Withholding Tax Table

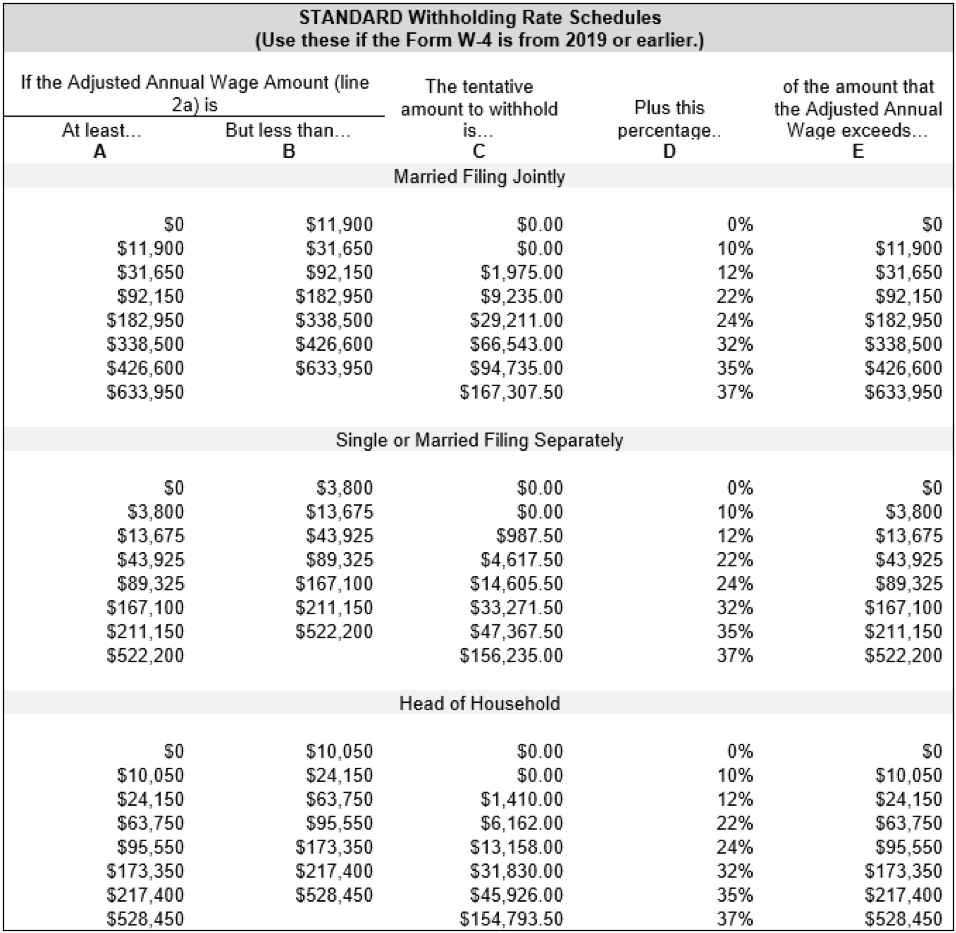

Withholding Tax Table - Here is a list of our partners. There are seven income tax rates, ranging from 10% to 37%. If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and the percentage method tables in this section to figure. Which federal income tax brackets are you in?. Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system. The first federal tax table from the irs is.

If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and the percentage method tables in this section to figure. Which federal income tax brackets are you in?. The first federal tax table from the irs is. Here is a list of our partners. There are seven income tax rates, ranging from 10% to 37%. Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system.

Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system. The first federal tax table from the irs is. Which federal income tax brackets are you in?. Here is a list of our partners. There are seven income tax rates, ranging from 10% to 37%. If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and the percentage method tables in this section to figure.

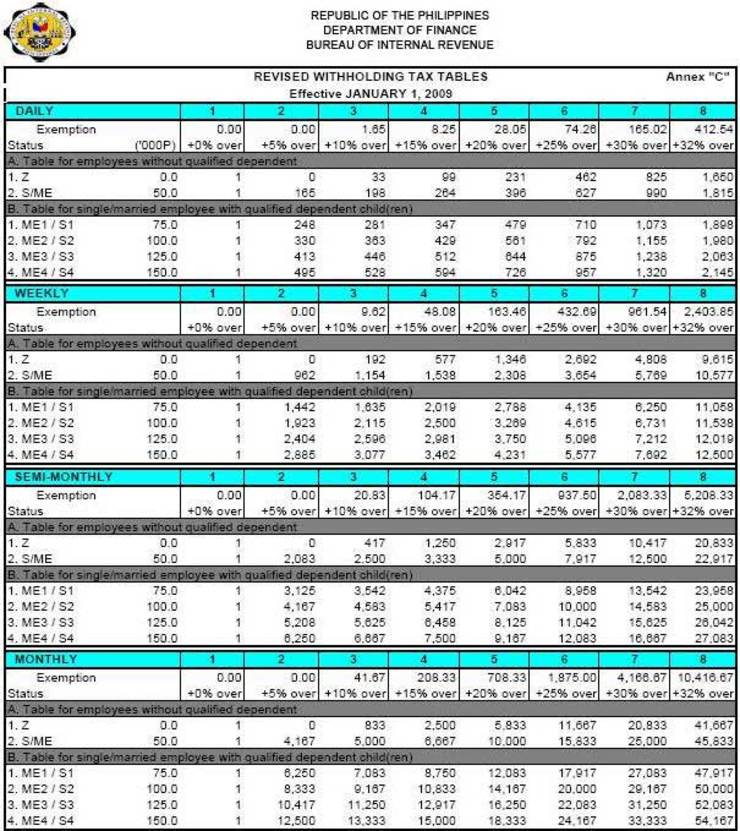

Bir Annual Withholding Tax Table 2017 Matttroy

Here is a list of our partners. Which federal income tax brackets are you in?. Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system. There are seven income tax rates, ranging from 10% to 37%. The first federal tax table from the irs is.

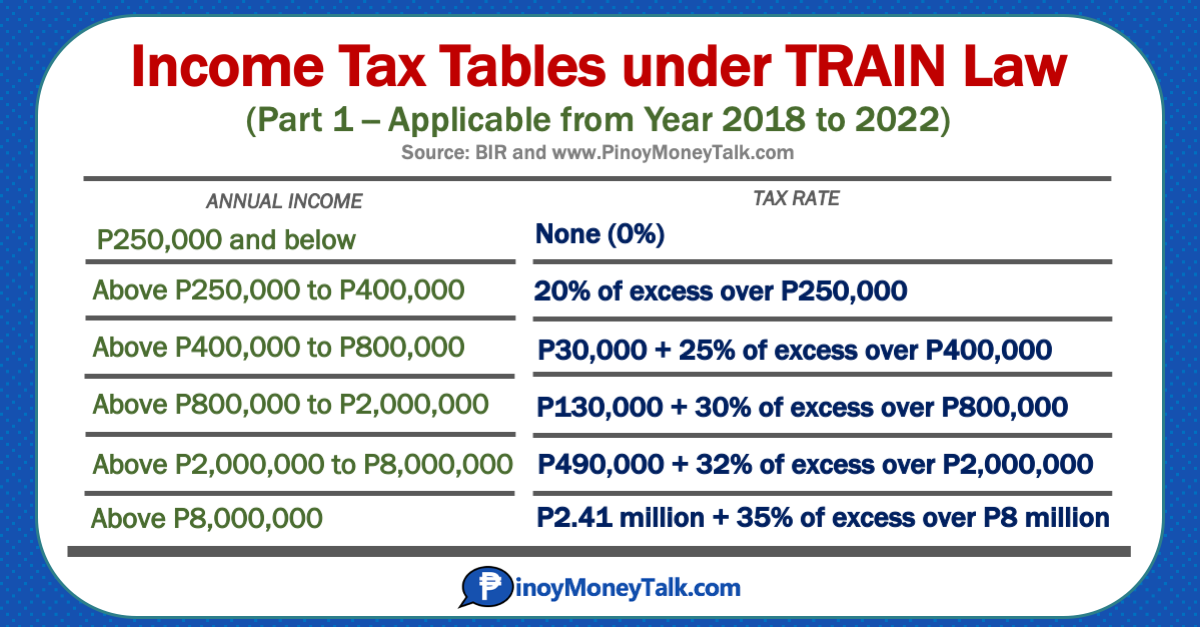

WITHHOLDING TAX COMPUTATION UNDER TRAIN LAW USING VERSION 2 TABLE EBV

There are seven income tax rates, ranging from 10% to 37%. Here is a list of our partners. Which federal income tax brackets are you in?. The first federal tax table from the irs is. If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and the percentage method tables in this section to figure.

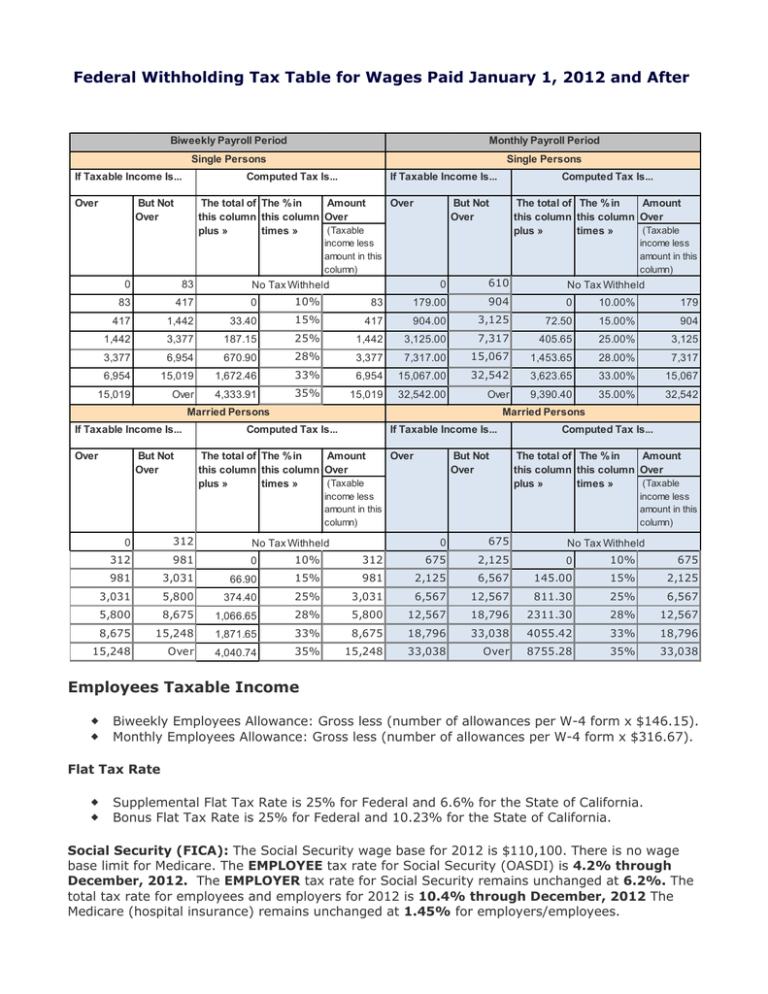

Federal Withholding Tax Table for Wages Paid January 1, 2012...

The first federal tax table from the irs is. Which federal income tax brackets are you in?. If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and the percentage method tables in this section to figure. Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system. There are.

Payg Withholding Tax Table Fortnightly 2023 Image to u

There are seven income tax rates, ranging from 10% to 37%. Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system. Which federal income tax brackets are you in?. The first federal tax table from the irs is. If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and.

Withholding Tax Table in the Philippines NewstoGov

The first federal tax table from the irs is. If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and the percentage method tables in this section to figure. Which federal income tax brackets are you in?. Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system. There are.

Reading your pay stub 8 things that could be affecting your takehome

If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and the percentage method tables in this section to figure. Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system. Which federal income tax brackets are you in?. Here is a list of our partners. There are seven income.

Revised Withholding Tax Table Bureau of Internal Revenue

There are seven income tax rates, ranging from 10% to 37%. Here is a list of our partners. Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system. The first federal tax table from the irs is. Which federal income tax brackets are you in?.

AskTheTaxWhiz Is 13th month pay really taxable?

If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and the percentage method tables in this section to figure. Which federal income tax brackets are you in?. Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system. There are seven income tax rates, ranging from 10% to 37%..

Employer's Federal Withholding Tax Tables Monthly Chart Federal

Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system. The first federal tax table from the irs is. There are seven income tax rates, ranging from 10% to 37%. Here is a list of our partners. If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and the.

The 2022 Bir Tax Table Jobstreet Philippines

If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and the percentage method tables in this section to figure. Which federal income tax brackets are you in?. Here is a list of our partners. The first federal tax table from the irs is. There are seven income tax rates, ranging from 10% to 37%.

Here Are The Irs Withholding Tax Tables For 2024 For Employers That Use An Automated Payroll System.

Which federal income tax brackets are you in?. The first federal tax table from the irs is. If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and the percentage method tables in this section to figure. There are seven income tax rates, ranging from 10% to 37%.