Us Bank 1098 Tax Form

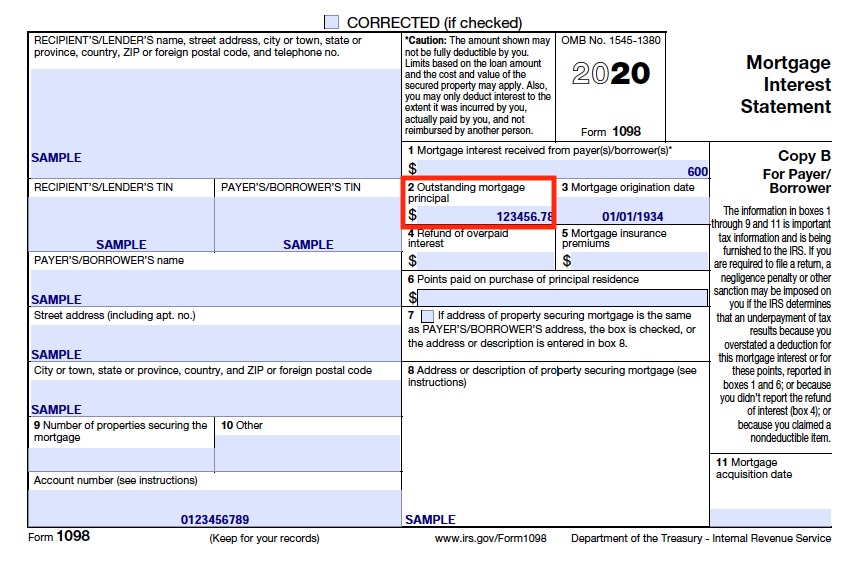

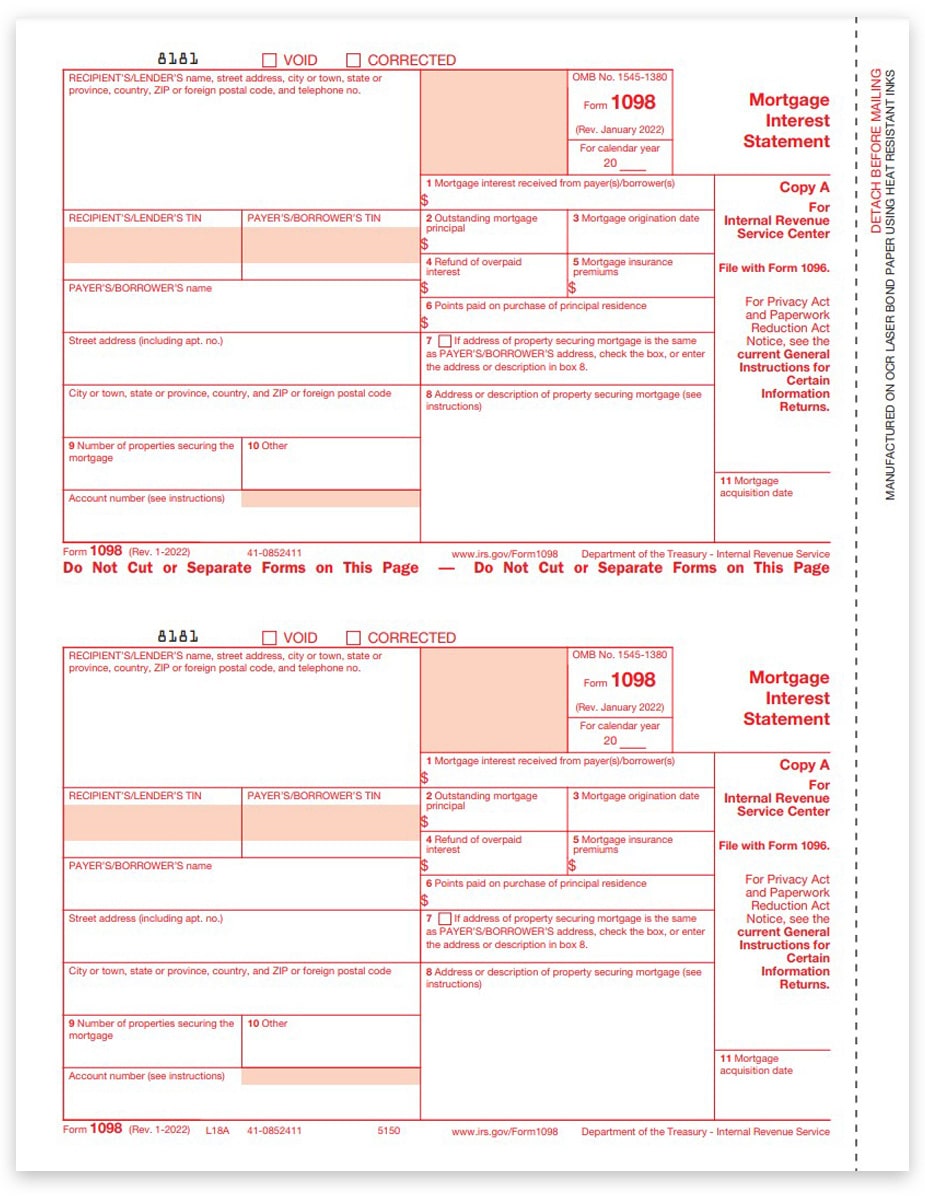

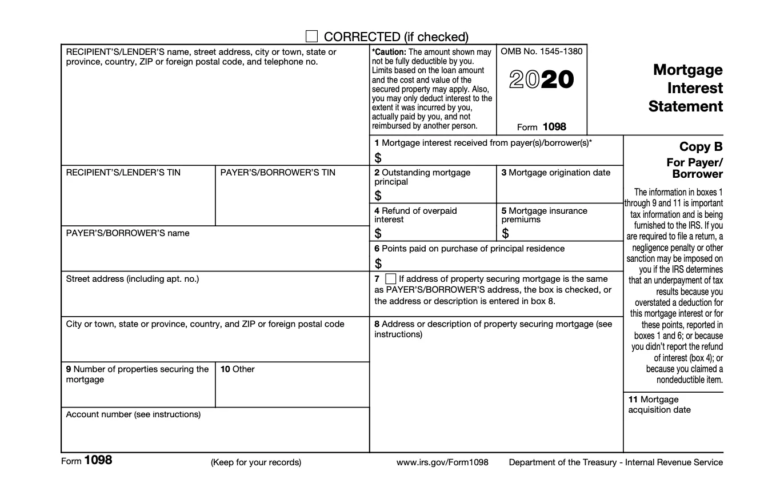

Us Bank 1098 Tax Form - Use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or. The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in private mortgage insurance (pmi), interest or. The 1098 form captures all interest, taxes, and mortgage insurance premiums you paid on your mortgage loan during the calendar year. To learn more, check out our video on how to access your tax documents digitally. The irs requires your financial institution to send a. The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in private mortgage insurance (pmi), interest, or.

The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in private mortgage insurance (pmi), interest or. To learn more, check out our video on how to access your tax documents digitally. The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in private mortgage insurance (pmi), interest, or. Use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or. The 1098 form captures all interest, taxes, and mortgage insurance premiums you paid on your mortgage loan during the calendar year. The irs requires your financial institution to send a.

The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in private mortgage insurance (pmi), interest, or. The 1098 form captures all interest, taxes, and mortgage insurance premiums you paid on your mortgage loan during the calendar year. The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in private mortgage insurance (pmi), interest or. The irs requires your financial institution to send a. Use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or. To learn more, check out our video on how to access your tax documents digitally.

1098 Tax Forms for Mortgage Interest IRS Copy A DiscountTaxForms

The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in private mortgage insurance (pmi), interest, or. The irs requires your financial institution to send a. To learn more, check out our video on how to access your tax documents digitally. The 1098 form captures all interest, taxes, and mortgage insurance.

The 15 Most Common Tax Forms in 2022 (+Infographics) Tax Guide 101

The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in private mortgage insurance (pmi), interest, or. Use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or. To learn more, check out our video.

Top20 US Tax Forms in 2022 Explained PDF.co

The 1098 form captures all interest, taxes, and mortgage insurance premiums you paid on your mortgage loan during the calendar year. Use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or. The irs requires your financial institution to send a 1098 tax form.

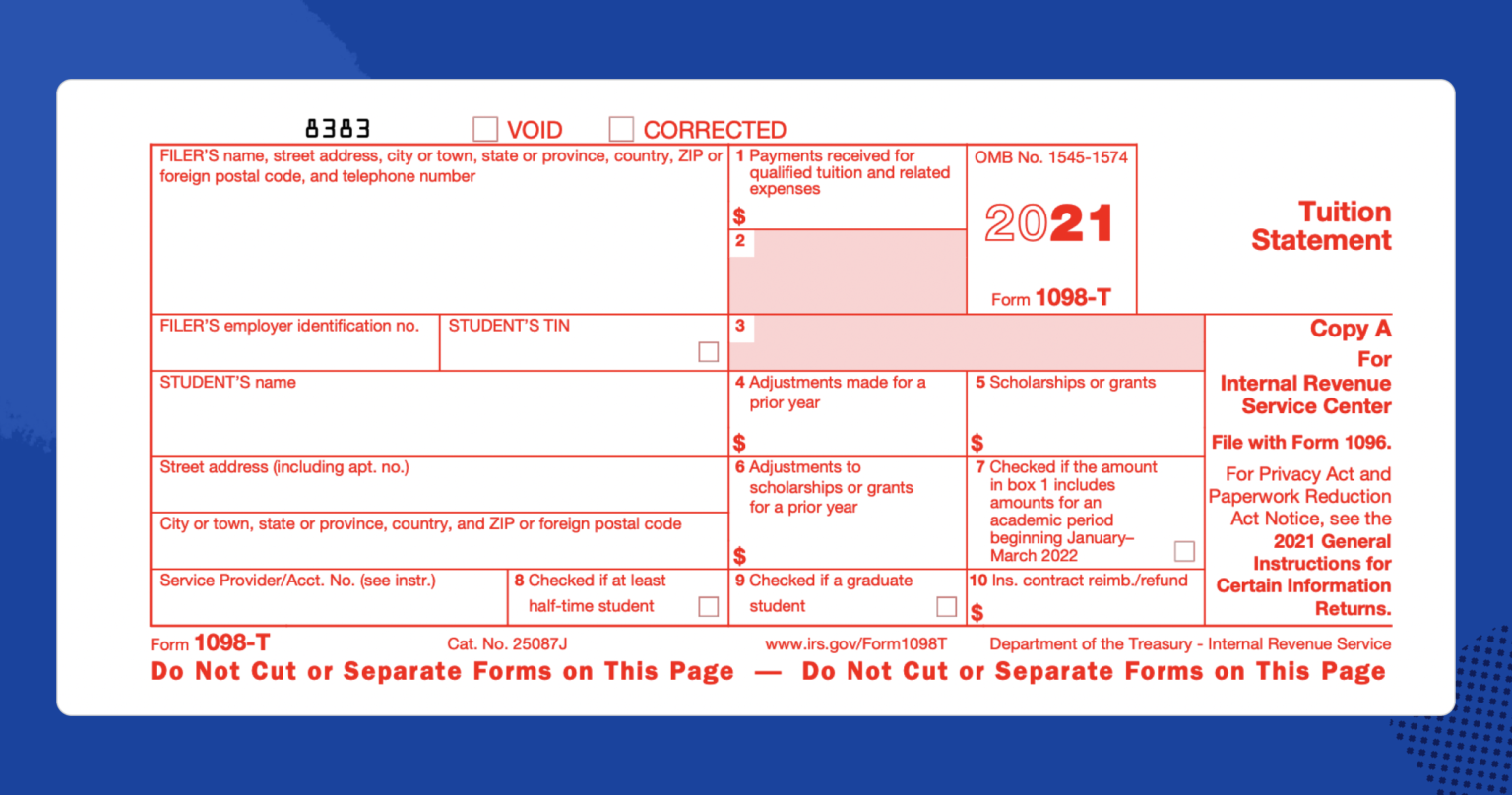

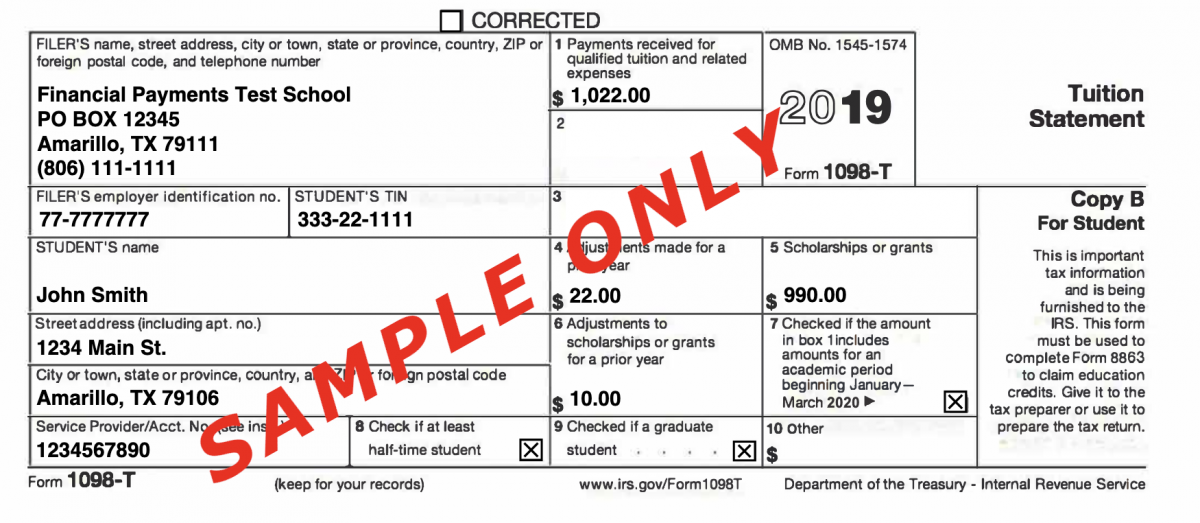

1098T Form How to Complete and File Your Tuition Statement

The 1098 form captures all interest, taxes, and mortgage insurance premiums you paid on your mortgage loan during the calendar year. The irs requires your financial institution to send a. To learn more, check out our video on how to access your tax documents digitally. Use form 1098 (info copy only) to report mortgage interest of $600 or more received.

1098T IRS Tax Form Instructions 1098T Forms

Use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or. The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in private mortgage insurance (pmi), interest, or. The irs requires your financial institution to.

Documents to Bring To Tax Preparer Tax Documents Checklist

The irs requires your financial institution to send a. To learn more, check out our video on how to access your tax documents digitally. The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in private mortgage insurance (pmi), interest, or. The 1098 form captures all interest, taxes, and mortgage insurance.

1098 Form 2023 Printable Forms Free Online

The 1098 form captures all interest, taxes, and mortgage insurance premiums you paid on your mortgage loan during the calendar year. To learn more, check out our video on how to access your tax documents digitally. The irs requires your financial institution to send a. The irs requires your financial institution to send a 1098 tax form only if you.

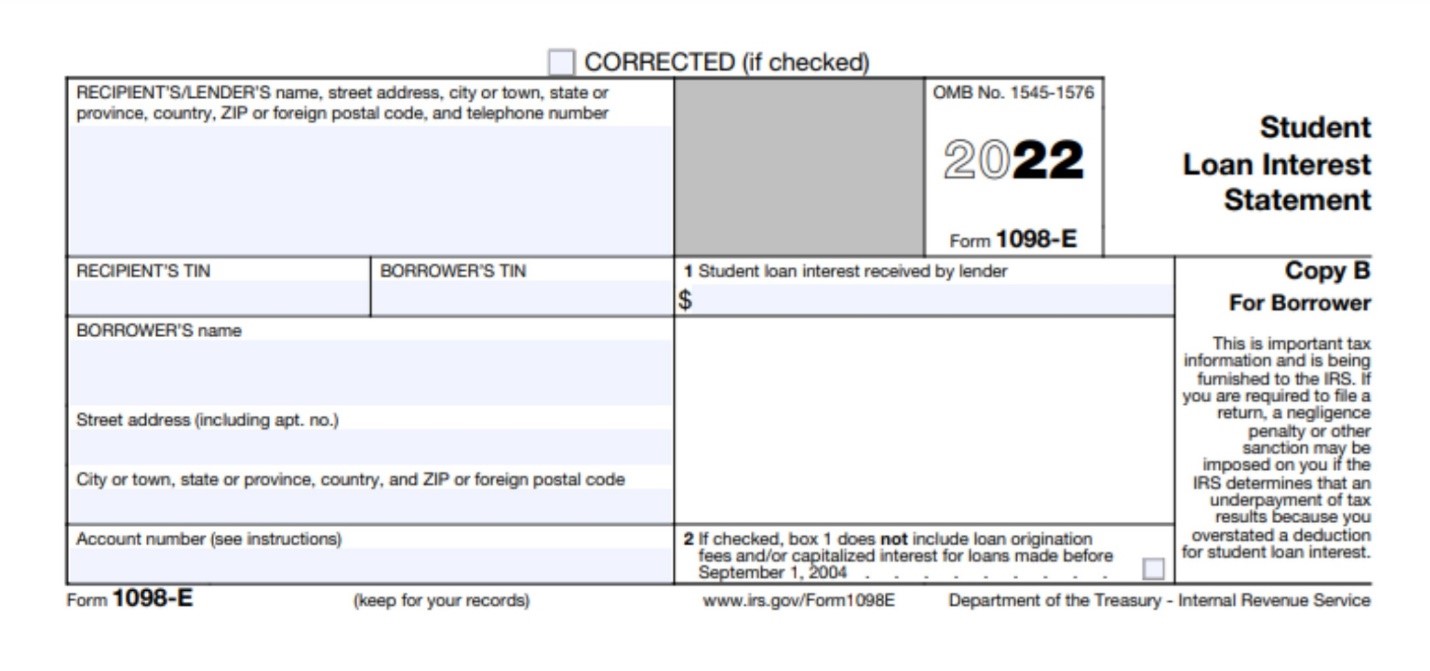

1098E Form Copy A Federal lupon.gov.ph

To learn more, check out our video on how to access your tax documents digitally. The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in private mortgage insurance (pmi), interest, or. The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more.

2022 1098 Mortgage Statement Forms Fillable Fillable Form 2024

The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in private mortgage insurance (pmi), interest, or. The 1098 form captures all interest, taxes, and mortgage insurance premiums you paid on your mortgage loan during the calendar year. To learn more, check out our video on how to access your tax.

1098 Mortgage Interest Forms United Bank of Union

Use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or. The 1098 form captures all interest, taxes, and mortgage insurance premiums you paid on your mortgage loan during the calendar year. The irs requires your financial institution to send a 1098 tax form.

The 1098 Form Captures All Interest, Taxes, And Mortgage Insurance Premiums You Paid On Your Mortgage Loan During The Calendar Year.

Use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or. The irs requires your financial institution to send a. The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in private mortgage insurance (pmi), interest, or. To learn more, check out our video on how to access your tax documents digitally.

:max_bytes(150000):strip_icc()/Form1098-30d7d922c32748bea2a293a28fbbe778.jpg)