Voluntary Foreclosure

Voluntary Foreclosure - They do this because they’re unable or unwilling to make. Voluntary foreclosure is a legal process in which a homeowner willingly surrenders their property. A homeowner, not a lender, starts the voluntary foreclosure process. This decision is known as a strategic default, which is also sometimes called voluntary foreclosure or walking. Voluntary foreclosure is a proactive measure taken by borrowers who find themselves unable to meet mortgage obligations. A traditional foreclosure begins when a bank or mortgage company decides to foreclose on a property.

Voluntary foreclosure is a legal process in which a homeowner willingly surrenders their property. A traditional foreclosure begins when a bank or mortgage company decides to foreclose on a property. This decision is known as a strategic default, which is also sometimes called voluntary foreclosure or walking. Voluntary foreclosure is a proactive measure taken by borrowers who find themselves unable to meet mortgage obligations. They do this because they’re unable or unwilling to make. A homeowner, not a lender, starts the voluntary foreclosure process.

They do this because they’re unable or unwilling to make. Voluntary foreclosure is a proactive measure taken by borrowers who find themselves unable to meet mortgage obligations. This decision is known as a strategic default, which is also sometimes called voluntary foreclosure or walking. Voluntary foreclosure is a legal process in which a homeowner willingly surrenders their property. A traditional foreclosure begins when a bank or mortgage company decides to foreclose on a property. A homeowner, not a lender, starts the voluntary foreclosure process.

What Is Voluntary Foreclosure? Experian

Voluntary foreclosure is a proactive measure taken by borrowers who find themselves unable to meet mortgage obligations. A traditional foreclosure begins when a bank or mortgage company decides to foreclose on a property. They do this because they’re unable or unwilling to make. This decision is known as a strategic default, which is also sometimes called voluntary foreclosure or walking..

Voluntary Disclosures Saving Point

Voluntary foreclosure is a proactive measure taken by borrowers who find themselves unable to meet mortgage obligations. They do this because they’re unable or unwilling to make. A homeowner, not a lender, starts the voluntary foreclosure process. A traditional foreclosure begins when a bank or mortgage company decides to foreclose on a property. This decision is known as a strategic.

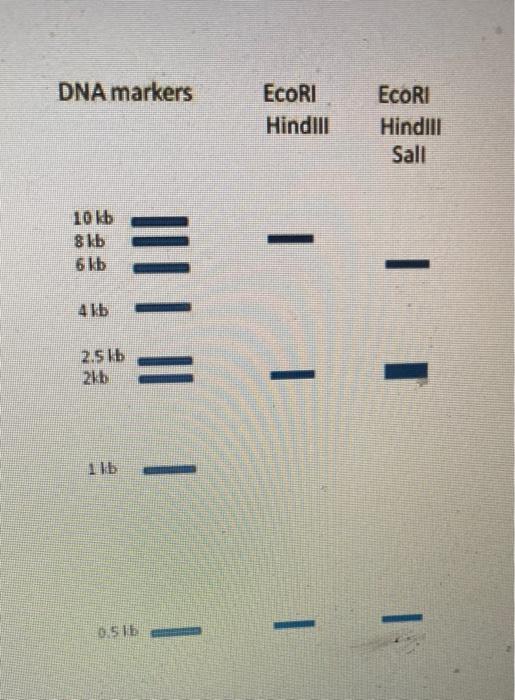

(Get Answer) A voluntary foreclosure is known as Q100; DNA markers

This decision is known as a strategic default, which is also sometimes called voluntary foreclosure or walking. Voluntary foreclosure is a proactive measure taken by borrowers who find themselves unable to meet mortgage obligations. A homeowner, not a lender, starts the voluntary foreclosure process. Voluntary foreclosure is a legal process in which a homeowner willingly surrenders their property. A traditional.

Voluntary Foreclosure Overview, Effects, Pros and Cons

They do this because they’re unable or unwilling to make. A traditional foreclosure begins when a bank or mortgage company decides to foreclose on a property. A homeowner, not a lender, starts the voluntary foreclosure process. Voluntary foreclosure is a legal process in which a homeowner willingly surrenders their property. Voluntary foreclosure is a proactive measure taken by borrowers who.

FORECLOSURE OR SALE BareLaw

They do this because they’re unable or unwilling to make. Voluntary foreclosure is a legal process in which a homeowner willingly surrenders their property. Voluntary foreclosure is a proactive measure taken by borrowers who find themselves unable to meet mortgage obligations. A traditional foreclosure begins when a bank or mortgage company decides to foreclose on a property. A homeowner, not.

Pike County Community Action Stop Foreclosure Fast Best Foreclosure

Voluntary foreclosure is a proactive measure taken by borrowers who find themselves unable to meet mortgage obligations. A homeowner, not a lender, starts the voluntary foreclosure process. Voluntary foreclosure is a legal process in which a homeowner willingly surrenders their property. This decision is known as a strategic default, which is also sometimes called voluntary foreclosure or walking. A traditional.

Voluntary Foreclosure Meaning, Pros and Cons, Example

Voluntary foreclosure is a proactive measure taken by borrowers who find themselves unable to meet mortgage obligations. Voluntary foreclosure is a legal process in which a homeowner willingly surrenders their property. A traditional foreclosure begins when a bank or mortgage company decides to foreclose on a property. A homeowner, not a lender, starts the voluntary foreclosure process. They do this.

Foreclosure properties, accepted offer!! My two foreclosure listings in

They do this because they’re unable or unwilling to make. Voluntary foreclosure is a legal process in which a homeowner willingly surrenders their property. A homeowner, not a lender, starts the voluntary foreclosure process. This decision is known as a strategic default, which is also sometimes called voluntary foreclosure or walking. A traditional foreclosure begins when a bank or mortgage.

💥 A deed in lieu of foreclosure is a voluntary transfer of property

They do this because they’re unable or unwilling to make. A traditional foreclosure begins when a bank or mortgage company decides to foreclose on a property. Voluntary foreclosure is a proactive measure taken by borrowers who find themselves unable to meet mortgage obligations. Voluntary foreclosure is a legal process in which a homeowner willingly surrenders their property. A homeowner, not.

National Mortgage News on LinkedIn VA extends its voluntary

A homeowner, not a lender, starts the voluntary foreclosure process. They do this because they’re unable or unwilling to make. A traditional foreclosure begins when a bank or mortgage company decides to foreclose on a property. This decision is known as a strategic default, which is also sometimes called voluntary foreclosure or walking. Voluntary foreclosure is a legal process in.

This Decision Is Known As A Strategic Default, Which Is Also Sometimes Called Voluntary Foreclosure Or Walking.

They do this because they’re unable or unwilling to make. Voluntary foreclosure is a proactive measure taken by borrowers who find themselves unable to meet mortgage obligations. A traditional foreclosure begins when a bank or mortgage company decides to foreclose on a property. A homeowner, not a lender, starts the voluntary foreclosure process.