Tucson Local Tax Rates

Tucson Local Tax Rates - The 8.7% sales tax rate in tucson consists of 5.6% arizona state sales tax, 0.5% pima county sales tax and 2.6% tucson tax. The minimum combined 2025 sales tax rate for tucson, arizona is 8.7%. This is the total of state, county, and city sales tax rates. The tucson, arizona sales tax is 8.60%, consisting of 5.60% arizona state sales tax and 3.00% tucson local sales taxes.the local sales tax consists of a.

The tucson, arizona sales tax is 8.60%, consisting of 5.60% arizona state sales tax and 3.00% tucson local sales taxes.the local sales tax consists of a. The 8.7% sales tax rate in tucson consists of 5.6% arizona state sales tax, 0.5% pima county sales tax and 2.6% tucson tax. This is the total of state, county, and city sales tax rates. The minimum combined 2025 sales tax rate for tucson, arizona is 8.7%.

This is the total of state, county, and city sales tax rates. The tucson, arizona sales tax is 8.60%, consisting of 5.60% arizona state sales tax and 3.00% tucson local sales taxes.the local sales tax consists of a. The 8.7% sales tax rate in tucson consists of 5.6% arizona state sales tax, 0.5% pima county sales tax and 2.6% tucson tax. The minimum combined 2025 sales tax rate for tucson, arizona is 8.7%.

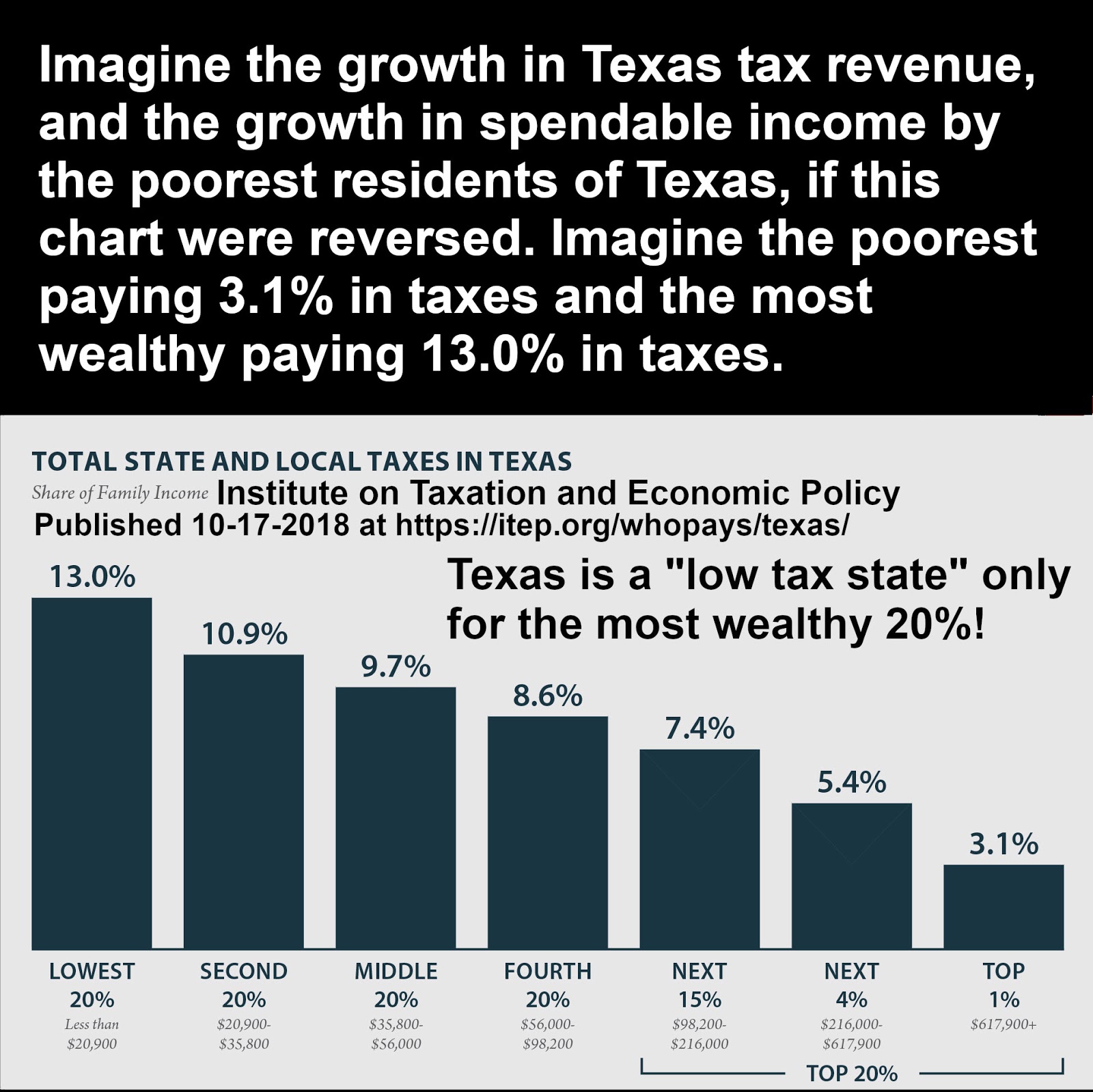

Bill Betzen's Blog Flip Texas State and Local Tax Rates for Prosperity

The minimum combined 2025 sales tax rate for tucson, arizona is 8.7%. This is the total of state, county, and city sales tax rates. The 8.7% sales tax rate in tucson consists of 5.6% arizona state sales tax, 0.5% pima county sales tax and 2.6% tucson tax. The tucson, arizona sales tax is 8.60%, consisting of 5.60% arizona state sales.

City Of Tucson Sales Tax Rate 2018 Tax Walls

The 8.7% sales tax rate in tucson consists of 5.6% arizona state sales tax, 0.5% pima county sales tax and 2.6% tucson tax. This is the total of state, county, and city sales tax rates. The minimum combined 2025 sales tax rate for tucson, arizona is 8.7%. The tucson, arizona sales tax is 8.60%, consisting of 5.60% arizona state sales.

State local effective tax rates map Infogram

The 8.7% sales tax rate in tucson consists of 5.6% arizona state sales tax, 0.5% pima county sales tax and 2.6% tucson tax. The minimum combined 2025 sales tax rate for tucson, arizona is 8.7%. This is the total of state, county, and city sales tax rates. The tucson, arizona sales tax is 8.60%, consisting of 5.60% arizona state sales.

Monday Map State and Local Sales Tax Rates, 2011 Tax Foundation

The 8.7% sales tax rate in tucson consists of 5.6% arizona state sales tax, 0.5% pima county sales tax and 2.6% tucson tax. The minimum combined 2025 sales tax rate for tucson, arizona is 8.7%. The tucson, arizona sales tax is 8.60%, consisting of 5.60% arizona state sales tax and 3.00% tucson local sales taxes.the local sales tax consists of.

Monday Map Combined State and Local Sales Tax Rates

The minimum combined 2025 sales tax rate for tucson, arizona is 8.7%. This is the total of state, county, and city sales tax rates. The tucson, arizona sales tax is 8.60%, consisting of 5.60% arizona state sales tax and 3.00% tucson local sales taxes.the local sales tax consists of a. The 8.7% sales tax rate in tucson consists of 5.6%.

Tucson Tax Team Tax Services 6111 E Grant Rd, Tucson, AZ Phone

This is the total of state, county, and city sales tax rates. The minimum combined 2025 sales tax rate for tucson, arizona is 8.7%. The tucson, arizona sales tax is 8.60%, consisting of 5.60% arizona state sales tax and 3.00% tucson local sales taxes.the local sales tax consists of a. The 8.7% sales tax rate in tucson consists of 5.6%.

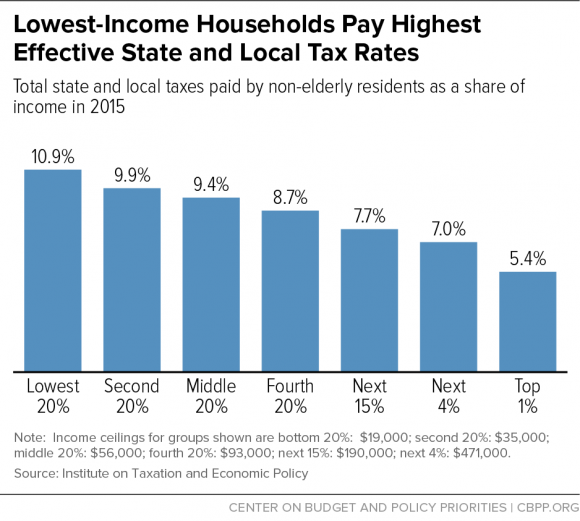

Households Pay Highest Effective State & Local Tax Rates

This is the total of state, county, and city sales tax rates. The 8.7% sales tax rate in tucson consists of 5.6% arizona state sales tax, 0.5% pima county sales tax and 2.6% tucson tax. The minimum combined 2025 sales tax rate for tucson, arizona is 8.7%. The tucson, arizona sales tax is 8.60%, consisting of 5.60% arizona state sales.

tucson sales tax rate change He Was A Great Cyberzine Art Gallery

The 8.7% sales tax rate in tucson consists of 5.6% arizona state sales tax, 0.5% pima county sales tax and 2.6% tucson tax. This is the total of state, county, and city sales tax rates. The minimum combined 2025 sales tax rate for tucson, arizona is 8.7%. The tucson, arizona sales tax is 8.60%, consisting of 5.60% arizona state sales.

Tucson water rates higher than Phx, usage lower here

The tucson, arizona sales tax is 8.60%, consisting of 5.60% arizona state sales tax and 3.00% tucson local sales taxes.the local sales tax consists of a. The minimum combined 2025 sales tax rate for tucson, arizona is 8.7%. The 8.7% sales tax rate in tucson consists of 5.6% arizona state sales tax, 0.5% pima county sales tax and 2.6% tucson.

Combined State and Average Local Sales Tax Rates Tax Foundation

The tucson, arizona sales tax is 8.60%, consisting of 5.60% arizona state sales tax and 3.00% tucson local sales taxes.the local sales tax consists of a. The 8.7% sales tax rate in tucson consists of 5.6% arizona state sales tax, 0.5% pima county sales tax and 2.6% tucson tax. The minimum combined 2025 sales tax rate for tucson, arizona is.

The 8.7% Sales Tax Rate In Tucson Consists Of 5.6% Arizona State Sales Tax, 0.5% Pima County Sales Tax And 2.6% Tucson Tax.

The minimum combined 2025 sales tax rate for tucson, arizona is 8.7%. This is the total of state, county, and city sales tax rates. The tucson, arizona sales tax is 8.60%, consisting of 5.60% arizona state sales tax and 3.00% tucson local sales taxes.the local sales tax consists of a.

.png)

.png)