Unemployment Fl Tax Form

Unemployment Fl Tax Form - An employer liable for reemployment tax may select an annual filing option if all the employees exclusively perform services that constitute. You can report and pay reemployment tax using the florida department of revenue's secure website, or you may choose to: Visit the florida department of commerce's tax information. The florida department of economic opportunity (deo) encourages all floridians who have lost their job as a direct. You must file reports and pay taxes online through the florida department of revenue if you paid reemployment taxes for 10 or more employees. Learn more about applying for unemployment benefits, including eligibility requirements, benefit payment amounts, and how to apply. The department recommends that employers register to pay reemployment tax using the online florida business tax application, or complete.

Visit the florida department of commerce's tax information. You must file reports and pay taxes online through the florida department of revenue if you paid reemployment taxes for 10 or more employees. An employer liable for reemployment tax may select an annual filing option if all the employees exclusively perform services that constitute. Learn more about applying for unemployment benefits, including eligibility requirements, benefit payment amounts, and how to apply. The florida department of economic opportunity (deo) encourages all floridians who have lost their job as a direct. You can report and pay reemployment tax using the florida department of revenue's secure website, or you may choose to: The department recommends that employers register to pay reemployment tax using the online florida business tax application, or complete.

The department recommends that employers register to pay reemployment tax using the online florida business tax application, or complete. An employer liable for reemployment tax may select an annual filing option if all the employees exclusively perform services that constitute. You must file reports and pay taxes online through the florida department of revenue if you paid reemployment taxes for 10 or more employees. The florida department of economic opportunity (deo) encourages all floridians who have lost their job as a direct. Visit the florida department of commerce's tax information. You can report and pay reemployment tax using the florida department of revenue's secure website, or you may choose to: Learn more about applying for unemployment benefits, including eligibility requirements, benefit payment amounts, and how to apply.

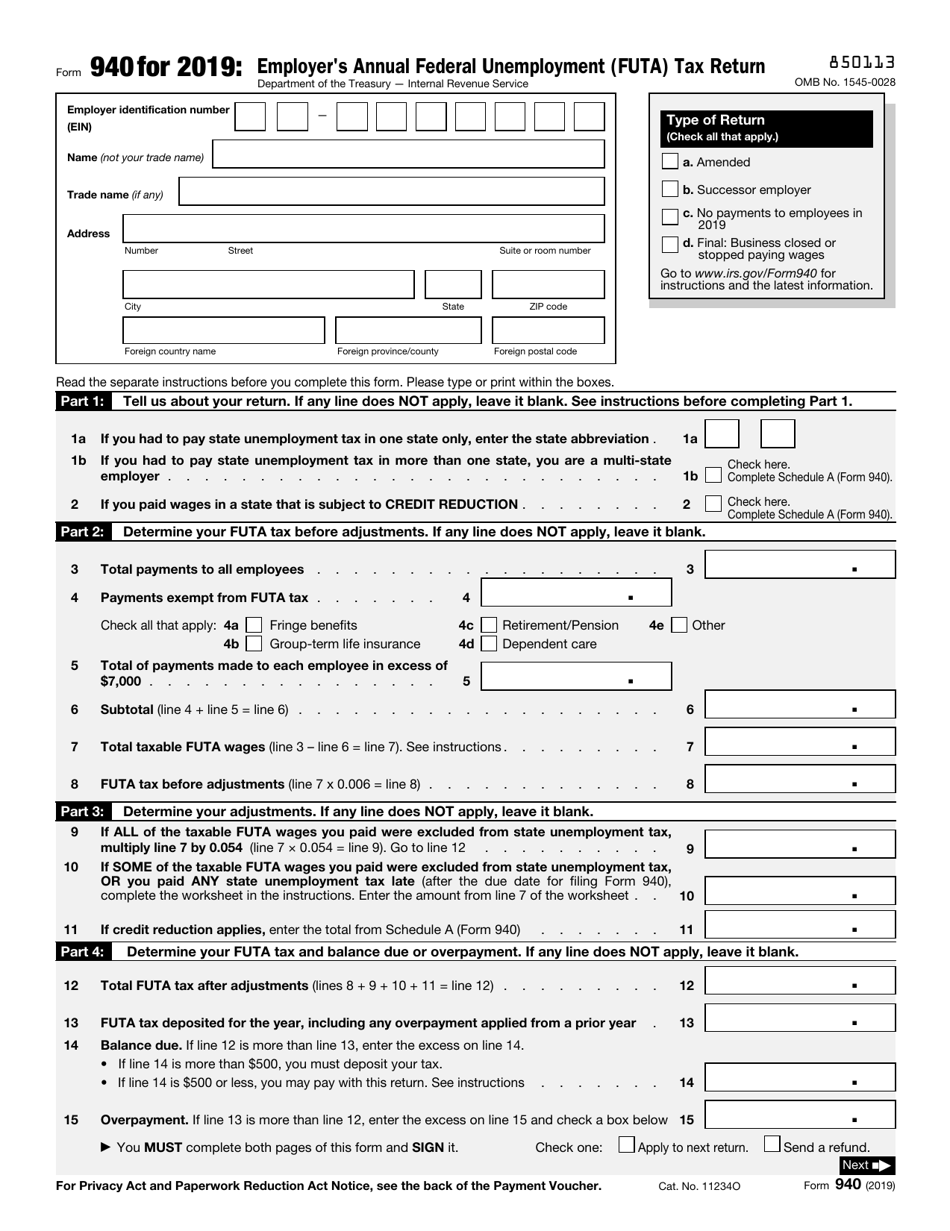

Your Easy Guide to Unemployment Taxes MBE CPAs

The florida department of economic opportunity (deo) encourages all floridians who have lost their job as a direct. You must file reports and pay taxes online through the florida department of revenue if you paid reemployment taxes for 10 or more employees. An employer liable for reemployment tax may select an annual filing option if all the employees exclusively perform.

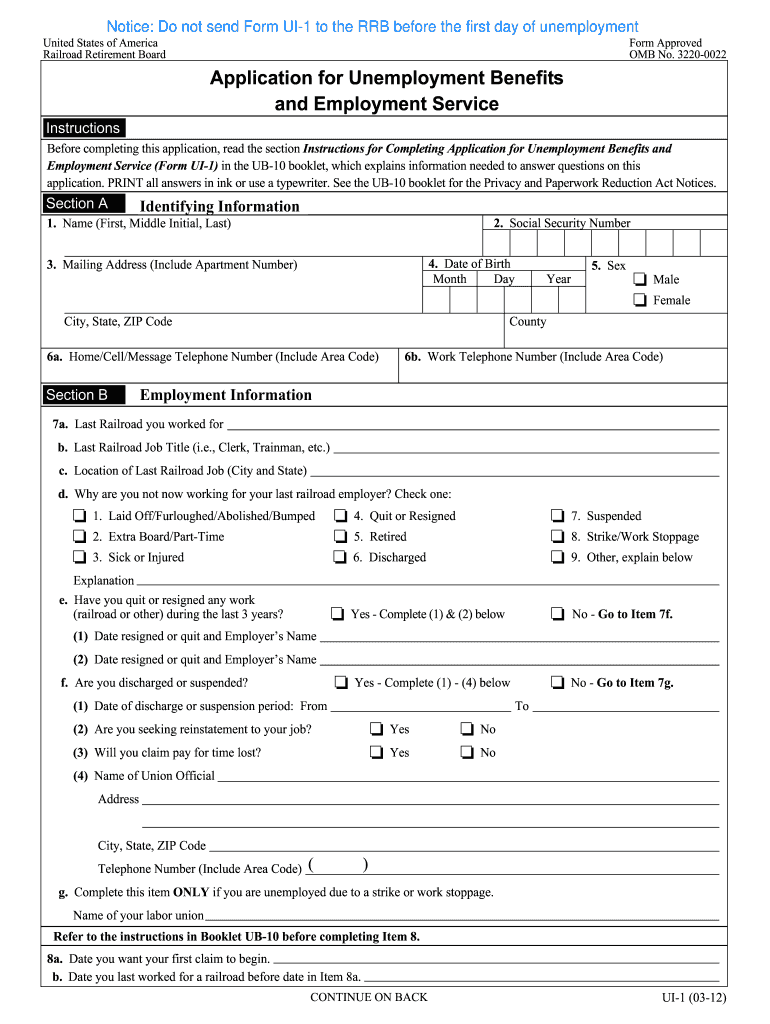

Unemployment Florida Printable Form Printable Forms Free Online

Learn more about applying for unemployment benefits, including eligibility requirements, benefit payment amounts, and how to apply. You can report and pay reemployment tax using the florida department of revenue's secure website, or you may choose to: The department recommends that employers register to pay reemployment tax using the online florida business tax application, or complete. The florida department of.

Ui1 Application Unemployment 20122024 Form Fill Out and Sign

You must file reports and pay taxes online through the florida department of revenue if you paid reemployment taxes for 10 or more employees. You can report and pay reemployment tax using the florida department of revenue's secure website, or you may choose to: Visit the florida department of commerce's tax information. The florida department of economic opportunity (deo) encourages.

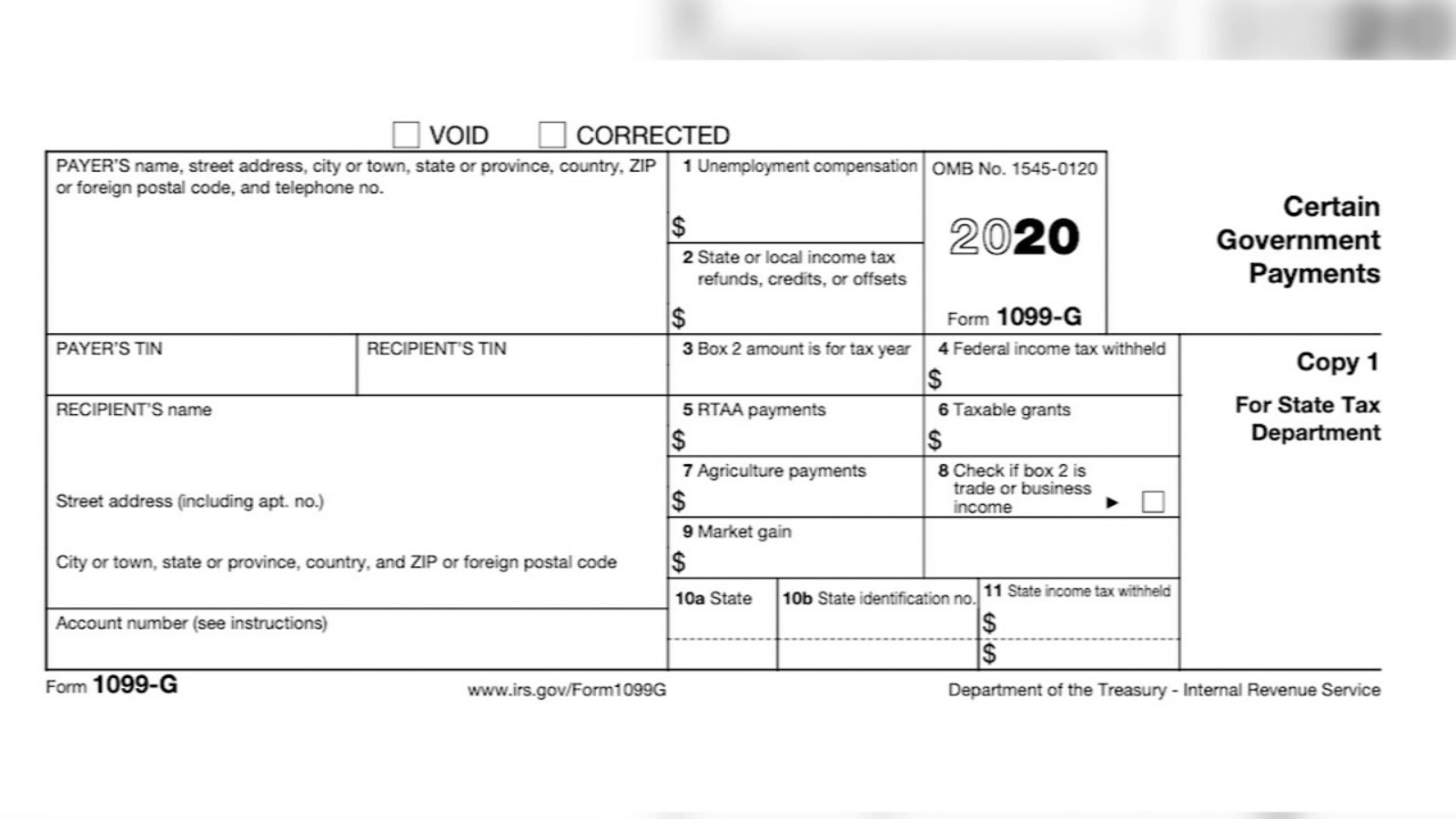

Il unemployment tax form 1099 g jerywee

An employer liable for reemployment tax may select an annual filing option if all the employees exclusively perform services that constitute. You can report and pay reemployment tax using the florida department of revenue's secure website, or you may choose to: You must file reports and pay taxes online through the florida department of revenue if you paid reemployment taxes.

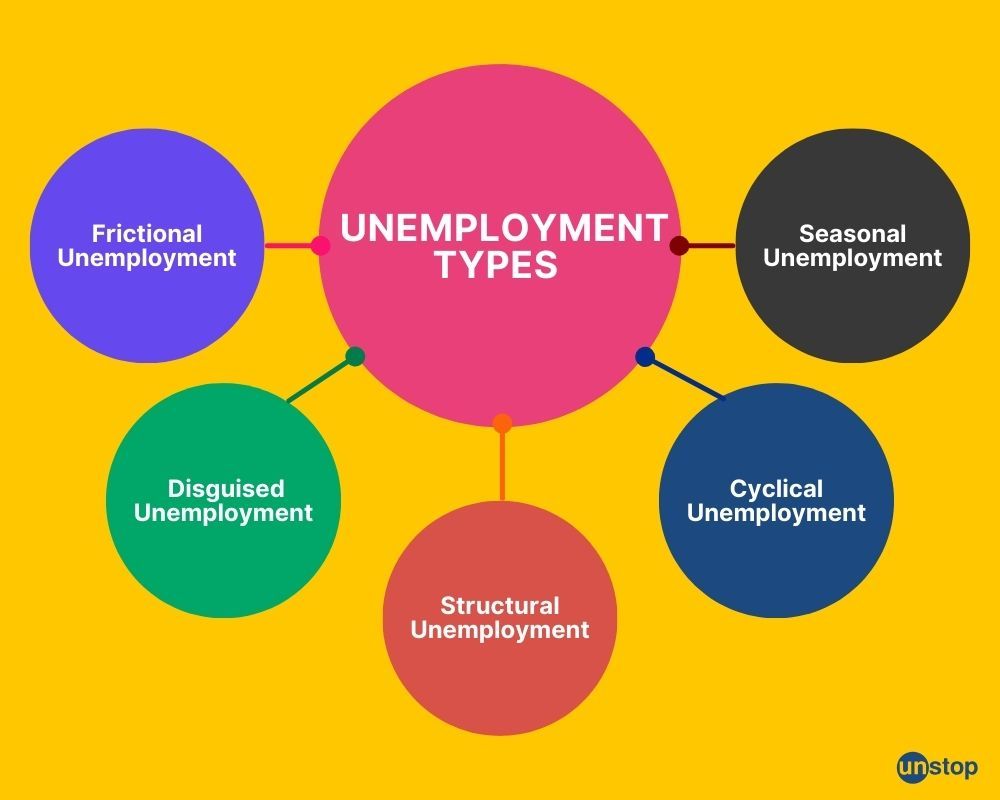

What is Unemployment? Definition, Types, Causes and Solutions // Unstop

The florida department of economic opportunity (deo) encourages all floridians who have lost their job as a direct. An employer liable for reemployment tax may select an annual filing option if all the employees exclusively perform services that constitute. Visit the florida department of commerce's tax information. You can report and pay reemployment tax using the florida department of revenue's.

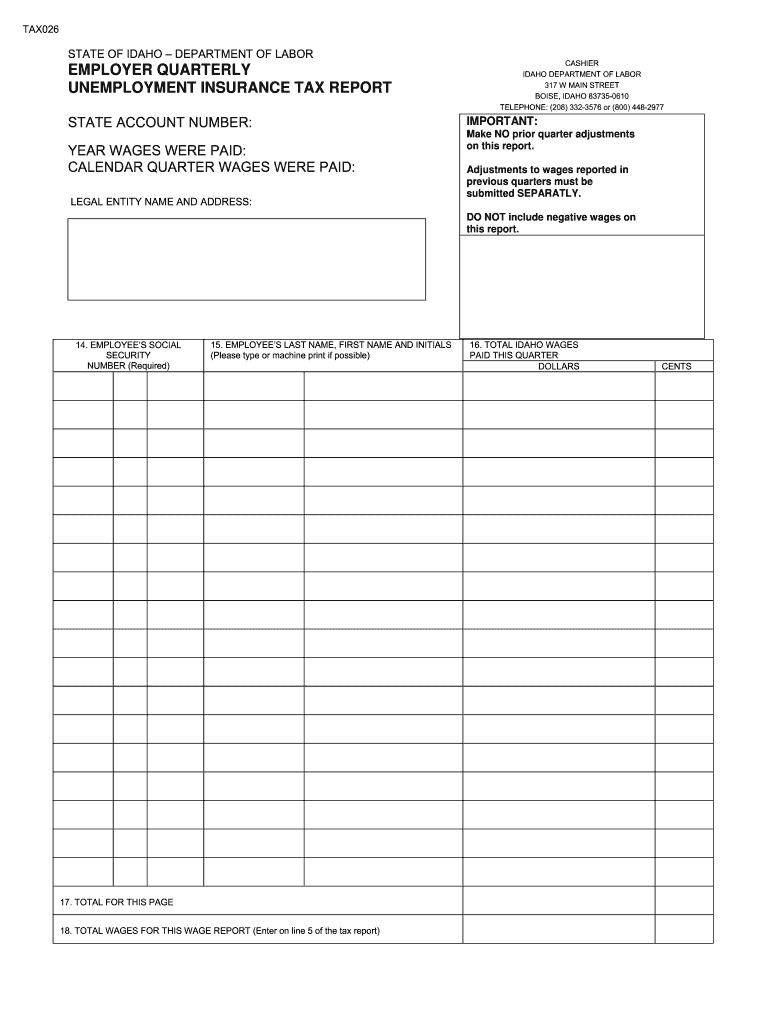

Quarterly Wage And Tax Report Example Fill Online, Printable

Visit the florida department of commerce's tax information. The florida department of economic opportunity (deo) encourages all floridians who have lost their job as a direct. The department recommends that employers register to pay reemployment tax using the online florida business tax application, or complete. You can report and pay reemployment tax using the florida department of revenue's secure website,.

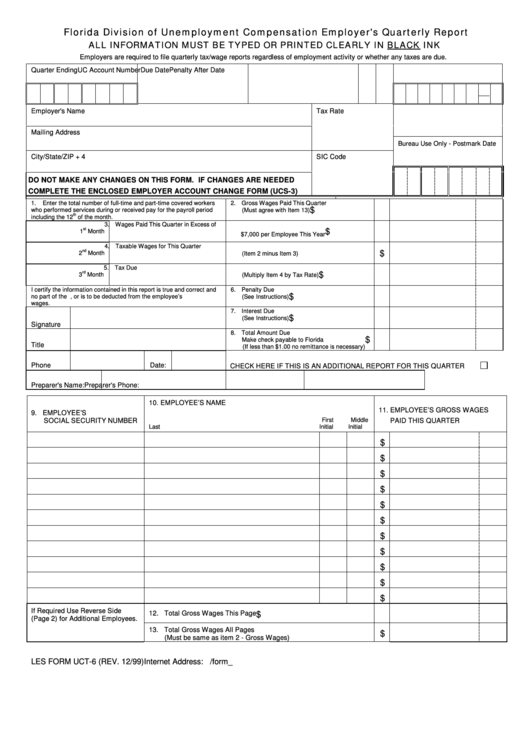

Form Uct6 Florida Division Of Unemployment Compensation Employer'S

The department recommends that employers register to pay reemployment tax using the online florida business tax application, or complete. You must file reports and pay taxes online through the florida department of revenue if you paid reemployment taxes for 10 or more employees. The florida department of economic opportunity (deo) encourages all floridians who have lost their job as a.

unemployment tax break refund calculator Aretha Cavanaugh

The florida department of economic opportunity (deo) encourages all floridians who have lost their job as a direct. An employer liable for reemployment tax may select an annual filing option if all the employees exclusively perform services that constitute. The department recommends that employers register to pay reemployment tax using the online florida business tax application, or complete. You must.

unemployment

Visit the florida department of commerce's tax information. An employer liable for reemployment tax may select an annual filing option if all the employees exclusively perform services that constitute. You can report and pay reemployment tax using the florida department of revenue's secure website, or you may choose to: Learn more about applying for unemployment benefits, including eligibility requirements, benefit.

Fill Out For Florida Unemployment Online Fill Online, Printable

An employer liable for reemployment tax may select an annual filing option if all the employees exclusively perform services that constitute. You can report and pay reemployment tax using the florida department of revenue's secure website, or you may choose to: Visit the florida department of commerce's tax information. The department recommends that employers register to pay reemployment tax using.

An Employer Liable For Reemployment Tax May Select An Annual Filing Option If All The Employees Exclusively Perform Services That Constitute.

Learn more about applying for unemployment benefits, including eligibility requirements, benefit payment amounts, and how to apply. Visit the florida department of commerce's tax information. The florida department of economic opportunity (deo) encourages all floridians who have lost their job as a direct. You must file reports and pay taxes online through the florida department of revenue if you paid reemployment taxes for 10 or more employees.

The Department Recommends That Employers Register To Pay Reemployment Tax Using The Online Florida Business Tax Application, Or Complete.

You can report and pay reemployment tax using the florida department of revenue's secure website, or you may choose to: