Wisconsin Tax Lien Sales

Wisconsin Tax Lien Sales - Tax liens list for properties in and near wisconsin. Current tax deed sales all tax deed sales will be held at the green county historic courthouse located at 1016 16th ave at the date and time. If a business or individual is delinquent and fails to pay over a period of time, wisconsin state law says their property can be relinquished to the. Once a year, typically in october, the county treasurer holds a public auction to sell the properties the county has foreclosed on. The wisconsin department of revenue considers a tax delinquent when the due date of an assessment passes, and after the expiration of. Two years after the issuance of the tax certificate the county is entitled to start foreclosure of tax lien by “tax deed” or “in rem”. Wisconsin, currently has 8,401 tax liens available as of january 2.

Once a year, typically in october, the county treasurer holds a public auction to sell the properties the county has foreclosed on. Wisconsin, currently has 8,401 tax liens available as of january 2. If a business or individual is delinquent and fails to pay over a period of time, wisconsin state law says their property can be relinquished to the. Two years after the issuance of the tax certificate the county is entitled to start foreclosure of tax lien by “tax deed” or “in rem”. The wisconsin department of revenue considers a tax delinquent when the due date of an assessment passes, and after the expiration of. Tax liens list for properties in and near wisconsin. Current tax deed sales all tax deed sales will be held at the green county historic courthouse located at 1016 16th ave at the date and time.

If a business or individual is delinquent and fails to pay over a period of time, wisconsin state law says their property can be relinquished to the. The wisconsin department of revenue considers a tax delinquent when the due date of an assessment passes, and after the expiration of. Tax liens list for properties in and near wisconsin. Once a year, typically in october, the county treasurer holds a public auction to sell the properties the county has foreclosed on. Wisconsin, currently has 8,401 tax liens available as of january 2. Current tax deed sales all tax deed sales will be held at the green county historic courthouse located at 1016 16th ave at the date and time. Two years after the issuance of the tax certificate the county is entitled to start foreclosure of tax lien by “tax deed” or “in rem”.

Investing in Tax Lien Seminars and Courses

Tax liens list for properties in and near wisconsin. Once a year, typically in october, the county treasurer holds a public auction to sell the properties the county has foreclosed on. If a business or individual is delinquent and fails to pay over a period of time, wisconsin state law says their property can be relinquished to the. Current tax.

COVID19 Impact on Tax Lien Sales Nationwide IssueWire

The wisconsin department of revenue considers a tax delinquent when the due date of an assessment passes, and after the expiration of. Once a year, typically in october, the county treasurer holds a public auction to sell the properties the county has foreclosed on. Two years after the issuance of the tax certificate the county is entitled to start foreclosure.

Guide On How To Start A Tax Lien Business Side Hustle

Once a year, typically in october, the county treasurer holds a public auction to sell the properties the county has foreclosed on. Tax liens list for properties in and near wisconsin. If a business or individual is delinquent and fails to pay over a period of time, wisconsin state law says their property can be relinquished to the. Two years.

Tax Lien Sale Download Free PDF Tax Lien Taxes

If a business or individual is delinquent and fails to pay over a period of time, wisconsin state law says their property can be relinquished to the. The wisconsin department of revenue considers a tax delinquent when the due date of an assessment passes, and after the expiration of. Tax liens list for properties in and near wisconsin. Wisconsin, currently.

The Wonderful Benefits of Tax Lien Sales Michael Schuett

Once a year, typically in october, the county treasurer holds a public auction to sell the properties the county has foreclosed on. Two years after the issuance of the tax certificate the county is entitled to start foreclosure of tax lien by “tax deed” or “in rem”. If a business or individual is delinquent and fails to pay over a.

Wisconsin notice lien Fill out & sign online DocHub

Wisconsin, currently has 8,401 tax liens available as of january 2. The wisconsin department of revenue considers a tax delinquent when the due date of an assessment passes, and after the expiration of. Once a year, typically in october, the county treasurer holds a public auction to sell the properties the county has foreclosed on. Current tax deed sales all.

Wisconsin Sales Tax Guide

If a business or individual is delinquent and fails to pay over a period of time, wisconsin state law says their property can be relinquished to the. Once a year, typically in october, the county treasurer holds a public auction to sell the properties the county has foreclosed on. The wisconsin department of revenue considers a tax delinquent when the.

Learn Tax Lien & Tax Deed Investing

If a business or individual is delinquent and fails to pay over a period of time, wisconsin state law says their property can be relinquished to the. Wisconsin, currently has 8,401 tax liens available as of january 2. Tax liens list for properties in and near wisconsin. Current tax deed sales all tax deed sales will be held at the.

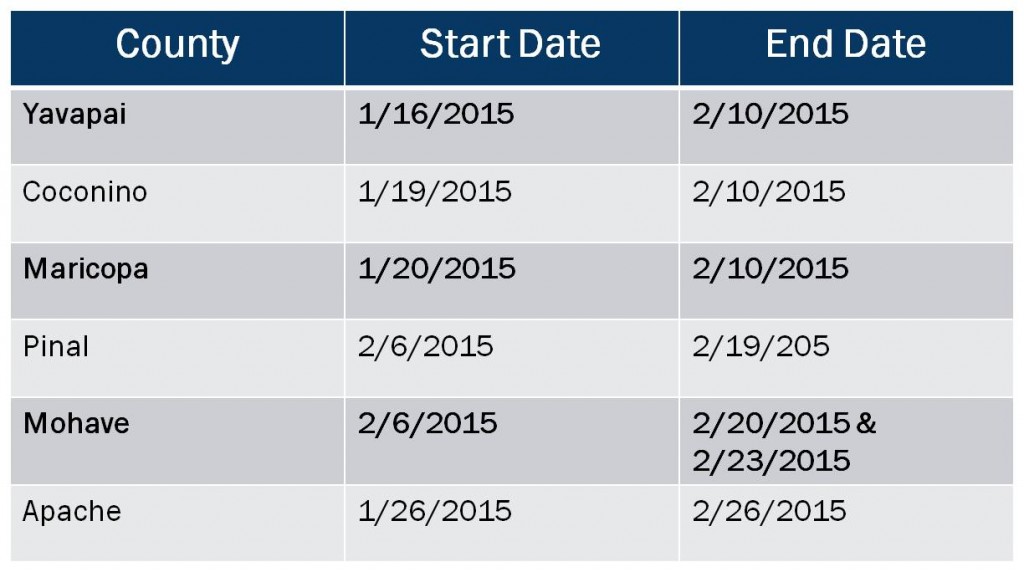

Arizona Tax Lien Sales Tax Lien Investing Tips

Current tax deed sales all tax deed sales will be held at the green county historic courthouse located at 1016 16th ave at the date and time. Two years after the issuance of the tax certificate the county is entitled to start foreclosure of tax lien by “tax deed” or “in rem”. The wisconsin department of revenue considers a tax.

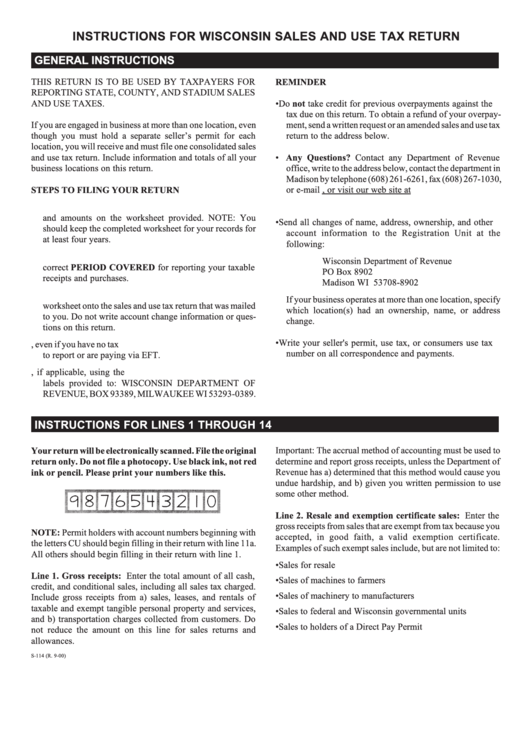

Instructions For Wisconsin Sales And Use Tax Return State Of

If a business or individual is delinquent and fails to pay over a period of time, wisconsin state law says their property can be relinquished to the. Tax liens list for properties in and near wisconsin. Current tax deed sales all tax deed sales will be held at the green county historic courthouse located at 1016 16th ave at the.

Tax Liens List For Properties In And Near Wisconsin.

Wisconsin, currently has 8,401 tax liens available as of january 2. Two years after the issuance of the tax certificate the county is entitled to start foreclosure of tax lien by “tax deed” or “in rem”. If a business or individual is delinquent and fails to pay over a period of time, wisconsin state law says their property can be relinquished to the. Current tax deed sales all tax deed sales will be held at the green county historic courthouse located at 1016 16th ave at the date and time.

Once A Year, Typically In October, The County Treasurer Holds A Public Auction To Sell The Properties The County Has Foreclosed On.

The wisconsin department of revenue considers a tax delinquent when the due date of an assessment passes, and after the expiration of.