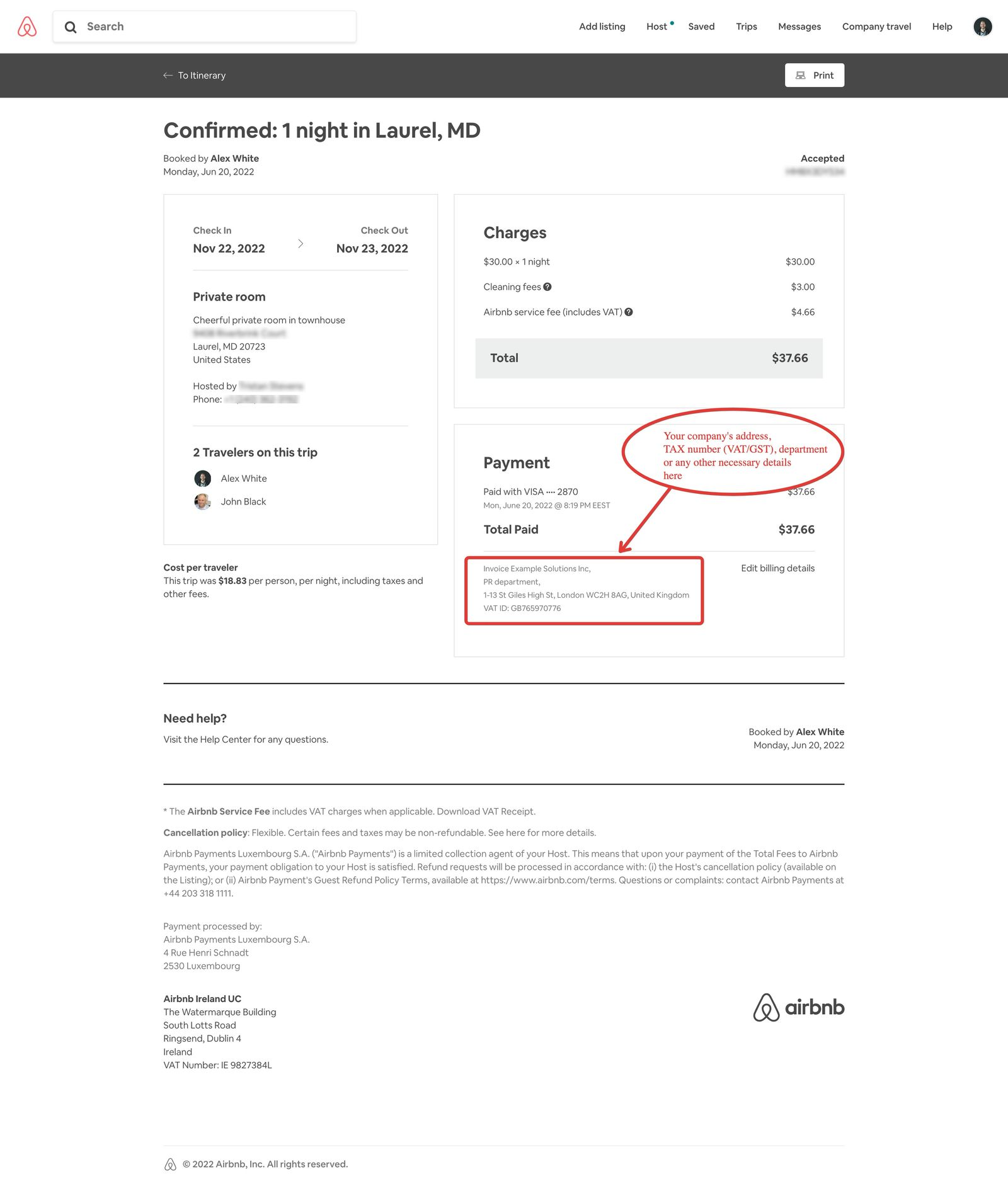

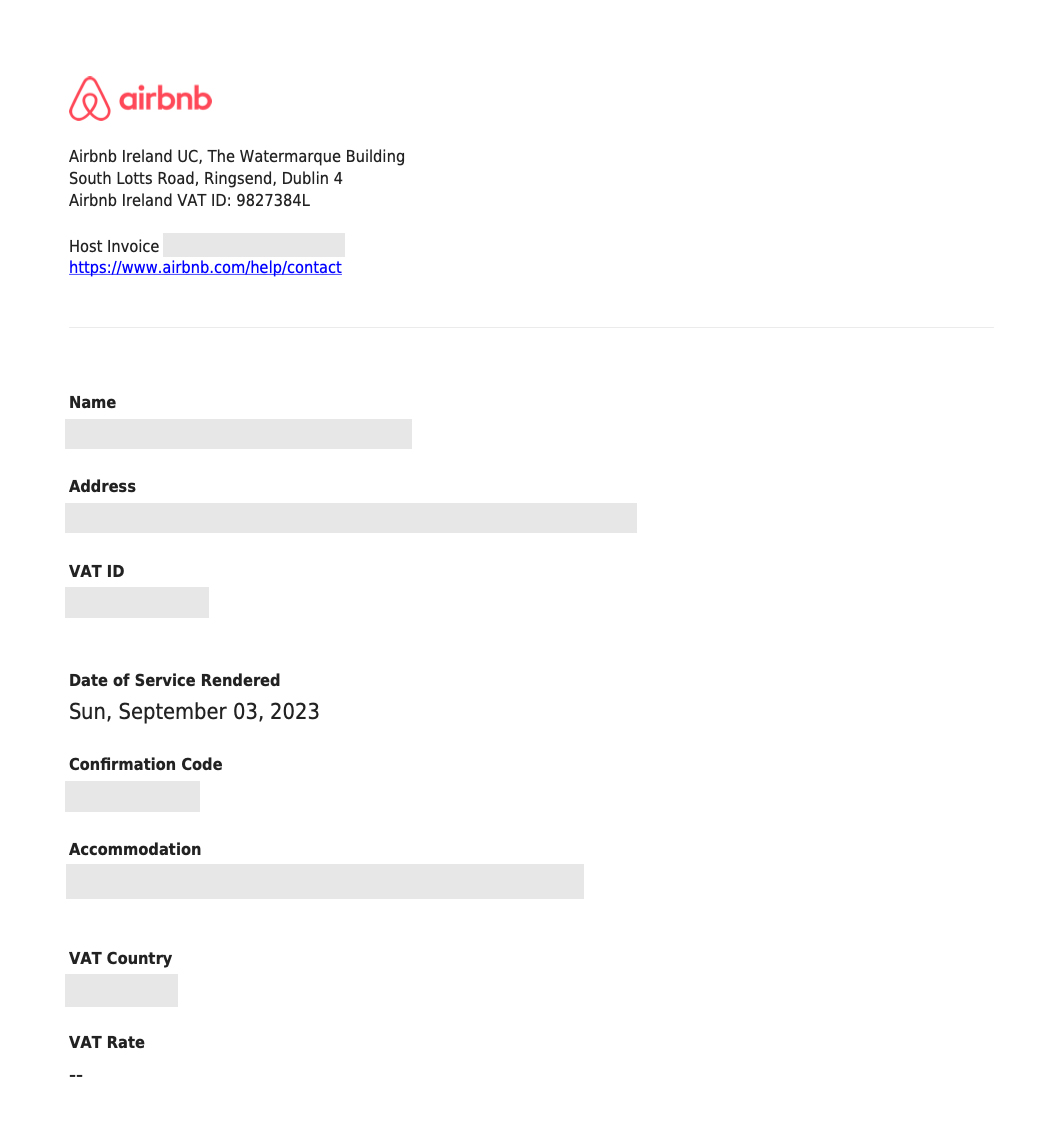

Vat Invoice Airbnb

Vat Invoice Airbnb - Value added tax, or vat, is a tax assessed on the supply of goods and services. Any guest requests for vat invoices should be addressed to airbnb (by the guest) as there is both your vat and airbnbs vat to include in the. A value added tax (vat) invoice is provided whenever vat is assessed on airbnb service fees. Airbnb charges vat on its service fees for. Your invoice is finalized and issued when a. You can access individual vat invoices for each reservation or download vat invoices in bulk in the regions. Value added tax, or vat, is a tax assessed on the supply of goods and services. Access a vat invoice as a host. Airbnb charges vat on its service fees for customers.

Airbnb charges vat on its service fees for customers. You can access individual vat invoices for each reservation or download vat invoices in bulk in the regions. Access a vat invoice as a host. A value added tax (vat) invoice is provided whenever vat is assessed on airbnb service fees. Value added tax, or vat, is a tax assessed on the supply of goods and services. Value added tax, or vat, is a tax assessed on the supply of goods and services. Airbnb charges vat on its service fees for. Any guest requests for vat invoices should be addressed to airbnb (by the guest) as there is both your vat and airbnbs vat to include in the. Your invoice is finalized and issued when a.

Airbnb charges vat on its service fees for. Your invoice is finalized and issued when a. A value added tax (vat) invoice is provided whenever vat is assessed on airbnb service fees. Airbnb charges vat on its service fees for customers. Value added tax, or vat, is a tax assessed on the supply of goods and services. You can access individual vat invoices for each reservation or download vat invoices in bulk in the regions. Any guest requests for vat invoices should be addressed to airbnb (by the guest) as there is both your vat and airbnbs vat to include in the. Value added tax, or vat, is a tax assessed on the supply of goods and services. Access a vat invoice as a host.

Airbnb Invoice Generator

Value added tax, or vat, is a tax assessed on the supply of goods and services. Any guest requests for vat invoices should be addressed to airbnb (by the guest) as there is both your vat and airbnbs vat to include in the. Value added tax, or vat, is a tax assessed on the supply of goods and services. Access.

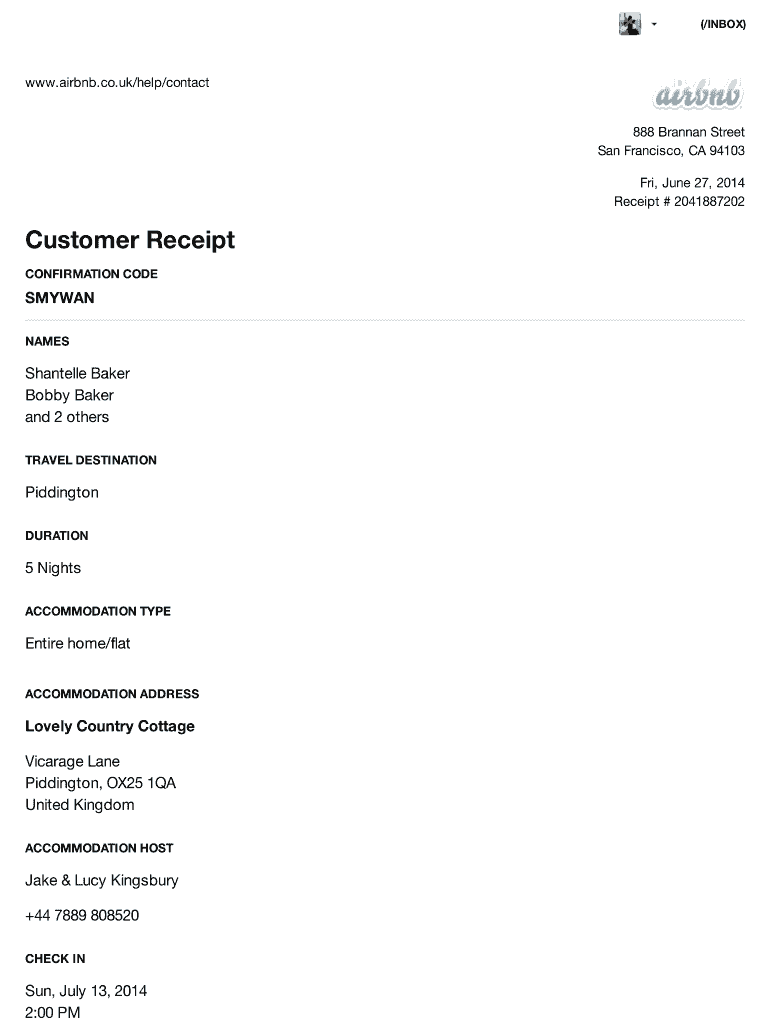

AirBnb invoice Airbnb Community

Value added tax, or vat, is a tax assessed on the supply of goods and services. Your invoice is finalized and issued when a. Value added tax, or vat, is a tax assessed on the supply of goods and services. Airbnb charges vat on its service fees for. You can access individual vat invoices for each reservation or download vat.

Customizable AirBnB Invoice Template, Informational Printable for VRBO

Value added tax, or vat, is a tax assessed on the supply of goods and services. Access a vat invoice as a host. Value added tax, or vat, is a tax assessed on the supply of goods and services. A value added tax (vat) invoice is provided whenever vat is assessed on airbnb service fees. Airbnb charges vat on its.

Airbnb Invoice ThomasSims Blog

Value added tax, or vat, is a tax assessed on the supply of goods and services. You can access individual vat invoices for each reservation or download vat invoices in bulk in the regions. Access a vat invoice as a host. Airbnb charges vat on its service fees for. Any guest requests for vat invoices should be addressed to airbnb.

Airbnb Receipt Complete with ease airSlate SignNow

Any guest requests for vat invoices should be addressed to airbnb (by the guest) as there is both your vat and airbnbs vat to include in the. Value added tax, or vat, is a tax assessed on the supply of goods and services. Access a vat invoice as a host. You can access individual vat invoices for each reservation or.

AirBnb invoice Airbnb Community

Value added tax, or vat, is a tax assessed on the supply of goods and services. A value added tax (vat) invoice is provided whenever vat is assessed on airbnb service fees. Your invoice is finalized and issued when a. Any guest requests for vat invoices should be addressed to airbnb (by the guest) as there is both your vat.

Download Airbnb Host EU VAT Invoices VATinvoicer

Value added tax, or vat, is a tax assessed on the supply of goods and services. You can access individual vat invoices for each reservation or download vat invoices in bulk in the regions. Access a vat invoice as a host. Airbnb charges vat on its service fees for. Value added tax, or vat, is a tax assessed on the.

Airbnb Invoice Template Airbnb Invoice Modern Airbnb Etsy

Access a vat invoice as a host. A value added tax (vat) invoice is provided whenever vat is assessed on airbnb service fees. Any guest requests for vat invoices should be addressed to airbnb (by the guest) as there is both your vat and airbnbs vat to include in the. You can access individual vat invoices for each reservation or.

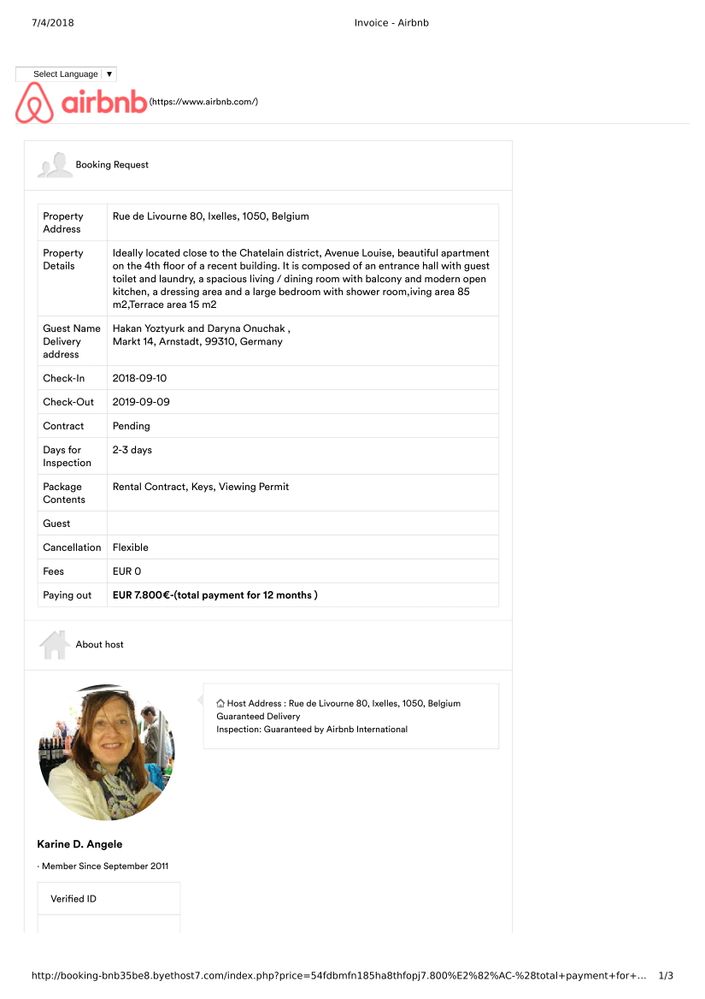

AirBnb invoice Airbnb Community

Value added tax, or vat, is a tax assessed on the supply of goods and services. A value added tax (vat) invoice is provided whenever vat is assessed on airbnb service fees. You can access individual vat invoices for each reservation or download vat invoices in bulk in the regions. Airbnb charges vat on its service fees for customers. Value.

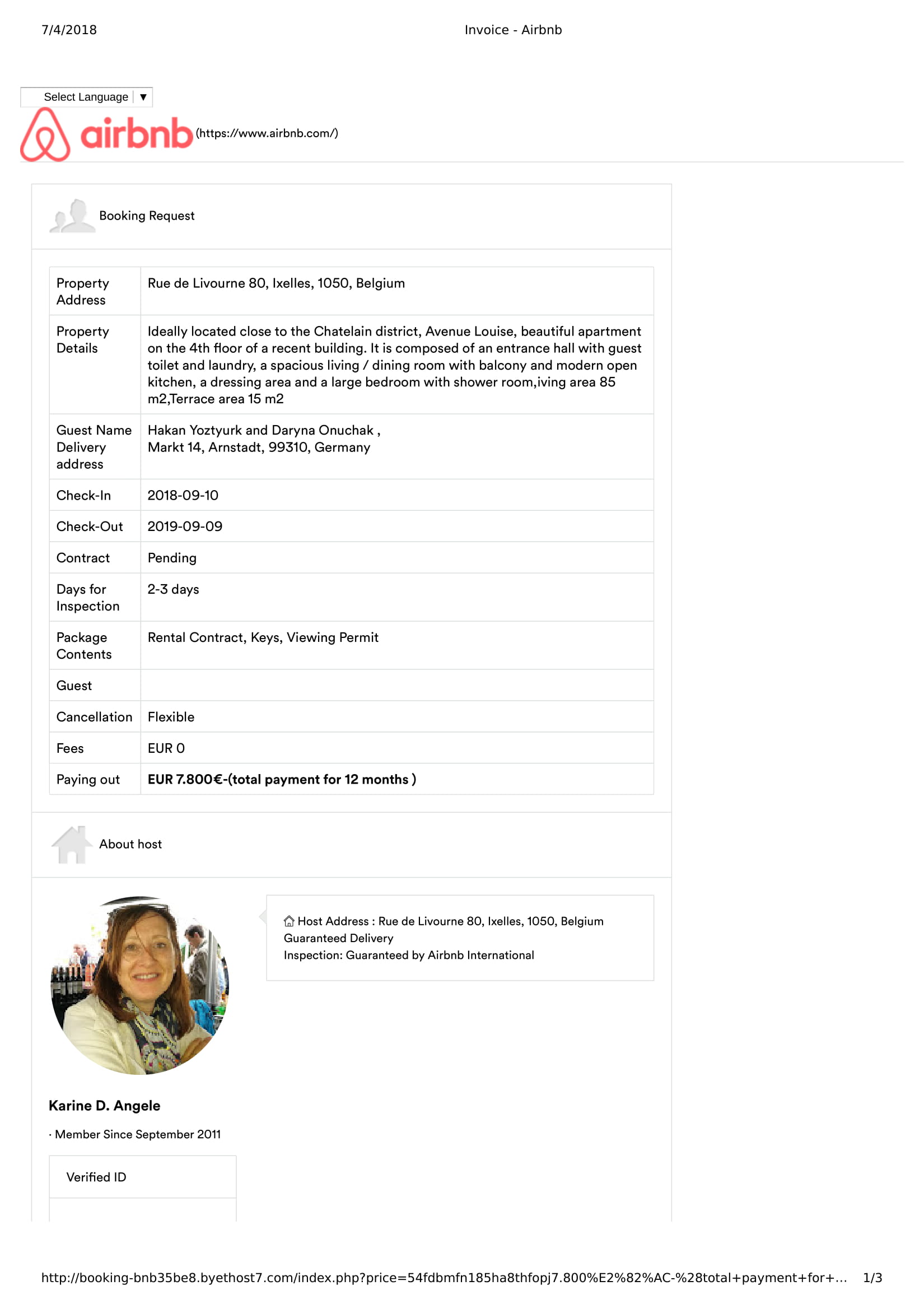

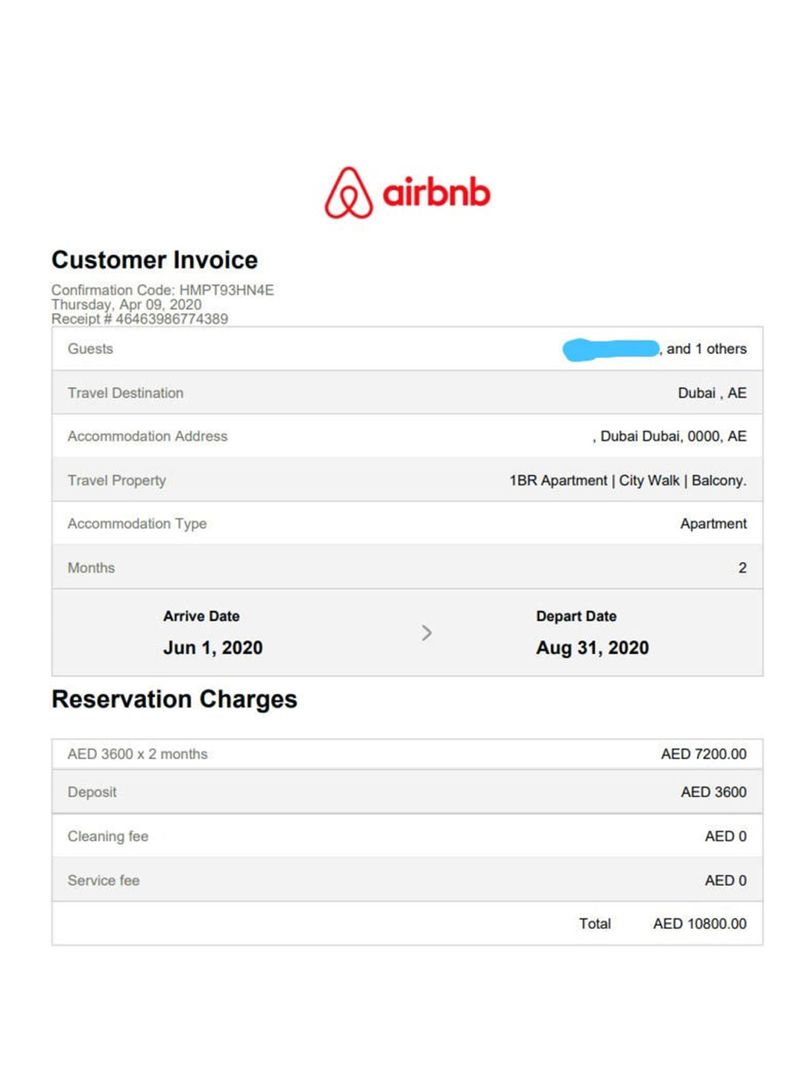

Fake Airbnb website scam snares British pilot in Dubai Uae Gulf News

A value added tax (vat) invoice is provided whenever vat is assessed on airbnb service fees. Access a vat invoice as a host. Value added tax, or vat, is a tax assessed on the supply of goods and services. Airbnb charges vat on its service fees for customers. Airbnb charges vat on its service fees for.

Value Added Tax, Or Vat, Is A Tax Assessed On The Supply Of Goods And Services.

Your invoice is finalized and issued when a. Airbnb charges vat on its service fees for. Access a vat invoice as a host. A value added tax (vat) invoice is provided whenever vat is assessed on airbnb service fees.

Value Added Tax, Or Vat, Is A Tax Assessed On The Supply Of Goods And Services.

Any guest requests for vat invoices should be addressed to airbnb (by the guest) as there is both your vat and airbnbs vat to include in the. Airbnb charges vat on its service fees for customers. You can access individual vat invoices for each reservation or download vat invoices in bulk in the regions.