Where To Send 8822 Form

Where To Send 8822 Form - There are five ways to tell the irs your new address: If you checked the box on line 2,. Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. The following replaces the “where to file” addresses on page 2 of form 8822 (rev. Form 8822, your tax return, by phone to a local office, in person, by mail.

If you checked the box on line 2,. The following replaces the “where to file” addresses on page 2 of form 8822 (rev. Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. There are five ways to tell the irs your new address: Form 8822, your tax return, by phone to a local office, in person, by mail.

If you checked the box on line 2,. The following replaces the “where to file” addresses on page 2 of form 8822 (rev. Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. There are five ways to tell the irs your new address: Form 8822, your tax return, by phone to a local office, in person, by mail.

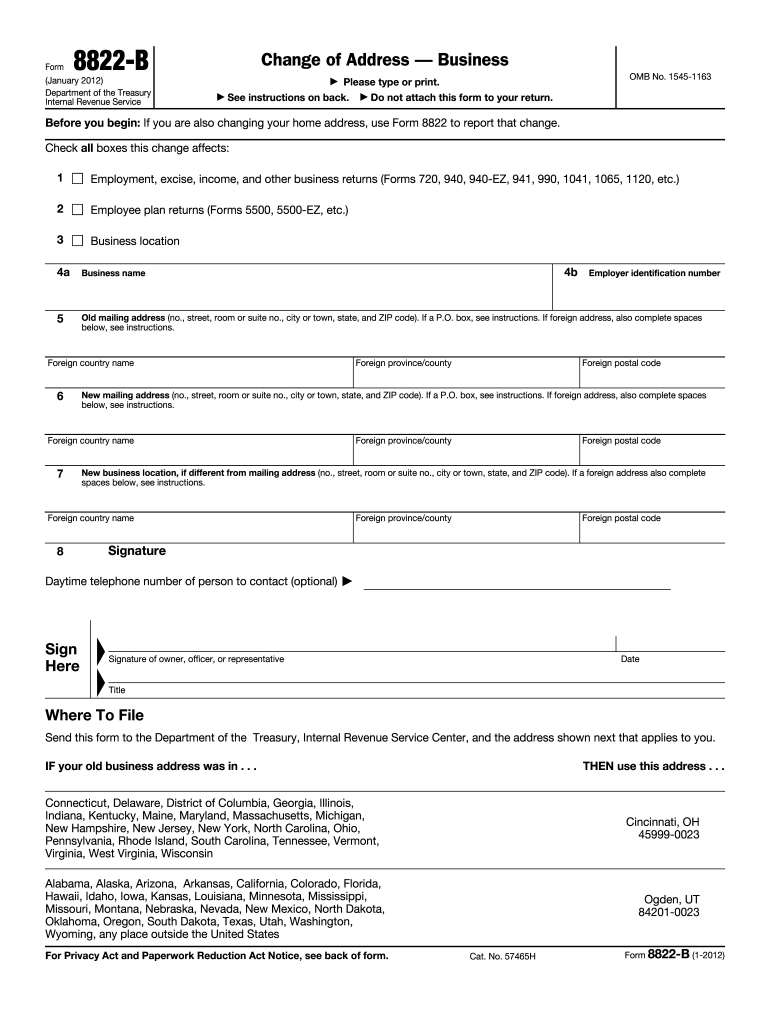

Form 8822 B Complete with ease airSlate SignNow

Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. The following replaces the “where to file” addresses on page 2 of form 8822 (rev. There are five ways to tell the irs your new address: Form 8822, your tax return, by phone to a local office, in person,.

Irs change address darkinfo

The following replaces the “where to file” addresses on page 2 of form 8822 (rev. If you checked the box on line 2,. Form 8822, your tax return, by phone to a local office, in person, by mail. There are five ways to tell the irs your new address: Form 8822 is used by taxpayers to notify the irs of.

How to Fill Out IRS Form 8822 (Change of Address) YouTube

Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. There are five ways to tell the irs your new address: Form 8822, your tax return, by phone to a local office, in person, by mail. If you checked the box on line 2,. The following replaces the “where.

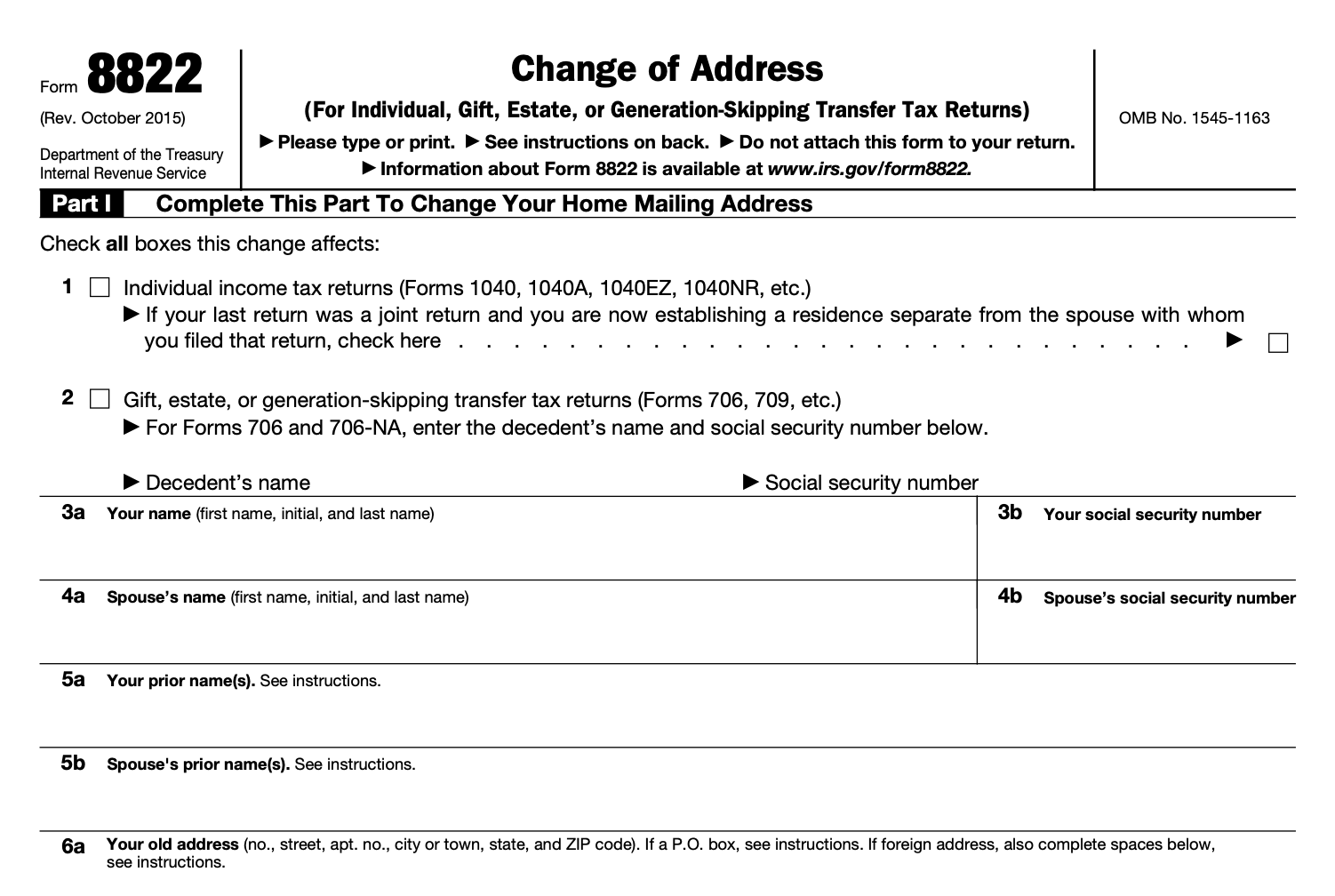

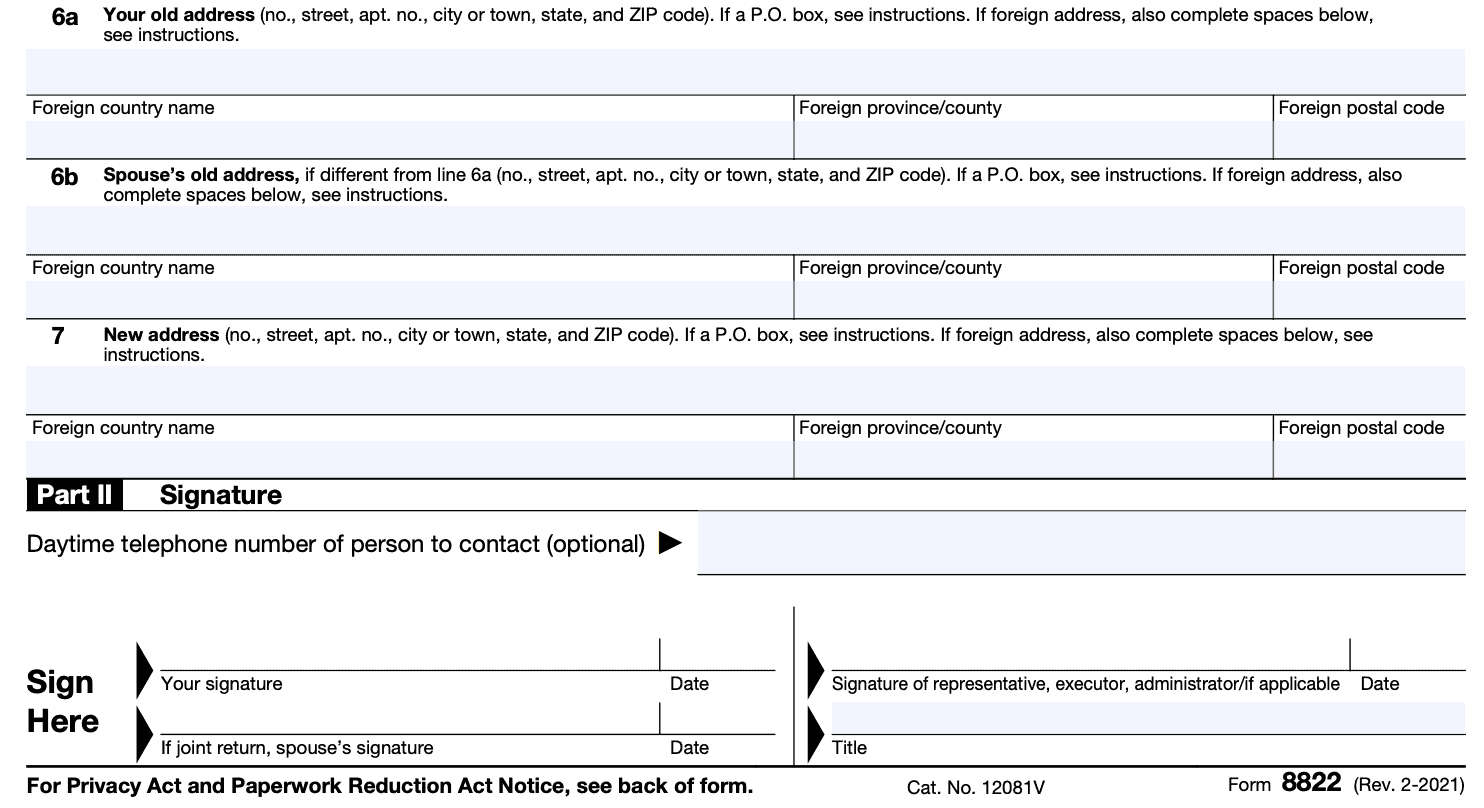

IRS Form 8822 Instructions Changing Your Address With the IRS

The following replaces the “where to file” addresses on page 2 of form 8822 (rev. Form 8822, your tax return, by phone to a local office, in person, by mail. Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. If you checked the box on line 2,. There.

Form 8822 Edit, Fill, Sign Online Handypdf

There are five ways to tell the irs your new address: Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. The following replaces the “where to file” addresses on page 2 of form 8822 (rev. Form 8822, your tax return, by phone to a local office, in person,.

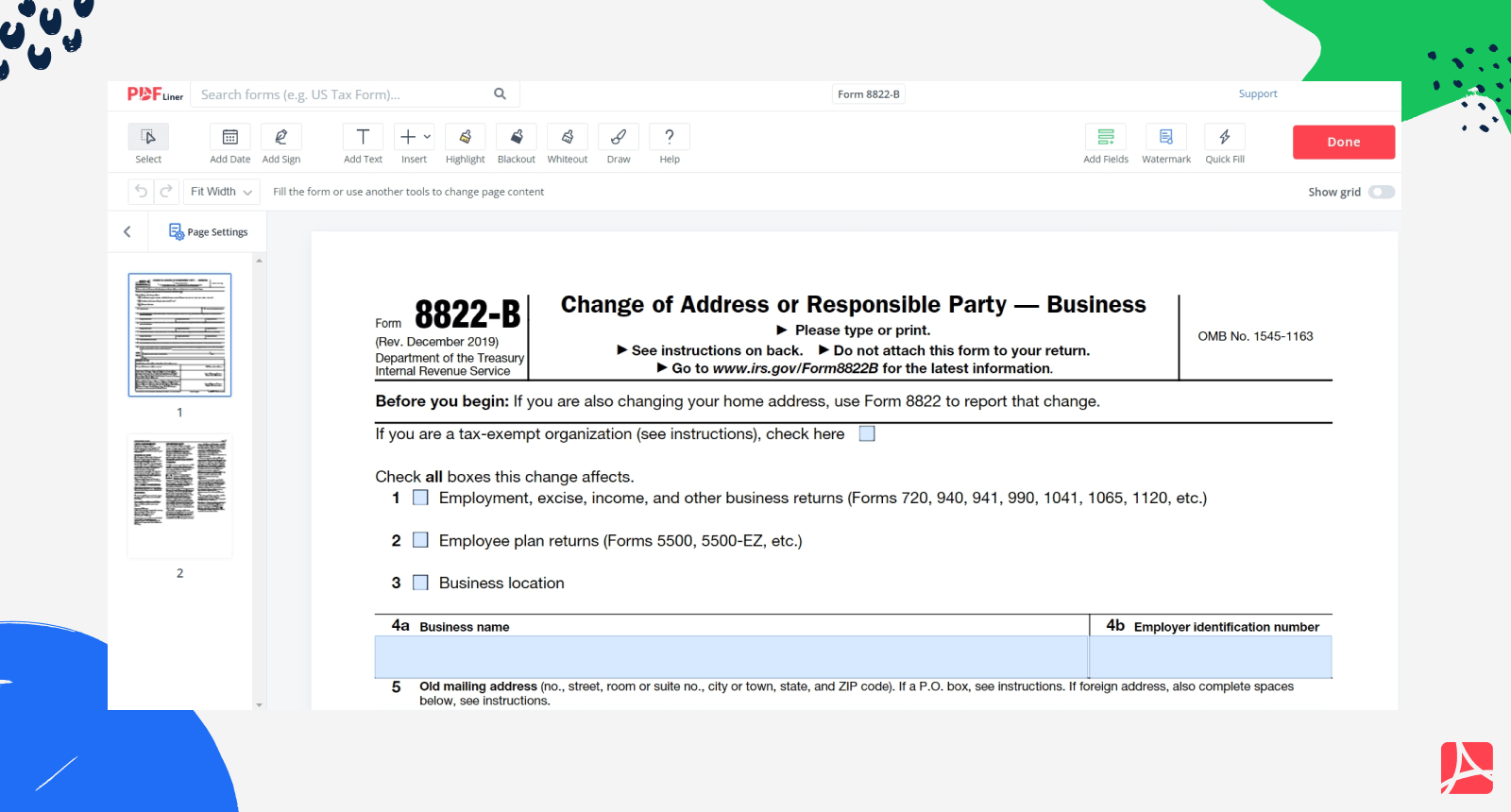

Tax Form 8822B Change of Address blank, online — PDFliner

Form 8822, your tax return, by phone to a local office, in person, by mail. Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. The following replaces the “where to file” addresses on page 2 of form 8822 (rev. If you checked the box on line 2,. There.

FORM 8822 AUTOFILL PDF

There are five ways to tell the irs your new address: Form 8822, your tax return, by phone to a local office, in person, by mail. The following replaces the “where to file” addresses on page 2 of form 8822 (rev. Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or.

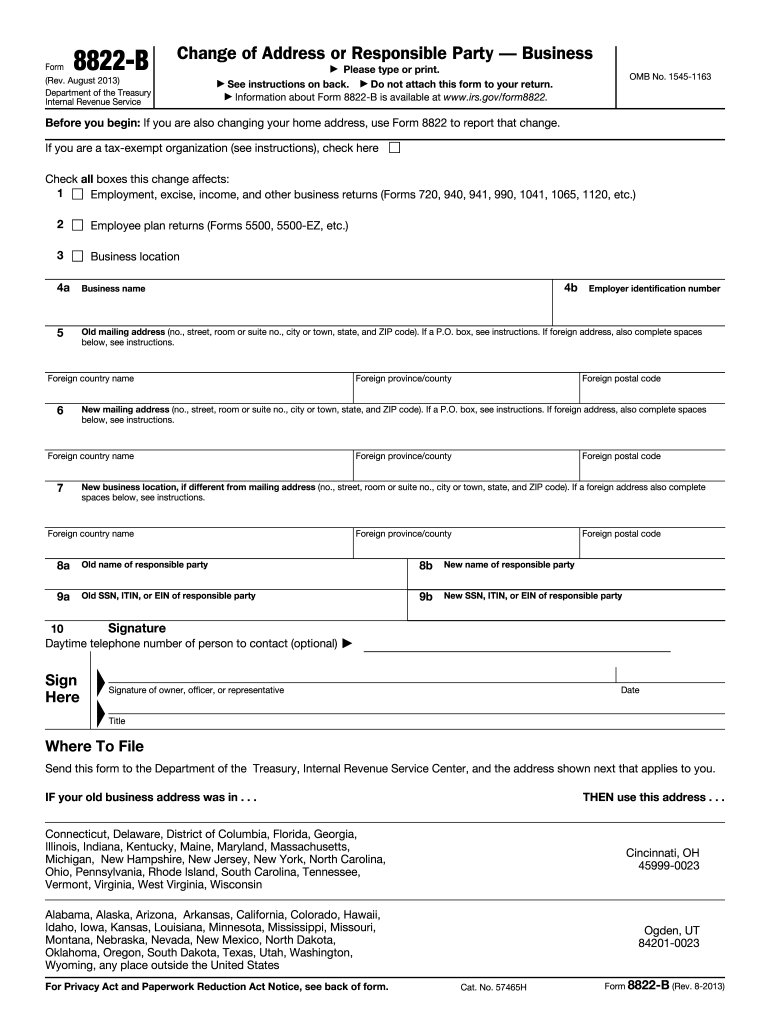

Form 8822 b 2013 Fill out & sign online DocHub

The following replaces the “where to file” addresses on page 2 of form 8822 (rev. Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. Form 8822, your tax return, by phone to a local office, in person, by mail. If you checked the box on line 2,. There.

IRS Form 8822B Instructions Change of Address or Party

The following replaces the “where to file” addresses on page 2 of form 8822 (rev. Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. There are five ways to tell the irs your new address: If you checked the box on line 2,. Form 8822, your tax return,.

Form 8822Change of Address

The following replaces the “where to file” addresses on page 2 of form 8822 (rev. If you checked the box on line 2,. Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. Form 8822, your tax return, by phone to a local office, in person, by mail. There.

There Are Five Ways To Tell The Irs Your New Address:

If you checked the box on line 2,. The following replaces the “where to file” addresses on page 2 of form 8822 (rev. Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. Form 8822, your tax return, by phone to a local office, in person, by mail.