Vermont Local Option Tax

Vermont Local Option Tax - More than two dozen cities and towns across vermont have implemented a local 1% sales tax. Local option taxes (a) local option taxes are authorized under this section for the purpose of affording municipalities an alternative method. A transaction is subject to local option tax if it is subject to the vermont sales, meals, rooms, or alcoholic beverage tax. Use the local option tax finder tool to search for a specific address or town to determine if a local option tax is levied. Now, the town of woodstock will. Local option tax is a way for municipalities in vermont to raise additional revenue. A local option tax is a way for municipalities in vermont to raise revenue by assessing a 1% tax in addition to certain state tax types. See attached vermont general guidelines on. A municipality may vote to levy the. A local option sales tax applies only to sales of items that are subject to the vermont sales tax.

A municipality may vote to levy the. Now, the town of woodstock will. Use the local option tax finder tool to search for a specific address or town to determine if a local option tax is levied. A transaction is subject to local option tax if it is subject to the vermont sales, meals, rooms, or alcoholic beverage tax. A local option tax is a way for municipalities in vermont to raise revenue by assessing a 1% tax in addition to certain state tax types. More than two dozen cities and towns across vermont have implemented a local 1% sales tax. See attached vermont general guidelines on. A local option sales tax applies only to sales of items that are subject to the vermont sales tax. Local option tax is a way for municipalities in vermont to raise additional revenue. Local option taxes (a) local option taxes are authorized under this section for the purpose of affording municipalities an alternative method.

Local option taxes (a) local option taxes are authorized under this section for the purpose of affording municipalities an alternative method. More than two dozen cities and towns across vermont have implemented a local 1% sales tax. A local option sales tax applies only to sales of items that are subject to the vermont sales tax. Local option tax is a way for municipalities in vermont to raise additional revenue. See attached vermont general guidelines on. Now, the town of woodstock will. A transaction is subject to local option tax if it is subject to the vermont sales, meals, rooms, or alcoholic beverage tax. Use the local option tax finder tool to search for a specific address or town to determine if a local option tax is levied. A local option tax is a way for municipalities in vermont to raise revenue by assessing a 1% tax in addition to certain state tax types. A municipality may vote to levy the.

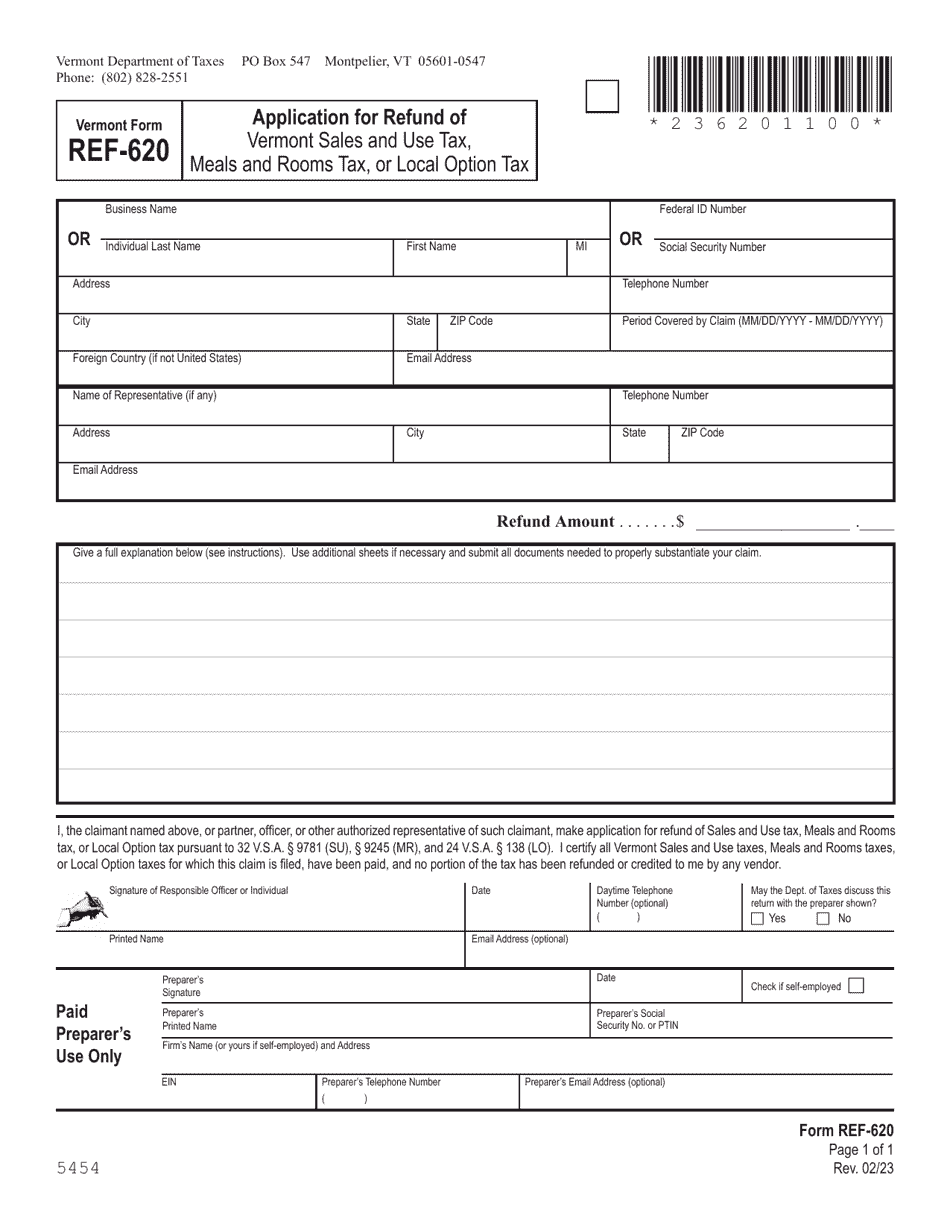

Form REF620 Fill Out, Sign Online and Download Printable PDF

Local option tax is a way for municipalities in vermont to raise additional revenue. Use the local option tax finder tool to search for a specific address or town to determine if a local option tax is levied. A transaction is subject to local option tax if it is subject to the vermont sales, meals, rooms, or alcoholic beverage tax..

Barre City Considers Local Option Tax (Again) Vermont Public Radio

Now, the town of woodstock will. A local option tax is a way for municipalities in vermont to raise revenue by assessing a 1% tax in addition to certain state tax types. A local option sales tax applies only to sales of items that are subject to the vermont sales tax. A transaction is subject to local option tax if.

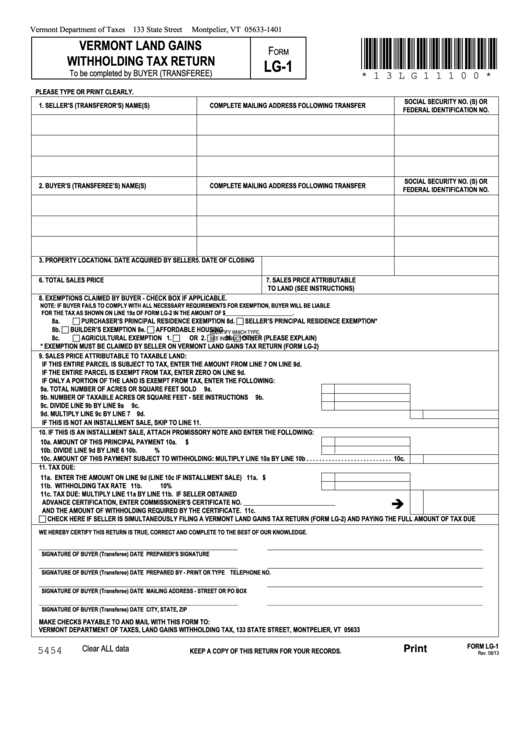

Fillable Form Lg1 Vermont Land Gains Withholding Tax Return

A local option tax is a way for municipalities in vermont to raise revenue by assessing a 1% tax in addition to certain state tax types. Local option taxes (a) local option taxes are authorized under this section for the purpose of affording municipalities an alternative method. More than two dozen cities and towns across vermont have implemented a local.

Updated State and Local Option Sales Tax

See attached vermont general guidelines on. Local option tax is a way for municipalities in vermont to raise additional revenue. More than two dozen cities and towns across vermont have implemented a local 1% sales tax. Now, the town of woodstock will. Use the local option tax finder tool to search for a specific address or town to determine if.

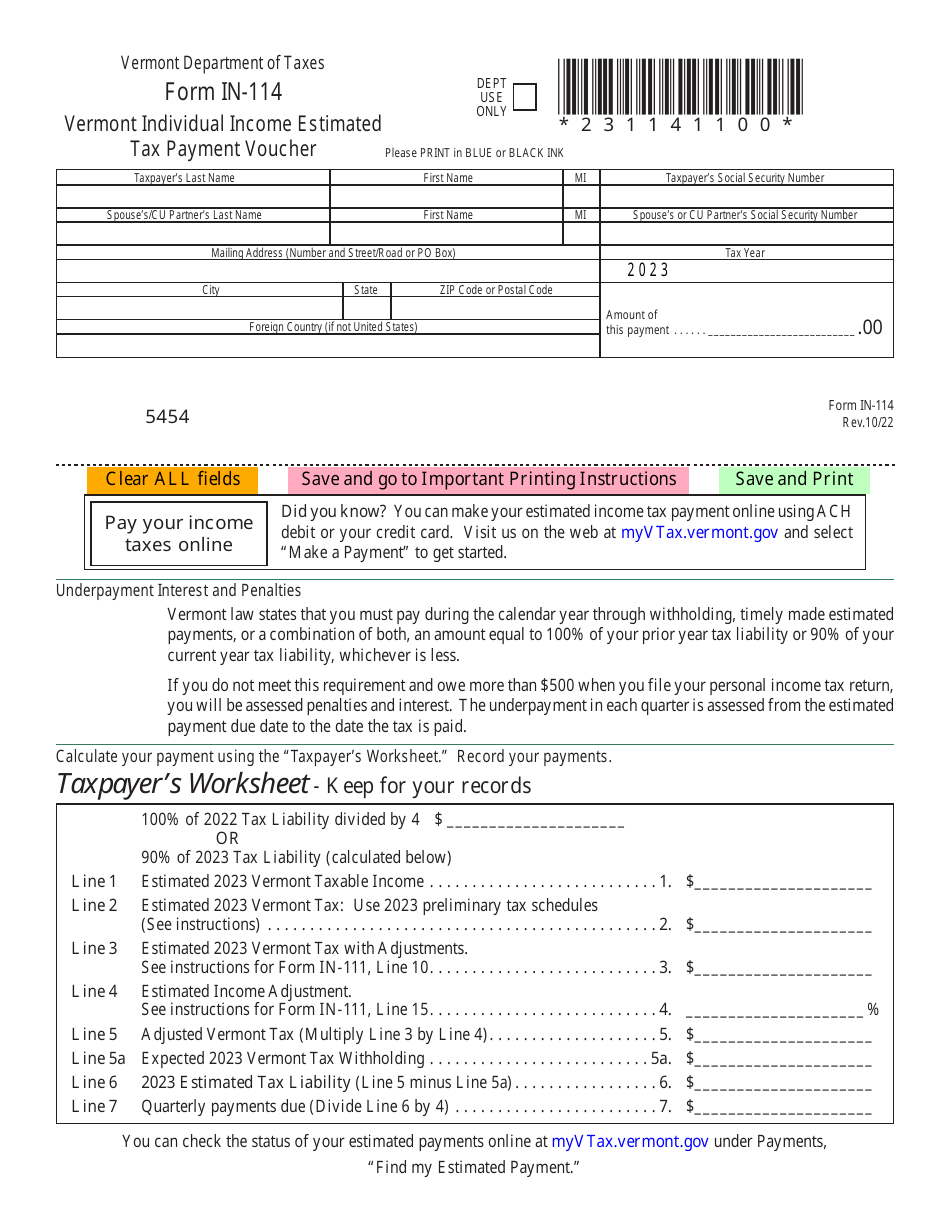

Form IN114 Download Fillable PDF or Fill Online Vermont Individual

Local option tax is a way for municipalities in vermont to raise additional revenue. A local option tax is a way for municipalities in vermont to raise revenue by assessing a 1% tax in addition to certain state tax types. Now, the town of woodstock will. Use the local option tax finder tool to search for a specific address or.

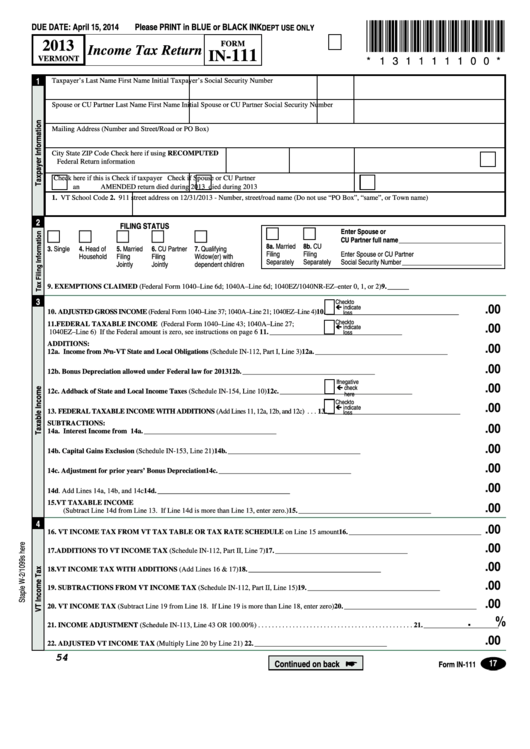

Fillable Form In111 Vermont Tax Return 2013 printable pdf

A transaction is subject to local option tax if it is subject to the vermont sales, meals, rooms, or alcoholic beverage tax. See attached vermont general guidelines on. A local option sales tax applies only to sales of items that are subject to the vermont sales tax. A local option tax is a way for municipalities in vermont to raise.

Vermont Property Tax Rates Highlights 2024

Local option tax is a way for municipalities in vermont to raise additional revenue. Local option taxes (a) local option taxes are authorized under this section for the purpose of affording municipalities an alternative method. More than two dozen cities and towns across vermont have implemented a local 1% sales tax. Now, the town of woodstock will. A local option.

Ketchum sees loss in local option tax revenue amid COVID19 pandemic

A municipality may vote to levy the. A transaction is subject to local option tax if it is subject to the vermont sales, meals, rooms, or alcoholic beverage tax. Now, the town of woodstock will. More than two dozen cities and towns across vermont have implemented a local 1% sales tax. Local option tax is a way for municipalities in.

Buy Vermont Local

More than two dozen cities and towns across vermont have implemented a local 1% sales tax. See attached vermont general guidelines on. Use the local option tax finder tool to search for a specific address or town to determine if a local option tax is levied. Local option tax is a way for municipalities in vermont to raise additional revenue..

Vermont Tax Information — Town of Craftsbury

More than two dozen cities and towns across vermont have implemented a local 1% sales tax. See attached vermont general guidelines on. Local option taxes (a) local option taxes are authorized under this section for the purpose of affording municipalities an alternative method. A transaction is subject to local option tax if it is subject to the vermont sales, meals,.

A Transaction Is Subject To Local Option Tax If It Is Subject To The Vermont Sales, Meals, Rooms, Or Alcoholic Beverage Tax.

A local option sales tax applies only to sales of items that are subject to the vermont sales tax. More than two dozen cities and towns across vermont have implemented a local 1% sales tax. Now, the town of woodstock will. Local option taxes (a) local option taxes are authorized under this section for the purpose of affording municipalities an alternative method.

Use The Local Option Tax Finder Tool To Search For A Specific Address Or Town To Determine If A Local Option Tax Is Levied.

See attached vermont general guidelines on. A local option tax is a way for municipalities in vermont to raise revenue by assessing a 1% tax in addition to certain state tax types. Local option tax is a way for municipalities in vermont to raise additional revenue. A municipality may vote to levy the.