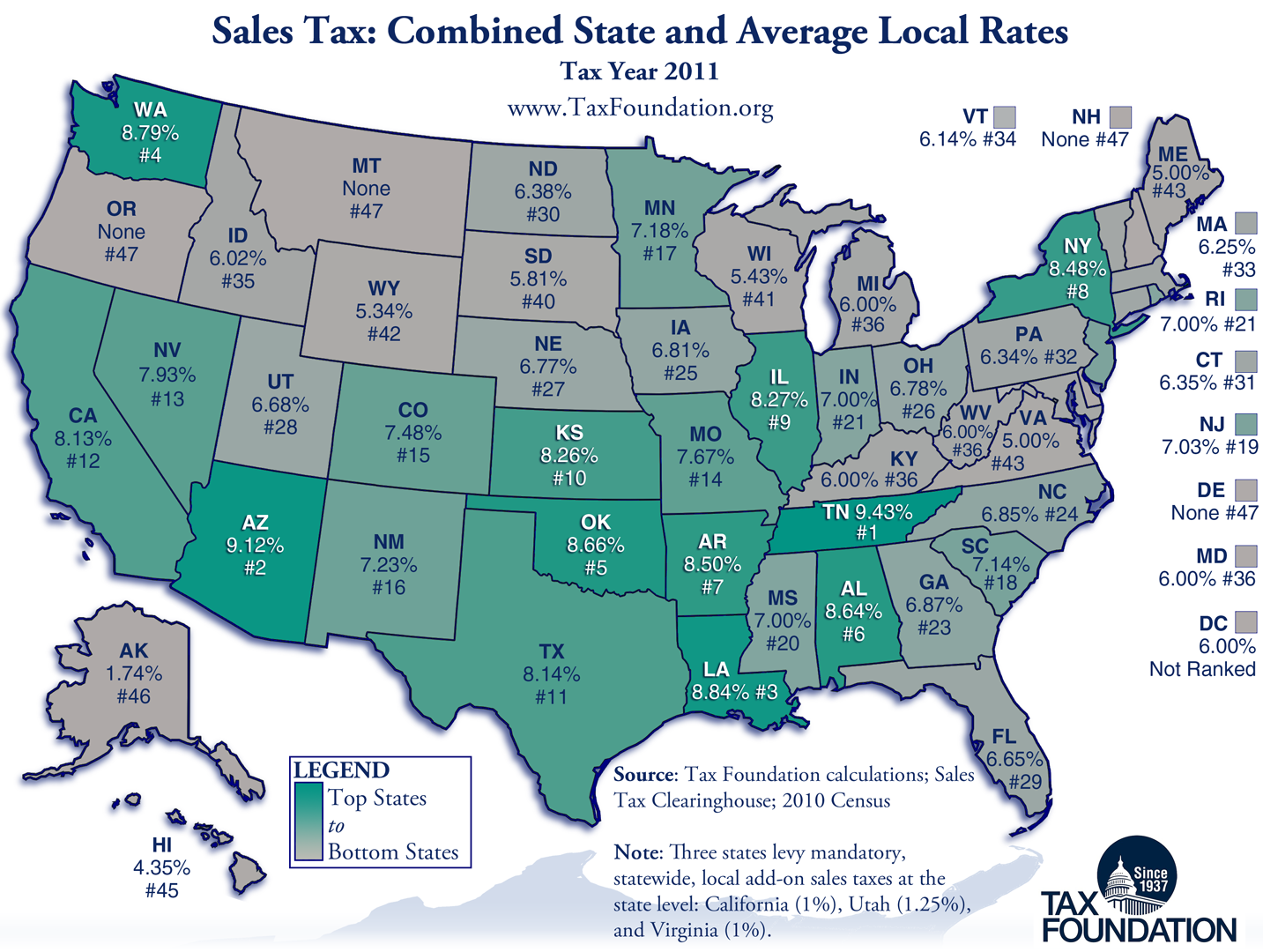

Texas Sales Tax Rate

Texas Sales Tax Rate - Sales and use tax applications. Collecting and paying the correct local tax rate is your. Sales tax filers, please validate the business location address shown on your permit to ensure local tax is being accurately reported. City sales and use tax. Depending on the tax, texas taxpayers may be required to electronically report (file) and/or pay based on the amount reported and paid in the preceding state fiscal year (september 1 to. Terminate or reinstate a business; Apply for a sales tax permit online! Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Local taxing jurisdictions (cities, counties, special purpose.

Local taxing jurisdictions (cities, counties, special purpose. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Terminate or reinstate a business; Collecting and paying the correct local tax rate is your. City sales and use tax. Sales tax filers, please validate the business location address shown on your permit to ensure local tax is being accurately reported. Sales and use tax applications. Depending on the tax, texas taxpayers may be required to electronically report (file) and/or pay based on the amount reported and paid in the preceding state fiscal year (september 1 to. Apply for a sales tax permit online!

Apply for a sales tax permit online! Collecting and paying the correct local tax rate is your. Terminate or reinstate a business; Local taxing jurisdictions (cities, counties, special purpose. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Sales tax filers, please validate the business location address shown on your permit to ensure local tax is being accurately reported. Depending on the tax, texas taxpayers may be required to electronically report (file) and/or pay based on the amount reported and paid in the preceding state fiscal year (september 1 to. Sales and use tax applications. City sales and use tax.

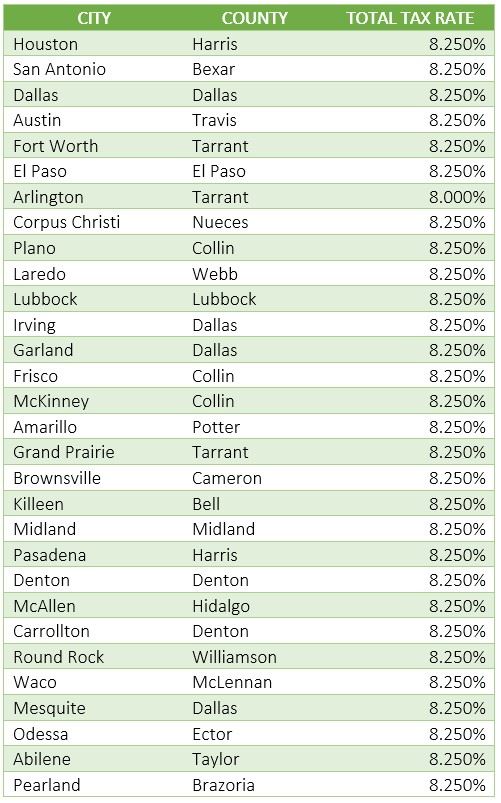

Printable Sales Tax Chart

Sales tax filers, please validate the business location address shown on your permit to ensure local tax is being accurately reported. Collecting and paying the correct local tax rate is your. Terminate or reinstate a business; Apply for a sales tax permit online! Depending on the tax, texas taxpayers may be required to electronically report (file) and/or pay based on.

Texas Sales Tax Chart

Terminate or reinstate a business; City sales and use tax. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Collecting and paying the correct local tax rate is your. Sales tax filers, please validate the business location address shown on your permit to ensure.

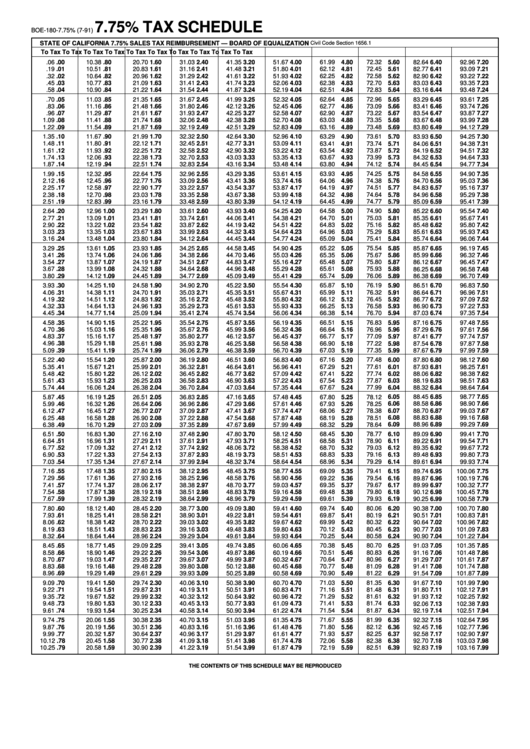

What Is Texas Sales Tax Rate 2024 Vivi Joletta

Apply for a sales tax permit online! Sales tax filers, please validate the business location address shown on your permit to ensure local tax is being accurately reported. Sales and use tax applications. Terminate or reinstate a business; Local taxing jurisdictions (cities, counties, special purpose.

Texas Sales Tax Holiday 2024 Alexa Marlane

Sales and use tax applications. Terminate or reinstate a business; Apply for a sales tax permit online! Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. City sales and use tax.

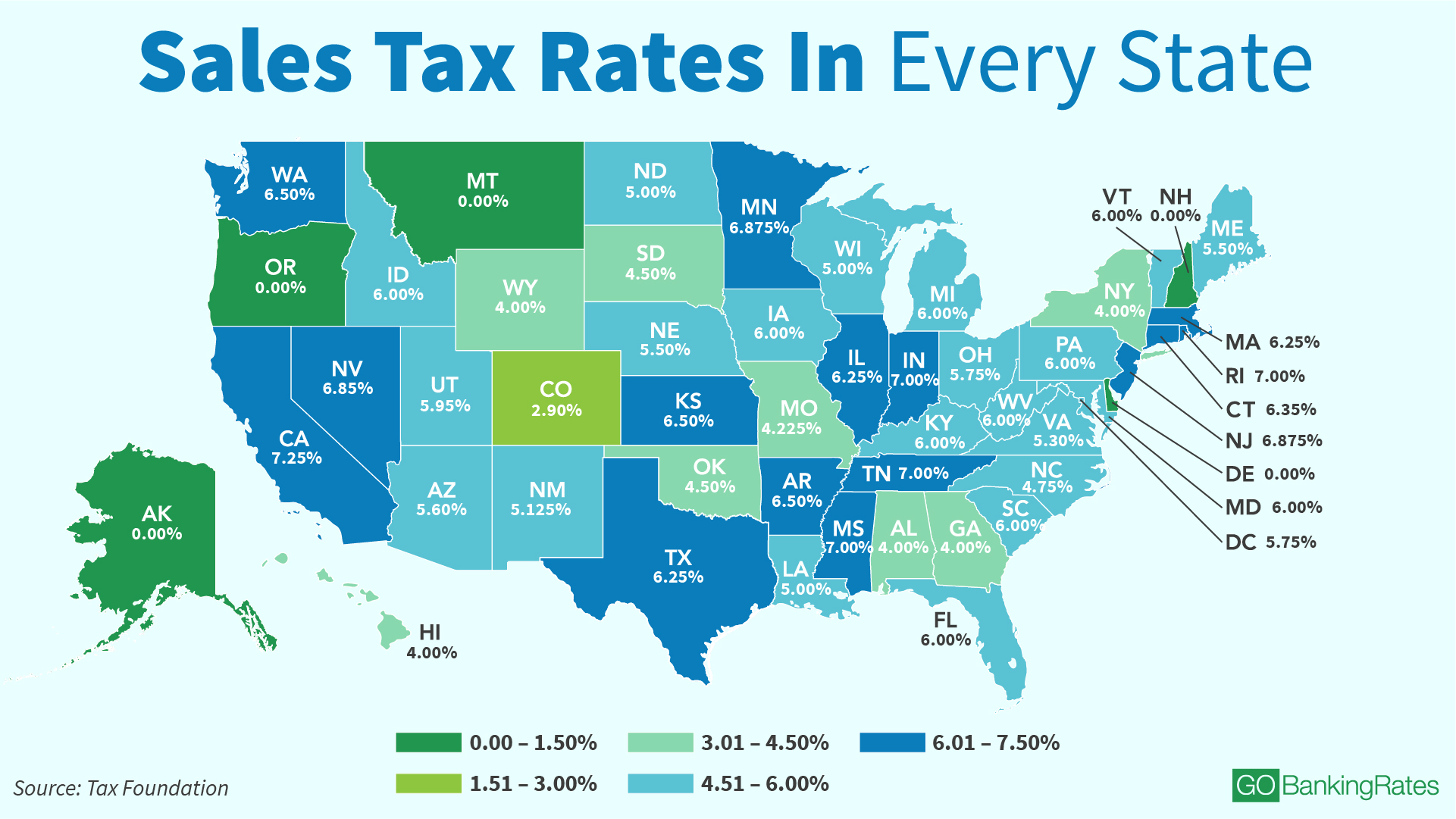

Texas Weekly Texas Weekly Vol 32 Issue 14 The Texas Tribune

Local taxing jurisdictions (cities, counties, special purpose. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Terminate or reinstate a business; Sales and use tax applications. Sales tax filers, please validate the business location address shown on your permit to ensure local tax is.

Texas Sales Tax Rate 2024 Jeanne Maudie

Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Local taxing jurisdictions (cities, counties, special purpose. City sales and use tax. Terminate or reinstate a business; Collecting and paying the correct local tax rate is your.

Sale Tax In Texas 2024 Berta Celinka

Depending on the tax, texas taxpayers may be required to electronically report (file) and/or pay based on the amount reported and paid in the preceding state fiscal year (september 1 to. Collecting and paying the correct local tax rate is your. Sales tax filers, please validate the business location address shown on your permit to ensure local tax is being.

Sales Tax Rate Texas 2024 Karee Marjory

Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Apply for a sales tax permit online! City sales and use tax. Sales tax filers, please validate the business location address shown on your permit to ensure local tax is being accurately reported. Local taxing.

Texas Sales Tax Rate Tax Sales Tax Sales Chart And if you’re

Collecting and paying the correct local tax rate is your. City sales and use tax. Apply for a sales tax permit online! Sales and use tax applications. Terminate or reinstate a business;

Ultimate Texas Sales Tax Guide Zamp

Sales and use tax applications. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Local taxing jurisdictions (cities, counties, special purpose. Depending on the tax, texas taxpayers may be required to electronically report (file) and/or pay based on the amount reported and paid in.

City Sales And Use Tax.

Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Terminate or reinstate a business; Local taxing jurisdictions (cities, counties, special purpose. Sales and use tax applications.

Apply For A Sales Tax Permit Online!

Sales tax filers, please validate the business location address shown on your permit to ensure local tax is being accurately reported. Collecting and paying the correct local tax rate is your. Depending on the tax, texas taxpayers may be required to electronically report (file) and/or pay based on the amount reported and paid in the preceding state fiscal year (september 1 to.

.png)